Performance shares are a type of equity-based compensation granted to employees based on the achievement of specific performance targets. These targets can include financial, operational, or environmental, social, and governance (ESG) metrics. The main purpose of performance shares is to align employees' interests with those of shareholders and incentivize long-term value creation. Advantages of performance shares include increased employee engagement, retention, and motivation to achieve company goals. Key players involved in performance shares include company management, the board of directors, shareholders, and employees who are granted performance shares as part of their compensation package. Time-based performance shares vest over a predetermined period, typically 3-5 years. The grant is contingent on the employee remaining with the company for the duration of the vesting period. Performance-vesting shares require employees to achieve specific performance targets during the vesting period. The number of shares that vest depends on the level of performance achieved, often measured by financial or operational metrics. Relative TSR shares vest based on the company's total shareholder return compared to a benchmark or peer group. This type of performance share rewards employees for outperforming competitors and generating value for shareholders. Market-condition shares vest upon meeting specific market-based performance criteria, such as stock price targets or market share growth. This type of performance share aligns employee incentives with market performance and shareholder value. EPS measures a company's profitability by dividing net income by the number of outstanding shares. Performance shares may be tied to EPS growth, incentivizing employees to improve profitability. ROE is a financial metric that measures the return on shareholders' equity investments. Performance shares linked to ROE encourage employees to maximize shareholder value. ROA measures how efficiently a company utilizes its assets to generate profits. Performance shares tied to ROA incentivize employees to optimize asset utilization and increase profitability. Customer satisfaction measures the degree to which a company's products or services meet or exceed customer expectations. Performance shares linked to customer satisfaction incentivize employees to focus on customer needs and satisfaction. Market share represents a company's portion of sales in its industry or market segment. Performance shares tied to market share growth encourage employees to expand the company's presence and competitiveness in the market. Employee retention measures the ability of a company to retain its employees over time. Performance shares linked to employee retention incentivize employees to create a positive work environment and reduce turnover. Carbon emissions reduction measures a company's progress in reducing greenhouse gas emissions. Performance shares tied to carbon emissions reduction incentivize employees to implement sustainable practices and reduce the company's environmental impact. Diversity and inclusion metrics assess a company's commitment to creating a diverse and inclusive work environment. Performance shares linked to diversity and inclusion encourage employees to promote equal opportunity and a culture of acceptance. Corporate governance refers to the rules and practices guiding a company's decision-making and accountability. Performance shares tied to corporate governance incentivize employees to adhere to ethical business practices and maintain strong corporate governance standards. Fair value measurement of performance shares involves estimating their value at the grant date using appropriate valuation models, such as the Black-Scholes option pricing model or the Monte Carlo simulation. These models consider factors such as stock price, expected term, volatility, and dividend yield to calculate the fair value of performance shares. Companies are required to expense the fair value of performance shares over the vesting period, which affects their income statement and financial reporting. This accounting treatment ensures that the cost of equity-based compensation is accurately reflected in the company's financial statements, providing transparency to investors and other stakeholders. The tax implications of performance shares vary depending on the jurisdiction and the specific plan design. Generally, employees may be subject to income tax upon vesting and/or sale of the shares, while companies may be eligible for a tax deduction for the expense recognized. It is important for companies and employees to understand the tax implications of performance shares to optimize their tax planning strategies. When designing a performance share plan, companies must carefully select the performance goals and metrics that align with their strategic objectives and shareholder value creation. This involves considering financial, operational, and ESG metrics that reflect the company's priorities and industry-specific factors. Performance periods are the timeframes over which performance goals must be achieved for performance shares to vest. Companies must determine the appropriate length of these periods, typically ranging from one to five years, to balance short-term performance incentives and long-term strategic focus. Companies must establish clear vesting and payout conditions for performance shares, including the achievement of performance targets, minimum and maximum payout levels, and any additional terms, such as continued employment. These conditions should be designed to motivate employees while minimizing the risk of unintended consequences. Effective communication of performance share plan details to participants is essential for employee engagement and understanding. Companies should provide clear explanations of the plan's objectives, performance metrics, vesting conditions, and potential payouts, ensuring that employees fully comprehend the plan and its implications. Performance shares align executive compensation with company performance, incentivizing executives to focus on achieving strategic objectives and creating shareholder value. This alignment helps to mitigate concerns about excessive executive pay and promotes long-term value creation. By linking equity-based compensation to long-term performance, performance shares encourage executives to focus on the company's long-term success rather than short-term gains. Additionally, performance shares can enhance employee retention by requiring continued employment throughout the vesting period. Performance shares may offer potential tax advantages for both companies and employees, depending on the jurisdiction and plan design. Companies may be able to claim tax deductions for the recognized expense, while employees may benefit from favorable tax treatment upon vesting and selling the shares. A potential risk of performance shares is the incentive for executives to manipulate financial results to achieve performance targets. This can lead to unethical behavior and financial reporting inaccuracies, negatively affecting the company's reputation and shareholder value. The issuance of performance shares can dilute shareholder value as it increases the number of outstanding shares. Companies must carefully consider the potentially dilutive effects of performance share plans and manage them accordingly. Performance shares may disincentivize risk-taking, as executives may hesitate to pursue innovative strategies or investments that could negatively impact their performance metrics. This risk aversion can hinder the company's ability to adapt, innovate, and grow in a competitive market. Performance share plans are subject to the United States's Securities and Exchange Commission (SEC) regulations. Companies must comply with registration, reporting, and disclosure rules of performance share plans and transactions to ensure transparency and protect investor interests. Depending on the jurisdiction and stock exchange rules, companies may be required to seek shareholder approval for performance share plans. In some cases, shareholders may also have the opportunity to cast advisory votes on executive compensation, including performance share grants. Companies must comply with executive compensation disclosure requirements, which vary by jurisdiction. These requirements typically involve providing detailed information about performance share plans and grants in proxy statements or annual reports, ensuring transparency for investors and other stakeholders. Adhering to best practices for corporate governance is essential when implementing performance share plans. This includes involving independent board members in the design and oversight of plans, regularly reviewing and adjusting plan metrics, and ensuring effective communication with shareholders and other stakeholders. Performance shares are important for aligning executive compensation with company performance, encouraging long-term focus and retention, and providing potential tax advantages. Companies must carefully design and implement performance share plans, considering the various performance metrics, vesting conditions, and regulatory environments in which they operate. As the business landscape evolves, performance share plans will likely continue to adapt to changing priorities and expectations. Companies may increasingly focus on ESG metrics, shareholder engagement, and global considerations in the design of performance share plans to stay competitive and responsive to stakeholder concerns. Given the complexities and potential implications of performance share plans, it is advisable for companies to seek guidance from a qualified financial advisor. What Are Performance Shares?

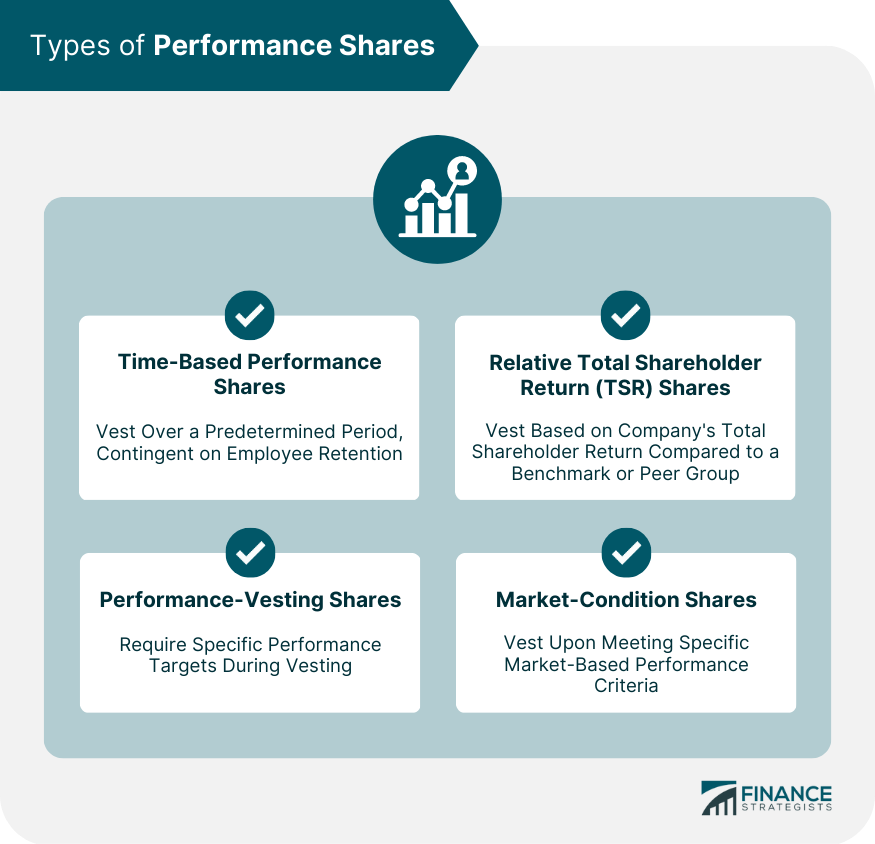

Types of Performance Shares

Time-Based Performance Shares

Performance-Vesting Shares

Relative Total Shareholder Return (TSR) Shares

Market-Condition Shares

Performance Metrics

Financial Metrics

Earnings per Share (EPS)

Return on Equity (ROE)

Return on Assets (ROA)

Operational Metrics

Customer Satisfaction

Market Share

Employee Retention

Environmental, Social, and Governance (ESG) Metrics

Carbon Emissions Reduction

Diversity and Inclusion

Corporate Governance

Valuation and Accounting for Performance Shares

Fair Value Measurement

Expensing of Performance Shares

Tax Implications

Designing Performance Share Plans

Determine Performance Goals and Metrics

Set Performance Periods

Establish Vesting and Payout Conditions

Communicate Plan Details to Participants

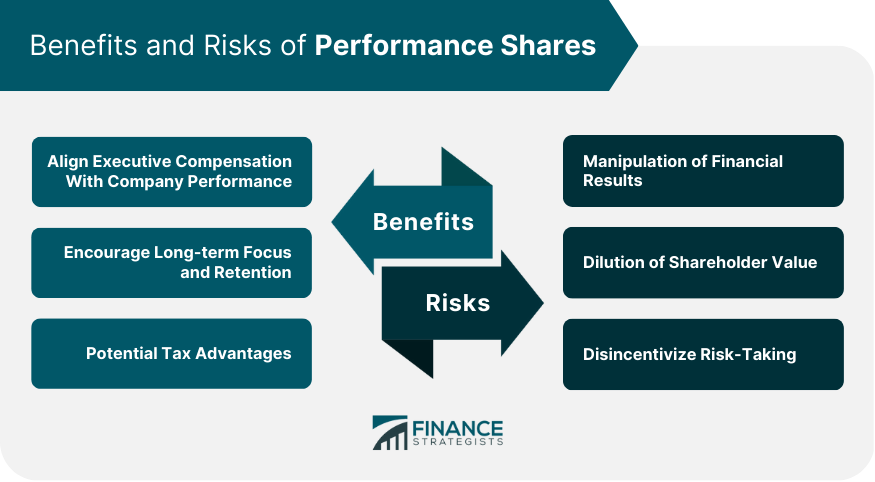

Benefits of Performance Shares

Aligning Executive Compensation with Company Performance

Encouraging Long-term Focus and Retention

Potential Tax Advantages

Risks of Performance Shares

Manipulation of Financial Results

Dilution of Shareholder Value

Disincentivizing Risk-taking

Regulatory Environment and Corporate Governance of Performance Shares

Securities and Exchange Commission (SEC) Regulations

Shareholder Approval and Advisory Votes

Executive Compensation Disclosure Requirements

Best Practices for Corporate Governance

Final Thoughts

Performance Shares FAQs

Performance shares are a type of equity-based compensation granted to employees based on achieving specific performance targets. They are important because they help align employees' interests with those of shareholders, incentivize long-term value creation, and promote employee engagement and retention.

Unlike stock options or restricted stock units, performance shares are contingent on achieving pre-determined performance metrics, such as financial, operational, or ESG goals. This makes them more directly tied to company performance and helps ensure that employees are rewarded for contributing to the company's success.

Common performance metrics used in performance share plans include financial metrics (e.g., earnings per share, return on equity, and return on assets), operational metrics (e.g., customer satisfaction, market share, and employee retention), and ESG metrics (e.g., carbon emissions reduction, diversity and inclusion, and corporate governance).

The tax implications of performance shares vary depending on the jurisdiction and plan design. Generally, employees may be subject to income tax upon vesting and/or sale of the shares, while companies may be eligible for a tax deduction for the expense recognized. It is important for both parties to understand the tax implications and plan accordingly.

To ensure the effectiveness of performance share plans, companies should involve independent board members in plan design and oversight, regularly review and adjust plan metrics, and maintain transparency through effective communication with shareholders and other stakeholders. Adhering to best practices for corporate governance helps promote long-term value creation and mitigates potential risks associated with performance share plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.