The Social Security Earnings Test is a process used by the Social Security Administration (SSA) to determine if a recipient of Social Security retirement benefits has earned too much money to continue receiving full benefits. The test calculates the recipient's annual earnings and compares it to a specified amount the SSA sets. If the recipient's earnings exceed the specified amount, a portion of their benefits may be withheld. Individuals who have yet to reach their full retirement age (FRA) and receive Social Security retirement benefits are subject to the Social Security Earnings Test. The Full Retirement Age is when an individual can start receiving full Social Security retirement benefits. FRA varies depending on the individual's birth year, with a gradual increase for those born later. Early Retirement Age is when an individual can receive Social Security retirement benefits before their FRA. This age is set at 62, regardless of the individual's FRA. However, benefits will be permanently reduced by a certain percentage when they are claimed before FRA. The Social Security Earnings Test affects benefit payments depending on the individual's age relative to their FRA: Before FRA: Benefits may be reduced if earnings exceed the annual limit. Year of FRA: Benefits may be reduced if earnings exceed a higher annual limit before reaching FRA. After FRA: The Earnings Test no longer applies, and earnings are not limited. The Earnings Test only considers earned income, such as wages and self-employment income. Other sources of income are not counted, including: Other exempt income sources, such as interest, dividends, and capital gains The Social Security Administration sets annual earnings limits for those subject to the Earnings Test. The limits vary depending on the individual's age: Before FRA: Lower annual limit applies. Year of FRA: Higher annual limits apply until the month they reach FRA. In the first year of retirement, the SSA may apply a monthly earnings limit instead of an annual limit. This allows for flexibility if the individual retires mid-year. The SSA adjusts the earnings limits annually based on the Cost-of-Living Adjustments (COLA). This helps ensure that the limits keep pace with inflation. The Earnings Test may cause a temporary reduction in Social Security benefits. However, at FRA, the SSA recalculates the benefits to account for any withheld amounts, effectively increasing the monthly benefit amount. When an individual reaches FRA, the SSA adjusts their monthly benefit amount to account for any withheld benefits due to the Earnings Test. This adjustment can result in a higher monthly benefit for the rest of the individual's life. The Earnings Test can also impact spousal and survivor benefits. The spousal or survivor benefits may also be reduced if the primary beneficiary's benefits are reduced due to the Earnings Test. The Earnings Test can also influence the taxation of Social Security benefits. When an individual's benefits are reduced due to the Earnings Test, the portion of benefits subject to taxation may also be lowered. Individuals who have reached FRA but have yet to reach 70 can voluntarily suspend their Social Security benefits. This allows the benefits to continue growing due to delayed retirement credits, and the Earnings Test will not apply during the suspension period. Individuals subject to the Earnings Test must report their earnings to the SSA. Accurate and timely reporting is essential to prevent overpayments and ensure proper benefit calculations. Failing to report or under-reporting earnings can result in penalties, including fines, benefit overpayments, and potential criminal charges. It is crucial to report any changes in earnings promptly and accurately. Individuals should contact the SSA to correct the information if an error is discovered in the earnings records. This ensures that the proper benefits are paid and any adjustments due to the Earnings Test are accurately calculated. Proponents of the Earnings Test argue that it prevents double-dipping, meaning that individuals can't receive both full benefits and full earnings from work. They also contend that the test encourages older workers to remain in the workforce, providing valuable experience and expertise. Opponents of the Earnings Test argue that it discourages older workers from continuing to work, as they may feel penalized for earning income. Various proposals have been made to reform or eliminate the Earnings Test, such as raising the earnings limits, simplifying the rules, or removing the test altogether. Understanding the Earnings Test and its impact on benefits is essential when planning for retirement. Individuals should consider their expected earnings and the potential effects on their Social Security benefits before deciding when to claim benefits. The SSA provides tools and resources to help individuals estimate their future Social Security benefits and the potential impact of the Earnings Test. Using these tools can assist in making informed decisions about when to claim benefits. Individuals can explore alternative income sources, such as investments or part-time work, that are not subject to the Earnings Test. This can help maintain financial stability in retirement while minimizing the impact on Social Security benefits. Delaying the start of Social Security benefits can result in higher monthly payments, especially if the Earnings Test will significantly reduce benefits. Individuals should weigh the benefits of delaying Social Security against the potential loss of benefits due to the Earnings Test. The Social Security Earnings Test is a crucial component of the Social Security system that affects individuals' retirement benefits based on their age and earnings. A comprehensive understanding of the Earnings Test, including its impact on various age groups, exempt income sources, annual and monthly limits, and implications for benefits, is essential for effective retirement planning. It is also vital for individuals to be aware of their reporting responsibilities, potential penalties, and the ongoing debate surrounding the Earnings Test. By considering alternative income sources and weighing the benefits of delaying Social Security, individuals can make well-informed decisions that maximize their retirement benefits while minimizing the effects of the Earnings Test.What Is the Social Security Earnings Test?

Age Requirements and the Social Security Earnings Test

Full Retirement Age (FRA)

For example, FRA is 66 for those born between 1943 and 1954, gradually increasing to 67 for those born in 1960 or later.Early Retirement Age

Effect of the Earnings Test on Different Age Groups

Social Security Earnings Test Exempt Income

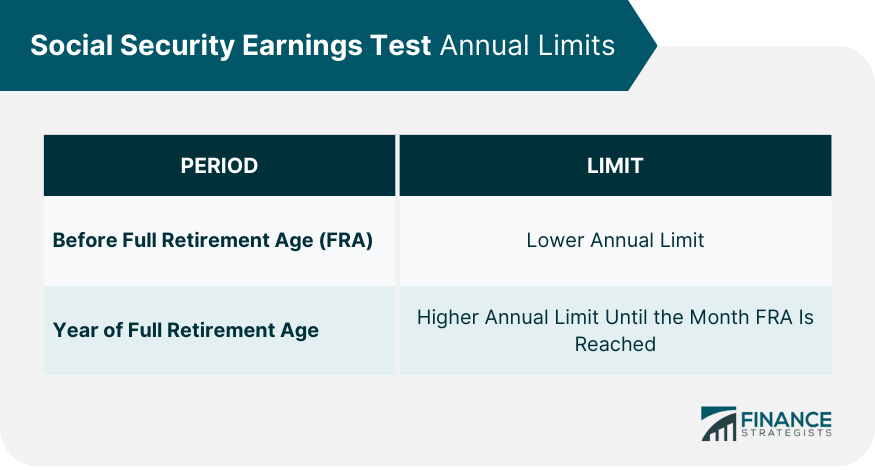

Social Security Earnings Test Limits

Annual Limits

Monthly Limits

Cost-of-Living Adjustments (COLA) and Limit Changes

Impact of the the Social Security Earnings Test on Benefits

Temporary Reduction of Benefits

Benefit Adjustment at FRA

Effect on Spousal and Survivor Benefits

However, similar to the primary beneficiary, spousal and survivor benefits may be recalculated and increased at the spouse or survivor's FRA to account for any withheld benefits.Taxation of Benefits

Voluntary Suspension of Benefits

Reporting Earnings and Penalties

Reporting Responsibilities

Penalty for Not Reporting or Under-Reporting Earnings

Correcting Earnings Records

Social Security Earnings Test Controversies and Reform Proposals

Arguments for the Earnings Test

Arguments Against the Earnings Test

They also claim that the test could be more complex and easier for individuals to understand, leading to confusion and potential errors in reporting earnings.Potential Reforms

These proposals aim to strike a balance between encouraging older workers to remain in the workforce while ensuring the financial stability of the Social Security system.Tips for Navigating the Social Security Earnings Test

Plan for Retirement

Estimate Benefits and Earnings Test Impact

Consider Alternative Income Sources

Weigh the Benefits of Delaying Social Security

Conclusion

Social Security Earnings Test FAQs

The Social Security Earnings Test is a process used by the Social Security Administration (SSA) to determine if a recipient of Social Security retirement benefits has earned too much money to continue receiving full benefits.

The Social Security Earnings Test works by calculating the recipient's annual earnings and comparing it to a specified amount set by the SSA. If the recipient's earnings exceed the specified amount, a portion of their benefits may be withheld.

Individuals who have yet to reach their full retirement age (FRA) and receive Social Security retirement benefits are subject to the Social Security Earnings Test.

The full retirement age for the Social Security Earnings Test is determined by the recipient's birth year and ranges from 66 to 67 years old.

The amount of benefits withheld due to the Social Security Earnings Test is based on the recipient's annual earnings and is determined by the SSA. The higher the earnings, the greater the amount of benefits that may be withheld.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.