Change-in-control agreements, also known as golden parachutes, are contractual provisions designed to protect key employees, executives, and board members in the event of a significant change in the ownership or control of a company. These agreements outline the rights, benefits, and compensation that the affected parties will receive if specific triggering events occur. The primary purpose of change-in-control agreements is to retain and incentivize key employees and executives during periods of uncertainty, such as mergers, acquisitions, or other significant corporate events. These agreements provide a level of financial security and stability for affected parties, which helps maintain focus and productivity during transitions. Common scenarios that trigger change-in-control agreements are pivotal events that can significantly impact a company's direction, control, and overall stability. These events are often accompanied by uncertainty, both for the organization and its key employees. Here are some common scenarios that typically activate change-in-control agreements: Mergers or acquisitions Sale of a significant portion of a company's assets Change in the composition of the board of directors Change in majority shareholders A change in control refers to a significant shift in the ownership, control, or management of a company. This shift can be triggered by various events, which can impact the organization's direction and decision-making processes. Typically, a change in control is defined by one or more of the following events: Merger or Acquisition: The company is involved in a merger or acquisition, resulting in a change of control or ownership. In such cases, the existing company may be integrated into the acquiring organization, leading to alterations in its structure, management, and direction. Sale of a Significant Portion of Assets: The company sells a substantial part of its assets, which impacts its overall control. This can include the sale of key business units or intellectual property, which may result in a change in the company's focus or capabilities. Change in the Composition of the Board of Directors: A significant change in the composition of the company's board of directors occurs, altering the balance of power. Majority Shareholder Change: This can occur when a new investor acquires a majority stake in the company or when the existing majority shareholder sells their shares, resulting in a transfer of control and influence over the company's direction and management. Change-in-control agreements play a crucial role in providing stability and ensuring the smooth transition of a company during significant events, such as mergers, acquisitions, or other changes in control. These agreements typically affect the following parties: Executives and Key Employees: Senior management and essential employees who are critical to the company's success and continuity. Shareholders: Investors and stakeholders who may be affected by changes in control or ownership. Board of Directors: The governing body responsible for overseeing the company's management and strategic direction. Change-in-control agreements are designed to activate under specific circumstances, ensuring that key employees and executives receive the agreed-upon benefits when the company undergoes significant changes. There are three types of triggering events commonly used in these agreements: Single Trigger: A change in control alone is enough to activate the agreement. Double Trigger: The agreement is activated only if both a change in control occurs and the employee is terminated or experiences a significant change in their role or responsibilities. Hybrid Trigger: A combination of single and double triggers, depending on the specific circumstances. Change-in-control agreements are designed to offer financial security and protection to key employees and executives during significant corporate events. These agreements typically include the following protection provisions to ensure that the affected parties receive the necessary support: Severance Payments: Lump-sum payments or salary continuation for a specified period following the triggering event. Accelerated Vesting of Equity Awards: The acceleration of equity awards, such as stock options or restricted stock, ensuring they become immediately exercisable or fully vested. Continuation of Benefits: The continuation of health, retirement, or other benefits for a specified period. Tax Gross-up Provisions: Payments to cover any additional taxes that may be incurred by the employee as a result of the change-in-control benefits. Change-in-control agreements encourage key employees to remain with the company during uncertain times, helping to ensure business continuity and maintain shareholder value. These agreements can act as a deterrent to hostile takeovers by making it more expensive for the acquiring company to replace the existing management team. Change-in-control agreements can help facilitate smoother transitions during mergers, acquisitions, or other significant corporate events by providing key employees with a sense of financial security and stability By providing financial protection to key employees and executives, change-in-control agreements help minimize conflicts of interest that might arise during negotiations and decision-making processes related to potential changes in control. Critics argue that change-in-control agreements can lead to excessive compensation for executives, particularly in cases where the agreements are triggered without any negative consequences for the company or its shareholders. Some argue that these agreements may encourage short-term thinking among executives who focus on potential payouts rather than the long-term interests of the company. Excessive payouts resulting from change-in-control agreements can negatively impact shareholder value by diverting resources away from other uses, such as reinvestment in the company or dividends. The term "golden parachute" is often used pejoratively to describe change-in-control agreements, implying that executives are being rewarded excessively for their role in the change of control, regardless of the impact on the company or shareholders. Section 280G of the Internal Revenue Code imposes a 20% excise tax on certain change-in-control payments that are deemed to be excessive. Companies must carefully structure their agreements to avoid triggering this tax. Publicly traded companies must disclose the terms of change-in-control agreements in their proxy statements and other SEC filings, ensuring transparency for shareholders. In some cases, shareholder approval may be required for change-in-control agreements, particularly if they involve significant payments or changes to executive compensation. It is crucial to define the specific events that will trigger the change-in-control agreement clearly, ensuring that both the company and affected parties understand the circumstances under which the agreement will be activated. Change-in-control agreements should be designed to align with the company's long-term goals and values, supporting the overall success and continuity of the business. Protections offered in change-in-control agreements should be reasonable and balanced, considering the interests of all parties involved, including the company, affected employees, and shareholders. Companies should regularly review and update their change-in-control agreements to ensure they remain relevant, compliant with legal and regulatory requirements, and in line with the company's strategic goals and objectives. Change-in-control agreements play an essential role in modern business, providing key employees and executives with a sense of financial security and stability during times of uncertainty. By carefully crafting these agreements to balance the interests of all parties involved, companies can help ensure smooth transitions during significant corporate events and protect shareholder value. Adapting change-in-control agreements to the evolving corporate landscape is crucial for businesses looking to remain competitive and successful in today's fast-paced and dynamic environment.What Are Change-In-Control Agreements?

Purpose and Significance of Change-In-Control Agreements

Common Scenarios Triggering Change-In-Control Agreements

Key Components of Change-In-Control Agreements

Definition of Change in Control

Affected Parties

Triggering Events

Protection Provisions

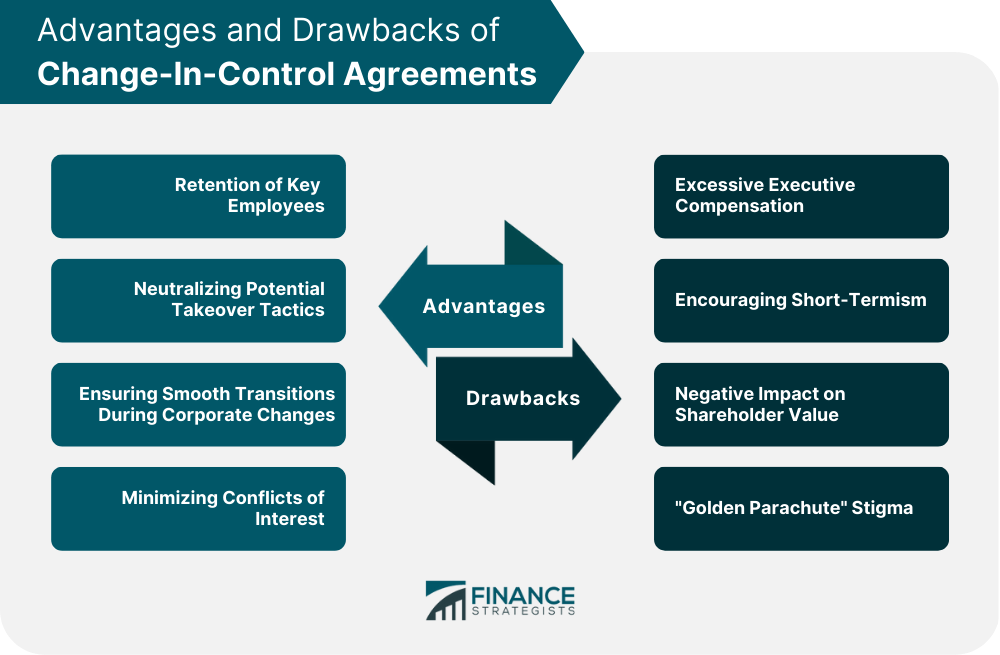

Advantages of Change-In-Control Agreements

Retention of Key Employees

Neutralizing Potential Takeover Tactics

Ensuring Smooth Transitions During Corporate Changes

Minimizing Conflicts of Interest

Criticisms and Potential Drawbacks of Change-In-Control Agreements

Excessive Executive Compensation

Encouraging Short-Termism

Negative Impact on Shareholder Value

"Golden Parachute" Stigma

Legal and Regulatory Considerations

Internal Revenue Code Section 280G

Securities and Exchange Commission (SEC) Disclosure Requirements

Shareholder Approval Requirements

Best Practices for Drafting Change-In-Control Agreements

Clearly Defining Triggering Events

Aligning Agreements With Company Goals and Values

Setting Reasonable Protection Provisions

Regularly Reviewing and Updating Agreements

Conclusion

Change-In-Control Agreements FAQs

Change-in-control agreements are legal contracts between a company and its key employees that outline the compensation and benefits they will receive if there is a change in ownership or control of the company.

Companies use change-in-control agreements to retain key employees and ensure business continuity in the event of a merger, acquisition, or other change in ownership or control. These agreements provide incentives for employees to remain with the company during periods of uncertainty.

Common provisions in change-in-control agreements include severance payments, accelerated vesting of stock options and other equity-based compensation, and the continuation of benefits such as health insurance and retirement plans.

Senior executives, key managers, and other key employees who have a significant impact on the company's success are typically eligible for change-in-control agreements. These agreements are not typically offered to rank-and-file employees.

Yes, change-in-control agreements are enforceable as long as they are properly drafted and comply with applicable laws and regulations. It is important to seek legal advice when drafting and negotiating these agreements to ensure they are legally sound and enforceable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.