Plan sponsor assistance refers to the support, guidance, and services offered to plan sponsors who are responsible for managing and administering employee benefit plans, such as retirement and health plans. This assistance aims to ensure that plan sponsors meet their fiduciary duties, maintain regulatory compliance, and provide effective plan management for their participants. Plan sponsor assistance is crucial as it enables organizations to navigate complex regulatory requirements, optimize plan design, and improve participant outcomes. By leveraging external expertise and resources, plan sponsors can minimize risk, reduce administrative burden, and enhance the overall effectiveness of their benefit programs. Retirement plan assistance focuses on helping plan sponsors manage and administer various types of retirement plans to ensure compliance, efficiency, and participant satisfaction. 401(k) plan sponsor assistance helps plan sponsors design, implement, and manage 401(k) plans while ensuring compliance with regulations. This assistance can include investment selection, participant education, and fiduciary support to improve plan outcomes and mitigate risk. Pension plan sponsor assistance supports sponsors in managing defined benefit plans, which guarantee a specific retirement benefit to participants. This assistance may include actuarial services, funding strategy development, and compliance support to ensure the plan's long-term viability and sustainability. Profit-sharing plan sponsor assistance aids plan sponsors in designing and administering profit-sharing plans, which distribute a portion of company profits to eligible employees. This assistance may involve plan design optimization, compliance support, and participant communication to maximize employee engagement and satisfaction. Health and welfare plan assistance focuses on helping plan sponsors manage various types of employee benefit plans related to health and welfare, ensuring regulatory compliance and participant satisfaction. Health insurance plan sponsor assistance supports plan sponsors in designing, implementing, and managing group health insurance plans. This assistance may include plan design consultation, carrier negotiations, and compliance guidance to ensure employees have access to affordable, high-quality healthcare. Disability insurance plan sponsor assistance helps plan sponsors manage and administer disability insurance programs, which provide income replacement to employees unable to work due to illness or injury. This assistance may involve plan design optimization, carrier negotiations, and regulatory compliance support to protect employees' financial well-being. Life insurance plan sponsor assistance aids plan sponsors in offering life insurance benefits to employees, typically providing a death benefit to beneficiaries in the event of an employee's death. This assistance may include plan design consultation, carrier negotiations, and compliance guidance to ensure employees have access to appropriate coverage levels. Plan sponsors are responsible for designing and implementing benefit plans that meet the needs of their organization and employees. This includes selecting plan features, investment options, and service providers, as well as ensuring that the plan complies with applicable regulations. Plan sponsors must administer their benefit plans in accordance with regulatory requirements, including timely reporting, disclosure, and participant communication. This responsibility also involves monitoring plan operations to identify and address potential compliance issues proactively. Plan sponsors are responsible for selecting and monitoring the investment options offered within their benefit plans. This includes ensuring that investments are diversified, cost-effective, and appropriate for participants' needs, as well as monitoring investment performance and making necessary adjustments. Plan sponsors are responsible for providing participants with the necessary information and education to make informed decisions about their benefits. This includes distributing plan documents, providing investment education, and offering tools and resources to help participants understand and manage their benefits effectively. As fiduciaries, plan sponsors must act in the best interests of plan participants, ensuring that benefit plans are managed prudently and in accordance with applicable laws and regulations. This responsibility includes monitoring service providers, managing plan fees, and addressing potential conflicts of interest to minimize risk and protect participant outcomes. Various types of providers offer plan sponsor assistance, each with their areas of expertise and services designed to support plan sponsors in managing their benefit plans effectively. TPAs provide administrative and operational support for benefit plans, including plan document preparation, compliance testing, and participant recordkeeping. By outsourcing these tasks, plan sponsors can reduce their administrative burden and focus on strategic plan management. Recordkeepers maintain participant account records, process contributions, and distributions, and provide reporting for benefit plans. They also offer web-based platforms for participants to access their account information, enabling plan sponsors to streamline plan administration and improve participant engagement. Investment advisors and managers help plan sponsors select, monitor, and adjust investment options within their benefit plans. They provide investment research, performance reporting, and fiduciary oversight to ensure plan sponsors meet their obligations and optimize investment outcomes for participants. Actuaries play a crucial role in pension plan sponsor assistance by assessing the financial health of defined benefit plans and projecting future plan liabilities. Their services include actuarial valuations, funding strategy development, and risk management support, enabling plan sponsors to maintain the long-term sustainability of their pension plans. Legal and compliance consultants provide expert guidance on the complex regulatory landscape surrounding employee benefit plans. They help plan sponsors interpret and apply regulations, identify potential compliance issues, and develop strategies to mitigate risk and maintain compliance. Choosing the right assistance provider is critical to ensuring the success of a benefit plan. Plan sponsors should consider several factors when evaluating and selecting providers to support their plan management needs. When selecting an assistance provider, plan sponsors should assess the provider's expertise in managing and administering similar benefit plans. This includes evaluating the provider's industry experience, professional credentials, and depth of knowledge in relevant regulatory and technical areas. Plan sponsors should compare the fees and services offered by different assistance providers to determine the best value for their organization. This includes assessing the scope of services provided, the quality of those services, and the associated costs to ensure that the selected provider meets the organization's needs and budget constraints. Evaluating a provider's reputation and client satisfaction can provide valuable insight into the quality of their services and their ability to meet plan sponsor needs. Plan sponsors should consider seeking references from existing clients, reading reviews, and researching any regulatory or legal issues associated with the provider to make an informed decision. Plan sponsor assistance helps organizations navigate complex regulatory requirements, ensuring compliance and reducing the risk of penalties or legal issues. Assistance providers offer expert guidance and support to help plan sponsors proactively address potential compliance concerns and manage their fiduciary responsibilities effectively. Working with assistance providers can help plan sponsors optimize their benefit plans, resulting in improved participant satisfaction and engagement. Providers can offer insights into best practices and industry trends, enabling plan sponsors to make informed decisions about plan design, investment options, and participant communication. Outsourcing plan administration tasks to assist providers can significantly reduce the workload for plan sponsors, allowing them to focus on strategic plan management. Assistance providers can manage time-consuming administrative functions, such as recordkeeping, compliance testing, and participant communication, resulting in a more efficient plan administration process. Plan sponsor assistance providers, such as investment advisors and managers, help plan sponsors select and monitor investment options within their benefit plans. By leveraging the expertise of these professionals, plan sponsors can optimize investment performance, manage risk, and ensure they meet their fiduciary obligations. Working with plan sponsor assistance providers gives organizations access to specialized knowledge and resources that may be unavailable in-house. Providers can offer guidance on regulatory changes, industry trends, and best practices, ensuring plan sponsors stay informed and make decisions that benefit their organization and participants. When working with assistance providers, plan sponsors must be vigilant in identifying and addressing potential conflicts of interest. Providers may have relationships with other organizations or financial incentives that could influence their recommendations, potentially compromising the best interests of plan participants. Plan sponsor assistance can come with significant costs and fees, which can impact the overall effectiveness of benefit plans. Plan sponsors must carefully evaluate the fees and services offered by assistance providers to ensure they are receiving value for their investment and not compromising participant outcomes. Effective communication between plan sponsors and assistance providers is crucial for successful plan management. Plan sponsors must establish clear lines of communication and ensure that providers deliver timely and accurate information to facilitate informed decision-making and maintain plan compliance. Plan sponsors must ensure that their assistance providers maintain robust data privacy and security measures to protect sensitive participant information. This includes implementing secure data storage and transmission practices, regularly reviewing and updating security protocols, and adhering to applicable data protection regulations. To optimize the benefits of plan sponsor assistance, it's essential to establish clear roles and responsibilities for all parties involved. This includes defining the scope of services provided by assistance providers, outlining expectations for plan sponsors, and maintaining open communication channels to ensure a successful partnership. Plan sponsors should regularly review and assess the performance of their assistance providers to ensure they continue to meet the organization's needs and maintain a high level of service quality. This may include conducting periodic performance evaluations, reviewing fees and services, and soliciting participant feedback. Transparent and open communication between plan sponsors and assistance providers is critical for effective plan management. Plan sponsors should establish regular communication channels, such as meetings or progress reports, to ensure that all parties stay informed and aligned in managing the benefit plan. Continuing education and training for plan sponsors and assistance providers is essential to stay informed about industry trends, regulatory changes, and best practices. By investing in ongoing education, organizations can ensure they have the knowledge and skills necessary to effectively manage their benefit plans and make informed decisions. Plan sponsors and assistance providers must stay current with industry trends and regulatory changes to ensure their benefit plans remain compliant and competitive. Regularly monitoring industry news, attending conferences, and participating in industry associations can help organizations stay informed and adapt to evolving market conditions. Plan sponsor assistance refers to the support, guidance, and services offered to plan sponsors responsible for managing and administering employee benefit plans. The assistance providers offer expert guidance and support to help plan sponsors proactively address potential compliance concerns, manage their fiduciary responsibilities effectively, and minimize risk. Various types of providers offer plan sponsor assistance, including third-party administrators, recordkeepers, investment advisors and managers, actuaries, and legal and compliance consultants. Plan sponsors should evaluate provider expertise and experience, compare fees and services, and assess the provider's reputation and client satisfaction when selecting the right assistance provider. Best practices for plan sponsor assistance include establishing clear roles and responsibilities, regularly reviewing and assessing assistance providers, ensuring transparent and open communication, and implementing ongoing education and training for key personnel. Plan sponsors and assistance providers must stay current with industry trends and regulatory changes to ensure their benefit plans remain compliant and competitive.What Is a Plan Sponsor Assistance?

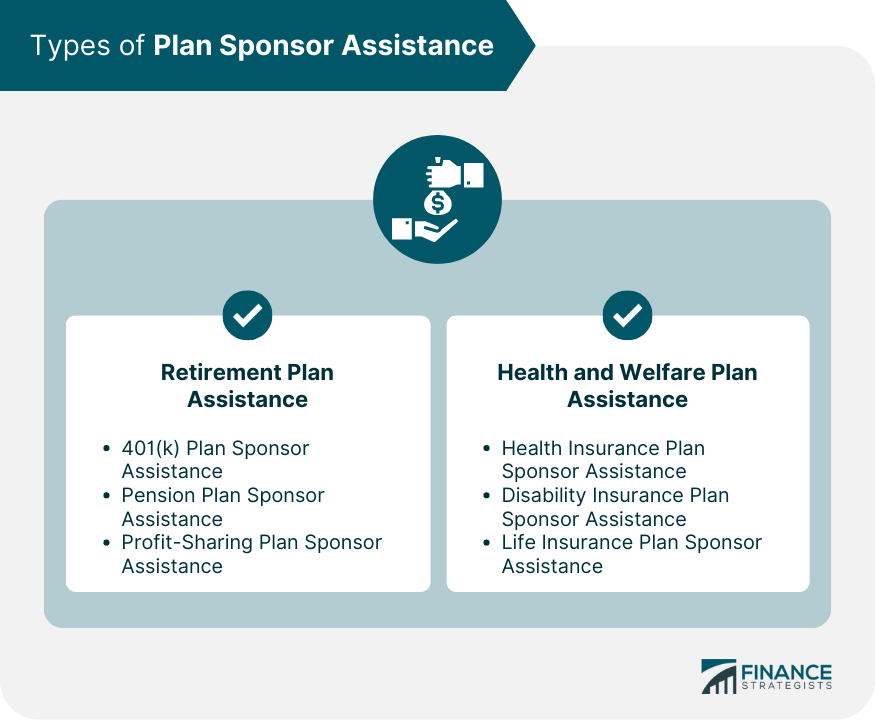

Types of Plan Sponsor Assistance

Retirement Plan Assistance

401(k) Plan Sponsor Assistance

Pension Plan Sponsor Assistance

Profit-Sharing Plan Sponsor Assistance

Health and Welfare Plan Assistance

Health Insurance Plan Sponsor Assistance

Disability Insurance Plan Sponsor Assistance

Life Insurance Plan Sponsor Assistance

Key Responsibilities of Plan Sponsors

Plan Design and Implementation

Plan Administration and Compliance

Investment Management and Monitoring

Participant Education and Communication

Fiduciary Responsibilities and Risk Management

Plan Sponsor Assistance Providers

Types of Assistance Providers

Third-Party Administrators (TPAs)

Recordkeepers

Investment Advisors and Managers

Actuaries

Legal and Compliance Consultants

Selecting the Right Assistance Provider

Evaluating Provider Expertise and Experience

Comparing Fees and Services

Assessing the Provider's Reputation and Client Satisfaction

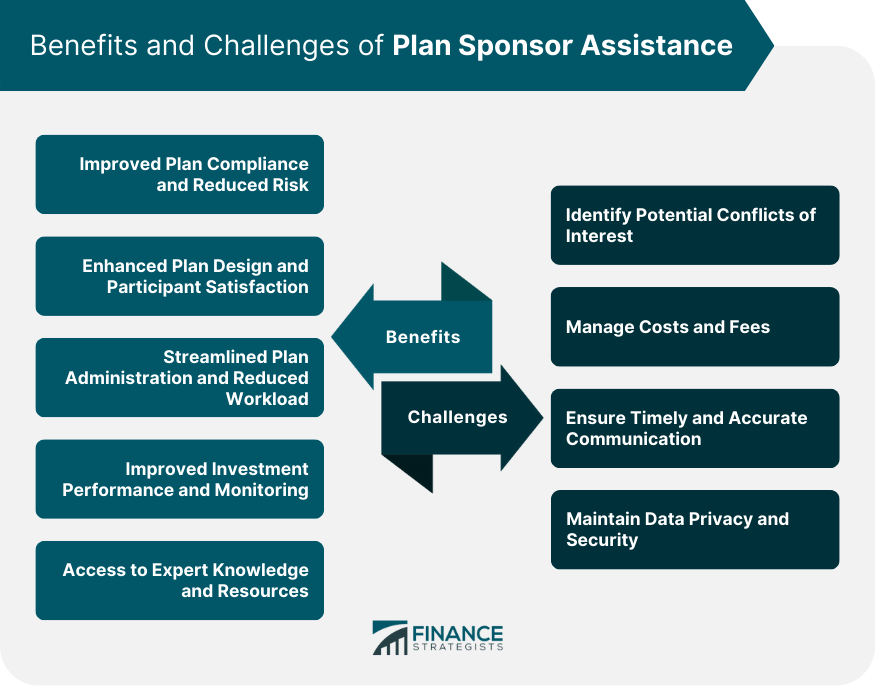

Benefits of Plan Sponsor Assistance

Improved Plan Compliance and Reduced Risk

Enhanced Plan Design and Participant Satisfaction

Streamlined Plan Administration and Reduced Workload

Improved Investment Performance and Monitoring

Access to Expert Knowledge and Resources

Challenges and Pitfalls in Plan Sponsor Assistance

Identifying Potential Conflicts of Interest

Managing Costs and Fees

Ensuring Timely and Accurate Communication

Maintaining Data Privacy and Security

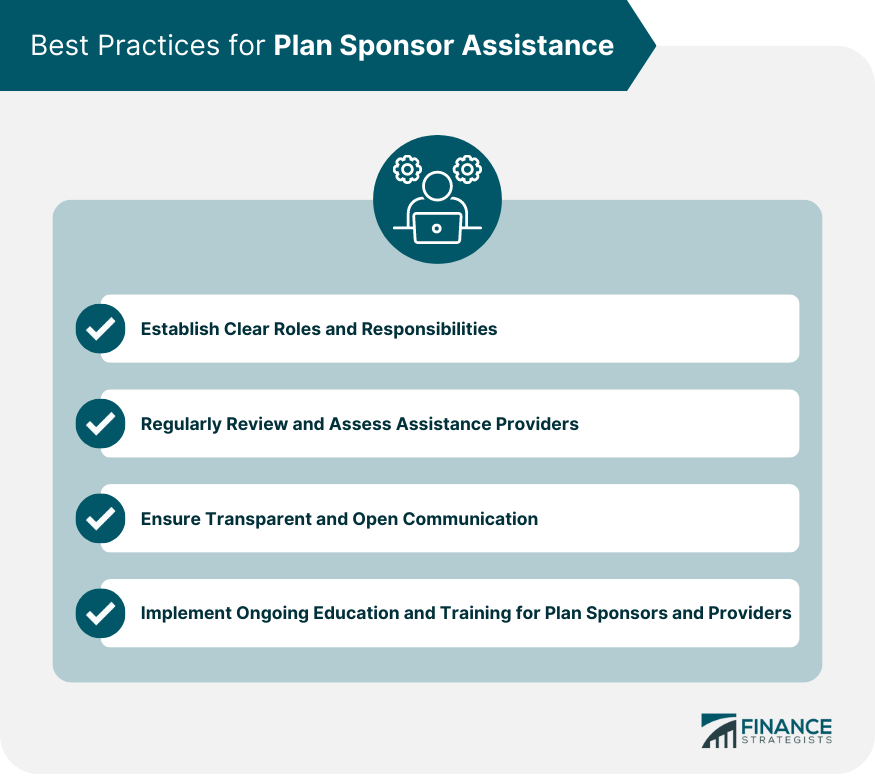

Best Practices for Plan Sponsor Assistance

Establishing Clear Roles and Responsibilities

Regularly Reviewing and Assessing Assistance Providers

Ensuring Transparent and Open Communication

Implementing Ongoing Education and Training for Plan Sponsors and Providers

Final Thoughts

Plan Sponsor Assistance FAQs

Plan sponsor assistance refers to the support and guidance provided by specialized providers to help organizations manage their employee benefit plans, such as retirement and health insurance plans. By leveraging plan sponsor assistance, organizations can improve plan compliance, enhance plan design, streamline administration, optimize investment performance, and access expert knowledge and resources.

Various types of providers offer plan sponsor assistance, including third-party administrators (TPAs), recordkeepers, investment advisors and managers, actuaries, and legal and compliance consultants. Each provider offers specific services and expertise to support plan sponsors in managing their benefit plans effectively.

Plan sponsor assistance providers offer expert guidance on complex regulatory requirements and best practices, helping organizations navigate the compliance landscape and reduce the risk of penalties or legal issues. By partnering with assistance providers, plan sponsors can proactively address potential compliance concerns and fulfill their fiduciary responsibilities effectively.

When selecting a plan sponsor assistance provider, organizations should consider factors such as provider expertise and experience, fees and services, and the provider's reputation and client satisfaction. Assessing these factors can help plan sponsors choose the right provider to meet their specific needs and ensure a successful partnership.

Best practices for plan sponsors seeking assistance include establishing clear roles and responsibilities, regularly reviewing and assessing assistance providers, ensuring transparent and open communication, implementing ongoing education and training, and staying up-to-date with industry trends and regulatory changes. By following these practices, plan sponsors can optimize the benefits of plan sponsor assistance and effectively manage their benefit plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.