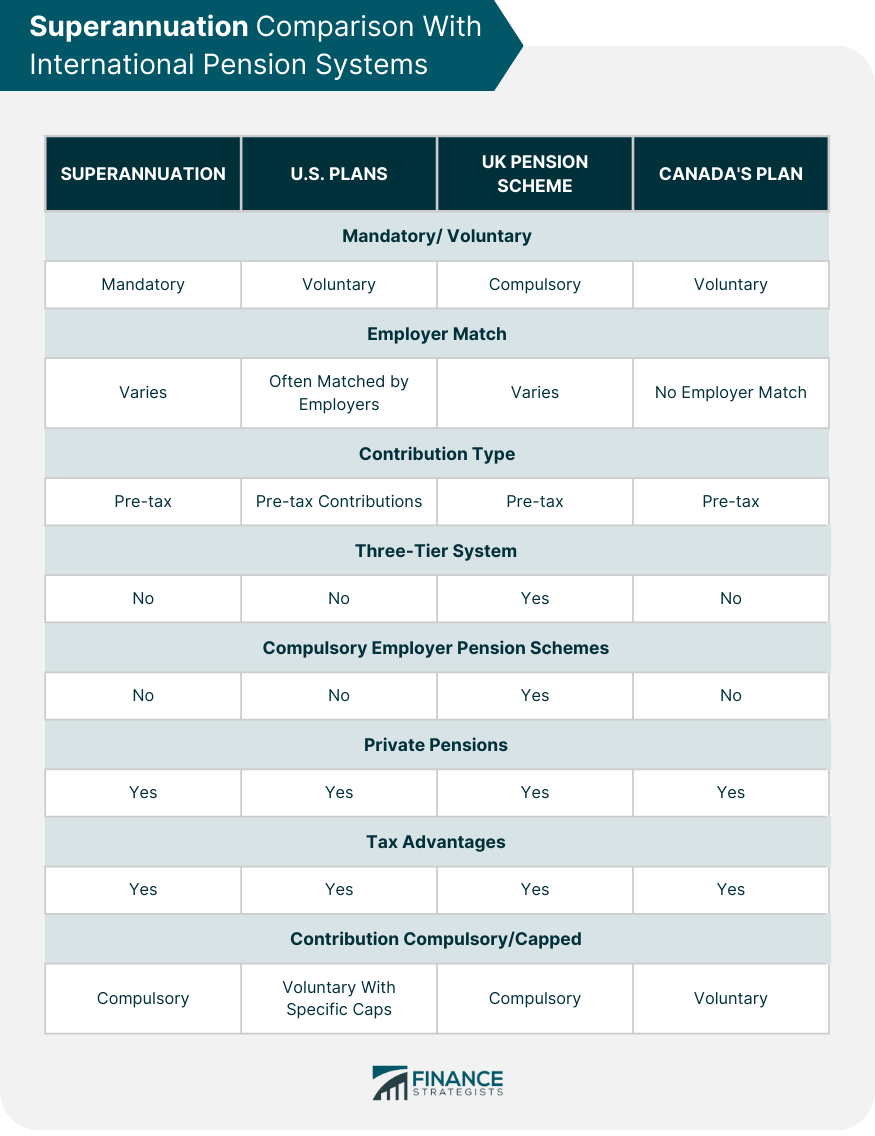

Superannuation, commonly referred to as "super," is a long-term savings arrangement that aids Australians in securing financial stability in their retirement. It is a mandatory long-term savings arrangement in Australia, involving contributions from employees, employers, and sometimes the government. It differs from other pension programs by emphasizing private sector management. Compared to systems like Social Security, superannuation combines defined-benefit and defined-contribution features. Its origins can be traced back to the late 19th century, but it became widespread with the introduction of the Superannuation Guarantee (SG) in 1992. The SG made it mandatory for employers to contribute to their employees' super funds, ensuring retirement benefits for nearly all Australian employees. The SG requires employers to contribute a percentage of an employee's earnings (currently set at 10.5%) into a super fund. These are known as SG contributions, and they form a significant part of most people's superannuation. In addition to employer contributions, employees can also contribute to their super. These contributions, known as "non-concessional" or "after-tax" contributions, can help increase retirement savings and may offer tax advantages. There are other forms of contributions to super funds, including government co-contributions for low to middle-income earners and spouse contributions, which can provide tax benefits. The money in a super fund is invested by fund managers. Different funds have varying investment strategies, and the returns from these investments contribute to the growth of the individual's retirement savings. Retail super funds are usually run by banks or investment companies. They are open to everyone and often have a wide range of investment options. Industry super funds were initially designed for workers from specific industries, but many are now open to all Australians. They are run by a board of trustees for the benefit of members. Public sector funds are for employees of the federal and state government departments. They often provide a defined benefit scheme for their members. SMSFs are private superannuation funds that you manage yourself. SMSFs are regulated by the Australian Taxation Office (ATO) and must be set up for the sole purpose of providing retirement benefits to members. Many super funds provide insurance options for their members. This insurance can include life insurance, total and permanent disability (TPD) insurance, and income protection insurance. APRA is responsible for the prudential supervision of banks, credit unions, insurance companies, and most members of the superannuation industry. APRA's role is to ensure these entities maintain financial promises to their customers and maintain a stable, efficient, and competitive financial system. ASIC regulates financial services to protect Australian consumers, investors, and creditors. Its jurisdiction includes corporate governance, financial services, and consumer protection in the area of superannuation. The ATO is responsible for the oversight of self-managed super funds (SMSFs). It also administers tax and regulatory systems that affect super funds. Super funds are subject to various regulatory requirements to ensure they operate in the best interests of their members. They must adhere to investment rules, trustee obligations, and restrictions on withdrawals. They are also required to provide regular reporting on the fund’s performance and financial position, allowing members to make informed decisions about their retirement savings. The Australian Financial Complaints Authority (AFCA) provides a dispute resolution service for super fund members. AFCA helps resolve disputes between consumers and financial service providers, including super funds, by providing a fair and independent process. The Superannuation Complaints Tribunal (SCT) was an alternative avenue for dispute resolution, but it ceased operations in 2020, with AFCA taking over its role. Consumer protection in the superannuation sector is also bolstered by measures like the Superannuation Consumer Centre, a non-profit organization providing independent information and advice on superannuation matters. The preservation age is the minimum age at which a person can access their superannuation benefits, provided they have met a condition of release. The preservation age varies between 55 and 60, depending on the individual's date of birth. In general, super benefits can only be accessed when a person reaches their preservation age and retires or satisfies another condition of release. In specific circumstances, individuals may be able to access their super early. Some conditions for early release include severe financial hardship, compassionate grounds, permanent incapacity, or a terminal medical condition. It is essential to understand the criteria and tax implications of early access to super benefits. A transition to retirement strategy allows individuals who have reached their preservation age to access their super benefits while still working. This can be done by starting a TTR pension, which provides a regular income from the super fund. The TTR strategy can help individuals reduce their working hours while maintaining their lifestyle or boost their super savings through tax-effective strategies. Upon meeting a condition of release, individuals can withdraw part or all of their super as a lump sum. Lump-sum withdrawals may have tax implications, depending on the individual's age and the components of their super benefit. Retirees can access their super benefits through an income stream, such as an account-based pension or an annuity. These options provide regular payments from the super fund, helping retirees manage their retirement income and maintain their lifestyle. Superannuation plays a crucial role in Australia's capital markets by providing a significant source of investment capital. As of Dec 2022, Australia's superannuation industry is one of the largest pension systems globally, with over $3.4 trillion in assets. These funds are invested across various asset classes, including shares, property, and fixed interest, contributing to economic growth and financial market stability. Superannuation has significantly impacted national savings, effectively increasing Australia's savings rate. It has also played a role in wealth distribution, although there are ongoing debates about the extent of its effectiveness. While superannuation has undoubtedly helped many Australians accumulate wealth for retirement, concerns remain about the system's equity, particularly regarding gender and income disparities. The superannuation system continues to evolve in response to demographic, economic, and policy changes. Proposed changes include increasing the Superannuation Guarantee to 12% by 2025 and reviewing the effectiveness of the current tax concessions. The future of superannuation will likely involve an ongoing debate about its role, structure, and impact on Australian society. Making early and regular contributions to your super can significantly impact your retirement savings due to the power of compounding. Even small contributions made early in your working life can grow substantially over time. Your super fund's investment returns can significantly impact your retirement savings. It's essential to understand your risk profile and ensure your super is invested in a way that aligns with your retirement goals and risk tolerance. Superannuation offers several tax advantages, including concessional tax rates on contributions and investment earnings and tax-free withdrawals for those over 60. Understanding these benefits can help you make the most of your super. Financial advisors can provide valuable advice on superannuation strategies, including contribution strategies, investment choice, insurance through super, and retirement income planning. They can help you understand the complexities of superannuation and make informed decisions to maximize your retirement savings. Unlike Australia's superannuation system, which is a mandatory system for all employees, the U.S. has voluntary defined-benefit and defined-contribution plans. The most common defined-contribution plan in the U.S. is the 401(k), where employees make pre-tax contributions, often matched by employers. The UK has a three-tier pension system consisting of a state pension, compulsory employer pension schemes (similar to Australia's superannuation), and private pensions. The UK's compulsory employer pension, known as auto-enrolment, requires employers to automatically enrol eligible workers into a pension scheme. Canada's RRSP is similar to a superannuation fund in that it is a government-approved scheme that provides tax advantages to encourage retirement savings. However, unlike superannuation, contributions to an RRSP are not compulsory and are capped at a specific amount each year. Superannuation is a critical component of retirement planning for Australians. Its structure, involving mandatory employer contributions and the ability for individuals to make voluntary contributions, allows for the accumulation of significant retirement savings. The regulation of superannuation by bodies such as APRA, ASIC, and the ATO ensures the system's integrity and protects consumers' interests. However, understanding superannuation can be complex, with considerations around investment choices, tax implications, and the timing of contributions all playing a role in the ultimate benefit received. For this reason, many individuals may benefit from consulting with a financial advisor to ensure they are making the most of their superannuation. Comparing Australia's superannuation system with international pension systems, such as those in the U.S., UK, and Canada, highlights the unique features of each system. While there are similarities, such as tax advantages and the goal of providing income in retirement, the mandatory nature of superannuation and the level of individual choice in investment options sets the Australian system apart. Looking ahead, the superannuation system will continue to play a vital role in Australia's economy and the financial security of Australians in retirement. What Is Superannuation?

Structure of Superannuation

How Superannuation Works

Employer Contributions

Employee Contributions

Other Contributions

Investment in Superannuation Funds

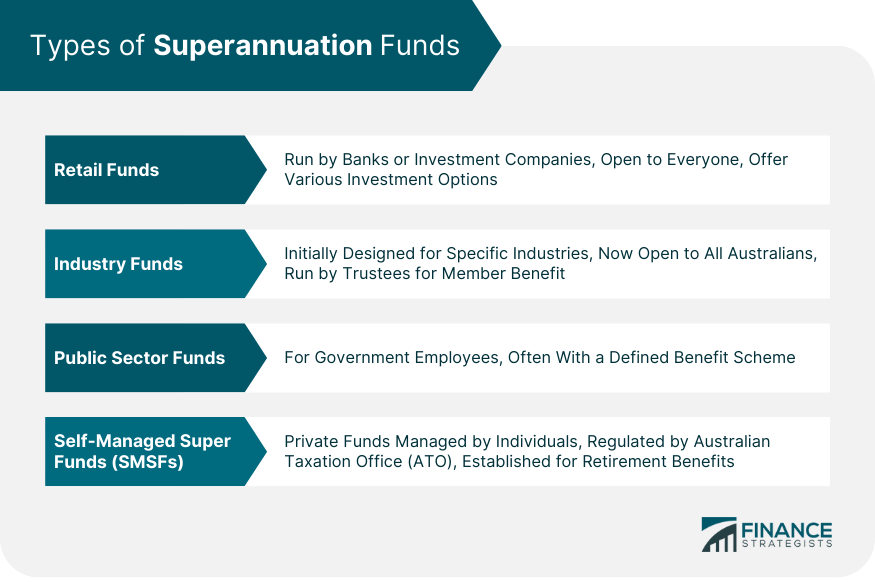

Types of Superannuation Funds

Retail Funds

Industry Funds

Public Sector Funds

Self-Managed Super Funds (SMSFs)

Insurance Within Superannuation

Regulation of Superannuation

Governing Bodies and Legislation

Australian Prudential Regulation Authority (APRA)

Australian Securities and Investments Commission (ASIC)

Australian Taxation Office (ATO)

Compliance and Reporting Requirements

Dispute Resolution and Consumer Protection

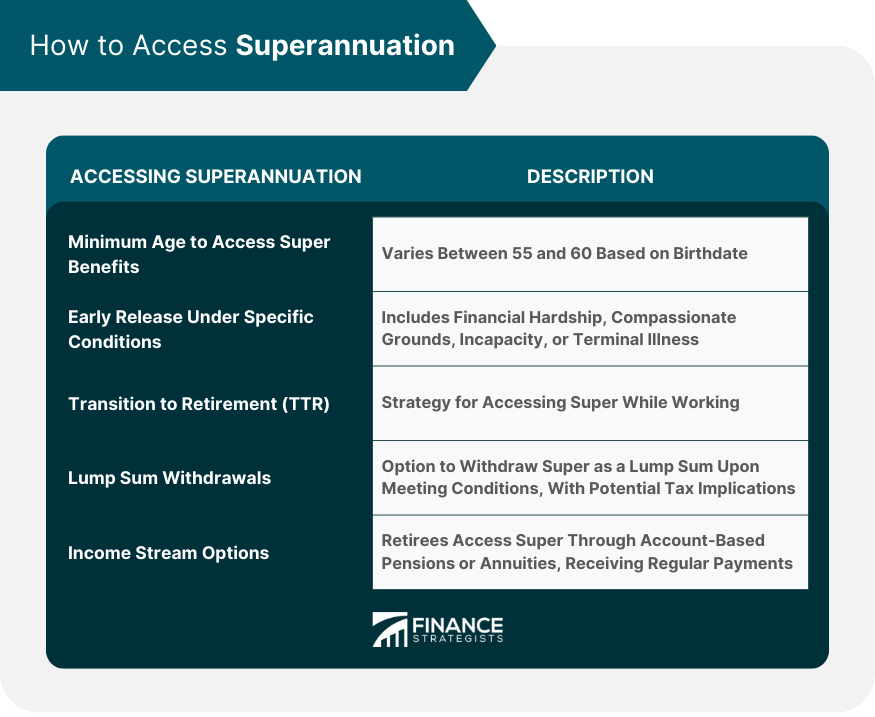

Accessing Superannuation

General Preservation Age and Rules

Conditions of Early Release

Superannuation and Retirement

Transition to Retirement (TTR)

Lump Sum Withdrawals

Income Stream Options

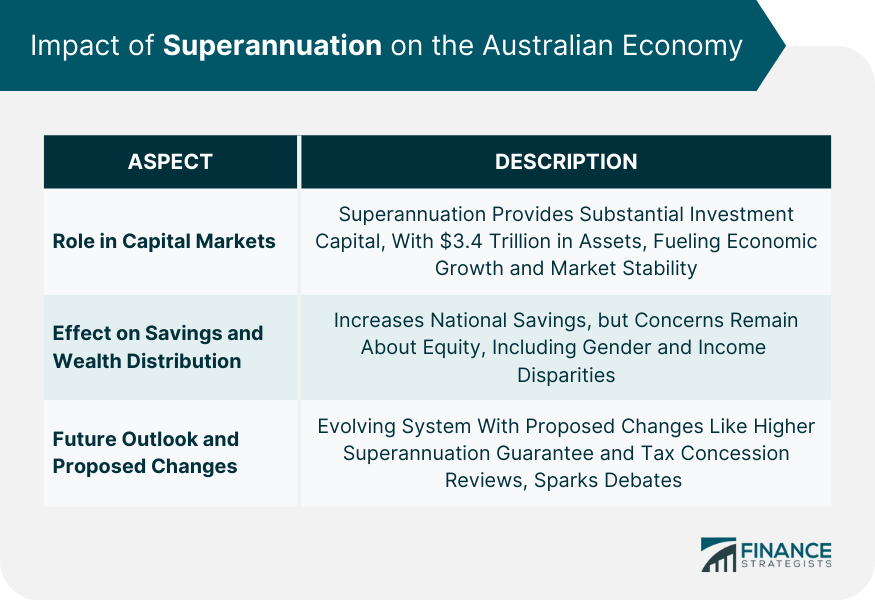

Impact of Superannuation on the Australian Economy

Role of Superannuation in Capital Markets

Effect on National Savings and Wealth Distribution

Future Outlook and Proposed Changes

Superannuation Planning and Strategy

Importance of Early and Regular Contributions

Investment Choices and Risk Profile

Tax Implications and Benefits

Role of Financial Advisors in Superannuation Planning

Comparison With International Pension Systems

Superannuation vs U.S. Defined-Benefit or Defined-Contribution Plans

Superannuation vs UK Pension Schemes

Superannuation vs Canada's Registered Retirement Savings Plan (RRSP)

Final Thoughts

Superannuation FAQs

Superannuation, often referred to as "super," is a compulsory pension program in Australia. It involves employers contributing a percentage of an employee's earnings into a superannuation fund, which is then invested to provide retirement benefits for the employee.

Superannuation works by accumulating funds throughout your working life to provide income during retirement. Employers are required to contribute a percentage of your salary (currently 11% as of 2024) into your super fund. You can also make voluntary contributions. The funds are then invested by the super fund, with the aim of growing the balance over time.

You can access your superannuation when you reach your preservation age (between 55 and 60, depending on when you were born) and meet a condition of release, such as retiring from the workforce. In certain circumstances, such as severe financial hardship or specific medical conditions, you may be able to access your super early.

There are four main types of superannuation funds: retail funds, industry funds, public sector funds, and self-managed super funds (SMSFs). Retail funds are typically run by banks or investment companies, while industry funds are associated with specific industries. Public sector funds cater to government employees, and SMSFs are private funds managed by the members themselves.

Superannuation plays a significant role in the Australian economy. With over $3.4 trillion in assets as of December 2022, it provides a substantial source of investment capital. Superannuation funds invest in a range of assets, contributing to economic growth and financial market stability. It also plays a role in national savings and wealth distribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.