Estate planning is an important part of financial planning which involves making arrangements to transfer a person's assets when they die. Living trusts and living wills are two legal documents commonly utilized in estate planning. However, they have distinct functions. A living trust helps avoid probate, provides for the management of assets if the creator becomes incapacitated, and ensures a smoother transfer of assets to beneficiaries. A living will, on the other hand, allows an individual to specify the medical treatment they want to receive or not receive if they become incapacitated.

A living trust is a legal document that allows an individual to transfer ownership of assets to a trust while they are still alive. This trust can be revoked, amended, or modified at anytime during the individual's life. The creator of the trust, also known as the grantor, appoints a trustee who manages the trust assets according to the grantor's instructions. A living trust can be either revocable or irrevocable. A revocable trust allows the grantor to retain control of the assets and can be revoked or amended, whereas an irrevocable trust cannot be canceled or amended. Depending on the type of the trust, it can be funded or assigned with various assets, such as real estate, commercial properties, homes, and land, personal property such as antiques, jewelry, artwork, and financial accounts. Financial accounts and items that can be included are: Safe Deposit Boxes Stock and Bond Certificates Brokerage Accounts Money Market Accounts Certificates of Deposit Savings and Checking Accounts Cash Money Owed to the Individual However, transferring a 401(k) or IRA to a living trust is not recommended, as doing so may be seen as an early withdrawal by the IRS, which could result in tax penalties. A living trust is a tool for estate planning that can offer advantages and disadvantages. Below are the pros and cons of a living trust. Below are the steps involved in creating a living trust: One should determine the type of living trust one needs by considering the two main types: revocable and irrevocable. A revocable living trust can be modified or terminated by the individual who created it at any time during their lifetime. An irrevocable living trust, on the other hand, cannot be changed once it has been established. It's important to weigh the benefits and drawbacks of each type of trust before making a decision. After deciding on the type of trust, assets must be transferred into the trust to fund it. This includes real estate, bank accounts, stocks, and other types of property. It is essential to work with an estate planning lawyer to ensure a proper transfer of ownership of these assets to the trust. The creator of the living trust must designate beneficiaries who will receive the assets in the trust after they pass away. They can also specify how the assets should be distributed among the beneficiaries, such as splitting the assets evenly or leaving a larger portion to a child with special needs. A trustee is responsible for managing the assets in the trust and distributing them according to the creator's wishes after they pass away. The creator can choose to be their own trustee or name someone else to take on this role and pay the appropriate fees for their services. It is important to select a responsible and trustworthy trustee who is willing to take on the responsibilities of managing the trust. Once all decisions have been made, the creator of the living trust must complete the living trust document with the assistance of an estate lawyer. The document will outline all the trust details, including the type of trust, the assets, the beneficiaries and distribution percentages, and the trustee. It is crucial to store the original copy of the living trust document in a safe location, such as a safe deposit box at a bank. The trustee should know where the original document is located and how to access it when necessary. Periodic reviews should be conducted to make any necessary updates or changes to the document. A living will, which is often called an advance directive, is a legal paper that outlines a person's preferences regarding the medical care they wish to receive or refuse in case they become incapable of making decisions independently. When an individual unconscious due to a terminal illness or life-threatening injury needs life-sustaining treatment, doctors and hospitals will refer to their living will to determine if they want the treatment. However, if there is no living will available, the responsibility of making decisions about medical care falls on the spouse, family members, or other third parties. Unfortunately, these individuals may not be aware of the patient's wishes or may choose not to follow any unwritten or verbal directives that the patient had communicated previously. Living wills can offer both benefits and drawbacks. Here are some of the potential advantages and disadvantages to consider: Setting up a living will is a relatively simple process that can be done with the help of an attorney or online legal service. Here are the basic steps involved: When creating a living will, it is important to consider how personal or religious beliefs may influence medical decisions. This may include considering whether certain medical procedures, such as blood transfusions or organ donation, conflict with an individual's beliefs. For example, some religious beliefs prohibit blood transfusions, so individuals may choose to exclude this option from their living will. By considering personal and religious beliefs, individuals can ensure that their living will reflect their values and wishes. To ensure that all medical preferences are covered, it can be helpful to organize the living will into categories of care. This can include life-saving or life-preserving care, palliative care, and end-of-life care. By organizing the living will in this way, an individual can ensure that they have covered all necessary aspects of medical care and provided clear instructions for each category. It is important to consider whether an individual wants to receive care if they are in a vegetative or unconscious state. This can include decisions about life-sustaining treatments, such as ventilators, as well as the location of care, such as at home or in a hospital. These decisions can be difficult, and it is important to consider the individual's values and preferences when making these choices. Nutrition options should also be addressed in the living will. This may include whether an individual wants to receive nutrition intravenously or by mouth or whether they want nutrition withheld altogether. These decisions may be influenced by an individual's overall health, as well as their personal beliefs about medical interventions. Pain management is another important consideration in a living will. This may include outlining preferred types and levels of pain management, such as medication or alternative therapies. This category can be further divided into life-sustaining pain management, which may be used to alleviate pain while extending life, and pain management in lieu of life-sustaining care, which may focus on providing comfort during the end-of-life phase. Involving trusted family members or friends in the decision-making process can provide valuable support and insight. They can help ensure that the living will accurately reflect the individual's wishes and may offer perspectives that the individual may not have considered. This can help reduce potential conflicts among family members or caregivers in the future. It is also recommended to seek guidance from a professional when creating a living will. An estate planner or attorney can provide legal advice and help ensure that the living will comply with relevant laws and regulations. They can also provide guidance on the various options available for medical care and ensure that the living will is properly documented and accessible when needed. The differences between wills and living trusts are significant in terms of what they include and how they are managed. Wills solely focus on asset distribution after death and do not hold the assets themselves. Conversely, living trusts hold assets until a predetermined time and contain instructions for their management and distribution. Wills must go through probate court, which means that the court has the final say in asset distribution, regardless of any instructions in the will. In contrast, a living trust usually allows assets to be distributed according to the trust's instructions, bypassing probate court. However, a will does allow for the appointment of a guardian for minor children or dependents, the designation of power of attorney, and the expression of end-of-life wishes, which a living trust does not provide. It can be challenging to distinguish between wills and trusts since there is so much overlap. Understanding the differences can aid in deciding which option is best, or you might choose to include both in your estate planning. It is critical to examine state laws to ensure compliance. Deciding whether a living trust or living will is best for you depends on your individual circumstances and estate planning goals. A living will may be the better choice if: The individual has minor children or dependents. The individual has specific wishes for end-of-life care. The individual would like to name a power of attorney. On the other hand, a living trust may be a better choice if: The individual wants to avoid the probate process. The individual wants their beneficiaries to have access to assets while they are still alive. The individual wants to avoid estate tax with an irrevocable trust. If both situations apply, having both a will and a living trust may be prudent, as each serves a unique purpose. If someone is unsure, it is recommended to consult with an estate planning lawyer about their specific circumstances. They can provide guidance on which option is a better fit for their life. A living trust and a living will are both important estate planning documents, but they serve different purposes. A living trust is designed to protect and manage assets during a person's lifetime and after their death. A living will is designed to ensure that a person's healthcare wishes are respected if they become incapacitated. When deciding whether to create a living trust, a living will, or both, it is important to consider your individual circumstances and estate planning goals. Working with a knowledgeable lawyer who specializes in estate planning can assist you in developing a thorough estate plan that safeguards your wealth, maintains your heritage, and brings assurance to both you and your family members.Living Trust vs Living Will: Overview

What Is a Living Trust?

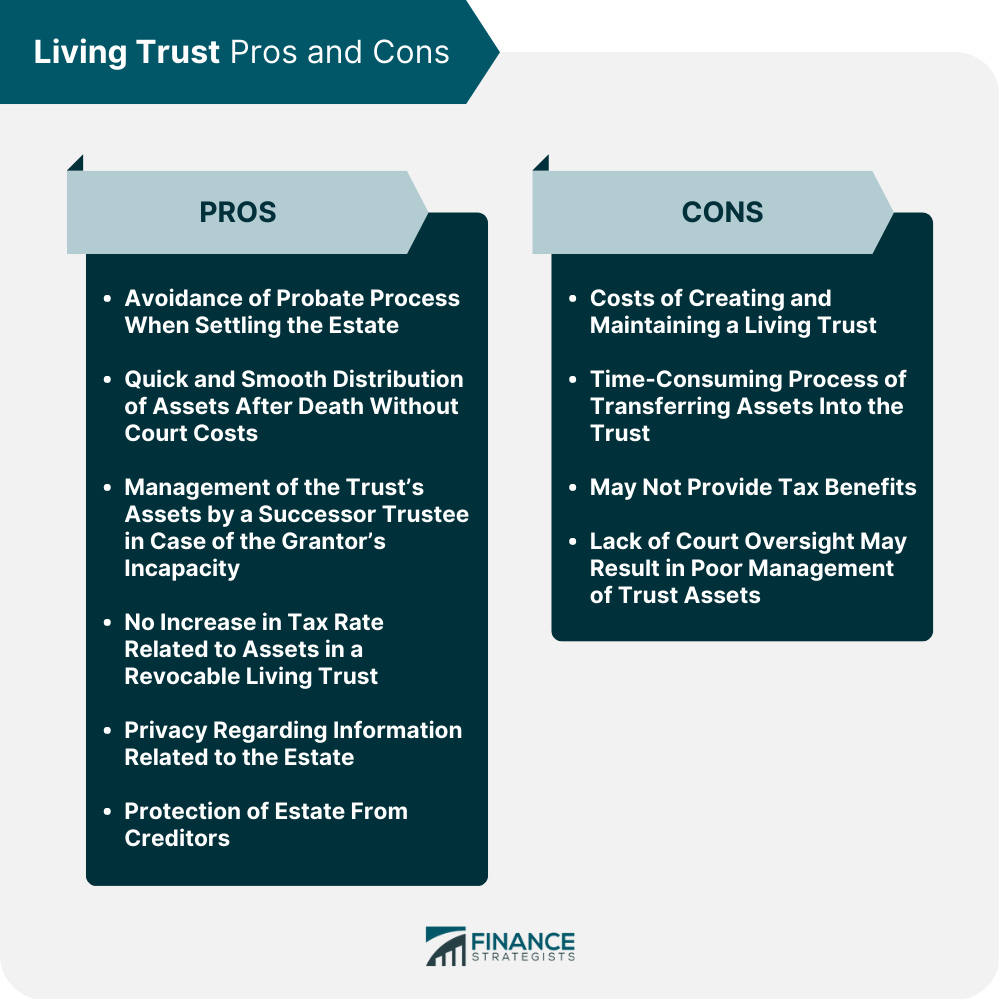

Pros and Cons of a Living Trust

How to Set up a Living Trust

Determine the Type of Living Trust You Need

Fund the Trust

Designate Your Beneficiaries and Distribution Percentages

Name a Trustee

Complete the Living Trust Document

Store the Original Living Trust Document Safely

What Is a Living Will?

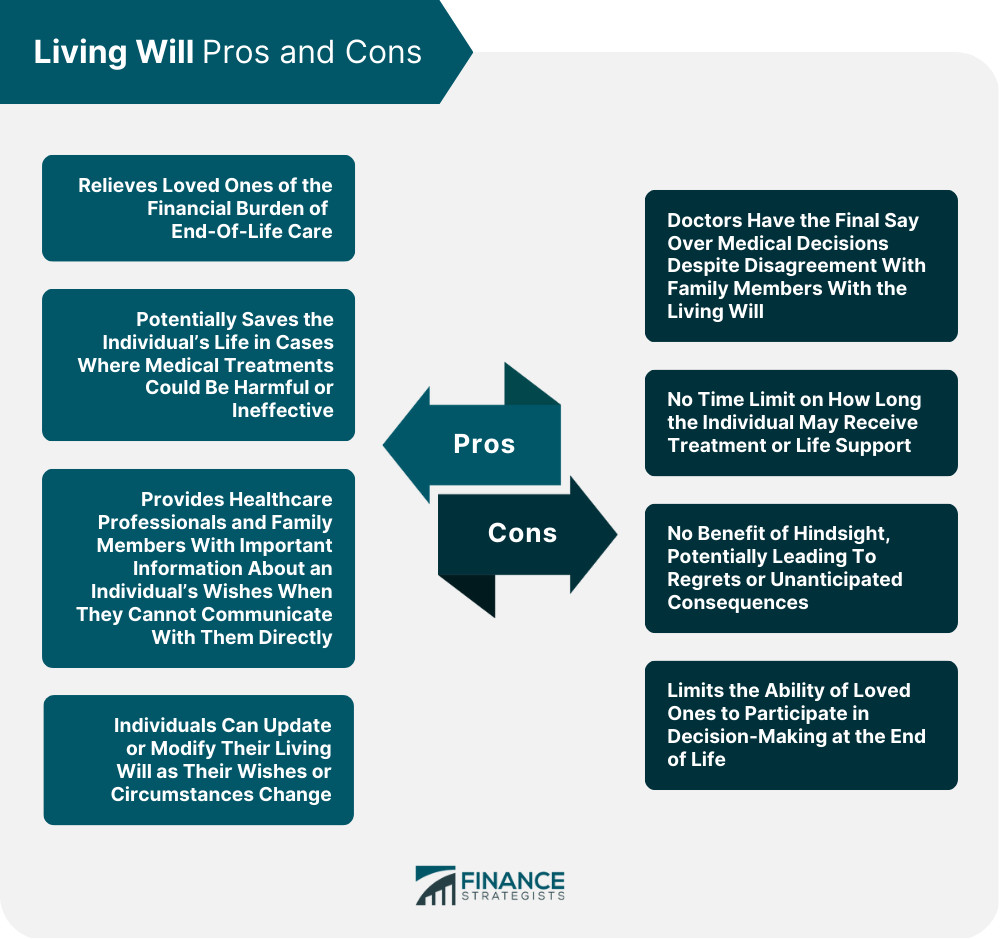

Pros and Cons of a Living Will

How to Set up a Living Will

Consider Personal and Religious Beliefs

Organize the Living Will into Categories of Care

Address Care in Vegetative or Unconscious States

Determine Nutrition Options

Outline Preferred Pain Management

Involve Trusted Family Members or Friends

Seek Guidance from a Professional

Differences Between a Living Trust & Living Will

Living Trust vs Living Will: Which One Do You Need?

The Bottom Line

Living Trust vs Living Will FAQs

A living trust is a legal document that allows you to transfer ownership of your assets to a trust while you are still alive. The trust is managed by a trustee, and when you die, the assets are distributed to your beneficiaries according to the terms of the trust.

A living will is a legal document that outlines your healthcare wishes if you become unable to communicate them. It specifies the type of medical treatment you want or does not want, as well as end-of-life decisions.

Living trusts and living wills are different legal documents with different purposes. A living trust is designed to protect and manage assets during a person's lifetime and after their death. A living will is designed to ensure that a person's healthcare wishes are respected if they become incapacitated.

It is a good idea to review your living will and living trust documents periodically to ensure they still reflect your wishes and goals. Major life events, such as a marriage, divorce, birth of a child, or change in financial circumstances, may also prompt a review of your documents.

The decision between a living trust and a living will depend on your individual circumstances and estate planning goals. Consulting with an estate planning attorney can help you determine which option is best for you.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.