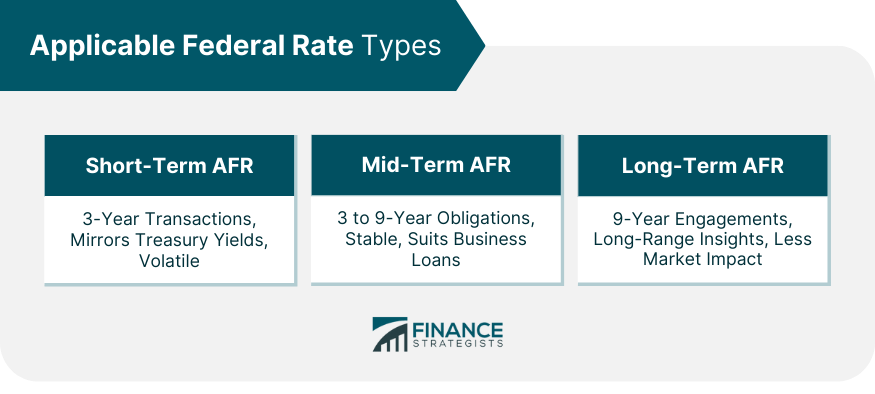

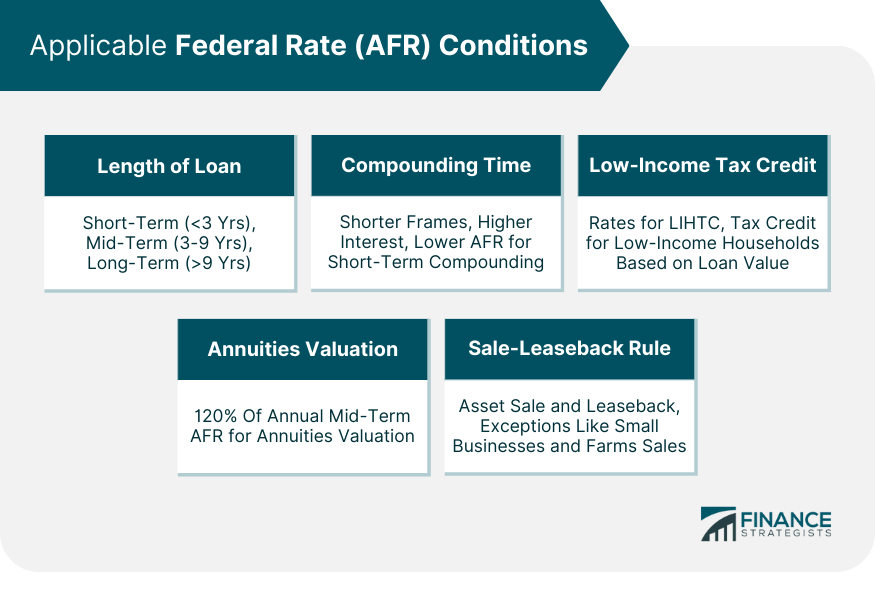

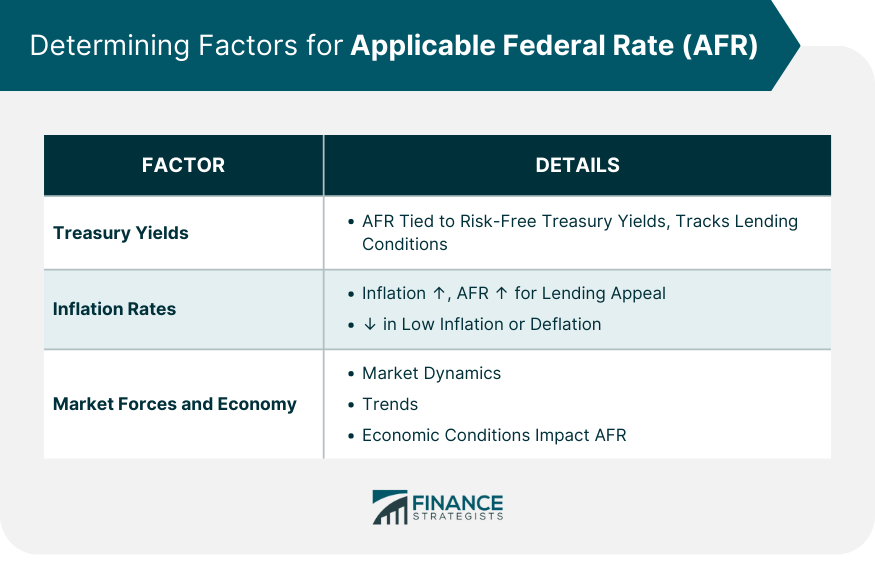

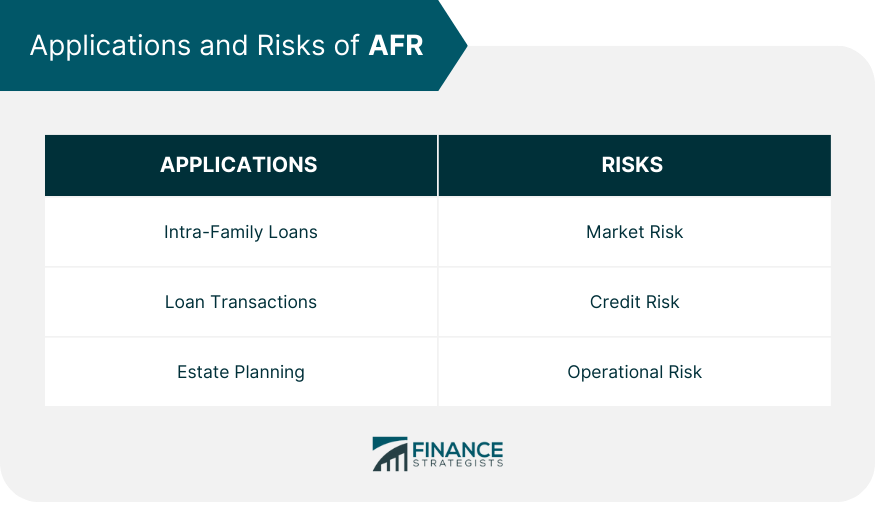

The Applicable Federal Rate, or AFR, is the minimum rate of interest that can be charged on private loans without incurring taxes. If a loan's interest falls below the Applicable Federal Rate, the loan can trigger a taxable event. The AFR is published monthly by the IRS based on aggregated data from the market yields of US marketable debts, such as US Treasury Bills. The Applicable Federal Rate is a term many encounter in the realm of tax law and financial planning. At its core, the AFR represents the minimum interest rate that the Internal Revenue Service (IRS) requires for certain transactions, ensuring they reflect a fair market rate. This ensures that they don't inadvertently become vehicles for unintended gifts or other financial manipulations. Set monthly by the IRS, the AFR plays a role in various financial and estate planning transactions. Specifically designed for transactions or financial instruments with a lifespan of three years or less, this rate is paramount when considering brief lending or borrowing scenarios. The Short-Term AFR mirrors the fluctuations of average market yields on U.S. Treasury obligations with durations under three years. For those engaging in quick-turnaround loans or considering short-term financial arrangements, this rate serves as an essential benchmark. Given its short window, the rate is naturally more volatile and is prone to shifts based on immediate economic conditions. Pegged to federal obligations that range from over three years to nine years, this rate captures a broader sense of economic expectations and is a bit more stable than its short-term counterpart. This stability is a reflection of its longer span, which naturally averages out the peaks and troughs seen in shorter financial instruments. The Mid-Term AFR is the gold standard for multi-year engagements, be it business loans, medium-term investments, or other financial commitments that fall within its duration. Reserved exclusively for engagements and obligations that span beyond nine years, this rate is pivotal for transactions that have a prolonged maturation period. Given its extended nature, the Long-Term AFR provides insight into long-range economic forecasts and is less susceptible to short-term market volatility. The IRS publishes a document each month that outlines the Federal Short Term Rate for various conditions: 1. Length of loan There are three Applicable Federal Rates, depending on the length of the loan. Short-term -- loans of three years or less Mid-term -- loan terms between three and nine years Long-term -- loans longer than nine years Other AFR conditions include: 2. The time frame which the loan compounds Shorter compounding time frames result in higher annual interest, so the AFR decreases for compounding interest on shorter time frames. 3. Rates for Low-Income Housing Tax Credit, or LIHTC The rates at which low-income households receive a tax credit on the value of their loans. 4. Rate for Valuation of Annuities 120% of the annually compounding mid-term Applicable Federal Rate. 5. The Sale-Leaseback Rule and Exceptions This is where an asset is sold and leases it back for use. Exceptions include the sale of small businesses and farms. The Applicable Federal Rate (AFR) often draws its cue from the treasury yields, specifically U.S. Treasury bills and bonds. Given that these treasuries are viewed as risk-free, they form a benchmark for many interest rates, including the AFR. When treasury yields rise, the AFR often follows suit, and conversely, a dip in treasury yields typically signals a decrease in the AFR. This close correlation ensures that the AFR reflects the broader state of the government's lending market, making it a credible standard for various financial transactions. Essentially, as inflation rises, the purchasing power of money diminishes. This dynamic presses the need for higher interest rates to maintain lending appeal. Thus, an uptick in inflation can lead to a corresponding increase in AFR, ensuring that lenders receive real, positive returns. Conversely, in periods of low inflation or deflation, the AFR may trend downward, reflecting the prevailing economic temperature and the reduced cost of borrowing. The broader tapestry of market forces and prevailing economic conditions significantly influence the AFR. Factors such as global economic trends, monetary policies, and geopolitical events can sway market sentiments, which in turn impact the AFR. For instance, during times of economic prosperity and growth, increased lending and borrowing can push the AFR up. In contrast, during economic downturns, reduced lending appetite can lead to a subdued AFR. In the realm of personal finance, the AFR is a crucial component in intra-family loans. When family members lend to one another, it's essential that the interest rate used is at least the AFR to avoid potential tax consequences. By adhering to the AFR, families can ensure that their loans are deemed legitimate by the IRS and avoid any imputed interest issues. On a broader scale, the AFR plays a pivotal role in various loan transactions. Lenders, whether they're institutions or individuals, often reference the AFR to determine competitive interest rates. By aligning with or surpassing the AFR, lenders ensure they're compliant with IRS guidelines and safeguard themselves against any potential tax repercussions. In the intricate world of estate planning, the AFR provides clarity. Whether it's in the creation of trusts, annuities, or other financial vehicles designed to transfer wealth, the AFR serves as a benchmark to determine fair market interest rates. This helps in establishing legitimate estate transactions, shielding individuals from undue tax implications. The AFR, while pivotal, is susceptible to the inherent volatility of market dynamics. External factors such as geopolitical events, global economic shifts, or sudden market downturns can introduce unpredictability in the AFR, potentially affecting those who rely on it for various transactions. Though the AFR is benchmarked against risk-free treasury yields, the broader lending market doesn't operate without risk. If there's a widespread perception of increased credit risk in the market, it could lead to a deviation between the AFR and actual market interest rates. Such scenarios can introduce challenges for lenders and borrowers alike. The calculation and publication of AFR involve a set of procedures and operations. Any discrepancies, delays, or errors in these processes can result in mismatches or misinterpretations of the rate. This operational risk underscores the importance of accurate data handling and timely dissemination to ensure that stakeholders are working with the most relevant and accurate AFR figures. If the IRS Applicable Federal Rate for a short-term loan is 2.5% and $20,000 is lent for one year, then $500 in interest should be incurred when the loan is repaid. If less than $500 in interest is charged, the IRS may add imputed interest to the income to reflect the AFR rather than the interest paid by the borrower. Also, if $20,000 is above the annual gift tax exclusion, income taxes may be incurred on the amount in excess of the annual gift tax exclusion. The Applicable Federal Rate (AFR) refers to the minimum interest rate set by the IRS for various financial transactions to ensure fairness and compliance. As the IRS establishes AFR rates based on market yields of US Treasury Bills, AFR holds a direct correlation with treasury yields and inflation rates. Moreover, the AFR acts as a guiding standard for intra-family loans, loan transactions, and estate planning, preventing unintended tax implications. While its role is significant, AFR is not without risks. Market, credit, and operational risks can impact its stability and accuracy. By understanding AFR's nuances, individuals and institutions can make informed financial decisions while navigating the complex landscape of interest rates and tax implications.Applicable Federal Rate (AFR) Definition

Types of Applicable Federal Rates

Short-Term AFR

Mid-Term AFR

Long-Term AFR

AFR Conditions

Determining Factors for AFR

Treasury Yields

Inflation Rates

Market Forces and Economic Conditions

Applications of Applicable Federal Rate (AFR)

Intra-Family Loans

Loan Transactions

Estate Planning

Risks of Applicable Federal Rate (AFR)

Market Risk

Credit Risk

Operational Risk

Example of Applicable Federal Rates

Conclusion

Applicable Federal Rate (AFR) FAQs

AFR stands for applicable federal rate.

The applicable federal rate is the minimum rate of interest that can be charged on private loans without incurring taxes

Short term - loans of 3 years or less; Mid-term - loans between 3 and 9 years; Long-term - Loans longer than 9 years.

The AFR is published monthly by the IRS based on aggregated data from the market yields of US marketable debts, such as US Treasury Bills.

To be in compliance with the IRS, you need to charge at least the applicable AFR rate, depending on the length of time the loan runs for.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.