Managed futures refer to investment strategies that involve trading futures contracts, options on futures, and other derivatives. These strategies are managed by professional portfolio managers, known as commodity trading advisors (CTAs). Managed futures have gained popularity for their ability to provide diversification, risk management, and return enhancement to investment portfolios. The concept of managed futures dates back to the 1940s when Richard Donchian, widely recognized as the father of trend-following, started to apply systematic trading rules to commodity markets. Over time, managed futures have evolved into a diverse and sophisticated asset class, with numerous investment strategies and a growing number of market participants. As financial markets become more interconnected and complex, the need for alternative investment strategies, such as managed futures, has grown. Managed futures offer several advantages, including the potential for uncorrelated returns, enhanced risk management, and exposure to a wide range of markets and asset classes. Managed futures encompass a wide range of investment strategies. Some of the most common types include trend-following, mean reversion, global macro, and commodity trading advisor strategies. Trend-following strategies aim to profit from existing price trends in various markets, including commodities, currencies, interest rates, and equity indices. Momentum-based strategies capitalize on the tendency of market prices to continue moving in the same direction. These strategies often use technical indicators, such as moving averages, to identify and trade with the prevailing market trend. Breakout-based strategies focus on identifying price levels at which a market is expected to break out of a trading range. These strategies typically involve placing trades when the market price moves above or below a predetermined level, with the expectation that the breakout will continue in that direction. Mean reversion strategies attempt to exploit the tendency of market prices to revert to their historical average levels over time. Short-term trading strategies focus on capturing small price movements that occur within a single trading day or over a few days. These strategies often rely on technical analysis and sophisticated algorithms to identify and trade short-term market inefficiencies. Statistical arbitrage strategies involve identifying and exploiting price discrepancies between related financial instruments. These strategies typically use statistical models and historical data analysis to determine the relationships between assets and to identify potential trading opportunities. Global macro strategies seek to profit from changes in macroeconomic conditions and trends. These strategies often involve trading a wide range of financial instruments, including futures, options, and currencies. Discretionary global macro strategies rely on the portfolio manager's judgment and expertise to make investment decisions based on their assessment of global macroeconomic conditions and trends. Systematic global macro strategies use quantitative models and algorithms to identify and trade global macroeconomic trends. These strategies often involve trading a wide range of financial instruments, including futures, options, and currencies. CTA strategies involve trading futures contracts and other derivatives on commodities, such as metals, energy, and agricultural products. Fundamental analysis-based CTA strategies focus on the underlying supply and demand dynamics of the commodity markets. These strategies often involve analyzing economic data, weather patterns, and other factors that can affect commodity prices. Technical analysis-based CTA strategies rely on historical price data and various technical indicators to identify patterns and trends in commodity markets. These strategies often involve the use of charting tools and mathematical models to identify potential trading opportunities. Managed futures offer several benefits to investors, including diversification, risk management, and return enhancement. Diversification is an essential component of successful investing, as it helps to spread risk across a range of assets and reduce the impact of any single investment on overall portfolio performance. Managed futures have historically exhibited low or negative correlations with traditional assets such as stocks and bonds. This lack of correlation can help to reduce overall portfolio risk and enhance long-term returns. Managed futures provide exposure to a wide range of market sectors, including commodities, currencies, interest rates, and equity indices. This diverse exposure can help to further diversify an investment portfolio and provide additional sources of return. Managed futures can also help investors manage risk more effectively, as they often employ sophisticated risk management techniques. Leverage is a double-edged sword, as it can magnify both gains and losses. However, when used judiciously by experienced managers, leverage can help enhance returns and manage risk more effectively. Managed futures strategies often focus on generating risk-adjusted returns, meaning that they aim to maximize returns for a given level of risk. This focus on risk management can help investors achieve more stable and consistent portfolio performance. Managed futures can potentially enhance portfolio returns through their ability to trade both long and short positions and to tactically allocate capital to different markets and strategies. Managed futures strategies can take both long and short positions, allowing them to profit from both rising and falling markets. This flexibility can help to enhance portfolio returns, particularly during periods of market stress or declining asset prices. Managed futures managers can tactically allocate capital to different markets and strategies based on their assessment of market conditions and opportunities. This ability to dynamically adjust portfolio exposures can help to generate additional returns and manage risk more effectively. Despite their many benefits, managed futures also come with certain risks and challenges, including market risk, operational risk, and regulatory risk. Market risk refers to the potential for losses due to changes in market prices, interest rates, or other factors that can affect the value of an investment. Managed futures strategies often trade in volatile markets, which can lead to significant price fluctuations and the potential for large losses. Liquidity risk arises when an investment cannot be easily bought or sold at a reasonable price. Some managed futures strategies trade in less liquid markets or instruments, which can increase the potential for losses and make it more difficult to exit positions. Operational risk refers to the potential for losses due to problems with a manager's infrastructure, technology, or personnel. Selecting the right managed futures manager is crucial to success, as manager skill and expertise can have a significant impact on portfolio performance. Investors need to conduct thorough due diligence to evaluate a manager's track record, risk management procedures, and operational capabilities. Managed futures strategies often rely on sophisticated technology and infrastructure to implement their trading and risk management processes. The potential for technology failures, data breaches, or other operational issues can pose risks to investors. Regulatory risk refers to the potential for losses due to changes in laws, regulations, or other government actions that can affect the managed futures industry. Managed futures managers must comply with various compliance and reporting requirements imposed by regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) in the United States. Compliance with these requirements can be costly and time-consuming, and failure to comply can result in penalties or other adverse consequences. Changes in regulations can have a significant impact on managed futures strategies and the broader industry. For example, new regulations may impose additional compliance requirements, limit the use of certain trading strategies, or affect the availability of leverage. Investors need to be aware of the potential for regulatory changes and their potential impact on managed futures investments. Evaluating the performance of managed futures strategies is an essential part of the investment process. Key aspects of performance evaluation include performance metrics, benchmarks and indices, and due diligence. Performance metrics are used to assess the risk and return characteristics of managed futures strategies. The Sharpe ratio is a widely used performance metric that measures the risk-adjusted return of an investment strategy. It is calculated as the average return in excess of the risk-free rate divided by the standard deviation of returns. A higher Sharpe ratio indicates a better risk-adjusted performance. The Sortino ratio is similar to the Sharpe ratio but focuses on downside risk, or the risk of negative returns. It is calculated as the average return in excess of the risk-free rate divided by the downside deviation of returns. A higher Sortino ratio indicates a better downside risk-adjusted performance. Benchmarks and indices are used to compare the performance of managed futures strategies to that of their peers or to relevant market indices. The Barclay CTA Index is a widely recognized benchmark for managed futures performance. It is an equal-weighted composite of over 500 managed futures programs and provides a broad representation of the managed futures industry. The BTOP50 Index is another widely used benchmark for managed futures performance. It tracks the performance of the largest managed futures programs by assets under management and provides a more concentrated representation of the managed futures industry. Due diligence is the process of evaluating a managed futures manager's track record, risk management procedures, and operational capabilities before making an investment. Investors should conduct thorough due diligence to ensure that they are selecting a manager with the skill, expertise, and resources necessary to deliver strong risk-adjusted returns. Integrating managed futures into an investment portfolio involves determining the optimal allocation and selecting the appropriate investment vehicles. Determining the optimal allocation to managed futures depends on several factors, including the diversification benefits, risk tolerance, and investment objectives of the investor. Managed futures can provide significant diversification benefits to an investment portfolio. Investors should consider the potential for uncorrelated returns and exposure to different market sectors when determining the optimal allocation to managed futures. Investors should also consider their risk tolerance when determining the optimal allocation to managed futures. Those with a higher risk tolerance may choose to allocate a larger portion of their portfolio to managed futures, while those with a lower risk tolerance may choose to allocate a smaller portion. There are several investment vehicles available for investing in managed futures, including managed futures funds and separately managed accounts. Managed futures funds pool investor capital and use it to invest in managed futures strategies. These funds can offer investors access to a diversified portfolio of managed futures strategies and provide professional management and risk oversight. Separately managed accounts (SMAs) are individual investment accounts managed by a managed futures manager on behalf of an investor. SMAs can offer investors greater customization and control over their managed futures investments, as well as increased transparency and direct access to the manager. However, SMAs may require higher minimum investments and may not provide the same level of diversification as managed futures funds. Managed futures refer to investment strategies that trade futures contracts, options on futures, and other derivatives managed by commodity trading advisors. As the investment landscape continues to evolve, managed futures are likely to play an increasingly important role in modern portfolio management. As you consider integrating managed futures into your investment portfolio, it is highly recommended to consult with a professional wealth management advisor. These experts can help you navigate the complexities of managed futures.Definition of Managed Futures

Types of Managed Futures Strategies

Trend-Following

Mean Reversion

Global Macro

Commodity Trading Advisor (CTA) Strategies

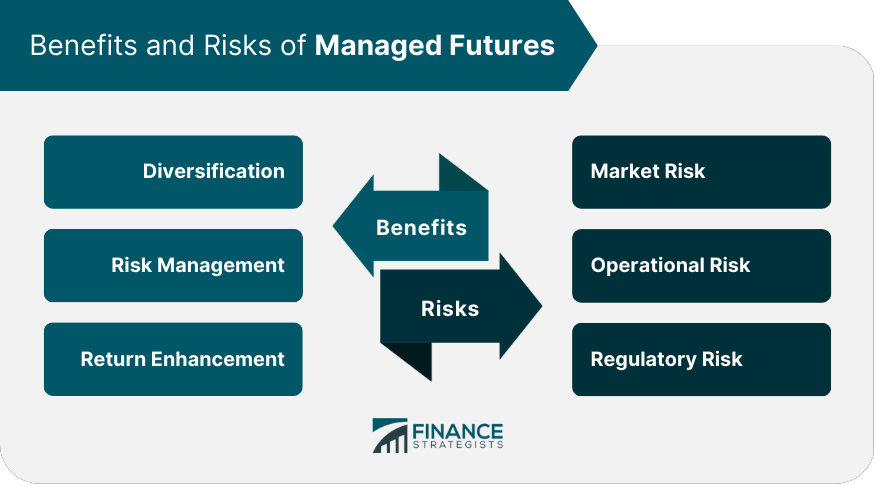

Benefits of Managed Futures

Diversification

Risk Management

Return Enhancement

Risks and Challenges in Managed Futures

Market Risk

Operational Risk

Regulatory Risk

Evaluating Managed Futures Performance

Performance Metrics

Benchmarks and Indices

Due Diligence

Integrating Managed Futures Into a Portfolio

Optimal Allocation

Investment Vehicles

Conclusion

Managed futures have evolved into a diverse and sophisticated asset class with various investment strategies and a growing number of market participants.

They offer several advantages such as diversification, risk management, and exposure to a wide range of markets and asset classes.

Managed futures can be classified into different strategies, including trend-following, mean reversion, global macro, and commodity trading advisor strategies.

Despite the benefits, managed futures also come with certain risks and challenges, including market risk, operational risk, and regulatory risk.

Managed Futures FAQs

Managed futures are investment strategies involving futures contracts, options on futures, and other derivatives managed by commodity trading advisors (CTAs). They provide diversification, risk management, and return enhancement to investment portfolios, making them essential in modern portfolio management.

Common managed futures strategies include trend-following, mean reversion, global macro, and commodity trading advisor (CTA) strategies, which can be further subdivided into specific approaches like momentum-based, breakout-based, short-term trading, and fundamental or technical analysis.

Managed futures offer diversification benefits through their non-correlation with traditional assets like stocks and bonds and their exposure to different market sectors, such as commodities, currencies, interest rates, and equity indices.

Key risks of investing in managed futures include market risk (volatility and liquidity), operational risk (manager selection and infrastructure/technology), and regulatory risk (compliance and reporting requirements and potential regulatory changes).

Investors can integrate managed futures into their portfolios by determining the optimal allocation based on diversification benefits and risk tolerance, and selecting the appropriate investment vehicles, such as managed futures funds or separately managed accounts. Consulting a professional wealth management advisor can be helpful in this process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.