A client update refers to a report or communication provided to a client regarding their investment portfolio, financial plan, or other relevant information. This update may include information on market conditions, investment performance, changes in regulations, or other factors that could impact the client's financial situation. The purpose of a client update in finance is to keep clients informed and engaged, provide transparency into the management of their finances, and ensure that their financial goals are being met. Providing timely and accurate information is crucial for maintaining client trust. It enables clients to respond effectively to changes in the market and make well-informed decisions. The finance industry is heavily regulated, and staying current with changes is essential for both advisors and clients. Financial regulations are constantly evolving. Keeping clients informed of new rules or modifications ensures their investments and portfolios remain compliant. Regulatory changes can significantly impact clients' investments and portfolios. Advisors must communicate these changes to help clients make necessary adjustments and mitigate potential risks. Advisors should inform clients about compliance requirements and best practices. This can help clients better understand their responsibilities and maintain compliance. Market and economic updates are vital for clients to make informed decisions about their investments and financial plans. Advisors should provide updates on macro and microeconomic factors that can influence the financial markets. This helps clients gauge the potential impact on their investments and make necessary adjustments. Clients must stay informed about financial market trends to capitalize on opportunities and minimize risks. Advisors should provide regular updates on market trends and their implications for client portfolios. By highlighting potential risks and opportunities, advisors can help clients make well-informed decisions. This enables clients to react effectively to market fluctuations and achieve their financial goals. Regular investment and portfolio updates are crucial for monitoring performance and making adjustments as needed. Advisors should provide periodic performance reviews and analysis of client portfolios. This helps clients understand how their investments are performing and make informed decisions. Asset allocation and diversification are essential for managing risk and optimizing returns. Regular updates ensure clients' portfolios remain aligned with their risk tolerance and investment objectives. As market conditions and client goals change, investment strategies must be adjusted accordingly. Keeping clients informed of these adjustments ensures that their portfolios remain on track to achieve their financial goals. Clients must stay informed about the latest financial products and services to make the best choices for their needs. Advisors should provide updates on new financial products and services that may benefit clients. This helps clients explore new investment opportunities and optimize their portfolios. Keeping clients informed about updates to existing products and services is crucial for ensuring they continue to meet their needs. Advisors should provide regular updates on any changes or improvements. By highlighting the benefits and considerations of new or updated products and services, advisors can help clients make well-informed decisions. This enables clients to choose the most suitable options for their financial goals. Regular financial planning and goal updates are essential for keeping clients on track to achieve their objectives. Advisors should periodically reassess client goals and objectives to ensure they remain aligned with their current circumstances. This helps clients stay focused and make any necessary adjustments to their financial plans. Regular updates on clients' progress towards their financial goals Regular updates on clients' progress towards their financial goals help maintain motivation and engagement. This allows clients to see the results of their efforts and make any necessary adjustments to stay on track. As clients' financial situations and goals change, so must their strategies. Advisors should communicate these adjustments to clients to ensure their financial plans remain aligned with their current needs and objectives. Taxation and legal updates are critical for clients to maintain compliance and make informed decisions. Advisors should keep clients informed about changes in tax laws and regulations. This helps clients understand their tax obligations and make necessary adjustments to their financial plans. By providing updates on tax planning strategies, advisors can help clients minimize their tax liabilities and optimize their financial plans. This ensures clients remain compliant and take advantage of available tax benefits. Advisors should inform clients about legal considerations and implications related to their investments and financial plans. This helps clients make informed decisions and avoid potential legal issues. Effective communication and engagement are crucial for maintaining a strong client-advisor relationship. Advisors should understand and use their clients' preferred communication channels. This ensures clients receive updates in a manner that is most convenient and effective for them. Regular and timely updates are essential for keeping clients informed and engaged. Advisors should establish a schedule for updates that best meets their clients' needs and preferences. Advisors should encourage client feedback and involvement in the financial planning process. This fosters a collaborative relationship and ensures clients are actively engaged in their financial plans. Client updates are essential in the finance industry to keep clients informed and engaged, provide transparency into the management of their finances, and ensure that their financial goals are being met. Regular financial planning and goal updates help clients stay on track toward their financial goals. Advisors should reassess client goals and objectives periodically and adjust strategies for changing circumstances. What Is a Client Update?

Regulatory and Compliance Updates

Changes in Financial Regulations

Impact on Client Investments and Portfolios

Compliance Requirements and Best Practices

Market and Economic Updates

Macro and Micro Economic Factors

Financial Market Trends

Potential Risks and Opportunities

Investment and Portfolio Updates

Performance Review and Analysis

Asset Allocation and Diversification

Investment Strategy Adjustments

Product and Service Updates

New Financial Products and Services

Updates on Existing Offerings

Client Benefits and Considerations

Financial Planning and Goal Updates

Reassessing Client Goals and Objectives

Updates on Progress Towards Goals

Updates on Progress Towards Goals

Adjusting Strategies for Changing Circumstances

Taxation and Legal Updates

Changes in Tax Laws and Regulations

Tax Planning Strategies and Updates

Legal Considerations and Implications

Client Communication and Engagement

Preferred Communication Channels

Frequency and Timing of Updates

Encouraging Client Feedback and Involvement

Conclusion

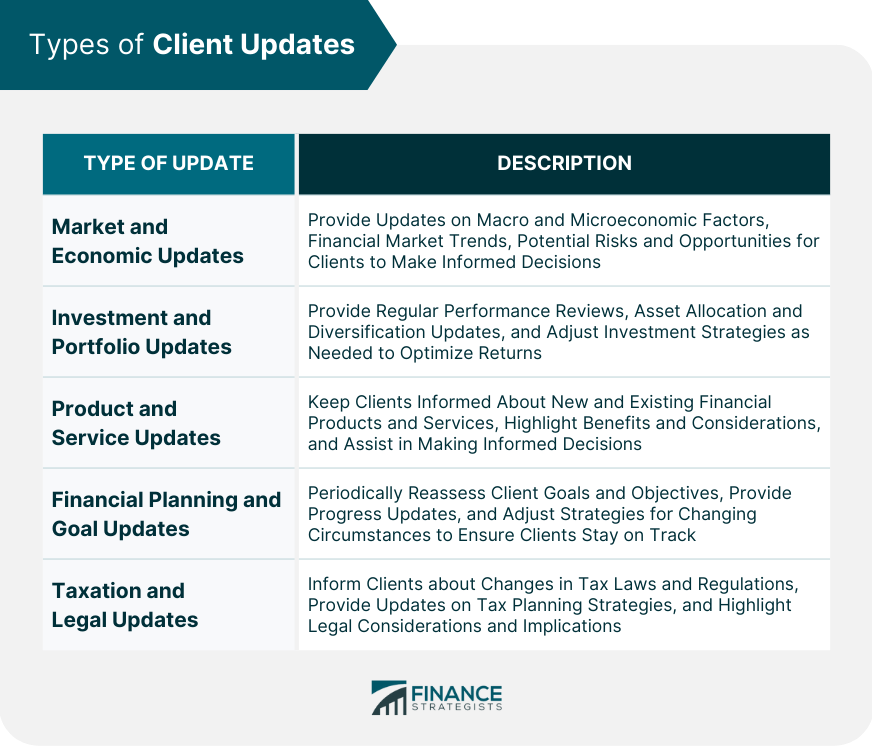

These updates cover several areas, including regulatory and compliance updates, market and economic updates, investment and portfolio updates, product and service updates, financial planning and goal updates, and taxation and legal updates.

Communication and engagement are also crucial in maintaining a strong client-advisor relationship.

Advisors should understand and use their clients' preferred communication channels, establish a schedule for updates that best meets their clients' needs and preferences, and encourage client feedback and involvement in the financial planning process.

By providing timely and accurate information and fostering a collaborative relationship, advisors can maintain client trust and help clients make well-informed decisions. They can also differentiate themselves from competitors and establish themselves as trusted partners in their client's financial journey.

Client Update FAQs

A client update refers to any changes or modifications made to a product or service provided to a client.

It is best to communicate a client update as soon as possible after it is finalized, preferably before it takes effect.

Planning for a client update involves defining the scope of the update, identifying potential risks, creating a timeline, and determining how to communicate the update to clients.

Effective communication of client updates helps to manage expectations, build trust, and minimize potential disruptions or misunderstandings.

You can ensure that client updates are well-received by providing clear and concise information, addressing any concerns or questions promptly, and showing a willingness to work with clients to address any issues that arise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.