A trust situs refers to the jurisdiction where a trust is administered. The chosen state's laws will govern the trust, including tax implications, asset protection, and trust modification options. Choosing the correct trust situs ensures that the trust operates efficiently and achieves the desired goals. The right jurisdiction can provide tax savings, enhanced asset protection, and increased privacy for the grantor and beneficiaries. There are several factors to consider when selecting a trust situs, including the state's tax laws, asset protection provisions, trust modification options, and privacy protections. Understanding the differences in state trust situs laws is essential when selecting the most suitable jurisdiction for your trust. State trust laws vary significantly, which can impact asset protection, tax implications, trust duration, decanting provisions, and privacy protections. Asset protection laws differ across states, with some offering stronger protections for trust assets against creditors. It is important to evaluate each state's asset protection features when choosing a trust situs. States have varying tax structures that can affect trusts and their beneficiaries. Consider the state income taxes, estate taxes, and inheritance taxes when selecting a trust situs to optimize tax efficiency. Trust duration, or the maximum period a trust can last, varies among states. Some states allow for perpetual or long-term trusts, while others impose limits on trust duration. Choose a state with a trust duration that aligns with your goals. Decanting provisions, which enable the transfer of trust assets to a new trust with different terms, differ by state. Consider the flexibility and requirements of each state's decanting provisions when selecting a trust situs. Privacy protections for trusts, such as silent trusts and sealed court records, vary by state. Analyze each state's privacy laws to ensure the confidentiality of trust matters. Some states are favored for their advantageous trust laws, including Delaware, Nevada, South Dakota, Alaska, and Wyoming. Delaware is a popular trust situs due to its favorable tax environment, strong asset protection laws, and flexible decanting provisions. The state also offers excellent privacy protections and allows for perpetual trusts. Nevada has no state income tax, making it an attractive trust situs for tax efficiency. The state also provides robust asset protection, allows for perpetual trusts, and offers flexible decanting provisions. South Dakota is known for its favorable trust laws, including no state income tax, strong asset protection, and perpetual trusts. The state also offers privacy protections and flexible trust modification options. Alaska is a sought-after trust situs for its tax advantages, such as no state income tax and favorable estate tax laws. The state also offers robust asset protection, perpetual trusts, and flexible decanting provisions. Wyoming is an attractive trust situs due to its tax advantages, including no state income tax and favorable estate tax laws. The state also provides strong asset protection, perpetual trusts, and flexible trust modification options. Taxes play a significant role in trust situs selection, as they can greatly impact the overall financial efficiency of a trust. State income taxes affect both the trust and its beneficiaries. It is crucial to understand how a state taxes trust income and its implications for the beneficiaries to minimize tax liabilities. Estate and inheritance taxes can impact the amount of wealth transferred to beneficiaries. Understanding a state's tax thresholds, exemptions, and rates can help you choose the most tax-efficient trust situs. Asset protection is a key consideration when choosing a trust situs, as it can safeguard the trust's assets from creditors. Asset protection trusts can be either self-settled or third-party trusts. Selecting a state with strong asset protection trust laws can help protect the trust's assets from potential creditor claims. States offer various creditor protection features, such as spendthrift provisions and fraudulent transfer laws. These protections help secure trust assets and prevent unauthorized access by creditors. Trust modification options and decanting provisions allow for changes to a trust to accommodate unforeseen circumstances or evolving needs. Trust modification options include judicial and non-judicial modifications. Understanding a state's modification options can provide the flexibility needed to adapt a trust to changing circumstances. Decanting provisions allow a trustee to transfer assets from an existing trust to a new trust with different terms. Familiarizing yourself with a state's decanting statutes and requirements can offer additional flexibility in trust administration. Privacy is an essential factor in trust situs selection, as it can help maintain the confidentiality of trust matters. States have varying trust privacy laws. Choosing a state with robust privacy protections can help ensure that the trust's details remain confidential. Silent trusts restrict the amount of information disclosed to beneficiaries. Selecting a state that permits silent trusts can provide an additional layer of privacy for grantors and beneficiaries. Some states allow trust-related court records to be sealed. Choosing a state that offers this option can help protect sensitive trust information from public access. Choosing the right state trust situs is crucial for any trust's effective operation, tax efficiency, asset protection, and privacy. It is essential to understand the differences in state trust laws, such as asset protection, tax implications, trust duration, decanting provisions, and privacy protections, when selecting the most suitable jurisdiction for a trust. Delaware, Nevada, South Dakota, Alaska, and Wyoming are among the favored trust situs jurisdictions due to their favorable trust laws. Tax considerations, asset protection and creditor protection features, trust modification and decanting provisions, and privacy protections are crucial factors to consider when selecting a trust situs. Understanding the various state trust situs laws can help grantors and beneficiaries make informed decisions for their estate plan and achieve their desired goals. Consult with estate planning professionals, such as attorneys and financial advisors, to help you navigate the complexities of trust situs selection. Their expertise will ensure that you make the best choice for your trust. Regularly review your trust and its situs selection to ensure continued alignment with your trust objectives. Periodic updates may be necessary to adapt to changing circumstances or take advantage of new opportunities in state trust laws.What Is a State Trust Situs Selection?

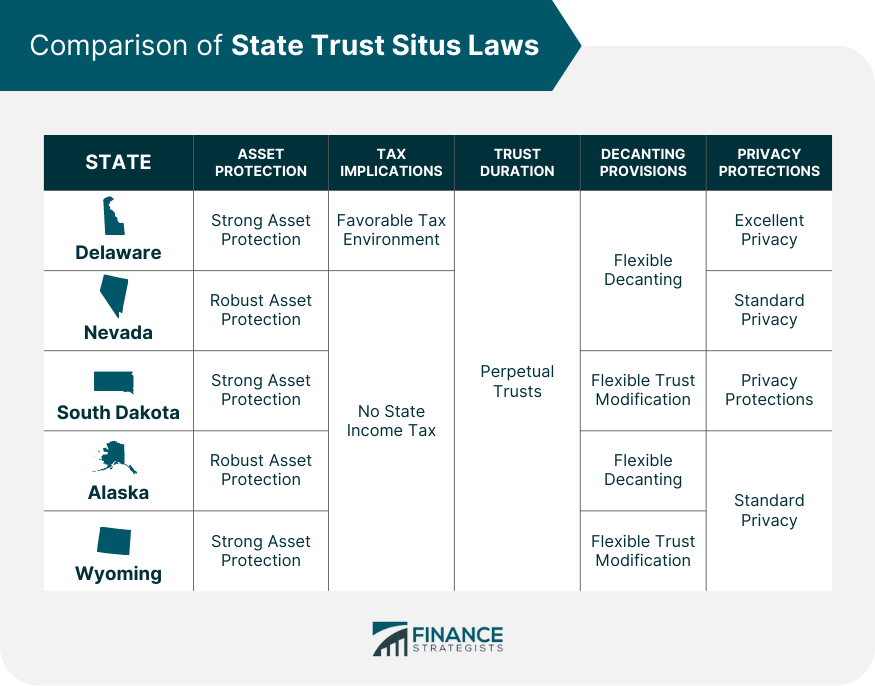

Differences in State Trust Laws

Asset Protection

Tax Implications

Trust Duration

Decanting Provisions

Privacy Protections

Common State Trust Situs Jurisdictions

Delaware

Nevada

South Dakota

Alaska

Wyoming

Tax Considerations for Trust Situs Selection

State Income Taxes

State Estate and Inheritance Taxes

Asset Protection and Creditor Considerations

Asset Protection Trusts

Creditor Protection Features

Trust Modification and Decanting Provisions

Trust Modification Options

Decanting Provisions

Privacy Protections in Trust Situs Selection

Trust Privacy Laws by State

Silent Trusts

Sealed Court Records

Final Thoughts

State Trust Situs Selection FAQs

It refers to the process of selecting a state where a trust will be located for legal purposes such as taxes, asset protection, and administration.

The state where a trust is located can affect its tax implications, asset protection, and governance. Choosing the right state can result in significant benefits.

Yes, a trust can be located in any state regardless of the grantor's residence, as long as the state's laws allow it.

Different states have varying tax laws, which can affect a trust's income, estate, and gift taxes. Choosing a state with favorable tax laws can result in significant savings.

Factors such as state tax laws, trust laws, creditor protection laws, and trustee requirements should be considered when selecting a state for a trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.