Fraud alerts are notifications added to your credit report that inform potential lenders of possible identity theft or fraudulent activity. When a fraud alert is in place, lenders must take extra steps to verify your identity before extending credit in your name. There are three types of fraud alerts: 1. Initial Fraud Alert: This alert lasts for one year and can be used by individuals who suspect they are or may become victims of identity theft. 2. Extended Fraud Alert: This alert lasts for seven years and is designed for confirmed identity theft victims. A valid identity theft report is required to place an extended fraud alert. 3. Active Duty Military Alert: This alert is specifically for active duty military members and lasts for one year. It helps protect their credit while they are deployed. To place a fraud alert, contact one of the three major credit bureaus—Equifax, Experian, or TransUnion. The bureau you contact is required to notify the other two. You may need to provide proof of identity and other relevant documentation. Some advantages of fraud alerts include: 1. Extra Layer of Security: Fraud alerts provide an additional layer of protection against identity theft. 2. Lenders Must Verify Identity: Lenders are required to verify your identity before extending credit. 3. Free Credit Reports: You are entitled to additional free credit reports when you place a fraud alert. Despite their benefits, fraud alerts also have some limitations: 1. Expiration: Fraud alerts expire and must be renewed. 2. Dependence on Lenders' Vigilance: Fraud alerts rely on lenders' attention to the alerts on your credit report. A credit freeze, also known as a security freeze, restricts access to your credit report. This prevents new accounts from being opened in your name without your permission. To place a credit freeze, you must contact each of the three major credit bureaus individually. You will need to provide personal information and may be required to create a PIN or password. There are two ways to lift or remove a credit freeze: 1. Temporary Lift: You can lift a credit freeze temporarily, for a specific period or for a specific lender. 2. Permanent Removal: You can remove a credit freeze permanently when you no longer need it. Some advantages of credit freezes include: 1. Stronger Protection Against Identity Theft: Credit freezes offer more robust protection than fraud alerts. 2. Control Over Credit Report Access: You decide when and with whom to share your credit report. Some limitations of credit freezes include: 1. Inconvenience: Lifting or removing a credit freeze can take time and may delay credit applications. 2. Cost: There may be fees associated with placing, lifting, or removing a credit freeze. 3. Does Not Protect Existing Accounts: Credit freezes only prevent new accounts from being opened; they do not protect existing accounts from fraudulent activity. Credit freezes offer more robust protection against identity theft than fraud alerts. Fraud alerts are generally easier to use and require less effort to manage compared to credit freezes. Fraud alerts are typically free, while credit freezes may have associated fees. Fraud alerts are more suitable for those who suspect they may be victims of identity theft or want an extra layer of protection. Credit freezes are better for individuals who want to prevent access to their credit reports entirely. When choosing between a fraud alert and a credit freeze, consider the following factors: Besides fraud alerts and credit freezes, there are other ways to protect your credit: Regularly review your credit reports for any suspicious activity or inaccuracies. You can request a free credit report from each of the three major credit bureaus annually. These services monitor your personal information for signs of identity theft and provide assistance if you become a victim. They may also offer credit monitoring, insurance, and recovery services. Implement strong, unique passwords for your online accounts and use two-factor authentication when available. Be cautious when sharing personal information online and avoid unsecured Wi-Fi networks. Taking action to protect your credit information is essential in today's digital age, where the risk of identity theft and credit fraud is ever-present. Understanding the differences between fraud alerts and credit freezes is a crucial step in making informed decisions about the best protection measures for your individual situation. Fraud alerts serve as a valuable tool for those who want an added layer of protection, especially when there is suspicion of identity theft or fraudulent activity. They provide a warning to potential lenders, prompting them to verify your identity before granting credit. When deciding between a fraud alert and a credit freeze, consider factors such as security level, ease of use, and potential costs. Each option has its benefits and limitations, so it is essential to weigh these factors based on your specific needs and circumstances. What Are Fraud Alerts?

Types of Fraud Alerts

How to Place a Fraud Alert

Benefits of Fraud Alerts

Limitations of Fraud Alerts

What Are Credit Freezes?

How to Place a Credit Freeze

Lifting or Removing a Credit Freeze

Benefits of Credit Freezes

Limitations of Credit Freezes

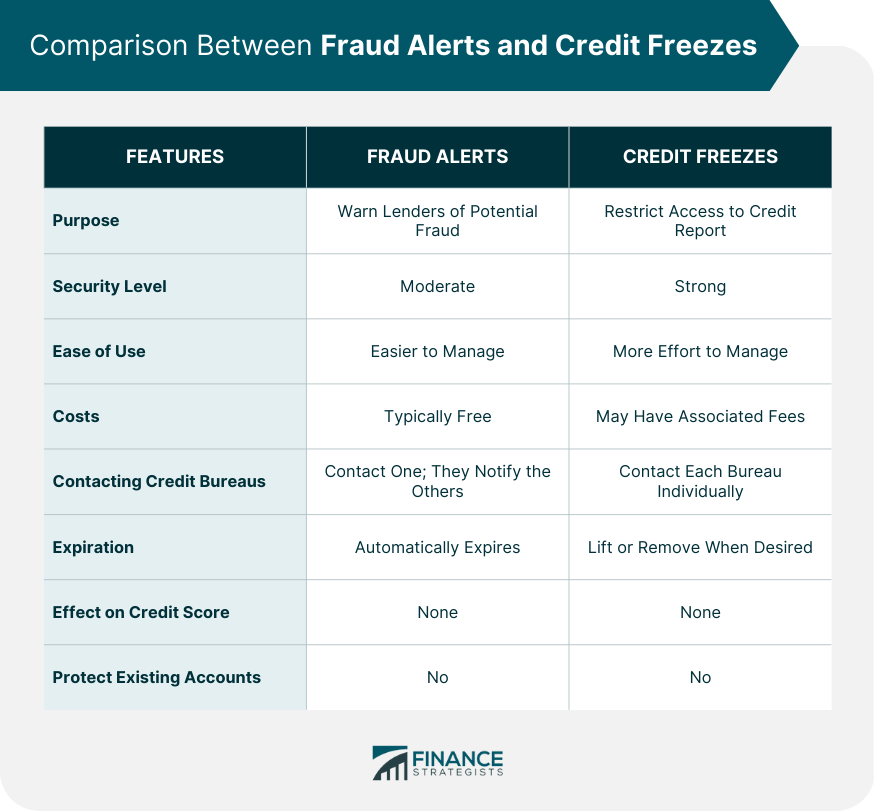

Comparing Fraud Alerts and Credit Freezes

Additional Credit Protection Measures

Regular Credit Report Monitoring

Identity Theft Protection Services

Using Strong Passwords and Secure Online Practices

The Bottom Line

On the other hand, credit freezes offer a stronger safeguard, completely restricting access to your credit report and preventing new accounts from being opened in your name without your permission.

Fraud Alerts and Credit Freezes FAQs

Fraud alerts and credit freezes are both tools for protecting your credit. Fraud alerts add a notification to your credit report, requiring lenders to take extra steps to verify your identity before extending credit. Credit freezes restrict access to your credit report entirely, preventing new accounts from being opened in your name without your permission. Credit freezes offer stronger protection but may be less convenient and have associated fees.

To place a fraud alert, contact one of the three major credit bureaus (Equifax, Experian, or TransUnion), and they will notify the other two. To place a credit freeze, you must contact each of the three credit bureaus individually. Both processes may require personal information and documentation for verification.

Yes, it is possible to have both fraud alerts and credit freezes on your credit report simultaneously. However, since credit freezes offer more robust protection, having a fraud alert in addition to a credit freeze might not provide any significant added benefit.

Fraud alerts automatically expire after a set period (one year for initial and active duty military alerts, seven years for extended alerts). For credit freezes, you can request a temporary lift or a permanent removal by contacting each of the three major credit bureaus. You may need your PIN or password to lift or remove a credit freeze.

Additional measures to protect your credit include regularly monitoring your credit reports, using identity theft protection services, and practicing secure online habits such as using strong, unique passwords and two-factor authentication for your accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.