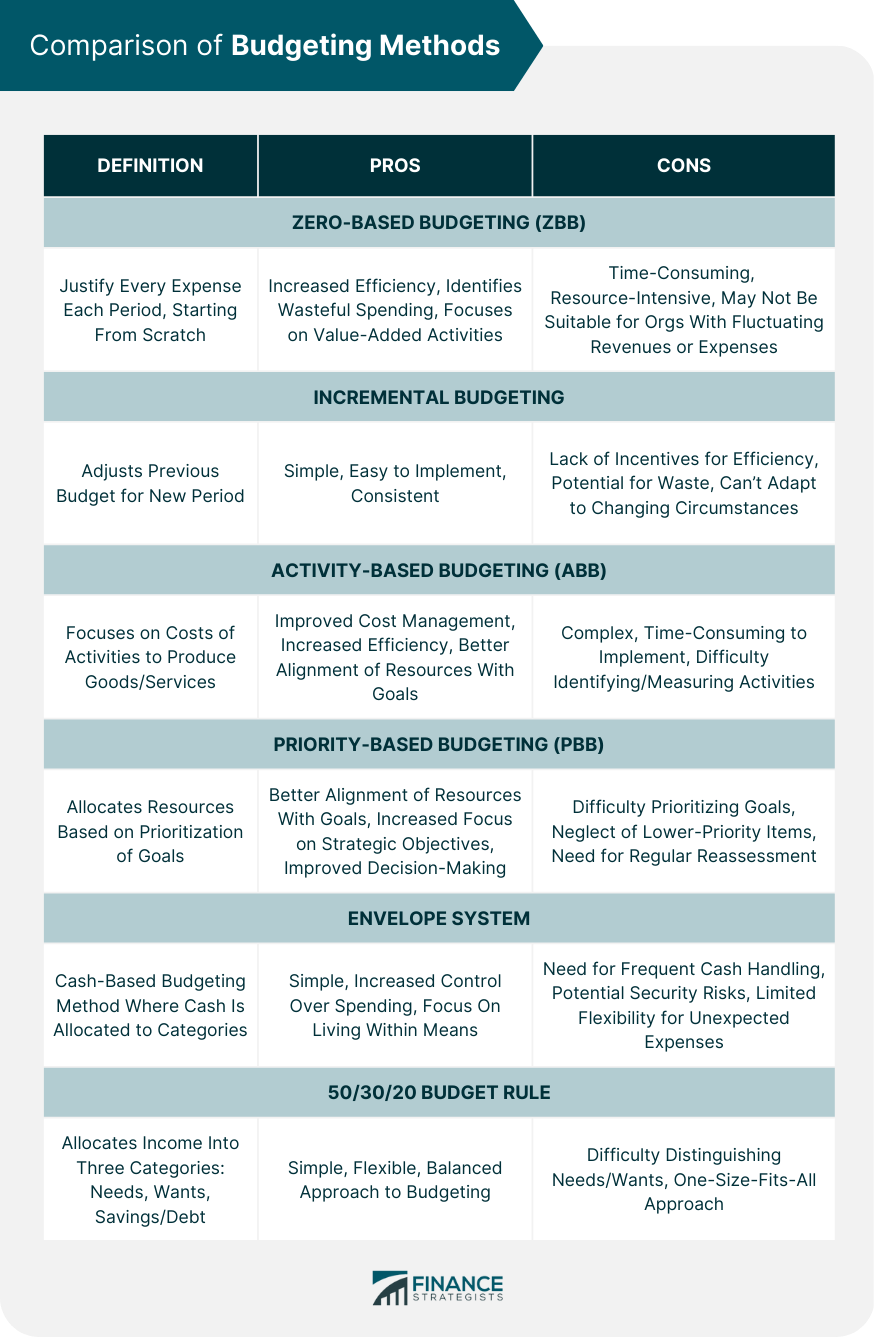

Budgeting is the process of creating a plan to allocate financial resources, balancing income and expenses over a specific period. It helps individuals and organizations prioritize their spending, track their financial progress, and achieve their financial goals. Budgeting is crucial for financial stability, as it enables individuals and organizations to control their finances, identify potential issues, and make informed decisions. It promotes discipline, reduces the likelihood of debt, and helps in achieving financial goals. Various budgeting methods can be employed depending on individual preferences, financial situations, and goals. Zero-based budgeting (ZBB) is a method where every expense must be justified for each budgeting period. It starts from scratch, with a "zero base," and each expense is analyzed to determine its necessity and allocated funds accordingly. Advantages of ZBB include increased efficiency, identification of wasteful spending, and a focus on value-added activities. However, it can be time-consuming, resource-intensive, and may not be suitable for organizations with fluctuating revenues or expenses. To implement ZBB, follow these steps: Identify budget categories and subcategories. Determine the costs associated with each category. Justify each expense based on its necessity and value. Allocate funds to justified expenses. Monitor and adjust the budget as needed. ZBB is ideal for individuals and organizations seeking to optimize their spending, eliminate waste, and focus on value-added activities. It is well-suited for those with a stable income and expenses. Incremental budgeting is a method where the previous period's budget is used as a base and adjusted by a fixed percentage or amount for the new budgeting period. This method assumes that past spending patterns are accurate and relevant to future expenses. Advantages of incremental budgeting include simplicity, ease of implementation, and consistency. Disadvantages include a lack of incentives for efficiency, potential for waste, and an inability to adapt to changing circumstances. To implement incremental budgeting, follow these steps: Identify the previous period's budget as a base. Determine an appropriate increment, either a fixed percentage or amount. Adjust the base budget by the increment. Allocate funds to each category accordingly. Monitor and adjust the budget as needed. Incremental budgeting is suitable for individuals and organizations with stable financial situations, consistent spending patterns, and limited time or resources for budgeting. Activity-based budgeting (ABB) is a method that focuses on the costs of activities necessary to produce goods and services. It involves identifying the activities, determining their costs, and allocating resources based on the demand for those activities. Advantages of ABB include improved cost management, increased efficiency, and better alignment of resources with organizational goals. Disadvantages include complexity, time-consuming implementation, and potential difficulty in identifying and measuring activities. To implement ABB, follow these steps: Identify the activities necessary to produce goods and services. Determine the costs associated with each activity. Estimate the demand for each activity. Allocate funds based on the demand for each activity. Monitor and adjust the budget as needed. ABB is ideal for organizations with complex operations, multiple products or services, and a focus on cost management and efficiency. It may not be suitable for individuals or small organizations with simple financial situations. Priority-based budgeting (PBB) is a method that allocates resources based on the prioritization of goals and objectives. It requires individuals and organizations to rank their financial goals and allocate funds accordingly, ensuring that the most important goals are funded first. Advantages of PBB include better alignment of resources with goals, increased focus on strategic objectives, and improved decision-making. Disadvantages include potential difficulty in prioritizing goals, possible neglect of lower-priority items, and the need for regular reassessment of priorities. To implement PBB, follow these steps: Identify financial goals and objectives. Rank the goals based on their importance or urgency. Allocate funds to the highest-priority goals first. Continue allocating funds to lower-priority goals as resources allow. Monitor and adjust the budget as needed, and reassess priorities periodically. PBB is suitable for individuals and organizations with multiple financial goals, limited resources, and a desire to focus on their most important objectives. It may not be ideal for those with a single, overarching financial goal or abundant resources. The envelope system is a cash-based budgeting method where cash is allocated to physical envelopes or digital categories representing different expense categories. Once the allocated funds for a category are spent, no additional spending is allowed in that category until the next budgeting period. Advantages of the envelope system include simplicity, increased control over spending, and a focus on living within one's means. Disadvantages include the need for frequent cash handling, potential security risks, and limited flexibility for unexpected expenses. To implement the envelope system, follow these steps: Identify expense categories. Determine the monthly allocation for each category. Label envelopes or digital categories with the corresponding expense category and allocation. Fill envelopes with cash or allocate funds in digital categories. Spend only the allocated amounts for each category, and do not exceed the limits. The envelope system is ideal for individuals seeking to control their spending, live within their means, and develop disciplined financial habits. It may not be suitable for those with complex financial situations or a preference for electronic transactions. The 50/30/20 budget rule is a guideline for allocating income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This method provides a simple framework for balancing essential expenses, discretionary spending, and financial goals. Advantages of the 50/30/20 budget rule include simplicity, flexibility, and a focus on balanced financial priorities. Disadvantages include potential difficulty in distinguishing between needs and wants, and a one-size-fits-all approach that may not suit individual circumstances. To implement the 50/30/20 budget rule, follow these steps: Calculate your after-tax income. Allocate 50% of your income to essential needs, such as housing, utilities, and groceries. Allocate 30% of your income to discretionary wants, such as dining out, entertainment, and hobbies. Allocate 20% of your income to savings and debt repayment, such as emergency funds, retirement savings, and credit card payments. Monitor and adjust the budget as needed, ensuring that spending remains within the allocated percentages. The 50/30/20 budget rule is suitable for individuals seeking a simple, flexible, and balanced approach to budgeting. It may not be ideal for those with unique financial situations, such as high debt levels or irregular income, that require a more tailored budgeting method. Selecting the right budgeting method is crucial for achieving financial stability and meeting financial goals. Each method has its advantages and disadvantages, so it is important to choose a method that aligns with individual preferences, financial situations, and objectives. Budgeting methods can be adapted and combined to create a customized approach that best meets an individual's needs. Regular monitoring and adjustments can help ensure that the chosen method remains effective and relevant. A successful budgeting process requires ongoing commitment, monitoring, and adjustment. Regularly reviewing the chosen method and making necessary changes can help individuals and organizations stay on track with their financial goals and achieve long-term financial success.Budgeting Methods: Overview

Zero-Based Budgeting

Definition and Key Principles

Advantages and Disadvantages

Implementation Process

Ideal Situations for Zero-Based Budgeting

Incremental Budgeting

Definition and Key Principles

Advantages and Disadvantages

Implementation Process

Ideal Situations for Incremental Budgeting

Activity-Based Budgeting

Definition and Key Principles

Advantages and Disadvantages

Implementation Process

Ideal Situations for Activity-Based Budgeting

Priority-Based Budgeting

Definition and Key Principles

Advantages and Disadvantages

Implementation Process

Ideal Situations for Priority-Based Budgeting

Envelope System

Definition and Key Principles

Advantages and Disadvantages

Implementation Process

Ideal Situations for the Envelope System

50/30/20 Budget Rule

Definition and Key Principles

Advantages and Disadvantages

Implementation Process

Ideal Situations for the 50/30/20 Budget Rule

Conclusion

Importance of Choosing the Right Budgeting Method

Adapting Budgeting Methods to Individual Needs

Continuous Improvement and Monitoring of the Budgeting Process

Budgeting Methods FAQs

Zero-based budgeting is a budgeting method where every expense must be justified for each budgeting period. It starts from scratch with a "zero base," and each expense is analyzed to determine its necessity, and allocated funds accordingly.

The envelope system is a cash-based budgeting method where cash is allocated to physical envelopes or digital categories representing different expense categories. Its advantages include simplicity, increased control over spending, and a focus on living within one's means.

The 50/30/20 budget rule is a guideline for allocating income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This method provides a simple framework for balancing essential expenses, discretionary spending, and financial goals.

Priority-based budgeting (PBB) is suitable for individuals and organizations with multiple financial goals, limited resources, and a desire to focus on their most important objectives. However, it may not be ideal for those with a single, overarching financial goal or abundant resources.

Activity-based budgeting (ABB) focuses on the costs of activities necessary to produce goods and services. Its advantages include improved cost management, increased efficiency, and better alignment of resources with organizational goals. However, ABB may be complex, time-consuming to implement, and may have difficulty identifying and measuring activities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.