In-service withdrawals refer to the option to withdraw funds from a qualified retirement plan, such as a 401(k), while still employed by the plan sponsor. In-service withdrawals allow individuals to withdraw funds from their qualified retirement plan, such as a 401(k), while they are still employed by the company that sponsors the plan. This is in contrast to traditional withdrawals, which can only be taken once the individual has left their job or reached a certain age. Eligibility for in-service withdrawals can vary by plan, but typically those who are over age 59 ½ or have a financial hardship may be eligible to withdraw funds. However, it's important to note that taking in-service withdrawals may have tax implications. The amount withdrawn is generally subject to income tax and may also be subject to a 10% early withdrawal penalty if taken before age 59 ½. A 401(k) is a qualified employer-sponsored retirement plan that allows employees to contribute a portion of their wages to individual accounts on a tax-deferred basis. Some 401(k) plans permit in-service withdrawals under specific circumstances. A 403(b) plan is a tax-deferred retirement plan for employees of public schools, non-profit organizations, and certain ministers. Like 401(k) plans, in-service withdrawals may be allowed under certain conditions. A 457(b) plan is a non-qualified, tax-deferred retirement plan offered to state and local government employees and some non-governmental organizations. In-service withdrawals may be allowed under specific circumstances, similar to 401(k) and 403(b) plans. The Thrift Savings Plan is a defined-contribution retirement savings plan for federal employees and members of the uniformed services. In-service withdrawals may be available under certain conditions. IRAs are tax-advantaged retirement accounts that individuals can establish independently of their employers. In-service withdrawals from IRAs are generally unrestricted, but tax consequences and penalties may apply depending on the specific IRA type and the individual's age. One common reason for in-service withdrawals is financial hardship. When faced with an unexpected expense or an urgent need for cash, an individual may choose to withdraw from their retirement account. In the event of a major illness or accident, an individual may need to access their retirement funds to cover medical expenses not covered by insurance. If an individual becomes disabled and can no longer work, they may need to withdraw from their retirement account to cover living expenses and medical costs. In the event of a divorce or legal separation, an individual may need to access retirement funds to cover legal fees or support themselves during the transition. Sometimes, an individual may withdraw from their retirement account to pay for higher education expenses for themselves or a family member. In certain circumstances, an individual may withdraw from their retirement account to make a down payment on a home or to cover significant home repairs. Some retirement plans allow in-service withdrawals once the participant reaches a specific age, typically 59½. Certain plans may require a minimum length of employment before allowing in-service withdrawals. Each retirement plan may have its own set of rules and restrictions regarding in-service withdrawals. These may include limits on the withdrawal amount, frequency, or reasons for withdrawal. Some plans may limit the total amount an individual can withdraw or the frequency of withdrawals. Withdrawals from tax-deferred retirement accounts are generally subject to income tax. An additional 10% early withdrawal penalty may apply if the individual is under the age of 59½. Mandatory tax withholding may apply to in-service withdrawals unless the individual elects otherwise or the withdrawal is rolled over into another eligible retirement account. In-service withdrawals can significantly reduce an individual's retirement savings, potentially affecting their ability to retire comfortably. Some retirement plans allow loans instead of withdrawals. While loans can provide temporary access to funds, they must be repaid, typically with interest, to avoid additional taxes and penalties. Some retirement plans offer loans as an alternative to withdrawals, allowing participants to borrow against their account balance and repay the loan with interest over time. Establishing and maintaining an emergency fund can help individuals avoid the need for in-service withdrawals by providing a separate source of funds for unexpected expenses. Disability and long-term care insurance can help cover costs associated with illness, injury, or long-term care, reducing the need for in-service withdrawals. Debt consolidation can help manage high-interest debt, potentially lowering monthly payments and reducing the need for in-service withdrawals. Part-time jobs or side gigs can provide additional income, decreasing the need for in-service withdrawals to cover expenses. To initiate an in-service withdrawal, the individual should contact their plan administrator or account custodian for guidance and specific requirements. Before initiating an in-service withdrawal, individuals should review their plan documents to understand the rules and restrictions related to withdrawals. Individuals must determine their eligibility for an in-service withdrawal based on their plan's rules, age, length of employment, and other factors. Individuals must complete the necessary forms, including providing documentation of the reason for withdrawal and other required information. The individual must choose a withdrawal method, such as a lump sum or periodic payments, and consider the tax implications of each method. Individuals should carefully consider their tax withholding options to avoid under-withholding, which can result in tax liability and possible penalties. By rolling over the withdrawn amount to another eligible retirement account, individuals can avoid immediate tax consequences and maintain their retirement savings. By spreading withdrawals over multiple years, individuals can minimize the tax impact of withdrawals and better manage their overall financial situation. Individuals should consider coordinating withdrawals with other income sources to minimize the tax impact and maximize their overall financial well-being. Health Savings Accounts (HSAs) and other tax-advantaged accounts can be used to pay for qualified expenses, reducing the need for in-service withdrawals and minimizing the tax impact. In-service withdrawals provide individuals with the option to access funds from their qualified retirement accounts, such as 401(k), 403(b), and 457(b) plans, while still employed by the plan sponsor. While these withdrawals can be a valuable financial tool in cases of financial hardship, unexpected medical expenses, disability, divorce, education costs, or home-related expenses, they also come with potential tax consequences, including income tax and early withdrawal penalties. Eligibility for in-service withdrawals depends on factors such as age, length of employment, and plan-specific rules. Alternatives to in-service withdrawals, such as loans from retirement accounts, emergency funds, insurance products, debt consolidation, and other income sources, can help individuals manage financial needs while preserving retirement savings. Individuals should review plan documents, determine eligibility, and understand the tax implications when considering in-service withdrawals. Rolling over funds to another eligible retirement account, spreading withdrawals over multiple years, and utilizing tax-advantaged accounts are strategies to minimize the consequences of withdrawals. Ultimately, individuals should consult financial professionals to make informed decisions that align with their retirement planning goals.What Are In-Service Withdrawals?

Types of Retirement Plans Allowing In-Service Withdrawals

401(k) Plans

403(b) Plans

457(b) Plans

Thrift Savings Plan (TSP)

Individual Retirement Accounts (IRAs)

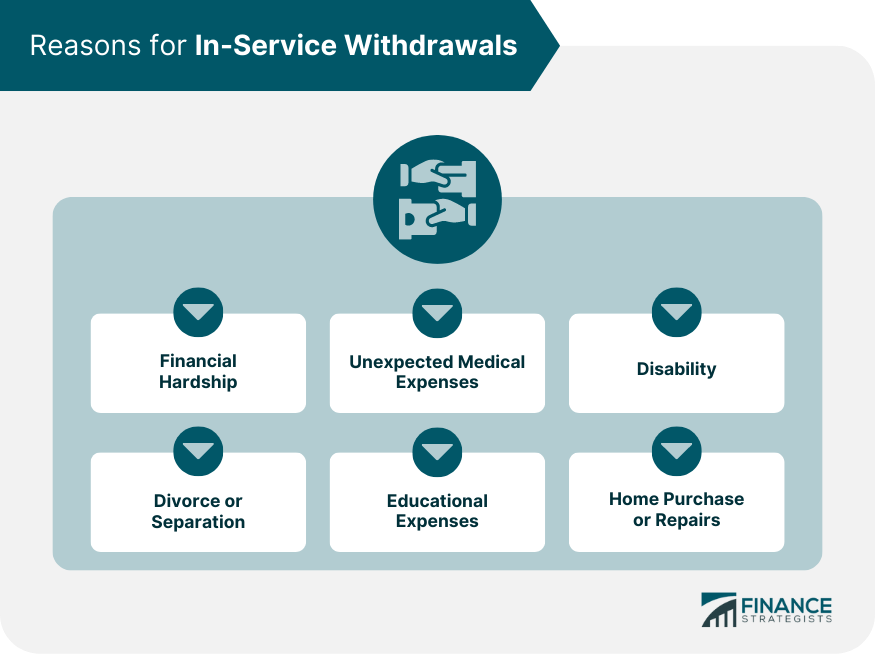

Reasons for In-Service Withdrawals

Financial Hardship

Unexpected Medical Expenses

Disability

Divorce or Separation

Educational Expenses

Home Purchase or Repairs

Eligibility Requirements for In-Service Withdrawals

Age-Based Eligibility

Length of Employment

Plan-Specific Rules and Restrictions

Withdrawal Limits

Consequences of In-Service Withdrawals

Taxes

Income Tax

Early Withdrawal Penalty

Tax Withholding

Impact on Retirement Savings

Loan Considerations

In-Service Withdrawal Alternatives

Loans From Retirement Accounts

Emergency Funds

Insurance Products

Debt Consolidation

Other Sources of Income

Process of Initiating an In-Service Withdrawal

Contacting Plan Administrator or Custodian

Reviewing Plan Documents

Determining Eligibility

Completing Required Forms

Selecting a Withdrawal Method

Tax Withholding Decisions

Strategies to Minimize Consequences of In-Service Withdrawals

Rolling Over Funds to Another Eligible Retirement Account

Spreading Withdrawals Over Multiple Years

Coordinating Withdrawals With Other Income Sources

Utilizing Tax-Advantaged Accounts

Conclusion

In-Service Withdrawal FAQs

In-service withdrawals refer to the option to withdraw funds from a qualified retirement plan, such as a 401(k), while still employed by the plan sponsor.

Eligibility for in-service withdrawals varies by plan, but typically those who are over age 59 ½ or have a financial hardship may be eligible to withdraw funds.

Yes, in-service withdrawals are generally subject to income tax and may also be subject to a 10% early withdrawal penalty if taken before age 59 ½.

The amount that can be withdrawn through in-service withdrawals varies by plan and may be subject to certain limits or restrictions.

Yes, taking in-service withdrawals can reduce the amount of retirement savings and potentially impact future retirement income. It is important to consider the potential long-term consequences before withdrawing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.