Pay-For-Success (PFS) financing is an innovative funding model that involves public-private partnerships to address pressing social issues. It is a performance-based financing mechanism where private investors provide upfront capital to social service providers. The government or other funding entity only pays when predetermined outcomes are achieved. The primary goal of PFS financing is to shift the focus from inputs to outcomes by linking financial returns to the successful delivery of social services. It aims to enhance accountability, improve the efficiency of public spending, and foster innovation in the delivery of social services. By leveraging private capital, PFS financing can also help address funding gaps and reduce the risk of governments investing in unproven interventions. PFS financing typically involves three key stakeholders: the government or funding entity, service providers, and private investors. Additionally, intermediary organizations and evaluators may also play critical roles in structuring and assessing PFS projects. The PFS financing process usually follows these steps: identifying social issues, selecting service providers, engaging private investors, designing the PFS contract, implementing the intervention, measuring and evaluating outcomes, and making outcome payments. The timeline of a PFS project may vary depending on the complexity and duration of the intervention. A critical aspect of PFS financing is the rigorous measurement and evaluation of outcomes to determine whether the predetermined targets have been met. Independent evaluators often assess the program's effectiveness using a robust evaluation design, such as randomized controlled trials or quasi-experimental methods. PFS financing offers governments several benefits, including the ability to transfer financial risk to private investors, access new funding sources, and promote evidence-based policymaking by paying only for successful interventions. Service providers can benefit from PFS financing by receiving upfront capital, which allows them to scale their operations and innovate in service delivery. Additionally, the focus on outcomes encourages the development of data-driven, evidence-based practices. Investors in PFS projects can achieve both financial returns and positive social impact, aligning with the growing trend of impact investing. Moreover, the rigorous measurement and evaluation processes can help mitigate investment risks. Implementing PFS financing can be complex and time-consuming, as it requires extensive collaboration among stakeholders, careful contract design, and robust evaluation methods. Additionally, the transaction costs associated with PFS financing can be high, limiting its applicability to large-scale projects. PFS financing raises several ethical concerns, such as the potential for cherry-picking clients by service providers, the risk of focusing on short-term outcomes at the expense of long-term impact, and the commodification of social services. While PFS financing can play a role in addressing social challenges, it is not a panacea. Some social issues may not be suitable for PFS financing due to the difficulty of measuring outcomes, the absence of proven interventions, or the lack of a clear financial return. Furthermore, PFS financing should not be seen as a substitute for adequate public funding of essential social services. The adoption of PFS financing will continue growing as governments, service providers, and investors recognize its potential benefits. The increased focus on evidence-based policymaking and the rise of impact investing may further drive interest in PFS financing. PFS financing has the potential to expand into new sectors, such as healthcare, environmental conservation, and international development, where measurable outcomes and cost savings can be achieved. Emerging technologies, such as artificial intelligence, big data analytics, and blockchain, may offer opportunities to enhance PFS financing by improving data collection, evaluation, and transparency, thereby reducing transaction costs and increasing efficiency. Pay-For-Success financing represents an innovative funding model that leverages public-private partnerships to tackle pressing social issues. Linking financial returns to successful outcomes promotes accountability, efficiency, and innovation in delivering social services. While there are challenges and limitations associated with PFS financing, it has demonstrated success in various sectors, and its adoption is likely to grow in the future. As an investor or wealth management client, staying informed about emerging investment opportunities, such as Pay-For-Success financing, is essential. By seeking professional wealth management services, you can explore the potential of PFS financing to diversify your portfolio and create a positive social impact. What Is Pay-For-Success (PFS) Financing?

Key Components of Pay-For-Success Financing

Stakeholders in Pay-For-Success Financing

Pay-For-Success Financing Process and Timeline

Measurement and Evaluation in Pay-For-Success Financing

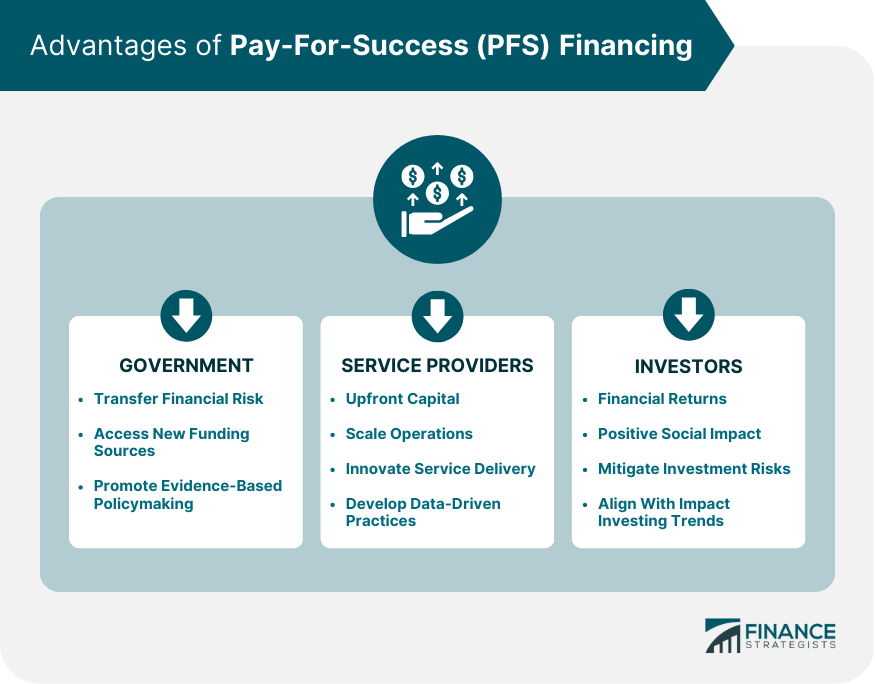

Advantages of Pay-For-Success Financing

Benefits of Pay-For-Success Financing for Governments

Benefits of Pay-For-Success Financing for Service Providers

Benefits of Pay-For-Success Financing for Investors

Challenges and Criticisms of Pay-For-Success Financing

Potential Issues in Pay-For-Success Financing Implementation

Ethical Concerns in Pay-For-Success Financing

Limitations of Pay-For-Success Financing in Addressing Social Issues

Future of Pay-For-Success Financing

Trends in Pay-For-Success Financing Adoption

Potential Growth Sectors for Pay-For-Success Financing

Integration of Pay-For-Success Financing with Emerging Technologies

Final Thoughts

Pay-For-Success (PFS) Financing FAQs

Pay-for-Success (PFS) financing is an innovative funding model that involves public-private partnerships to address pressing social issues. Private investors provide upfront capital to social service providers, and the government or other funding entity only pays when predetermined outcomes are achieved. This performance-based approach shifts the focus from inputs to outcomes, enhancing accountability and efficiency in the delivery of social services.

The primary stakeholders in PFS financing projects include the government or funding entity, service providers, and private investors. Additionally, intermediary organizations and independent evaluators may play essential roles in structuring and assessing PFS projects.

Governments benefit from PFS financing by transferring financial risk to private investors, accessing new funding sources, and promoting evidence-based policymaking. Service providers receive upfront capital, allowing them to scale their operations and innovate in service delivery. Investors can achieve both financial returns and positive social impact, aligning with the growing trend of impact investing.

PFS financing faces challenges in implementation complexity, high transaction costs, and potential ethical concerns, such as cherry-picking clients and focusing on short-term outcomes at the expense of long-term impact. Additionally, some social issues may not be suitable for PFS financing due to the difficulty of measuring outcomes or the lack of a clear financial return.

The future of PFS financing is promising, with potential expansion into new sectors such as healthcare, environmental conservation, and international development. By refining contract design, strengthening evaluation methods, fostering collaboration, and exploring innovative financing models, PFS financing can contribute significantly to addressing global social challenges as part of a broader strategy that includes public investment, policy reform, and cross-sector collaboration.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.