An administrator of an estate is a person who is responsible for managing and distributing the assets and affairs of a deceased person. When someone passes away, their estate goes through a legal process called probate, where a court supervises the distribution of the assets. The responsibilities of an estate's administrator are similar to those of an executor, which encompass tasks like assessing and estimating the value of assets, settling debts and taxes, and allocating the remaining assets to beneficiaries. Estate administration is an essential process for ensuring that the wishes of the deceased are carried out and that assets are distributed fairly among beneficiaries. An administrator of an estate plays a critical role in this process by overseeing the distribution of assets and ensuring that all legal requirements are met. The administrator is also responsible for managing the estate's finances and ensuring that any outstanding debts or taxes are paid. Failure to properly manage an estate can result in legal disputes and financial losses for beneficiaries. Therefore, it is crucial to have a competent and responsible administrator of an estate. An administrator of an estate can be any adult who is legally eligible to manage an estate. This may include a family member, a close friend, an attorney, or a professional fiduciary. However, the administrator should be someone who is trustworthy, reliable, and has a good understanding of the legal requirements of estate administration. It is also essential that the administrator has the necessary time and resources to manage the estate properly. Below are the common duties and responsibilities of an administrator of an estate: This includes identifying all bank accounts, real estate, investments, personal property, and any other assets that are part of the estate. The administrator must also determine the value of each asset and obtain appraisals if necessary. Once all the assets have been identified and valued, the administrator must safeguard them until they are distributed to the beneficiaries. The executor must file certain forms with the court in order to begin the process of probate. These forms include the probate petition, executor’s affidavit, petition for administration, notice of probate, notice to creditors, and life insurance claim form. Another critical duty of the administrator of an estate is to pay any outstanding debts and taxes owed by the deceased person. This includes funeral expenses, medical bills, credit card debt, and any other debts that the deceased person may have had. They must also file tax returns on behalf of the deceased person and the estate. This includes income tax returns for the year of death, as well as estate tax returns if the estate is worth more than the federal and state exemption limits. Once all the debts and taxes have been paid, the administrator of an estate can begin distributing the assets to the beneficiaries. This is often a complex process that requires careful consideration and planning. He or she must ensure that the distribution is done in accordance with the wishes of the deceased person, as expressed in their will or by law if there is no will. The administrator must also keep accurate records of all distributions and provide regular updates to the beneficiaries. The administrator of an estate is responsible for managing the estate's finances until the distribution of assets is complete. This includes keeping accurate records of all income and expenses, managing any investments or rental properties, and making sure that any ongoing obligations, such as mortgage payments or property taxes, are paid. To ensure that the estate administration process goes smoothly, there are several best practices that the administrator of an estate should follow. One of the most important best practices is to keep accurate records of all estate-related transactions. This includes a detailed inventory of all assets, receipts for all expenses paid, and a ledger of all distributions made to beneficiaries. This practice also provides transparency and accountability to the beneficiaries. Accurate records can help prevent disputes and legal challenges that can arise from a lack of clarity or misunderstandings. Effective communication with beneficiaries is another critical best practice for an administrator of an estate. The administrator should keep beneficiaries informed of the estate's progress and any significant developments. This includes providing regular updates on the distribution of assets and responding promptly to any questions or concerns that beneficiaries may have. Clear and open communication can help build trust and prevent misunderstandings that can lead to conflicts. Working with professionals, such as attorneys and accountants, is another best practice for an administrator of an estate. Estate administration can be a complex and challenging process, and working with professionals who have expertise in this area can help ensure that all legal requirements are met, and the estate is managed efficiently. An estate planning lawyer can provide guidance on legal matters, while accountants can help with tax filings and financial planning. Hiring professionals may increase the cost of estate administration, but it can ultimately save time, money, and reduce the risk of legal disputes. Family dynamics can be complicated, and conflicts can arise during the estate administration process. The administrator should be prepared to handle any conflicts that may arise, such as disagreements between beneficiaries or legal challenges to the estate. The administrator should also have a plan for resolving disputes and should be able to mediate conflicts to ensure a fair distribution of assets. When it comes to managing the affairs of a deceased person, two terms often come up - administrator of an estate and executor. While the two terms are similar in their duties and responsibilities, they differ in their appointment and legal standing. An executor is a person who is named in a will to manage the estate. The executor's primary duties are to collect and manage the assets of the estate, file relevant forms, pay off any debts and taxes owed, and distribute the assets to the beneficiaries named in the will. The executor holds a legal authority over the estate, and their actions are overseen by a probate court. On the other hand, an administrator of an estate is appointed by the court when there is no will, or the named executor is unable or unwilling to fulfill their duties. The administrator's duties and responsibilities are the same as the executor's. However, the administrator's actions are subject to court supervision, and they do not have the same legal authority over the estate as an executor. In some cases, the executor may also need to be appointed as the administrator of an estate if there are assets that were not included in the will or if the will is contested. In this case, the executor's duties and responsibilities would be the same as the administrator's, including managing and distributing the assets of the estate, filing relevant forms, paying debts and taxes, and keeping accurate records, but their actions would be subject to court supervision. Estate administration is a crucial process that ensures the fair and legal distribution of assets after someone passes away. An administrator of an estate plays a critical role in this process, overseeing the distribution of assets, paying debts and taxes, and managing the estate's finances. To ensure that the estate administration process goes smoothly, it is essential to follow best practices, such as keeping accurate records, communicating effectively with beneficiaries, and working with professionals. Having an administrator of an estate ensures that the process goes smoothly and that assets are distributed legally and fairly. An administrator of an estate can help prevent conflicts and legal challenges and provide peace of mind to the deceased person's family.What Is an Administrator of an Estate?

How Does Administration of an Estate Work?

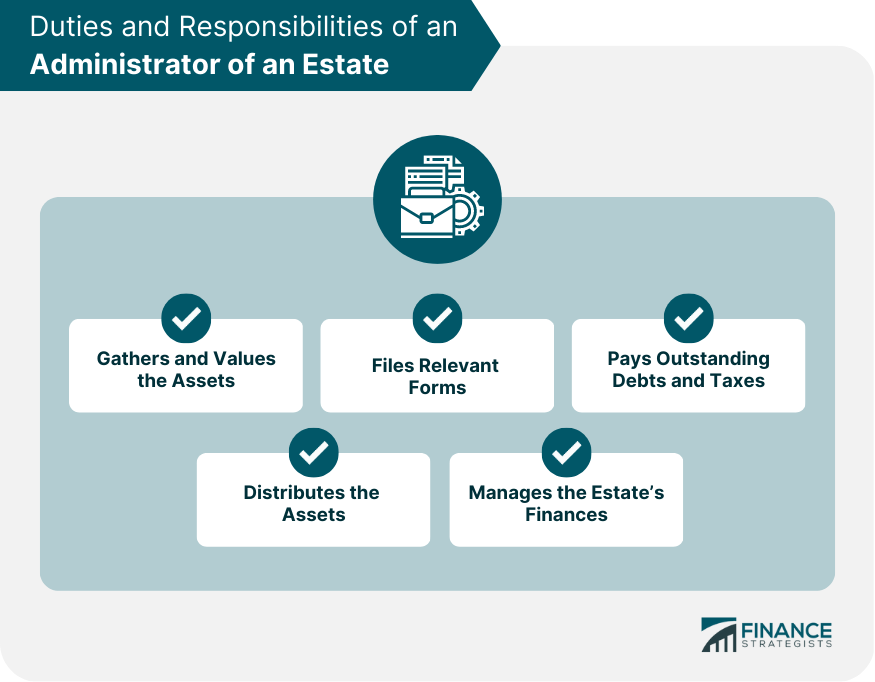

Duties and Responsibilities of an Administrator of an Estate

Gathers and Values the Assets

Files Relevant Forms

Pays Outstanding Debts and Taxes

Distributes the Assets

Manages the Estate’s Finances

Best Practices of an Administrator of an Estate

Keeping Accurate Records

Communicating With Beneficiaries

Working With Professionals

Managing Conflicts and Disputes

Administrator of an Estate vs Executor

Final Thoughts

Administrator of an Estate FAQs

An administrator of an estate is a person appointed by the court to manage and distribute the assets of a deceased person's estate when there is no will, or the named executor is unable or unwilling to fulfill their duties.

The duties and responsibilities of an administrator of an estate include managing and distributing the assets of the estate, paying debts and taxes, and keeping accurate records.

The best practices for an administrator of an estate include keeping accurate records, communicating effectively with beneficiaries, working with professionals such as attorneys and accountants, and managing conflicts and disputes.

An executor is named in a will to manage the estate, while an administrator of an estate is appointed by the court when there is no will or the named executor is unable or unwilling to fulfill their duties. Executors have legal authority over the estate, while an administrator's actions are subject to court supervision.

Yes, in some cases, an executor may need to be appointed as the administrator of an estate, such as when there are assets that were not included in the will or if the will is contested. In this case, the executor's duties and responsibilities would be the same as the administrator's.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.