A fiduciary audit is a systematic, independent examination and evaluation of an organization's fiduciary practices, governance, investment management, risk management, and compliance. The primary purpose of a fiduciary audit is to assess whether an organization is fulfilling its fiduciary duties and responsibilities to its stakeholders while also identifying areas for improvement. Fiduciary audits are essential for maintaining trust and confidence among stakeholders, including beneficiaries, clients, and shareholders. By identifying and addressing potential weaknesses in fiduciary practices, organizations can reduce the risk of breaches of fiduciary duty, protect against financial losses, and enhance their reputations. Fiduciary duty refers to the legal and ethical obligation of individuals or organizations to act in the best interests of another party, often in a position of trust or authority. Fiduciaries must prioritize the interests of the party to whom they owe the duty, over their own interests or those of any other party. There are various types of fiduciary relationships, including: Trustees manage assets on behalf of beneficiaries, ensuring that assets are invested and distributed according to the terms of the trust. Investment managers are responsible for managing clients' investments, ensuring they align with clients' goals and risk tolerances. Corporate directors are responsible for managing a corporation in its shareholders' best interests, ensuring its long-term success and profitability. Fiduciaries are required to fulfill several key duties, including: The duty of loyalty requires fiduciaries to act solely in the best interests of the party to whom they owe the duty, avoiding conflicts of interest and self-dealing. The duty of care requires fiduciaries to exercise reasonable care, skill, and diligence in carrying out their responsibilities, making informed decisions based on relevant information and expertise. The duty of prudence requires fiduciaries to manage assets with a focus on long-term preservation and growth, considering risks, returns, and diversification. The fiduciary audit process typically involves pre-audit, audit execution, and post-audit. Before conducting a fiduciary audit, auditors work with the organization to establish specific audit objectives, such as assessing compliance with fiduciary duties, evaluating investment performance, or identifying areas for improvement. An audit team consisting of professionals with expertise in fiduciary responsibilities, investment management, risk management, and compliance is assembled to conduct the audit. The audit team develops a detailed audit plan, outlining the scope, methodology, and timeline for the audit. The audit team reviews the organization's fiduciary governance structure, including board oversight, organizational structure, and policies and procedures, to assess whether the organization is effectively fulfilling its fiduciary duties and responsibilities. The audit team examines the organization's fiduciary practices, such as investment management, risk management, and compliance, to ensure they align with industry standards and best practices. Fiduciary controls, including internal controls, monitoring, and reporting mechanisms, are evaluated to ensure they are adequate and effective in managing fiduciary risks. The audit team tests the organization's compliance with applicable laws, regulations, and internal policies related to fiduciary duties and responsibilities. The audit team analyzes the findings from the audit, identifying areas of strength and weakness and any potential breaches of fiduciary duty. A comprehensive audit report is drafted detailing the audit's findings, conclusions, and recommendations for improvement. The audit team presents the audit report to the organization's leadership, discussing the findings and recommendations and assisting in developing an action plan to address any identified issues. The audit team monitors the organization's progress in implementing the action plan and may conduct follow-up audits to ensure continued compliance with fiduciary duties and responsibilities. The audit team assesses the effectiveness of the organization's board in overseeing fiduciary responsibilities, ensuring the board is adequately informed, engaged, and acting in the best interests of stakeholders. The organizational structure is evaluated to ensure it supports the fulfillment of fiduciary duties and responsibilities, with clear lines of authority and accountability. The audit team reviews the organization's policies and procedures related to fiduciary responsibilities, ensuring they are comprehensive, up-to-date, and aligned with industry standards and best practices. The organization's investment policy statement is reviewed to clearly outline investment objectives, risk tolerances, asset allocation, and manager selection and monitoring processes. The audit team evaluates the organization's asset allocation strategy to ensure it aligns with the investment policy statement and the best interests of stakeholders. The processes for selecting and monitoring investment managers are assessed to ensure they are thorough, transparent, and focused on achieving the organization's investment objectives. The audit team reviews the organization's processes for identifying and assessing fiduciary risks, ensuring they are comprehensive and up-to-date. Risk mitigation strategies are evaluated to ensure they effectively manage identified risks and align with the organization's risk appetite. The audit team assesses the organization's processes for monitoring and reporting fiduciary risks, ensuring they provide timely and accurate information to support decision-making. The organization's compliance with applicable laws and regulations related to fiduciary duties and responsibilities is evaluated to ensure it meets legal and regulatory requirements. The audit team reviews the organization's internal controls and procedures related to fiduciary responsibilities, ensuring they are adequate and effective in managing risks and ensuring compliance. The organization's processes for maintaining accurate and complete records and reporting on fiduciary activities are assessed to ensure they meet regulatory requirements and support effective decision-making. Fiduciary audits help organizations identify and address potential gaps in their fiduciary practices, improving compliance with their legal and ethical obligations. By assessing an organization's risk management processes and controls, fiduciary audits help organizations identify and mitigate potential risks, protecting stakeholders' interests and the organization's reputation. Fiduciary audits demonstrate the organization's commitment to fulfilling its fiduciary duties, and increasing trust and confidence among beneficiaries, clients, and shareholders. Fiduciary audits provide valuable insights into areas where the organization can improve its fiduciary practices, enabling more effective and efficient management of assets and responsibilities. Fiduciary audits can be time-consuming and costly, requiring organizations to allocate resources to the audit process and address any identified issues. Evaluating the fulfillment of fiduciary duties can be subjective, as it often involves assessing whether decisions were made in the best interests of stakeholders and whether the fiduciary exercised reasonable care, skill, and diligence. Fiduciary audits must navigate complex legal and regulatory landscapes, varying across jurisdictions and subject to frequent changes. Organizations may need help balancing their fiduciary duties with their broader business objectives, as they seek to maximize returns for stakeholders while fulfilling their legal and ethical obligations. A fiduciary audit is a comprehensive examination of an organization's fiduciary practices, governance, investment management, risk management, and compliance. The primary purpose of a fiduciary audit is to assess whether an organization is fulfilling its fiduciary duties and responsibilities to its stakeholders, while also identifying areas for improvement. Key components of fiduciary audits include fiduciary governance, investment management, risk management, and compliance. The benefits of fiduciary audits include improved fiduciary compliance, enhanced risk management, increased confidence among stakeholders, and identification of areas for improvement. However, fiduciary audits also face challenges and limitations, such as cost and resource constraints, subjectivity in assessing fiduciary duties, legal and regulatory complexity, and balancing fiduciary duties with business objectives. While challenges and limitations exist, the benefits of fiduciary audits make them a valuable tool for organizations seeking to build trust, protect against financial losses, and demonstrate their commitment to fulfilling their fiduciary duties and responsibilities.What Is a Fiduciary Audit?

Fiduciary Responsibilities

Definition of Fiduciary Duty

Types of Fiduciary Relationships

Trustees and Beneficiaries

Investment Managers and Clients

Corporate Directors and Shareholders

Key Fiduciary Duties

Duty of Loyalty

Duty of Care

Duty of Prudence

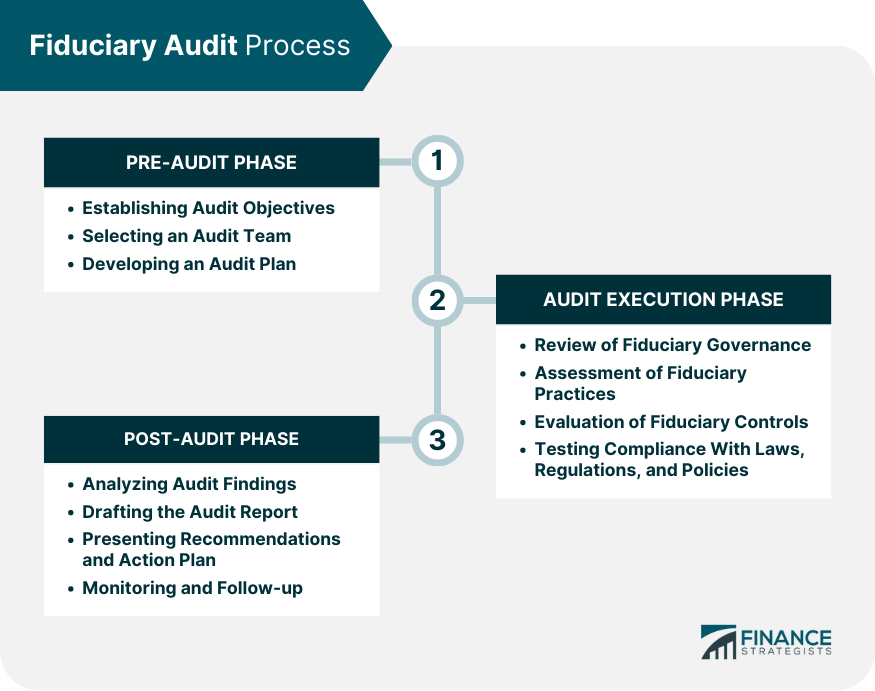

Fiduciary Audit Process

Pre-Audit Phase

Establishing Audit Objectives

Selecting an Audit Team

Developing an Audit Plan

Audit Execution Phase

Review of Fiduciary Governance

Assessment of Fiduciary Practices

Evaluation of Fiduciary Controls

Testing Compliance With Laws, Regulations, and Policies

Post-Audit Phase

Analyzing Audit Findings

Drafting the Audit Report

Presenting Recommendations and Action Plan

Monitoring and Follow-up

Key Components of Fiduciary Audits

Fiduciary Governance

Board Oversight

Organizational Structure

Policies and Procedures

Investment Management

Investment Policy Statement

Asset Allocation

Manager Selection and Monitoring

Risk Management

Identification of Risks

Risk Mitigation Strategies

Monitoring and Reporting of Risks

Compliance

Adherence to Laws and Regulations

Internal Controls and Procedures

Reporting and Record-Keeping

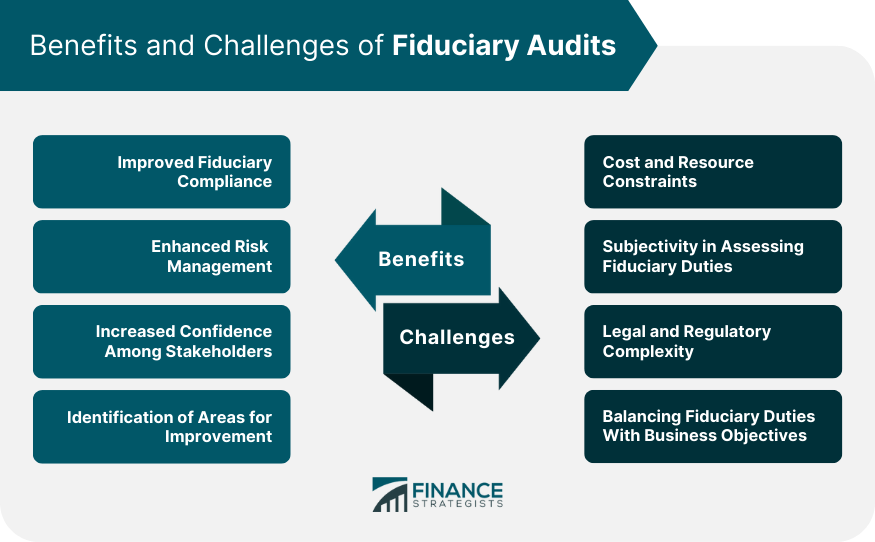

Benefits of Fiduciary Audits

Improved Fiduciary Compliance

Enhanced Risk Management

Increased Confidence Among Stakeholders

Identification of Areas for Improvement

Challenges and Limitations of Fiduciary Audits

Cost and Resource Constraints

Subjectivity in Assessing Fiduciary Duties

Legal and Regulatory Complexity

Balancing Fiduciary Duties With Business Objectives

Conclusion

Fiduciary Audit FAQs

A fiduciary audit is an examination of an individual or organization's management of assets and resources that are held in a position of trust or confidence for others.

Entities that serve as fiduciaries, such as banks, investment firms, and nonprofit organizations, often require fiduciary audits to ensure compliance with legal and ethical obligations.

A fiduciary audit typically involves a review of financial records, policies, and procedures to assess the fiduciary's compliance with legal and ethical standards. The auditor will also evaluate the fiduciary's internal controls and risk management practices.

A fiduciary audit is important to ensure that the fiduciary is acting in the best interest of its beneficiaries and fulfilling its obligations. It helps identify any potential weaknesses in the fiduciary's operations and safeguards against fraud and mismanagement of assets.

Failure to conduct a fiduciary audit can result in legal and financial consequences for the fiduciary. It may also lead to a loss of trust and confidence in the fiduciary's ability to fulfill its obligations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.