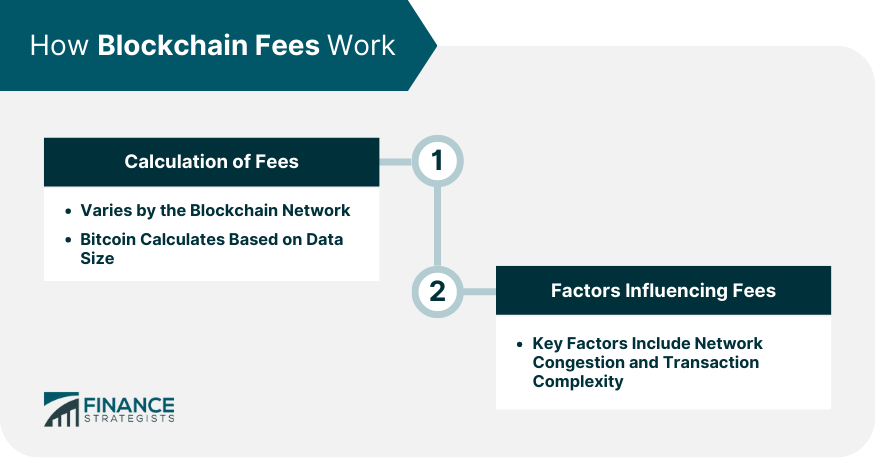

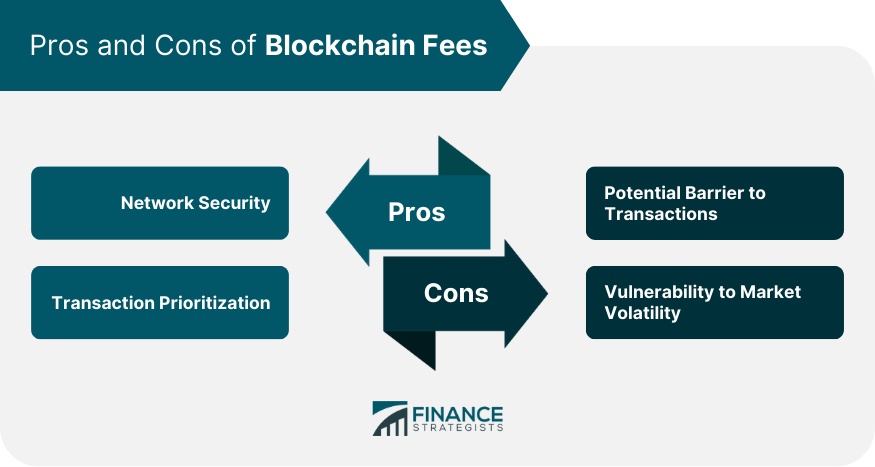

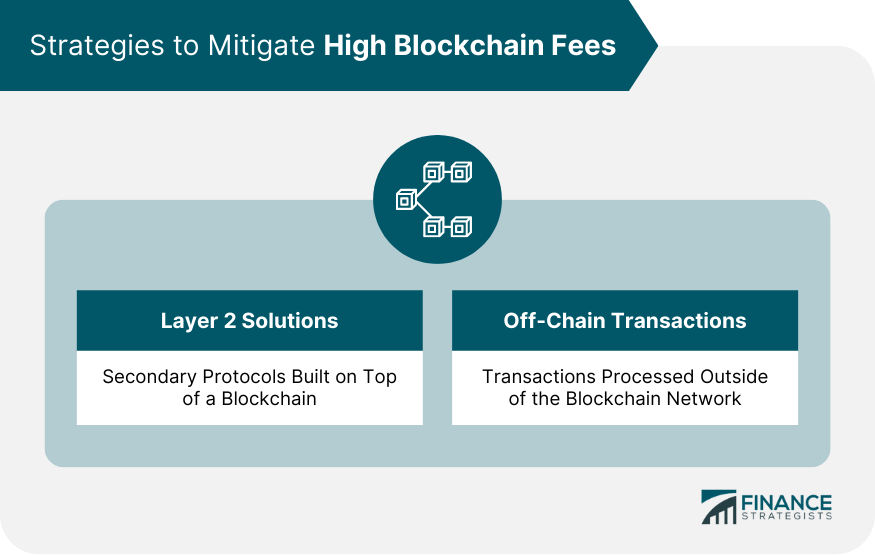

A Blockchain fee is a specific amount of cryptocurrency that users pay to miners or validators to process their transactions. These transactions could include transferring tokens, executing smart contracts, or any other operation that requires computational resources on a blockchain network. Blockchain fees are a fundamental aspect of how decentralized networks operate, ensuring that they remain secure, fair, and functioning efficiently. The purpose of blockchain fees is multifaceted. On one level, they compensate miners or validators for the computational resources used to process and validate transactions. By offering a fee, users incentivize miners to include their transactions in the blockchain, which ensures their transaction is processed in a timely manner. The calculation of blockchain fees varies depending on the specific blockchain network. For instance, on the Bitcoin network, transaction fees are usually calculated based on the data size of the transaction. In contrast, Ethereum uses a system called "Gas," which measures computational effort, to calculate fees. The user specifies a "Gas price," which is the amount of Ether they're willing to pay for each unit of Gas, and this, multiplied by the amount of Gas a transaction uses, determines the transaction fee. Several factors influence the blockchain fee. The most significant of these is network congestion. When more users want to transact on the blockchain at the same time, the demand for computational resources increases, leading to higher fees. Additionally, the complexity of the transaction and the speed at which a user wants the transaction to be processed can also influence the fee. In the Bitcoin network, users can set their transaction fees. Miners usually prioritize transactions with higher prices as it's more profitable. Therefore, if the network is congested, users may choose to pay higher fees to ensure their transactions are processed quickly. This system creates a market for block space, where users compete to have their transactions included in the next block. Unlike the Bitcoin network, the Ethereum network's fee model is based on computational complexity. The more complex a transaction—such as a smart contract operation—the higher the fee. This system is called Gas, and users pay for the amount of "Gas" their transaction consumes. One significant benefit of blockchain fees is that they incentivize network security. By rewarding miners with transaction fees, the system encourages more participants to take part in the mining process, which in turn, enhances the network's security. This reward system is crucial, particularly in networks like Bitcoin, where block rewards halve approximately every four years. Transaction fees also allow for the prioritization of transactions. During periods of high network activity, users who need their transactions processed urgently can opt to pay higher fees. This option ensures their transactions are processed first, contributing to the efficient functioning of the network. High blockchain fees can pose a barrier to transactions, especially for smaller transfers. If the transaction fee is too high relative to the transaction value, it might not be worth making the transaction at all. This issue can disproportionately affect users who wish to make micro-transactions or operate in regions where the average transaction size is small. Blockchain fees are also subject to market volatility. As the price of a cryptocurrency increases, so does the cost of transaction fees in fiat terms. This volatility can make it difficult for users to predict the cost of transacting, potentially causing disruption or deterrence from using the network. The level of network activity plays a significant role in determining blockchain fees. During periods of high demand, the number of transactions vying for validation exceeds the network's capacity, causing a backlog. As a result, transaction fees surge as users bid higher amounts to get their transactions processed quickly. The value of the cryptocurrency used for fees also impacts the amount paid. For example, if the price of Bitcoin or Ether rises dramatically, the cost of transactions on their respective networks can become prohibitively expensive, even if the fee in cryptocurrency terms hasn't changed. Layer 2 solutions are secondary protocols built on top of a blockchain (the primary, or layer 1, network) that aim to scale the network and reduce fees. These solutions process transactions off the main blockchain and then record the final state on the blockchain. This method reduces the load on the network and lowers transaction fees. Off-chain transactions are another way to mitigate high blockchain fees. These transactions are processed outside of the blockchain network and then the final state is recorded on the blockchain. This method is commonly used in payment channels or cryptocurrency exchanges where multiple transactions can be batched into one on-chain transaction, saving on fees. High transaction fees can deter new users and limit the adoption of blockchain technology. For the technology to reach mass adoption, it needs to provide a good user experience, which includes reasonable transaction costs. Excessive fees can make everyday transactions, like buying coffee with Bitcoin, impractical. Blockchain fees are an essential factor for businesses and individuals deciding whether to use a blockchain network. If the fees are too high or unpredictable, it may be more cost-effective to use a traditional payment system. Therefore, managing blockchain fees is crucial for the continued growth and adoption of cryptocurrency. Blockchain fees play a fundamental role in the operation of decentralized networks, compensating miners or validators for the computational resources they provide and incentivizing transaction prioritization. While they bolster network security, their calculation can vary across different blockchain networks, influenced by factors like network congestion, transaction complexity, and speed preferences. High fees, however, can pose challenges for smaller transactions and introduce unpredictability due to market volatility. As such, strategies like Layer 2 solutions and off-chain transactions are developed to mitigate these costs. As blockchain technology advances toward mass adoption, balancing reasonable transaction costs and network security becomes critical. An optimal fee structure that provides a favorable user experience while maintaining network integrity is crucial to facilitate widespread acceptance of cryptocurrencies and blockchain-based applications.What Is a Blockchain Fee?

How Blockchain Fees Work

Calculation of Blockchain Fees

Factors Influencing Blockchain Fees

Application of Blockchain Fees in Various Networks

Bitcoin Network

Ethereum Network

Pros of Blockchain Fees

Incentivizing Network Security

Facilitating Transaction Prioritization

Cons of Blockchain Fees

Potential Barrier to Transactions

Vulnerability to Market Volatility

Understanding Variations in Blockchain Fees

Impact of Network Congestion

Influence of Cryptocurrency Value

Strategies to Mitigate High Blockchain Fees

Layer 2 Solutions

Off-Chain Transactions

Blockchain Fees and Cryptocurrency Adoption

Role of Fees in User Experience

Blockchain Fees as a Factor in Adoption Decisions

Conclusion

Blockchain Fee FAQs

A blockchain fee is a certain amount of cryptocurrency that users pay to miners or validators on a blockchain network to process their transactions. The fee compensates for the computational resources used in the process.

The calculation of blockchain fees depends on the specific blockchain network. For Bitcoin, it's usually based on the data size of the transaction. In Ethereum, it uses a system called "Gas" that measures computational effort.

Several factors influence blockchain fees, including network congestion, transaction complexity, and the speed at which a user wants their transaction to be processed. When more users transact on the blockchain simultaneously, the demand for computational resources increases, which can lead to higher fees.

The architecture of different blockchain networks determines the way they calculate and apply fees. For example, Bitcoin network fees are based on transaction data size, while Ethereum network fees depend on computational complexity. Other factors like network congestion and transaction volume can also cause fee variation.

Strategies to mitigate high blockchain fees include Layer 2 solutions and off-chain transactions. Layer 2 solutions are protocols built on top of the main blockchain to scale the network and reduce fees. Off-chain transactions, on the other hand, process transactions outside the blockchain network, reducing the load on the network and lowering fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.