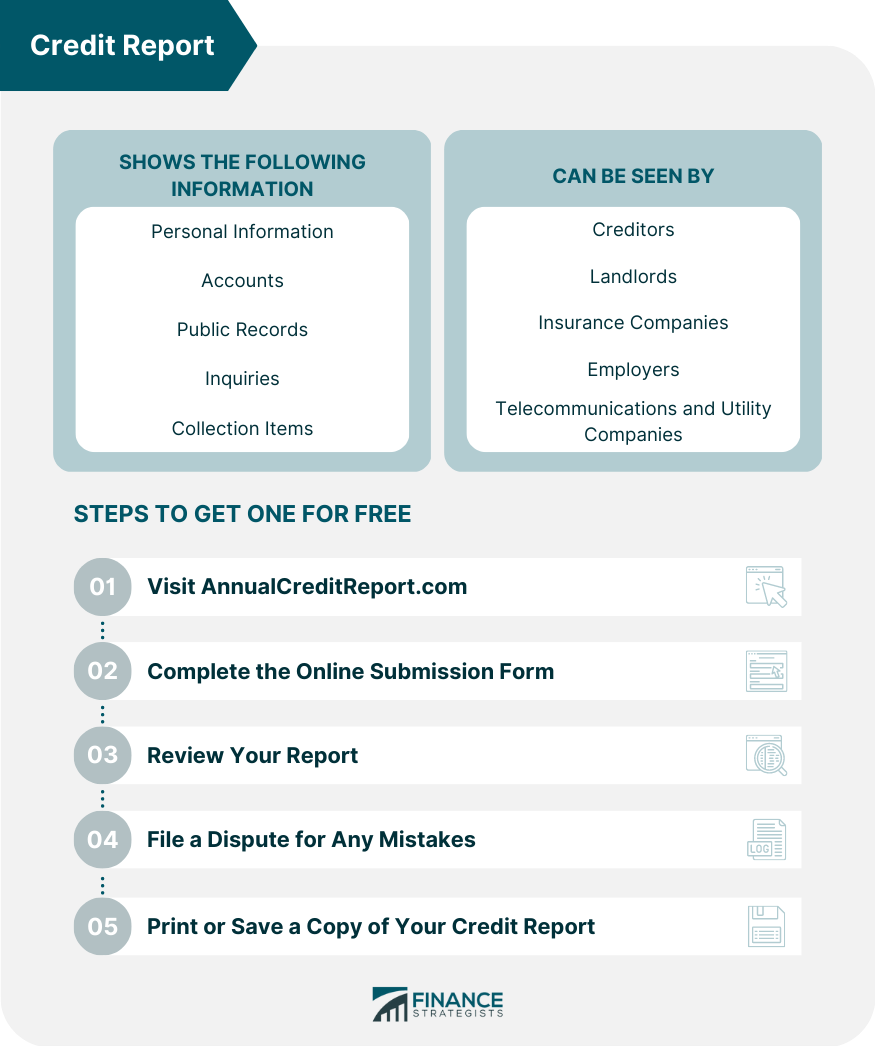

A credit report is a comprehensive document that outlines an individual's credit history and financial behavior. It contains information about an individual's credit accounts, payment history, outstanding debt, and other financial liabilities. Experian, Equifax, and TransUnion are the three major credit reporting agencies that create and maintain the report. These agencies gather information from various sources, including banks, lenders, and credit card issuers, to create a comprehensive report. The credit report plays a crucial role in determining an individual's creditworthiness and financial stability. Primarily, lenders and financial institutions use a credit report to assess your creditworthiness and determine your risk of defaulting on a loan or credit card debt. Your credit score, a numerical value that shows your creditworthiness, is based on your credit report. Employers, insurance companies, landlords, telecommunications, and utility companies may use the information on your credit report to determine your suitability for any related services you are applying for. Furthermore, a credit report can uncover unauthorized credit transactions related to identity theft and other fraudulent activities. Regularly checking your credit reports can assist in detecting any suspicious activity and allow for prompt resolution. The report contains various types of information that provide a comprehensive picture of an individual's creditworthiness: Personal information found on a credit report includes an individual's name, date of birth, current and previous addresses, contact information, Social Security Number (SSN), and employment information. This information is used to confirm an individual's identity and to match it to their credit history. The accounts section on a credit report includes a list of all the credit accounts an individual has opened, such as credit cards, loans, and mortgages. This section provides information on the type of account, the account balance, the credit limit, the payment history, and account standing. A positive credit rating can remain on your report indefinitely, in some cases for up to ten years after account closing. While negative information remains visible for seven years. Inaccuracies such as misreported credit limits or outdated delinquencies will appear in this section even if they are over seven years old. Public records information on a credit report includes any legal actions or court judgments related to the individual's financial life, such as bankruptcies, foreclosures, or tax liens. This information is typically included on a credit report for seven years. A negative public records history can make it difficult for an individual to obtain new credit. Inquiries information on a credit report includes a list of all the parties who have requested a copy of the individual's credit report, including lenders, insurance companies, and employers. These inquiries can be related to a credit application or non-credit related purpose, such as pre-approval credit offers, employment background checks or a landlord checking your report for rental purposes. Collection items information on a credit report includes any debts that have been sent to a collection agency. This can make lenders and creditors view the individual as having a higher risk of default, and as a result, they may decline a credit application or offer less favorable terms. A credit report can be accessed by a variety of entities for various reasons. Some of the most common entities that can access an individual's credit report include: Creditors, such as banks, credit card companies, and lenders, may access an individual's credit report to assess their risk level as a borrower when they apply for a loan, credit card, or any other type of credit. It helps them decide interest rates, credit limits, and repayment terms. Landlords may access credit reports when they are considering renting an apartment or a house to an individual. Payment history and outstanding debts can provide landlords with valuable insight into the individual's financial stability and ability to make rent payments on time. As part of their underwriting process, insurance companies may access an individual's credit report to assess their risk when considering them for insurance coverage. The information in the credit report can help insurance companies decide whether to approve the individual for coverage and what premium rate to charge. In some cases, employers may use the credit report if they have permission from the individual to do so. This information can be used to figure out if they are a good candidate and even to monitor their finances once employed. These companies may access an individual's credit report as part of the evaluation process when considering them for service provision. Companies can have an idea of the individual's ability to make timely payments for the services being offered. You are usually limited to one free credit report annually. This is an important step in understanding your financial standing and ensuring the accuracy of the information contained within it. Here are the steps to obtaining a free credit report: This is the official website for obtaining a free credit report. The three major credit bureaus maintain the website: Experian, Equifax, and TransUnion. You must complete an online submission form with your personal information, including name, address, and SSN. Your information will verify your identity and pull up your credit report. This step involves choosing which credit reporting agencies you want to receive reports from. These may have different information, resulting in differences in your credit history recorded by each agency. It is advisable to review reports from all three agencies throughout the year. Once you have submitted the form, you can access your credit report. It is essential to review it thoroughly to ensure that all the information is accurate. Any mistakes can affect the accuracy of your credit report. Suppose you find any errors or discrepancies in your credit report, file and submit a dispute with the credit bureau. You can write a dispute letter and send it to the credit bureau along with supporting documentation. After reviewing your credit report, printing or saving a copy for your records is important. This will be useful if you need to reference the report in the future because access to your credit report is limited. You will have to wait until the next available opportunity to obtain it. Although this is the official report, there are other ways to obtain a credit report. Some credit monitoring services offer credit reports as part of their services. Some banks, credit unions, and other financial institutions provide credit reports to their customers. A credit report and a credit score are separate but related pieces of information that reflect an individual's creditworthiness. Credit reports are a detailed record of an individual's credit history, including their accounts, payment history, public records, and credit inquiries. On the other hand, a credit score is a numerical representation of an individual's creditworthiness, calculated based on the information in their credit report. Financial institutions and lenders use a FICO scoring model to determine how much credit they can offer borrowers and at what interest rate. Its competition in the credit score business is the VantageScore model. Although the VantageScore scoring scale is comparable to FICO's 300-850, it contains a letter grade (A through F) for better comprehension. Higher numbers indicate better credit standing. Other scorings models are available, although they are less well known. Credit reports are comprehensive document that outlines an individual's credit history and financial behavior. It contains information about an individual's credit accounts, payment history, outstanding debt, and other financial liabilities. A credit report includes personal information, accounts, public records, inquiries, and collection items. The information on a credit report can be accessed by creditors, landlords, insurance companies, communications, utility companies, and employers. To obtain a free credit report, one must visit AnnualCreditReport.com, complete an online submission form, and answer questions to verify identity. Individuals should regularly review credit reports for accuracy. A credit report is an essential document that significantly impacts your financial life. Maintaining a positive credit history is critical to ensure access to financial opportunities with favorable terms and interest rates.What Is a Credit Report?

Why Your Credit Report Matters

Information That Appears in Your Credit Report

Personal Information

Accounts

Public Records

Inquiries

Collection Items

Who Can See Your Credit Report?

Creditors

Landlords

Insurance Companies

Employers

Telecommunications and Utility Companies

How to Get a Free Credit Report

Step 1: Visit AnnualCreditReport.com

Step 2: Complete the Online Submission Form

Step 3: Review Your Report

Step 4: File a Dispute for Any Mistakes

Step 5: Print or Save a Copy of Your Credit Report

Credit Report vs Credit Score

Final Thoughts

Credit Report FAQs

Your credit report is important in determining your financial stability and creditworthiness. It provides a comprehensive overview of your borrowing history, including information about your payment history, outstanding debts, and any legal actions or judgments related to your finances. A good credit history can open up many financial opportunities with favorable terms.

Your credit report can be accessed by creditors, lenders, insurers, and employers. In some cases, your credit report may be viewed by telecommunications, utility companies, landlords, or government agencies.

To get a free credit report, visit AnnualCreditReport.com and complete an online submission form. You will also have to answer questions to verify your identity. Once you have submitted the form, you can access your credit report.

Accurate information in credit reports cannot be removed. If there are errors or discrepancies in your credit report, you can submit and file a dispute to have them corrected. However, negative credit information stays in the report for seven to ten years.

Negative information in your credit report typically remains for seven years from the date of default. Bankruptcy records, however, could stay for up to ten years based on the type of bankruptcy. Public records such as liens and court judgments may remain in the report indefinitely. Monitoring your credit report regularly and disputing any inaccuracies or outdated information is crucial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.