The Annual Additions Limit is a term used in the context of retirement plans, such as 401(k) plans and defined benefit pension plans. It refers to the maximum amount of money that can be contributed to a retirement plan in a given year, including both employer contributions and employee contributions, as well as any forfeitures of contributions that were made but not vested. The Annual Additions Limit is primarily governed by Section 415 of the Internal Revenue Code (IRC). This section outlines the maximum annual contributions that can be made to an individual's retirement plan. The limits are in place to ensure fairness and prevent highly compensated employees from disproportionately benefiting from the tax advantages of retirement plans. The Employee Retirement Income Security Act (ERISA) is a federal law that sets standards for retirement plans in the private sector. ERISA, along with the IRC, outlines regulations for annual additions limits to ensure retirement plan compliance and protect plan participants. The Internal Revenue Service (IRS) provides guidelines and regulations on the Annual Additions Limit, including regular updates to the limits based on cost-of-living adjustments. These guidelines are essential for employers and employees to ensure compliance with federal retirement plan rules. The Annual Additions Limit encompasses several components, including: Employee contributions, also known as elective deferrals, are the amounts that employees choose to contribute to their retirement plans. These contributions are typically made on a pre-tax basis, reducing the employee's taxable income and providing tax benefits. Employees have the flexibility to decide how much they want to contribute to their retirement plans, subject to the Annual Additions Limit. Employer contributions are amounts that employers contribute to an employee's retirement plan. These contributions can take several forms, such as matching contributions, where the employer matches a portion of the employee's elective deferrals or non-elective contributions. The employer contributes a set amount to the employee's plan regardless of the employee's own contributions. Employer contributions help employees grow their retirement savings and provide an incentive for employees to contribute to their retirement plans. Forfeitures are amounts that employees lose when they leave the company before becoming fully vested in their retirement plan. Vesting refers to the process of earning the right to keep employer contributions in a retirement plan. The vesting schedule for employer contributions varies by plan and can be immediate or gradual over a specific period. If an employee leaves the company before meeting the vesting requirements, they will forfeit the non-vested portion of their employer contributions. When employees forfeit their non-vested employer contributions, these amounts are often reallocated to other employees' accounts within the retirement plan. This reallocation helps offset the costs of plan administration and can provide additional retirement savings for employees who remain with the company. To determine the Annual Additions Limit for a specific year, consider the following factors: 1. Percentage of Compensation: The annual additions limit is usually expressed as a percentage of the employee's compensation. 2. Dollar Amount: The IRC sets a maximum dollar amount that can be contributed to an employee's retirement plan annually. 3. Adjustments for Cost-Of-Living: The IRS adjusts the limits for cost-of-living increases, ensuring that the limits remain relevant as the economy changes. The Annual Additions Limit applies to various defined contribution plans, such as: 1. 401(k) Plans: These employer-sponsored retirement plans allow employees to make elective deferrals from their salary on a pre-tax basis. 2. 403(b) Plans: These plans are designed for employees of tax-exempt organizations and public schools, allowing them to save for retirement through elective deferrals and employer contributions. 3. Profit-Sharing Plans: These plans enable employers to share company profits with employees through contributions to their retirement accounts. Defined benefit plans, such as pension plans and cash balance plans, are also subject to the Annual Additions Limit. However, the limit applies differently to these plans, as the focus is on the maximum annual benefit payable at retirement rather than annual contributions. Exceeding the Annual Additions Limit can result in IRS penalties and sanctions. Employers and employees must carefully monitor their retirement plan contributions to avoid these consequences. If the Annual Additions Limit is consistently exceeded, the retirement plan may be disqualified, resulting in the loss of tax benefits for both the employer and employees. There are several methods for correcting excess contributions, including: 1. Voluntary Correction Program (VCP): The VCP allows plan sponsors to correct plan errors and excess contributions by paying a fee and submitting a correction proposal to the IRS. 2. Self-Correction Program (SCP): The SCP enables plan sponsors to correct certain plan errors, including excess contributions, without contacting the IRS or paying a fee, as long as specific conditions are met. 3. Audit Closing Agreement Program (Audit CAP): If the IRS discovers excess contributions during an audit, the plan sponsor may resolve the issue through the Audit CAP by paying a sanction and correcting the excess contributions. Individuals aged 50 and older can make catch-up contributions to their retirement plans, allowing them to save more for retirement without exceeding the Annual Additions Limit. Individuals can contribute to multiple retirement accounts, such as IRAs, 401(k)s, and 403(b)s, to maximize their savings while adhering to the limits for each plan. Employees should monitor their contributions throughout the year and adjust them as needed to avoid exceeding the Annual Additions Limit. Employers can also help employees stay within the limit by providing regular updates on their contribution amounts and limits. In conclusion, the Annual Additions Limit plays a crucial role in determining the maximum amount of money that can be contributed to retirement plans each year. It is governed by regulatory bodies such as the Internal Revenue Code, the Employee Retirement Income Security Act, and the Internal Revenue Service. The limit includes various components such as employee contributions, employer contributions, forfeitures, and allocations of certain plan forfeitures. Exceeding the limit can lead to consequences such as IRS penalties, plan disqualification, and sanctions. However, individuals can utilize strategies such as catch-up contributions, utilizing multiple retirement accounts, and monitoring and adjusting contributions throughout the year to maximize their contributions while staying within the limit. Employers can also play a significant role in helping employees stay within the limit by providing regular updates on contribution amounts and limits.Definition of Annual Additions Limit

Regulatory Background

Internal Revenue Code Section 415

Employee Retirement Income Security Act (ERISA)

IRS Regulations and Guidelines

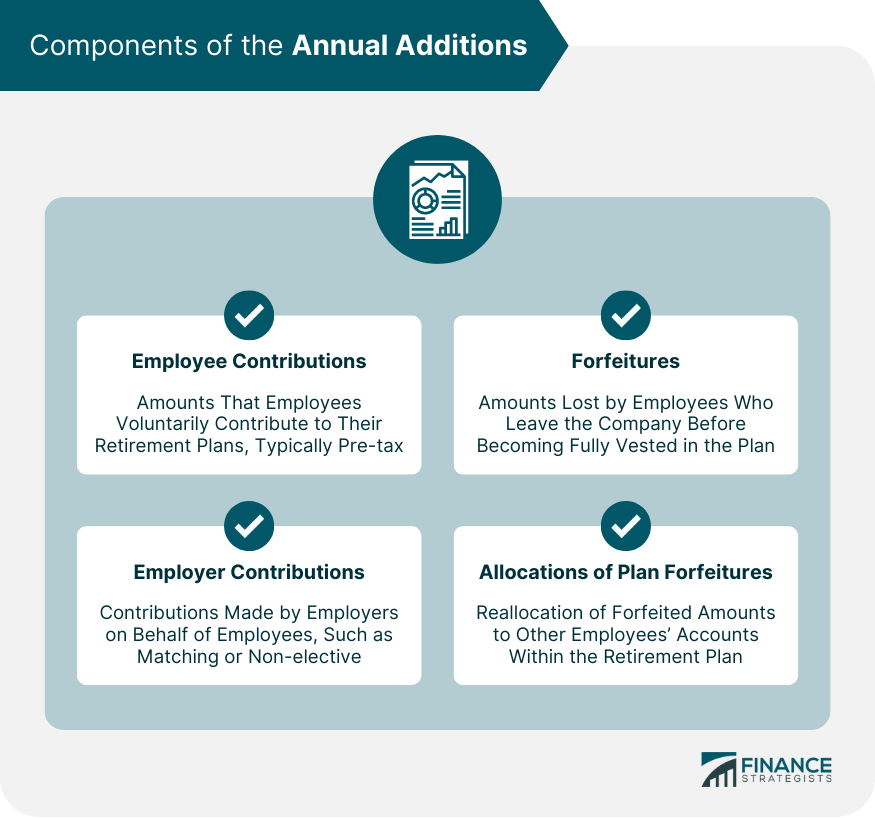

Components of the Annual Additions

Employee Contributions

Employer Contributions

Forfeitures

Allocations of Certain Plan Forfeitures

Determining the Limit for a Specific Year

Impact on Different Retirement Plans

Defined Contribution Plans

Defined Benefit Plans

Consequences of Exceeding the Annual Additions Limit

IRS Penalties and Sanctions

Plan Disqualification

Correction Methods

Strategies to Maximize Contributions While Staying Within the Limit

Catch-up Contributions for Individuals Aged 50 and Older

Utilizing Multiple Retirement Accounts

Monitoring and Adjusting Contributions Throughout the Year

Conclusion

Annual Additions Limit FAQs

The Annual Additions Limit is the maximum amount of contributions that can be made to an individual's retirement plan in a year, as governed by Section 415 of the Internal Revenue Code (IRC). It ensures fairness in retirement plans and prevents highly compensated employees from disproportionately benefiting from the tax advantages of these plans.

Yes, the Annual Additions Limit applies to both defined contribution and defined benefit retirement plans. However, the limit applies differently to each type of plan. For defined contribution plans, it focuses on the total annual contributions, while for defined benefit plans, it focuses on the maximum annual benefit payable at retirement.

The Annual Additions Limit applies to both defined contribution plans (e.g., 401(k), 403(b), and profit-sharing plans) and defined benefit plans (e.g., pension and cash balance plans). However, the limit applies differently to defined benefit plans, focusing on the maximum annual benefit payable at retirement rather than annual contributions.

Exceeding the Annual Additions Limit can result in IRS penalties and sanctions, plan disqualification, and loss of tax benefits for both employers and employees. Employers can correct excess contributions through programs such as the Voluntary Correction Program (VCP), Self-Correction Program (SCP), and Audit Closing Agreement Program (Audit CAP).

Individuals can use strategies such as making catch-up contributions (for those aged 50 and older), utilizing multiple retirement accounts, and monitoring and adjusting contributions throughout the year to maximize their retirement savings without exceeding the Annual Additions Limit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.