Zero-coupon bonds is a unique type of debt security that does not make periodic interest payments to bondholders. Instead, these bonds are issued at a discount to their face value, and investors receive the full face value upon maturity. The difference between the purchase price and the face value represents the imputed interest or return on investment for the bondholder. Zero-coupon bonds are characterized by several key features, including their lack of periodic interest payments, their discounted issuance price, and their lump-sum repayment at maturity. In comparison to traditional coupon bonds, zero-coupon bonds tend to have lower initial investments and higher sensitivity to interest rate fluctuations. U.S. Treasury bills are short-term government debt securities that have maturities of one year or less. These instruments are considered zero-coupon bonds, as they are issued at a discount to their face value and do not make periodic interest payments. U.S. Treasury strips are created by separating the principal and interest components of a U.S. Treasury bond. The interest components can be stripped away, leaving the principal component as a zero-coupon bond. These bonds are backed by the full faith and credit of the U.S. government, making them a relatively safe investment. Municipal zero-coupon bonds are issued by state and local governments to finance public projects. These bonds may be tax-exempt at the federal, state, and local levels, providing tax advantages to certain investors. Corporate zero-coupon bonds are issued by companies seeking to raise capital. These bonds tend to carry higher risks compared to government-issued zero-coupon bonds, as they are subject to the creditworthiness of the issuing corporation. Zero-coupon bond pricing is based on the concept of present value. The price of a zero-coupon bond is calculated by discounting the bond's face value using the prevailing market interest rate over the bond's time to maturity. Yield to maturity (YTM) represents the total return an investor will earn if they hold a zero-coupon bond until maturity. It is the annualized internal rate of return on the bond, taking into account the purchase price, the face value, and the time to maturity. Several factors influence the pricing of zero-coupon bonds, including interest rate fluctuations, the credit quality of the issuer, the time to maturity, and market conditions. Interest rates play a significant role in determining the price of zero-coupon bonds. When market interest rates rise, the price of existing zero-coupon bonds tends to fall. This is because new bonds issued at higher interest rates become more attractive to investors, leading to a decrease in demand for older, lower-yielding bonds. Conversely, when market interest rates fall, the price of existing zero-coupon bonds generally increases, as they become more attractive compared to new bonds issued at lower interest rates. The credit quality of the issuer directly impacts the pricing of zero-coupon bonds. Issuers with higher credit ratings are considered to be more creditworthy, and their bonds are generally perceived as lower-risk investments. As a result, investors may be willing to pay a higher price for bonds issued by high-credit-quality issuers. Conversely, bonds issued by issuers with lower credit ratings are considered riskier, leading to lower prices for these zero-coupon bonds. The time remaining until a zero-coupon bond maturity date can also influence its price. Generally, the longer the time to maturity, the more sensitive the bond's price is to changes in interest rates. This is because the bond's value is based on the present value of its future cash flows, which are discounted using prevailing market interest rates. As the time to maturity increases, the impact of interest rate changes on the bond's present value becomes more significant, leading to greater price fluctuations. Market conditions, such as investor sentiment and economic factors, can also affect the pricing of zero-coupon bonds. In times of economic uncertainty or when investors are risk-averse, they may seek safer investments like U.S. Treasury bonds or high-quality corporate bonds, driving up the prices of these zero-coupon bonds. On the other hand, during periods of economic growth and increased investor risk appetite, the demand for riskier assets may increase, leading to lower prices for zero-coupon bonds as investors shift their focus towards higher-yielding investments. Zero-coupon bonds offer investors predictable returns, as the bondholder knows the exact amount they will receive upon the bond's maturity. Zero-coupon bonds generally require a lower initial investment compared to traditional coupon bonds, as they are issued at a discount to their face value. Since zero-coupon bonds do not make periodic interest payments, investors do not face reinvestment risk, which arises when interest rates change and investors must reinvest their periodic interest payments at lower rates. Municipal zero-coupon bonds offer tax advantages for certain investors, as the interest earned may be exempt from federal, state, and local income taxes. Zero-coupon bonds do not provide periodic income, making them less suitable for investors seeking regular cash flow from their investments. Zero-coupon bonds are more sensitive to interest rate fluctuations than traditional coupon bonds, as their values can decline significantly when interest rates rise. Investors in zero-coupon bonds are exposed to the credit risk of the issuer, which may default on its obligation to repay the bond's face value upon maturity. While municipal zero-coupon bonds offer tax advantages, corporate and treasury zero-coupon bonds may have unfavorable tax implications for certain investors, as the imputed interest is taxable even though no cash payments are received until maturity. Laddering is a strategy that involves purchasing zero-coupon bonds with staggered maturity dates, allowing investors to minimize interest rate risk and create a predictable cash flow stream. The barbell strategy involves investing in a combination of short-term and long-term zero-coupon bonds, seeking to balance the risk and return of the portfolio. The bullet strategy involves investing in zero-coupon bonds with the same maturity date, aiming to match a specific future cash flow need or liability. Duration matching is a strategy that involves constructing a portfolio of zero-coupon bonds with a duration that matches the investor's investment horizon or a specific liability, helping to minimize interest rate risk. Zero-coupon bonds are subject to federal income tax on the imputed interest or the difference between the purchase price and face value. This interest is generally taxed as ordinary income, even though investors do not receive cash payments until the bond matures. State and local income tax treatment of zero-coupon bonds varies by jurisdiction. Municipal zero-coupon bonds are typically exempt from state and local taxes, while corporate and treasury zero-coupon bonds may be subject to these taxes. Zero-coupon bonds are subject to Original Issue Discount (OID) taxation rules, which require investors to report and pay taxes on the imputed interest annually, even though they do not receive cash payments until the bond matures. Investors who hold zero-coupon bonds in tax-deferred retirement accounts, such as IRAs or 401(k)s, can defer taxes on the imputed interest until they withdraw the funds from the account. Zero-coupon bonds can be an effective tool for college savings, as they can be timed to mature when tuition payments are due, providing a predictable lump sum for education expenses. Investors can use zero-coupon bonds to create a predictable income stream in retirement, by purchasing bonds with maturity dates that coincide with their anticipated retirement needs. Zero-coupon bonds can be used to match future liabilities, such as pension plan obligations, by selecting bonds with maturity dates that align with the timing of the liabilities. Including zero-coupon bonds in an investment portfolio can provide diversification benefits, as these bonds have different risk and return characteristics compared to other types of fixed-income securities and equities. Zero-coupon bonds offer unique investment opportunities for various investor profiles, with their predictable returns, lower initial investments, and lack of reinvestment risk. However, these bonds also present certain challenges, such as interest rate risk, credit risk, and tax implications. By understanding the key concepts and strategies related to zero-coupon bonds, investors can make informed decisions about whether these securities are suitable for their investment objectives and risk tolerance. Definition of Zero-Coupon Bonds

Key Features of Zero-Coupon Bonds

Types of Zero-Coupon Bonds

U.S. Treasury Bills

U.S. Treasury Strips

Municipal Zero-Coupon Bonds

Corporate Zero-Coupon Bonds

Pricing and Valuation of Zero-Coupon Bonds

Present Value Calculations

Yield to Maturity (YTM)

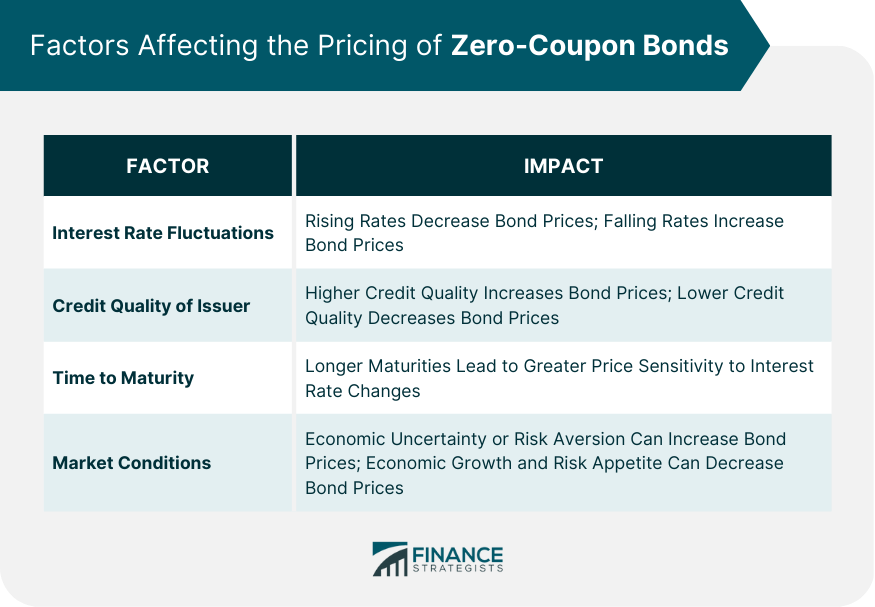

Factors Affecting the Pricing of Zero-Coupon Bonds

Interest Rate Fluctuations

Credit Quality of the Issuer

Time to Maturity

Market Conditions

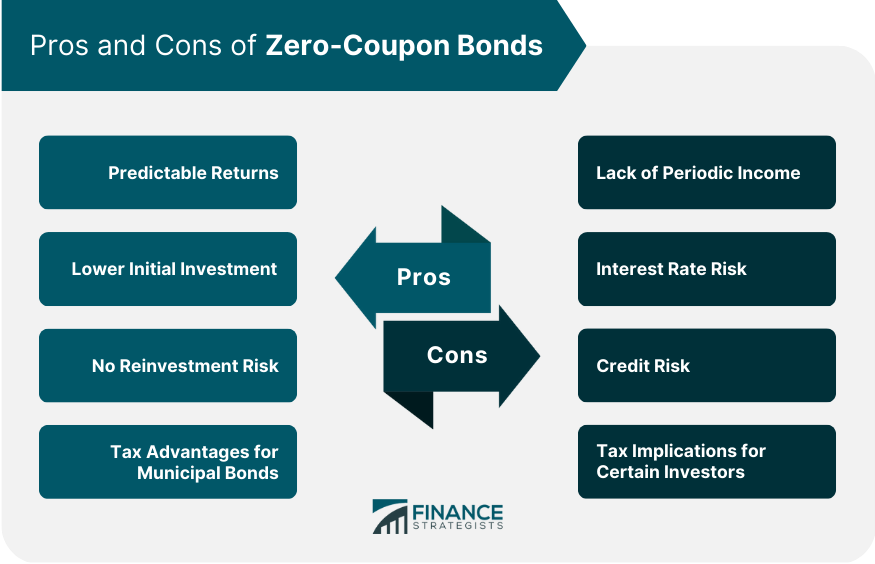

Pros of Zero-Coupon Bonds

Predictable Returns

Lower Initial Investment

No Reinvestment Risk

Tax Advantages for Municipal Bonds

Cons of Zero-Coupon Bonds

Lack of Periodic Income

Interest Rate Risk

Credit Risk

Tax Implications for Certain Investors

Strategies for Investing in Zero-Coupon Bonds

Laddering

Barbell Strategy

Bullet Strategy

Duration Matching

Taxation of Zero-Coupon Bonds

Federal Income Tax Considerations

State and Local Income Tax Considerations

Original Issue Discount (OID) Taxation Rules

Tax Implications for Retirement Accounts

Real-Life Applications of Zero-Coupon Bonds

College Savings

Retirement Planning

Liability Matching

Portfolio Diversification

Conclusion

Zero-Coupon Bonds FAQs

Zero-coupon bonds are debt securities that do not make periodic interest payments to investors. Instead, they are issued at a discount to their face value, and the full face value is paid upon maturity. The key difference between zero-coupon bonds and traditional bonds is that traditional bonds pay regular interest, while zero-coupon bonds only provide a return upon maturity.

The prices of zero-coupon bonds are determined by calculating the present value of the bond's face value, discounted using the prevailing market interest rate over the bond's time to maturity. The price will be lower than the face value due to the absence of periodic interest payments.

The advantages of investing in zero-coupon bonds include predictable returns, lower initial investment, no reinvestment risk, and potential tax advantages for municipal bonds. Disadvantages include the lack of periodic income, interest rate risk, credit risk, and unfavorable tax implications for certain investors in corporate and treasury zero-coupon bonds.

Yes, zero-coupon bonds can be an effective tool for college savings and retirement planning. By purchasing zero-coupon bonds with maturity dates that coincide with anticipated tuition payments or retirement needs, investors can create a predictable lump sum to cover these expenses.

Gains from zero-coupon bonds, known as imputed interest, are generally taxed as ordinary income at the federal level, even though investors do not receive cash payments until the bond matures. State and local income tax treatment varies by jurisdiction. Municipal zero-coupon bonds may be exempt from federal, state, and local taxes, while corporate and treasury zero-coupon bonds may be subject to these taxes. Investors should consult a tax professional for guidance on their specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.