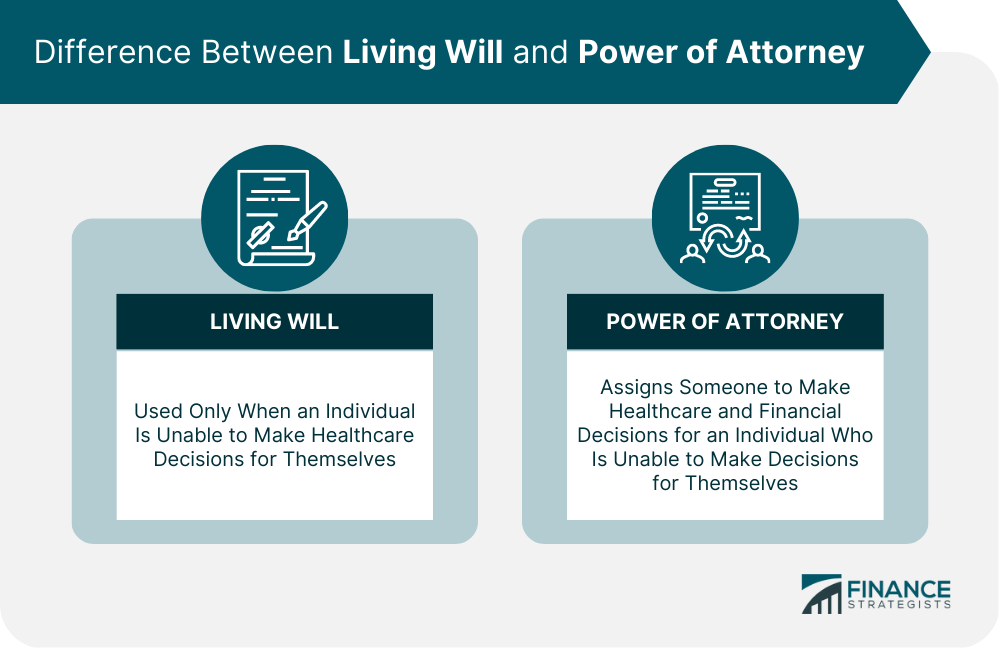

Legal documents such as living will and power of attorney can help individuals plan for their future healthcare and financial needs. In some cases, an individual may choose to create both a living will and a power of attorney to ensure their wishes are carried out. However, it is important to understand the key differences between the two documents. A living will is focused solely on an individual's healthcare preferences and is only used in the event they are unable to make decisions for themselves. On the other hand, a power of attorney can be used at any time that a person is unable to make choices for themselves, not simply in the event of a medical emergency.

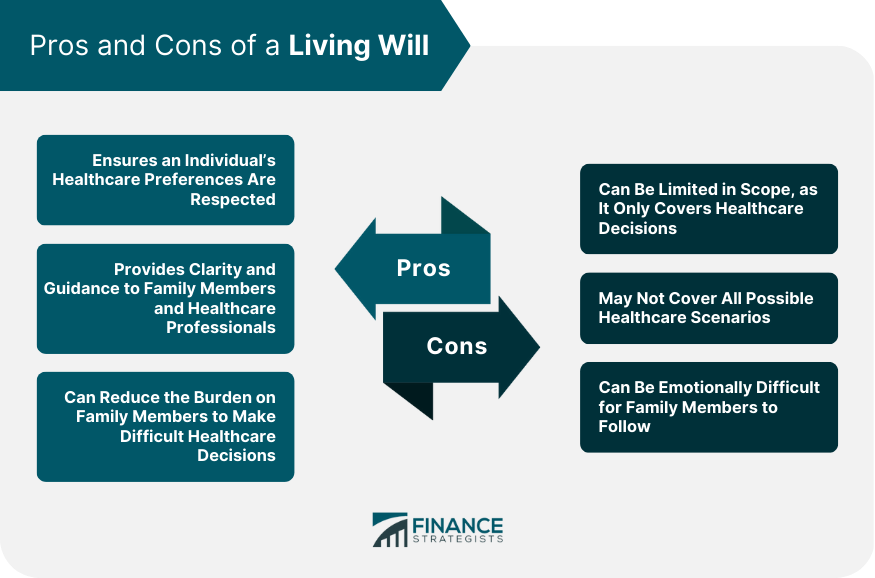

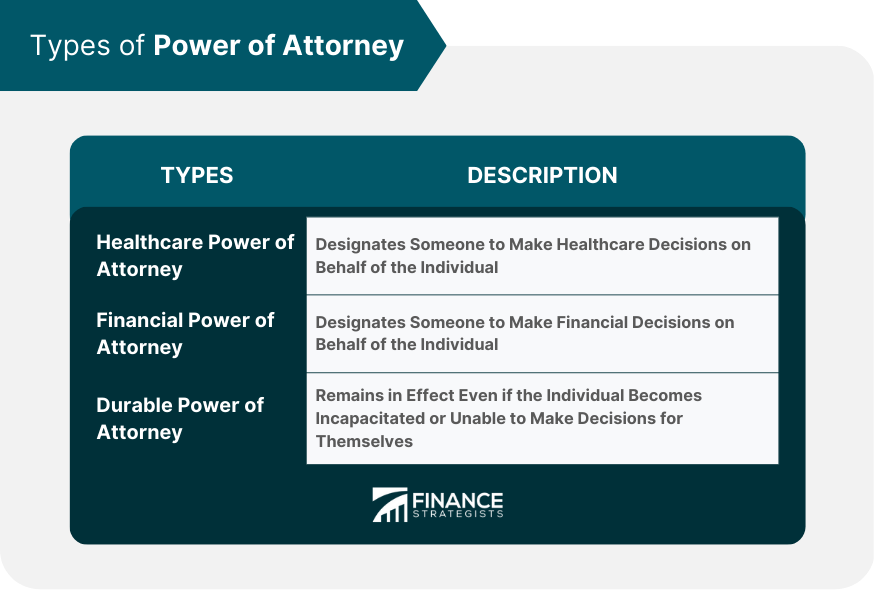

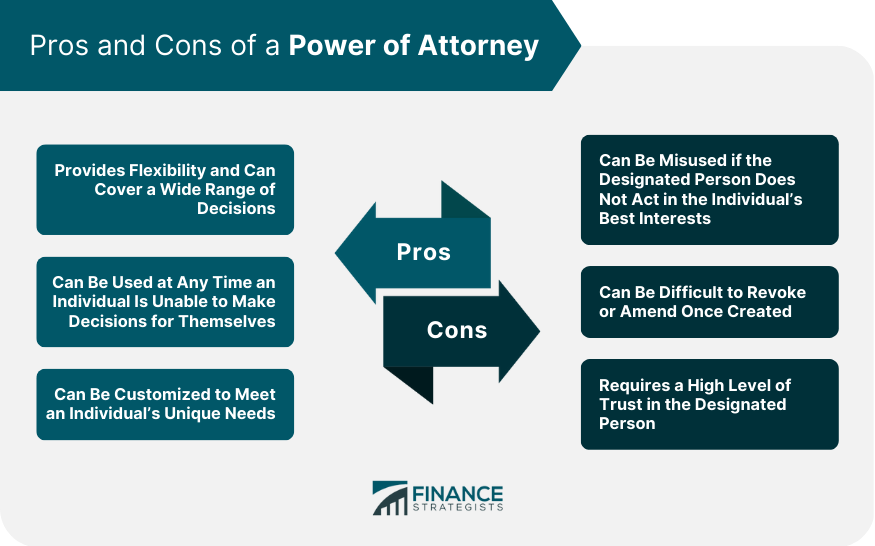

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. A client once faced a difficult health crisis without a Living Will, leaving their family in turmoil over medical decisions. Learning from this, we immediately set up both a Living Will and a Durable Power of Attorney for another client. This foresight ensured that when they faced an unexpected health event, their wishes were clear, and a trusted family member could manage their finances seamlessly. Don't wait until crisis strikes to take control of your future. Start planning today! Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Deciding between Living Will and Power of Attorney? Click here. Choosing between a living will and power of attorney can be a difficult decision, but it ultimately depends on an individual's unique needs and circumstances. A living will, often referred to as an advance directive, is a legal instrument that specifies a person's choices for medical care in the event that they are unable to make those decisions for themselves. This document is typically used when an individual is terminally ill, in a vegetative state, or unable to communicate. To create a living will, an individual must be of sound mind and able to understand the decisions they are making. The document must also be in writing and signed by the two witnesses and the individual. The witnesses must not be related to the individual or named as beneficiaries in the document. A living will can cover a wide range of healthcare decisions, including: Life Support. This can include the use of mechanical ventilation, feeding tubes, and other life-sustaining treatments. Resuscitation. A living will can outline an individual's preference for Cardiopulmonary Resuscitation (CPR) in the event their heart stops beating. Pain Management. An individual can specify their preferences for pain management, including the use of medication or alternative treatments. The table below shows the pros and cons to consider when creating a living will. A power of attorney is a legal document that designates someone to make financial and healthcare decisions on behalf of the individual. To create a power of attorney, an individual must be of sound mind and able to understand the decisions they are making. A power of attorney can cover a wide range of decisions, including: Healthcare Decisions. This can include decisions related to medical treatment, life support, and end-of-life care. Financial Decisions. This can cover decisions related to managing finances, paying bills, and making investments. Legal Decisions. This can include decisions related to legal matters, such as signing contracts and making legal agreements. When creating a power of attorney, you may refer to the table below for the pros and cons to take into account: Living wills and powers of attorney are important legal documents that can help individuals plan for their future healthcare and financial needs. It is important to understand the legal requirements for creating living wills and powers of attorney and to consult with an attorney or healthcare professional to ensure the legal documents meet an individual's unique needs.Living Will vs Power of Attorney

A living will outlines an individual's healthcare preferences, and a power of attorney designates someone to make financial and healthcare decisions on behalf of the individual.

Additionally, a power of attorney can cover both financial and healthcare decisions, while a living will only cover healthcare decisions.Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How to Choose Between Living Will and Power of Attorney

When making this decision, it is important to consider factors such as age, health status, financial situation, and personal preferences. For individuals who are primarily concerned with their healthcare preferences, a living will may be the best option.

However, for those who want to ensure their financial and legal matters are managed according to their wishes, a power of attorney may be more appropriate.

In some cases, it may be necessary to create both a living will and power of attorney to ensure all aspects of an individual's future planning are covered.

Consulting with an attorney or healthcare professional can also provide valuable guidance in making this decision and ensure that the legal documents meet an individual's unique needs.What Is a Living Will?

A living will can provide instructions to healthcare professionals about the types of medical treatments an individual wants or does not want to receive. This can include life support, resuscitation, and pain management.Legal Requirements for Creating a Living Will

Examples of Healthcare Decisions Covered by a Living Will

Pros and Cons of a Living Will

What Is a Power of Attorney?

This can include decisions related to medical treatment, financial transactions, and legal matters. There are several types of power of attorney as shown on the table below.

Legal Requirements for Creating a Power of Attorney

The document must also be in writing and signed by the individual and a notary public or witnesses. The requirements for witnesses may vary by state, so it is important to consult with an attorney when creating a power of attorney.Examples of Decisions Covered by a Power of Attorney

Pros and Cons of a Power of Attorney

The Bottom Line

A living will outlines an individual's healthcare preferences in the event they are unable to make decisions for themselves, while a power of attorney designates someone to make financial and healthcare decisions on their behalf.

Both legal documents have their own unique benefits and drawbacks, and the decision to create one or both should be based on an individual's unique needs and circumstances.

Living Will vs Power of Attorney FAQs

In the case that a person is unable to make decisions for themselves, a living will is a legal instrument that specifies their healthcare preferences, whereas a power of attorney appoints someone to make financial and healthcare decisions on their behalf.

Yes, an individual can choose to create both legal documents to ensure their wishes are carried out in all aspects of their healthcare and financial planning.

A power of attorney can cover decisions related to medical treatment, financial transactions, and legal matters, depending on the type of power of attorney created.

To create either legal document, an individual must be of sound mind and able to understand the decisions they are making. The documents must also be in writing and signed by the individual and witnesses or notary public, depending on the state's legal requirements.

The decision to create a living will, power of attorney, or both ultimately depends on an individual's unique needs and circumstances. Factors such as age, health status, financial situation, and personal preferences should be considered when making this decision. Consulting with an attorney or healthcare professional can also provide valuable guidance in making this decision and ensure that the legal documents meet an individual's unique needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.