Client privacy in finance refers to the protection and responsible management of personal and sensitive information of customers by financial institutions. This includes the collection, storage, use, sharing, and disposal of such information while maintaining the confidentiality and security of customers' data. Client privacy is essential in the financial industry as it promotes trust between customers and financial institutions. Protecting clients' information helps prevent identity theft, financial fraud, and other malicious activities. Additionally, compliance with privacy regulations helps financial institutions avoid legal and financial consequences, including fines and reputational damage. The General Data Protection Regulation (GDPR) is a comprehensive data protection regulation in the European Union, which sets strict standards for the processing of personal data. It provides individuals with increased control over their data and imposes heavy fines for non-compliance. The California Consumer Privacy Act (CCPA) is a state-level privacy regulation in California that grants residents the right to access, delete, and opt-out of the sale of their personal information. It requires businesses to be transparent about their data practices and provides consumers with increased control over their personal data. Financial Industry Regulatory Authority (FINRA) is an independent, self-regulatory organization that oversees brokerage firms and their registered representatives in the United States. It enforces rules and regulations related to client privacy, data protection, and cybersecurity in the financial industry. The Gramm-Leach-Bliley Act (GLBA) is a U.S. federal law that requires financial institutions to explain their information-sharing practices and to safeguard sensitive customer information. It mandates the implementation of a written information security program to protect the confidentiality, integrity, and security of customer information. The Bank Secrecy Act (BSA) is a U.S. anti-money laundering law that requires financial institutions to maintain records and report specific transactions to prevent financial crimes. While its primary focus is on preventing illegal activities, it also has provisions related to customer identification and the protection of customer data. Health Insurance Portability and Accountability Act (HIPAA) is a U.S. federal law that governs the privacy and security of protected health information. Although primarily focused on healthcare, it also applies to financial institutions that process or manage health-related financial transactions. Financial institutions collect vast amounts of personal data to provide services, assess risk, and comply with regulations. Clients may be concerned about the types and volume of information collected, how it is used, and whether it is shared with third parties. Customers entrust financial institutions with their sensitive information, and they expect these institutions to protect it from unauthorized access, disclosure, and misuse. Ensuring secure data storage and implementing robust security measures are essential for maintaining client privacy. Financial institutions often partner with third parties to provide various services or to comply with regulatory requirements. Clients may be concerned about the sharing of their information with these third parties and whether their privacy is adequately protected. Financial institutions may use client data for marketing purposes or to offer targeted products and services. Clients may be concerned about the extent to which their personal information is used for these activities and whether their preferences and choices are respected. Financial institutions should only collect and process the necessary data required for a specific purpose. Limiting data collection and processing to the minimum required can reduce privacy risks and help maintain client trust. Financial institutions should integrate privacy considerations into the design and operation of their products, services, and business processes. By adopting privacy by design and default, organizations can better ensure that privacy protections are built-in from the outset and that client data is protected by default. Institutions should be transparent about their data collection, use, and sharing practices. They should obtain informed consent from clients before processing their personal information, provide clear and easy-to-understand privacy notices, and allow clients to exercise their privacy rights. Financial institutions must have a robust data breach response plan in place, which includes identifying, containing, and mitigating the impact of a breach. They should notify affected clients and relevant authorities as required by applicable regulations. Encryption and tokenization are techniques used to protect sensitive data by rendering it unreadable or replacing it with substitute values. Financial institutions can implement these technologies to secure client data during storage and transmission. Secure multi-party computation is a cryptographic technique that allows multiple parties to perform computations on encrypted data without revealing the underlying values. This can enable financial institutions to collaborate on data analysis while preserving client privacy. Differential privacy is a technique used to protect individual privacy in statistical databases by adding controlled noise to the data. It enables financial institutions to perform data analytics while ensuring that individual clients' information remains private. Zero-knowledge proofs are cryptographic protocols that allow one party to prove a statement without revealing any additional information. Financial institutions can use these techniques to verify clients' data without exposing sensitive information. Financial institutions should provide regular training and awareness programs for employees to ensure they understand the importance of client privacy and the organization's policies and practices. This can help reduce the risk of privacy breaches due to human error or negligence. Organizations should foster a culture that values and prioritizes client privacy. This can be achieved through executive support, regular communication, and employee engagement in privacy initiatives. Privacy impact assessments (PIAs) can help financial institutions identify and mitigate privacy risks in their products, services, and processes. Conducting regular PIAs can ensure that privacy risks are addressed and minimized throughout the organization. Financial institutions should conduct internal privacy audits to assess their compliance with privacy regulations, policies, and best practices. Regular audits can help identify gaps and areas for improvement in their privacy practices. Organizations can obtain third-party assessments and certifications to demonstrate their commitment to client privacy and compliance with industry standards. These assessments can provide clients with additional confidence in the organization's privacy practices. Financial institutions should regularly review and update their privacy policies and practices to reflect changes in regulations, technology, and business processes. This ensures that the organization remains compliant and up-to-date with evolving privacy expectations. Maintaining client privacy in the financial industry is crucial for building trust between clients and financial institutions, preventing fraud, and ensuring compliance with legal and regulatory requirements. A strong commitment to client privacy helps safeguard the reputation and success of financial institutions. They must continue to invest in privacy-enhancing technologies, employee training, and regular assessments to stay ahead of evolving privacy challenges. By proactively addressing these concerns, organizations can ensure they maintain a high level of client privacy protection and meet the ever-changing expectations of their clients and regulators. Consult a financial advisor for more information on client privacy and its importance in finance.What Is Client Privacy?

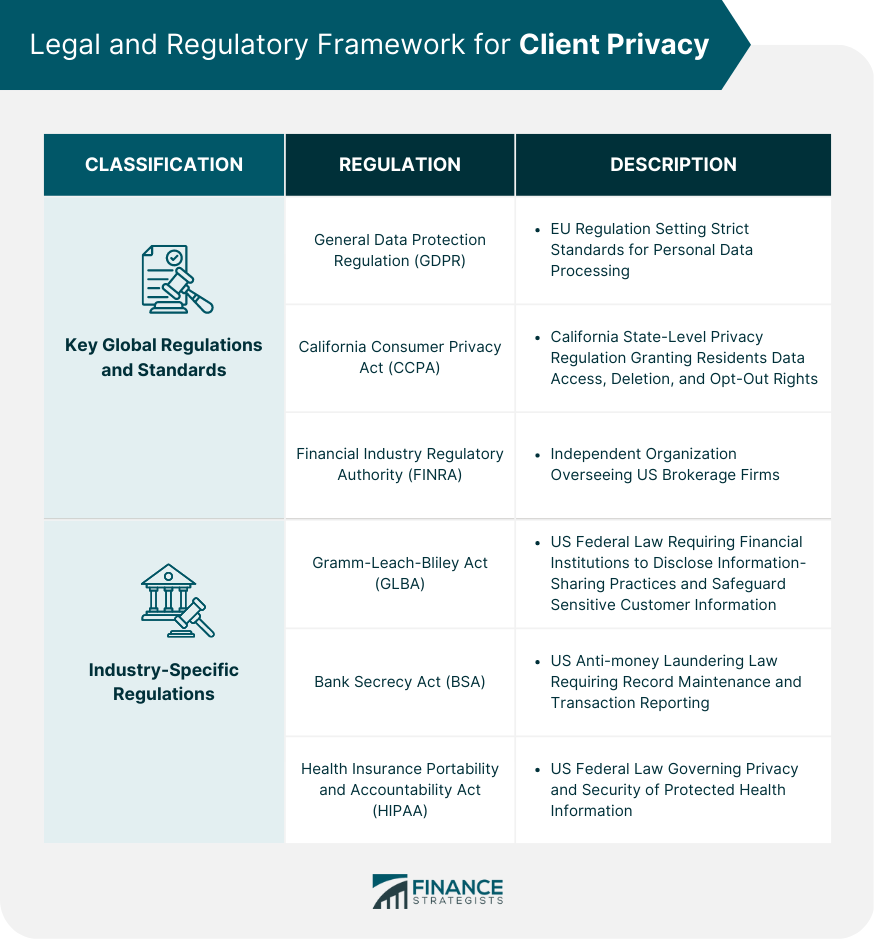

Legal and Regulatory Framework

Key Global Regulations and Standards

General Data Protection Regulation

California Consumer Privacy Act

Financial Industry Regulatory Authority

Industry-Specific Regulations

Gramm-Leach-Bliley Act

Bank Secrecy Act

Health Insurance Portability and Accountability Act

Client Privacy Concerns in Financial Services

Collection and Use of Personal Data

Data Storage and Security

Third-Party Sharing and Outsourcing

Marketing and Targeted Advertising

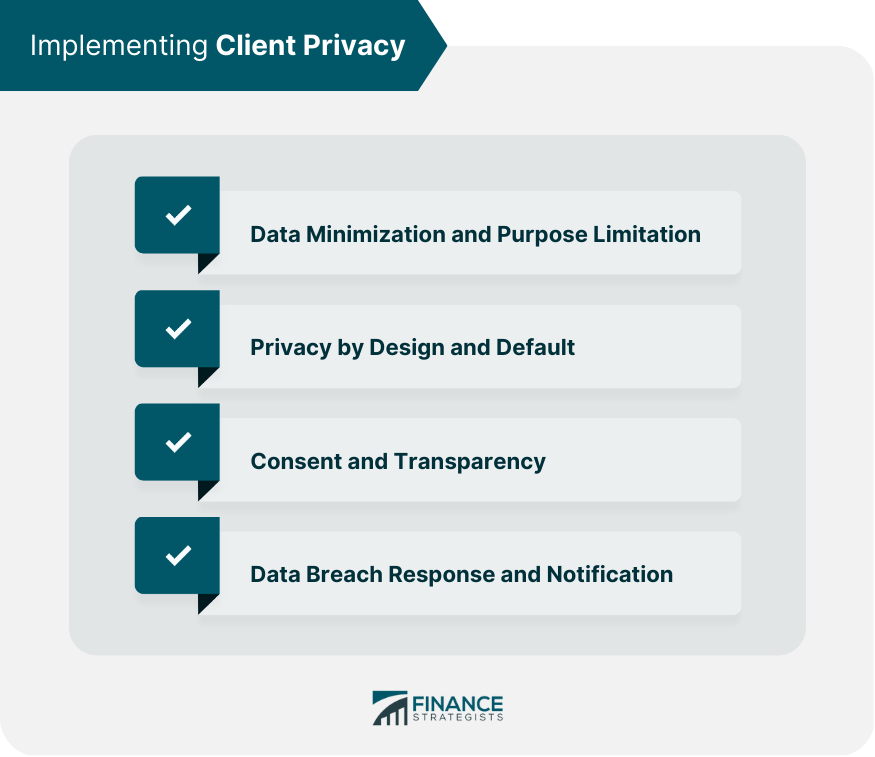

Implementing Client Privacy

Data Minimization and Purpose Limitation

Privacy by Design and Default

Consent and Transparency

Data Breach Response and Notification

Privacy-Enhancing Technologies (PETs)

Encryption and Tokenization

Secure Multi-Party Computation

Differential Privacy

Zero-Knowledge Proofs

Client Privacy Training and Awareness

Employee Training and Awareness Programs

Establishing a Privacy-Conscious Culture

Privacy Impact Assessments

Auditing and Monitoring Client Privacy

Internal Privacy Audits

External Assessments and Certifications

Regular Updates to Privacy Policies and Practices

Conclusion

Client Privacy FAQs

Client privacy is important in finance because it protects the sensitive financial and personal information of clients from being accessed or misused by unauthorized parties. This includes information such as social security numbers, account numbers, and transaction histories.

Financial institutions often protect client privacy by using encryption to secure data during transmission and storage, limiting access to sensitive information to only authorized personnel, implementing strict password policies, and regularly monitoring and auditing their systems for any breaches or unauthorized access.

Yes, clients have the right to opt-out of sharing their information with third parties in finance. Financial institutions are required to provide clients with clear and conspicuous notice of their privacy policies and provide a way for clients to opt-out of sharing their information.

Clients can protect their own privacy in finance by carefully reviewing their account statements and transactions for any unauthorized activity, regularly monitoring their credit reports, being cautious about sharing personal information online, and using strong and unique passwords for their financial accounts.

The consequences of violating client privacy in finance can include legal action, fines, loss of reputation and trust, and even criminal charges. Financial institutions have a legal obligation to protect the privacy of their clients, and failure to do so can have serious consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.