Home equity as retirement income refers to the practice of using the accumulated equity in a homeowner's property to supplement their income during retirement. Home equity is the difference between the current market value of a property and the outstanding balance on the mortgage. Home equity builds up as homeowners pay off their mortgage, and the property value increases over time. Tapping into this equity through strategies like downsizing, reverse mortgages, home equity loans, or home equity investments can provide additional funds to cover retirement expenses, enabling retirees to maintain their desired lifestyle and financial security. Before tapping into home equity for retirement income, individuals should evaluate their financial stability and retirement goals. This includes assessing savings, investments, and other sources of income, as well as estimating future expenses. Homeowners should consider the current housing market when deciding whether to use home equity as a retirement income source. A strong housing market may increase property values, providing more equity to draw from, while a weak market may limit the available equity. Using home equity for retirement income may have tax implications and could affect government benefits. Homeowners should consult a financial advisor or tax professional to understand these consequences. Home equity can be an important resource for funding long-term care, such as nursing homes or assisted living facilities. Homeowners should consider their potential care needs before using home equity for retirement income. Using home equity for retirement income may reduce the inheritance passed on to beneficiaries. Homeowners should discuss their plans with family members and consider the potential impact on their estate. One strategy for accessing home equity as retirement income is to sell the current home and purchase a smaller, less expensive property. This allows the homeowner to use the difference in property values to supplement their retirement income. Downsizing offers several benefits, such as lower property taxes, reduced maintenance costs, and potentially increased financial flexibility. However, downsizing may also present challenges, such as the emotional impact of leaving a long-time home or the difficulty of finding a suitable smaller property. A reverse mortgage loan allows homeowners to convert a portion of their home equity into cash. The homeowner is not required to make monthly payments on the loan, and the loan is repaid when the property is sold, or the homeowner passes away. There are three main types of reverse mortgages: Home Equity Conversion Mortgage (HECM): federally insured and backed by the U.S. Department of Housing and Urban Development (HUD). Proprietary Reverse Mortgage: are private loans offered by financial institutions. Single-Purpose Reverse Mortgage: Some state and local government agencies and nonprofit organizations offer single-purpose reverse mortgages for specific purposes, such as home repairs or property tax payments. To qualify for a reverse mortgage, homeowners must meet certain age and property ownership criteria. Reverse mortgages can provide a source of tax-free retirement income, but they can also have high fees and reduce the available inheritance for beneficiaries. A home equity loan is a type of second mortgage that allows homeowners to borrow money against the equity in their home. There are two main types of home equity loans: Home Equity Line of Credit (HELOC): a revolving line of credit allowing homeowners to borrow money up to a predetermined limit as needed. Fixed-Rate Home Equity Loan: provides a lump-sum payment and has a fixed interest rate for the life of the loan. Interest Rates and Repayment Terms: Home equity loans typically have lower interest rates than other types of loans but require monthly payments, which can impact a retiree's cash flow. Home equity loans can provide a source of funds for retirement expenses, but they also come with risks, such as the potential for foreclosure if the borrower fails to make payments. A Home Equity Investment is an agreement in which an investor provides a homeowner with a lump-sum cash payment in exchange for a percentage of the home's future appreciation. Homeowners agree to share a portion of their home's future value with the investor when they sell the property or at the end of a predetermined term. Eligibility for HEIs typically depends on factors such as the homeowner's credit score, the property's value, and the amount of existing home equity. HEIs can provide a source of retirement income without adding debt, but they also require the homeowner to share future appreciation, which could reduce the potential inheritance for beneficiaries. Homeowners should consider their individual financial situation, risk tolerance, and retirement goals when selecting the most suitable strategy for accessing home equity as retirement income. Each home equity strategy has its own potential risks and returns. Homeowners should weigh the potential benefits against the drawbacks, considering factors such as interest rates, fees, and future housing market conditions. Tax implications vary for each home equity strategy. Homeowners should consult with a tax professional to understand the potential tax consequences of each option. Homeowners should discuss their plans with family members and consider the potential impact on their estate and beneficiaries when selecting a home equity strategy. Maintaining and improving a home can increase its value, leading to greater home equity and more available funds for retirement. Understanding local housing market trends can help homeowners decide when to access their home equity. Relying solely on home equity for retirement income can be risky. Homeowners should diversify their retirement income sources to reduce their overall risk. Working with financial advisors and professionals can help homeowners make informed decisions about using home equity as a source of retirement income. Home equity can be a valuable source of retirement income when utilized effectively through careful planning and decision-making. Before tapping into their home equity, homeowners should consider various factors, such as their financial stability, retirement goals, and the potential impact on taxes, benefits, and beneficiaries. Strategies like downsizing, reverse mortgages, home equity loans, and home equity investments offer different ways to access home equity, each with its own risks and rewards. Evaluating and selecting the most suitable option requires assessing potential benefits, drawbacks, and tax implications while also considering the impact on beneficiaries. To maximize home equity as retirement income, homeowners should maintain and improve their homes, stay informed about local housing market trends, diversify their retirement income sources, and consult with financial advisors and professionals. Continuous evaluation of financial goals and strategies is vital for ensuring a secure and enjoyable retirement.Overview of Home Equity as Retirement Income

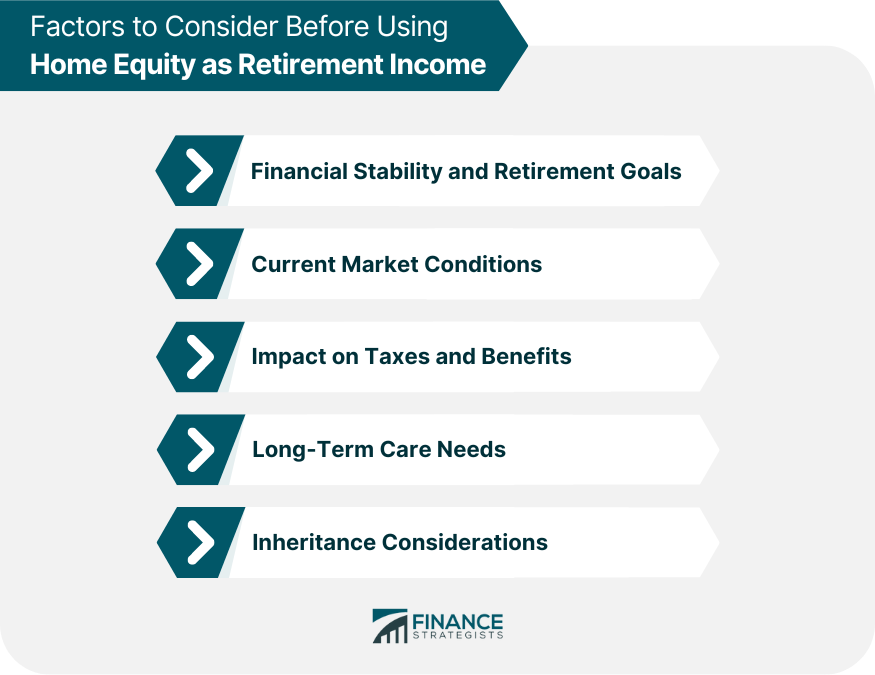

Factors to Consider Before Using Home Equity as Retirement Income

Financial Stability and Retirement Goals

Current Market Conditions

Impact on Taxes and Benefits

Long-Term Care Needs

Inheritance Considerations

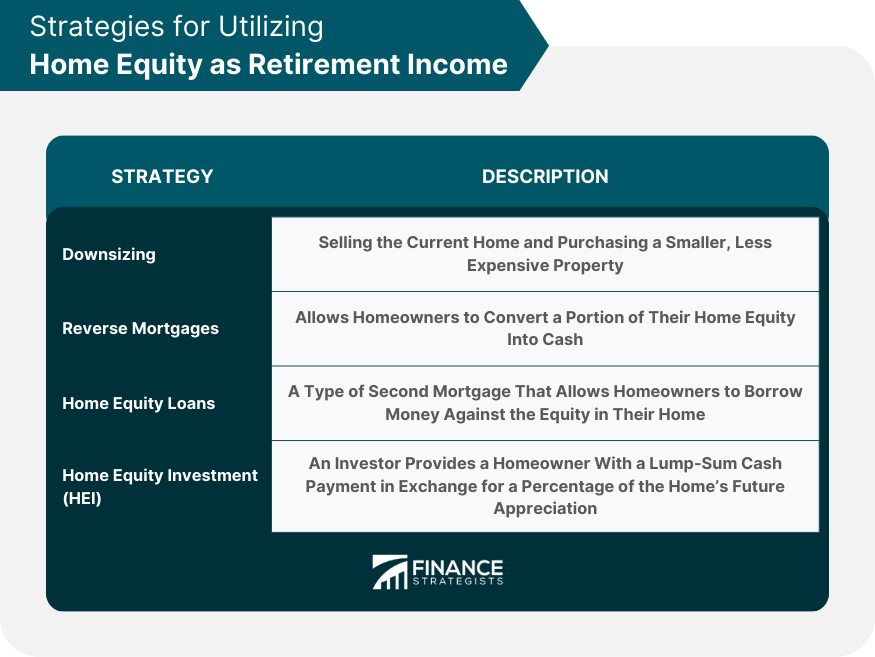

Strategies for Utilizing Home Equity as Retirement Income

Downsizing

Reverse Mortgages

Home Equity Loans

Home Equity Investment (HEI)

Selecting a Strategy for Using Home Equity as Retirement Income

Assessing the Most Suitable Option

Evaluating the Potential Risks and Returns

Considering Tax Implications

Weighing the Impact on Beneficiaries

Tips for Maximizing Home Equity as Retirement Income

Regular Home Maintenance and Improvements

Staying Informed About Local Housing Market Trends

Diversifying Retirement Income Sources

Consulting With Financial Advisors and Professionals

Conclusion

Home Equity as Retirement Income FAQs

Home Equity as Retirement Income refers to the practice of using the equity in one's home as a source of income during retirement, either through a reverse mortgage, home equity loan, or downsizing to a smaller home.

Using Home Equity as Retirement Income can provide retirees with a source of cash that does not require them to sell their home or liquidate other assets. It can also provide a stable stream of income that is not subject to market fluctuations.

The risks associated with using Home Equity as Retirement Income include potential reduction in inheritance for heirs, possible loss of the home if the borrower cannot meet the terms of the loan, and reduced equity in the home for future needs.

To determine if using Home Equity as Retirement Income is right for them, individuals should consider their overall financial situation, including their retirement income sources, expenses, and long-term goals. It is also important to consult with a financial advisor or mortgage professional.

Alternatives to using Home Equity as Retirement Income include building up other sources of retirement income, such as pensions, 401(k)s, or Social Security, as well as reducing expenses and potentially delaying retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.