Retained Earnings transferred to permanent capital, unavailable for future cash dividends is called capitalized retained earnings. Usually occurs when a stock dividend is issued. Capitalized Retained Earnings refers to the portion of a company's net income which is voluntarily retained by management, instead of being paid out to shareholders in the form of dividends. These earnings are typically re-invested into the business for activities like paying off debt, acquiring assets or promoting growth. The concept of capitalized retained earnings holds substantial importance in business finance, with broad implications for the financial stability, growth prospects and shareholder value of a corporation. Capitalized Retained Earnings form a critical component of a company's financial stability. This stability is primarily driven by the self-sufficiency that these earnings provide. A corporation with substantial retained earnings indicates that it is not entirely reliant on external borrowing to fund its operations or future ventures. In fact, it has a reservoir of internally generated funds to draw from. This reduces financial risk and enhances the company's ability to weather economic downturns or industry-specific shocks. Capitalized Retained Earnings are also essential for a company's growth and expansion. Essentially, they are funds that a company reinvests back into itself. These reinvested funds can be used for various purposes, such as research and development, marketing initiatives, capital expenditure, or even for acquiring other businesses. A firm with a robust reserve of capitalized retained earnings has the financial flexibility to seize opportunities that can drive growth. Instead of relying on external sources of finance, which may come with strings attached, they can use their own funds to strategize and execute their growth plans, providing a significant competitive advantage. Retained earnings offer a financial cushion for businesses to meet unexpected expenses or navigate business downturns. These funds can be used to offset losses, finance unexpected operational costs, or meet emergency needs without resorting to borrowing. It grants the company the ability to deal with financial uncertainties, thus ensuring business continuity in challenging times. The decision to capitalize retained earnings greatly depends on a company's growth prospects. Businesses expecting high growth rates in the future might prefer to retain more earnings. By reinvesting these earnings, they can fund their expansion initiatives and potentially realize higher returns in the future. On the other hand, businesses with lower growth prospects might choose to distribute more earnings to the shareholders in the form of dividends. In industries where large investments are required for growth or to maintain a competitive edge, such as the technology or manufacturing sectors, companies often capitalize a higher proportion of their earnings. Conversely, in more stable or mature industries, where growth opportunities may be limited, companies might prefer to return a larger share of their earnings to shareholders. Certain industries, such as banking and insurance, are subjected to stringent regulatory requirements regarding capital adequacy. Companies operating in these sectors may need to retain more earnings to comply with these regulations. On the other hand, some jurisdictions might incentivize companies to distribute earnings to shareholders by offering tax benefits on dividends. In such cases, companies might choose to capitalize a smaller proportion of their earnings. One common method of capitalizing retained earnings is through stock buybacks, where a company repurchases its own shares from the open market. This method can be particularly beneficial if the management believes that the company's shares are undervalued. By reducing the number of shares outstanding, buybacks increase earnings per share and often lead to a rise in the company's share price. Stock buybacks can also provide an exit path for shareholders wanting to sell their shares. They also send a positive signal to the market about the company's financial health, which might boost investor confidence and the company's stock price. Another method of capitalizing retained earnings is through dividend reinvestment plans (DRIPs). Under a DRIP, shareholders can choose to reinvest their dividends back into the company by purchasing more shares, instead of receiving a cash payout. This not only provides the company with additional capital but also allows shareholders to compound their investment over time. Such plans are advantageous to both the company and the shareholders. For the company, it’s a low-cost way of raising capital as it avoids the issuance costs associated with new shares. For the shareholders, it provides a convenient and automatic way of increasing their investment in the company. Capitalized retained earnings can also be used for making strategic investments. These investments could be in the form of expanding into new markets, investing in new technologies, or acquiring other businesses. The aim of these investments is to increase the company's market share and profitability in the long run. Such strategic investments allow a company to diversify its operations and increase its competitiveness. Moreover, by using internal funds for such investments, a company can maintain control over its strategies without having to worry about external investor pressures. With a significant amount of funds accumulated over time, a company has the financial muscle to undertake initiatives that can be beneficial in the long term. It could invest in promising opportunities, fund its growth plans, or even weather financial downturns. In essence, capitalized retained earnings can provide a company with the flexibility to manage its operations more effectively and strategically. Furthermore, a company with a high level of capitalized retained earnings can react quickly to changes in the business environment. Whether it’s a sudden market opportunity or an unforeseen obstacle, a company with substantial retained earnings can swiftly devise and implement responses, giving it a strategic edge over competitors that might be more reliant on external financing. By reinvesting profits back into the business, a company can fund its operations and expansion plans using its own funds, thereby minimizing the need for external borrowing or issuing new shares. Avoiding external financing not only saves on interest costs or dilution of ownership, but it also shields the company from the volatility of financial markets. Furthermore, not having to meet external investor expectations or repayment obligations gives the company greater control over its financial and strategic decisions. It signals to the market that the company is financially healthy and has been profitable enough to accumulate substantial earnings. This could lead to an increase in the company's share price, thereby enhancing shareholder value. Also, by reinvesting its earnings, a company can undertake initiatives that could lead to higher future profits, such as funding research and development, expanding into new markets, or improving operational efficiency. These initiatives could lead to higher future earnings and dividends, further enhancing shareholder value in the long term. When a company retains and reinvests its earnings, shareholders are denied the dividends that could have been invested elsewhere to potentially earn higher returns. If the company's return on reinvested earnings is lower than what shareholders could have achieved with dividends, it represents an opportunity cost. Moreover, there's also the risk that the company might not use the reinvested earnings efficiently, leading to sub-optimal returns or even losses. Hence, the decision to capitalize retained earnings should be based on a careful evaluation of the company's investment opportunities and expected returns. Another disadvantage is the potential dilution of ownership that can result from some methods of capitalizing retained earnings, such as issuing additional shares for a dividend reinvestment plan. Although the company might gain additional capital, it could result in the existing shareholders owning a smaller percentage of the company. However, it's important to note that while the proportion of ownership might decrease, the total value of a shareholder's investment might not necessarily decrease if the company uses the additional capital to create more value. Capitalizing retained earnings also limits the cash available for distribution to shareholders in the form of dividends. For some investors, particularly those who rely on dividends for their income, this might make the company's shares less attractive. Therefore, companies need to strike a balance between capitalizing retained earnings for future growth and returning cash to shareholders in the form of dividends. Capitalized Retained Earnings enhance financial stability, support growth and expansion, and provide a cushion for unexpected expenses. However, the decision to capitalize retained earnings is influenced by various factors, including the company's growth prospects, industry dynamics, and regulatory requirements. There are several methods of capitalizing retained earnings, such as stock buybacks, dividend reinvestment plans, and strategic investments, each with its own benefits. The process offers increased financial flexibility, reduces reliance on external financing, and enhances shareholder value. However, it also comes with potential downsides, including the opportunity cost of alternative investments, potential dilution of ownership, and limitations on cash distribution. The concept of capitalized retained earnings underlines the importance of sound financial management and strategic investment for a company's success. What Do You Mean by Capitalized Retained Earnings?

Importance of Capitalized Retained Earnings

Enhances Financial Stability

Supports Growth and Expansion

Provides Cushion for Unexpected Expenses

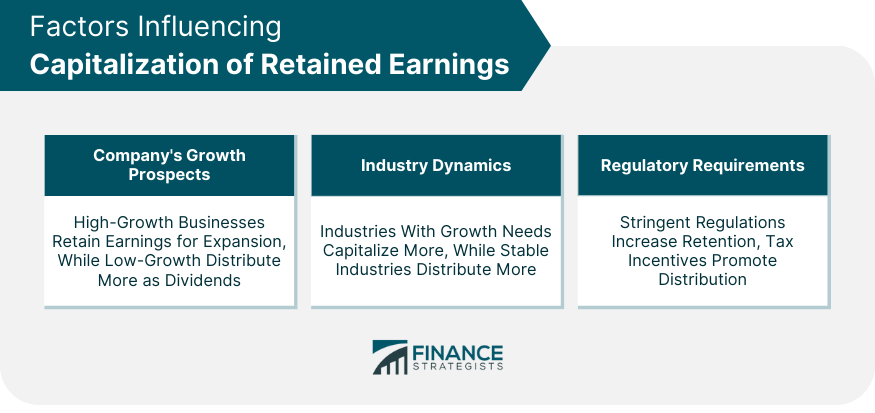

Factors Influencing Capitalization of Retained Earnings

Company's Growth Prospects

Industry Dynamics

Regulatory Requirements

Methods of Capitalizing Retained Earnings

Stock Buybacks

Dividend Reinvestment Plans

Strategic Investments

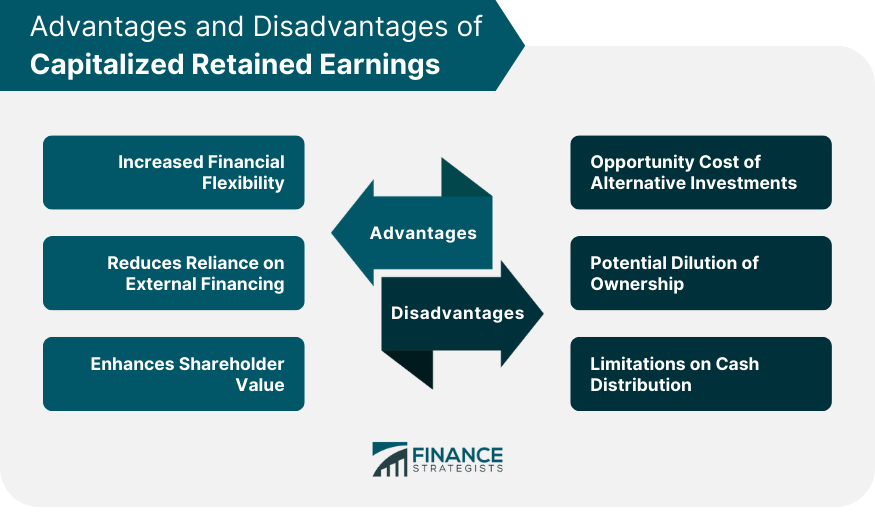

Advantages of Capitalized Retained Earnings

Increased Financial Flexibility

Reduces Reliance on External Financing

Enhances Shareholder Value

Disadvantages of Capitalized Retained Earnings

Opportunity Cost of Alternative Investments

Potential Dilution of Ownership

Limitations on Cash Distribution

The Bottom Line

Capitalized Retained Earnings FAQs

Capitalized Retained Earnings is the portion of a company's net income that is not paid out as dividends to shareholders but instead reinvested in the business.

Companies use Capitalized Retained Earnings to finance expansion, acquisitions, or other investments that are deemed necessary for long-term growth.

Generally speaking, no; however, it is important to note that the tax treatment of Capitalized Retained Earnings can vary depending on the specific circumstances of the company.

The primary benefits of Capitalized Retained Earnings are increased flexibility and access to capital in the event of an emergency or other unforeseen circumstances. It also allows companies to retain control over their finances while still generating positive returns.

Capitalized Retained Earnings is typically reported as part of the company’s balance sheet, under the equity section. The amount of Capitalized Retained Earnings is calculated by subtracting total dividends paid out from net income for a given year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.