Guaranteed investment contracts are financial instruments insurance companies, banks, or other financial institutions provide. These contracts offer investors the guarantee of principal protection and a fixed interest rate over a specified period. GICs serve as an attractive investment option for conservative investors seeking low-risk, predictable returns. They are commonly used by pension funds, retirement accounts, and individual investors looking for a stable source of income without exposing their capital to significant market volatility. GICs are primarily issued by insurance companies, but they can also be offered by banks and other financial institutions, such as investment firms or credit unions. One of the main features of GICs is the protection of the principal investment. Investors are guaranteed to receive their original investment amount back at the end of the contract term, regardless of market fluctuations. GICs provide a fixed interest rate for the entire duration of the contract. This interest rate is determined at the time of purchase and remains unchanged until the maturity date, ensuring a predictable return on investment. GICs offer various maturity terms, ranging from short-term options of a few months to long-term contracts lasting several years. The maturity term affects the interest rate offered, with longer-term GICs typically providing higher interest rates to compensate for the increased time commitment. The creditworthiness of the institution offering the GIC plays a crucial role in determining its safety and reliability. Credit rating agencies, such as Standard & Poor's, Moody's, and Fitch Ratings, assess the financial stability of GIC issuers and assign a credit rating accordingly. A higher credit rating indicates a lower likelihood of default by the issuer, making it a more secure investment. A laddering strategy involves investing in multiple GICs with different maturity dates, creating a series of staggered maturities. This approach provides regular access to funds, reduces interest rate risk, and allows for the potential to reinvest in higher-yielding GICs as they mature. The barbell strategy involves investing in a combination of short-term and long-term GICs to balance liquidity needs and the potential for higher returns. This strategy offers some flexibility and allows investors to take advantage of changing interest rates by reinvesting the short-term GICs as they mature. A bullet strategy involves investing in a single GIC with a specific maturity date that aligns with a future financial goal, such as college tuition or retirement. This approach focuses on preserving capital and ensuring funds are available when needed while still earning a fixed return. GICs can play an essential role in retirement planning, providing a stable and predictable income stream with minimal risk exposure. They can serve as a conservative component of a diversified retirement portfolio, helping to balance more aggressive investments and reduce overall volatility. Some advantages of GICs for retirees include: Capital Preservation: GICs provide principal protection, ensuring that retirees' investments remain secure. Predictable Income: The fixed interest rates offered by GICs allow retirees to plan for their expenses and budget accordingly. Reduced Risk Exposure: GICs help retirees minimize their exposure to market volatility, which can be particularly important as they transition from wealth accumulation to wealth preservation. Retirees should also consider the potential drawbacks of GICs, such as: Inflation Risk: As mentioned earlier, GICs may not provide sufficient returns to keep pace with inflation, potentially eroding the purchasing power of retirees' investments. Limited Liquidity: Retirees may need access to their funds for unexpected expenses, and the limited liquidity of GICs could pose a challenge in such situations. Opportunity Cost: Retirees may miss out on potentially higher returns from other investment options by focusing solely on GICs. The interest income earned on GICs is typically subject to federal and, if applicable, state income taxes. Investors should consult with a tax professional to understand the specific tax implications of their GIC investments. Some GICs may be eligible for tax-deferred status if held within certain retirement accounts, such as an Individual Retirement Account (IRA) or a 401(k). This allows the interest to grow tax-deferred until withdrawal, which can provide a significant advantage in long-term wealth accumulation. In cases where early withdrawal from a GIC is allowed, any interest earned may be subject to taxes and penalties. Additionally, if the GIC is held within a tax-deferred account, early withdrawals may trigger additional taxes and penalties associated with premature distributions from the account. When considering a GIC investment, it's essential to evaluate the financial stability and creditworthiness of the issuing institution. Investors can review credit ratings from agencies such as Standard & Poor's, Moody's, and Fitch Ratings to assess the issuer's financial health. Before investing in a GIC, investors should carefully review the contract terms and conditions, including the interest rate, maturity date, early withdrawal provisions, and any applicable fees or penalties. It is crucial to fully understand the investment's structure and limitations before committing to a GIC. Once invested in a GIC, it's essential to monitor the investment and stay informed about any changes in the financial stability of the issuing institution. Regularly reviewing one's overall investment portfolio and adjusting the mix of assets as needed can help maintain a well-balanced and diversified investment strategy. GICs are considered low-risk investments due to their principal protection and fixed interest rates. They offer a secure and stable option for investors seeking to preserve their capital and earn a predictable return. The fixed interest rates provided by GICs ensure a consistent return on investment throughout the contract term. This makes them an attractive option for investors seeking predictable income without the uncertainty of market fluctuations. Including GICs in an investment portfolio helps to diversify risk and reduce overall volatility. GICs can serve as a counterbalance to higher-risk investments, such as stocks or commodities, providing stability in times of market turbulence. Since GIC returns are independent of market fluctuations, they offer protection against market downturns. This makes them appealing to conservative investors or those nearing retirement who wish to preserve their capital and minimize risk exposure. GICs generally have limited liquidity, as they are designed to be held until maturity. While some GICs offer the option to cash out early, doing so may result in penalties, reduced interest, or even loss of principal in certain cases. The fixed interest rates of GICs can be a disadvantage in times of high inflation. If inflation outpaces the interest rate offered by the GIC, the real return on investment may be diminished, eroding the purchasing power of the invested capital. Investing in GICs may result in missed opportunities to earn higher returns through other investment options, such as stocks or bonds. While GICs offer stable returns, their relatively low-interest rates may be insufficient to keep pace with the growth potential of more aggressive investments. Although GICs are generally considered low-risk investments, credit risk is still associated with the financial institution issuing the contract. If the issuer faces financial difficulties or goes bankrupt, it may be unable to fulfill its obligations, potentially resulting in losses for the investor. Bonds are debt securities issued by corporations or governments, paying periodic interest and returning the principal at maturity. While both GICs and bonds offer fixed-income returns, there are some differences to consider: Credit Risk: Bonds carry credit risk based on the issuer's credit rating, while GICs are typically backed by insurance companies or banks, which are generally considered more stable. Liquidity: Bonds are usually more liquid than GICs, as they can be bought and sold in secondary markets. Interest Rate Risk: Bonds are more sensitive to changes in interest rates, which can affect their market value, while GICs maintain their principal value until maturity. Certificates of Deposit (CDs) are time deposit accounts offered by banks and credit unions, with a fixed interest rate and maturity date. GICs and CDs share some similarities, but they also have their differences: Issuers: CDs are primarily issued by banks and credit unions, while GICs are mostly issued by insurance companies. FDIC Insurance: CDs are often insured by the Federal Deposit Insurance Corporation (FDIC) up to a certain limit, providing an additional layer of protection, whereas GICs do not have FDIC coverage. Early Withdrawal: CDs generally have more flexibility for early withdrawals, although penalties may still apply. Fixed annuities are insurance contracts that provide a guaranteed income stream for a specified period or the lifetime of the annuitant. While both GICs and fixed annuities offer stable returns, they differ in several aspects: Payout Structure: GICs pay interest periodically or at maturity, while fixed annuities provide regular income payments. Tax Treatment: Interest earned on GICs is typically taxed as ordinary income, while fixed annuities may have tax-deferred growth and more favorable tax treatment upon withdrawal. Surrender Charges: Early withdrawal from a fixed annuity may result in substantial surrender charges, while GICs may have more lenient penalties for early withdrawal. Guaranteed investment contracts provide a secure and stable investment option for conservative investors seeking predictable returns and principal protection. They can serve as an essential component of a diversified portfolio, particularly for those nearing retirement or looking to minimize risk exposure. However, GICs also come with certain limitations, such as lack of liquidity, inflation risk, and opportunity cost. Investors should carefully consider their financial goals, risk tolerance, and investment horizon when incorporating GICs into their overall investment strategy. As interest rates and economic conditions change, monitoring market trends and adjusting one's investment approach is crucial. It is also essential to stay informed about the financial stability of GIC issuers and understand the terms and conditions of each contract before making an investment. To ensure you make the most informed decision about whether GICs are right for your financial goals and risk tolerance, consider seeking the help of an experienced insurance broker or financial advisor. They can guide you through the process, provide expert insights, and help you navigate the complexities of the GIC market. What Are Guaranteed Investment Contracts (GICs)?

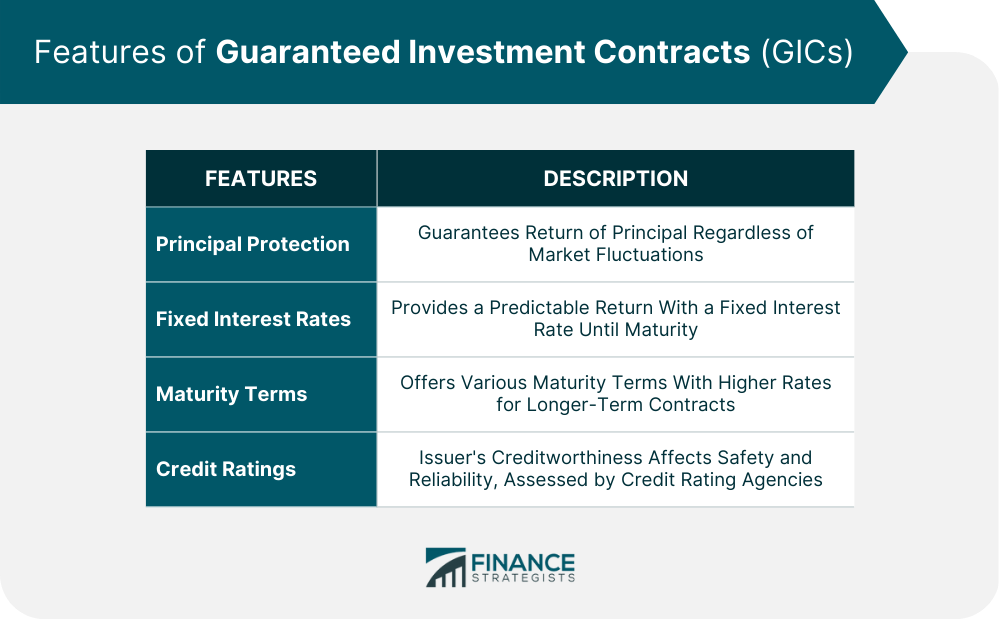

Features of Guaranteed Investment Contracts (GICs)

Principal Protection

Fixed Interest Rates

Maturity Terms

Credit Ratings

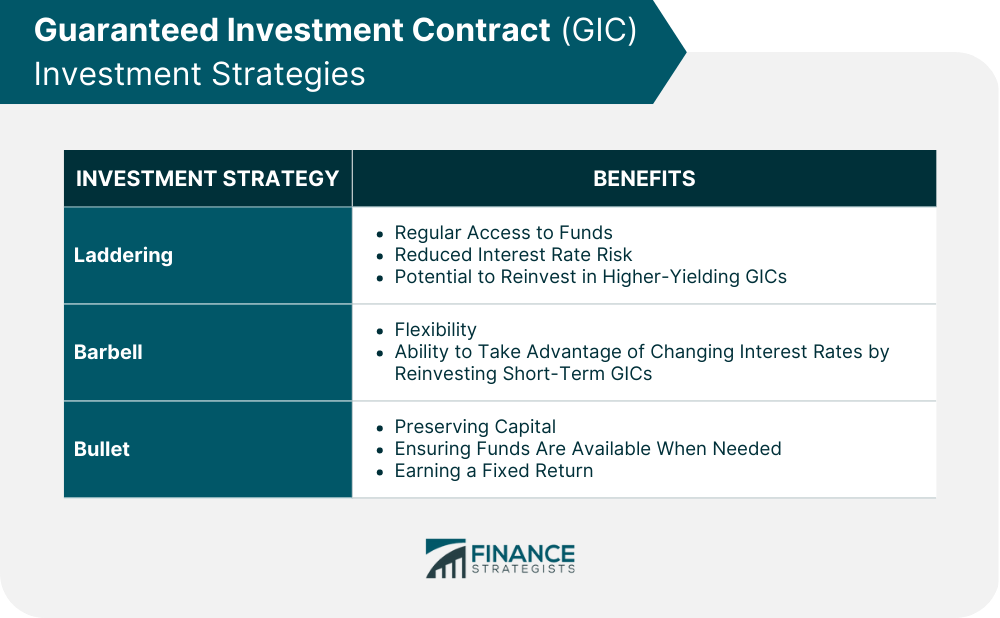

Guaranteed Investment Contract (GIC) Investment Strategies

Laddering Strategy

Barbell Strategy

Bullet Strategy

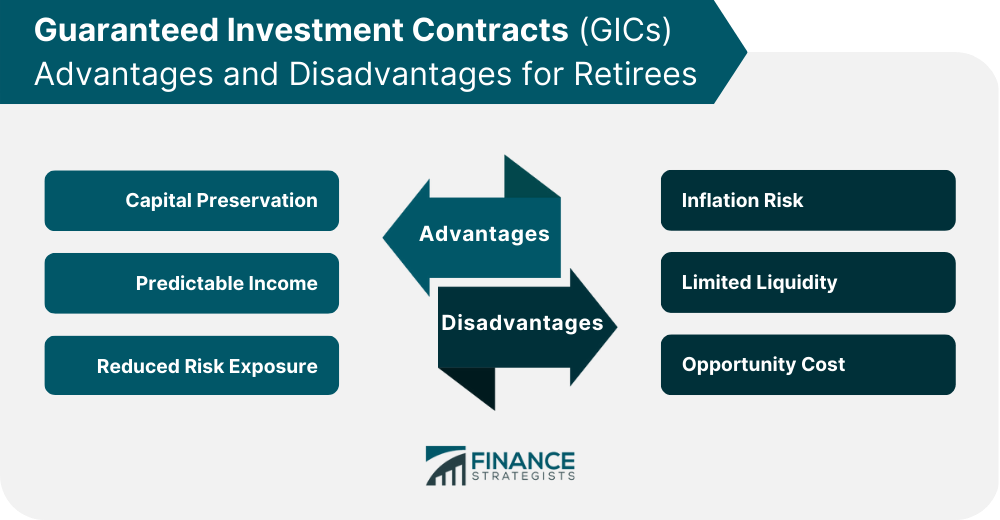

Guaranteed Investment Contracts (GICs) in Retirement Planning

Role of GICs in a Retirement Portfolio

Advantages for Retirees

Potential Drawbacks for Retirees

Tax Considerations for Guaranteed Investment Contracts (GICs)

Tax Treatment of GIC Interest Income

Tax-Deferred vs Taxable GICs

Tax Implications for Early Withdrawal

How to Invest in Guaranteed Investment Contracts (GICs)

Evaluating GIC Providers

Understanding Contract Terms and Conditions

Monitoring and Managing GIC Investments

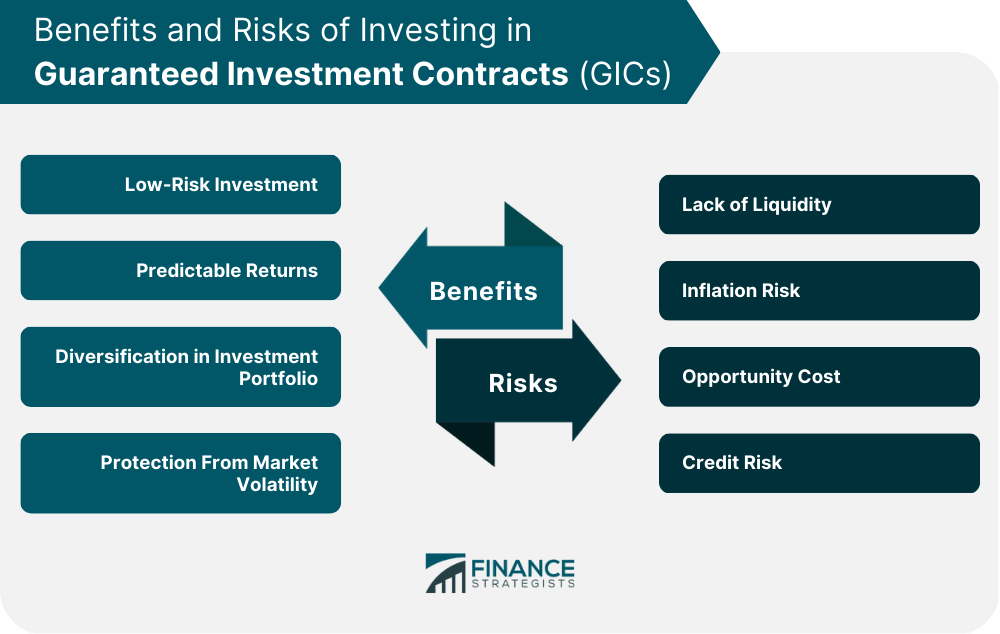

Benefits of Investing in Guaranteed Investment Contracts (GICs)

Low-Risk Investment

Predictable Returns

Diversification in Investment Portfolio

Protection From Market Volatility

Limitations and Risks of Guaranteed Investment Contracts (GICs)

Lack of Liquidity

Inflation Risk

Opportunity Cost

Credit Risk

Comparison With Other Fixed-Income Investments

GICs vs Bonds

GICs vs Certificates of Deposit (CDs)

GICs vs Fixed Annuities

Final Thoughts

Guaranteed Investment Contracts (GICs) FAQs

Guaranteed investment contracts (GICs) are financial instruments issued by insurance companies, banks, or other financial institutions that provide investors with principal protection and a fixed interest rate over a specified period.

GICs are considered low-risk investments that offer principal protection, fixed interest rates, predictable returns, and protection against market volatility. They can also serve as a diversification tool for an investment portfolio.

GICs have limited liquidity, and their fixed interest rates may not keep pace with inflation. There is also the opportunity cost of potentially missed investment opportunities, and credit risk associated with the financial institution issuing the contract.

GICs offer principal protection and are typically backed by insurance companies or banks, while bonds and CDs carry credit risk. CDs offer more flexibility for early withdrawals, while fixed annuities provide regular income payments.

Investors should evaluate the financial stability of the issuing institution and understand the contract terms and conditions before investing in GICs. It is also important to monitor the investment and stay informed about changes in economic conditions and the financial stability of the issuer.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.