Estate planning determines how your estate will be handled after your death or in the event of incapacitation. This process includes the distribution of assets to heirs, the settlement of estate taxes, and the arrangement of funeral proceedings. The assets involved in most estate plans include cash in bank accounts, investment accounts, retirement accounts, and insurance policies. These plans may also include real estate, vehicles, business interests, works of art, and sometimes even debt. Most individuals prepare an estate plan with the assistance of a financial professional to guarantee that their desires are carried out precisely as they desire. Estate planning can help preserve family wealth, provide for a surviving spouse or children, fund grandchildren's education, or leave a charitable legacy. No matter your wishes for your estate, it is crucial to have a solid plan in place to avoid any potential problems down the road. Whether you have a large or small estate, estate planning is important because it can help: Without an estate plan, the government may choose how your assets will be distributed, which might not align with your wishes. It is essential to arrange the distribution of assets to ensure that the correct beneficiaries of your estate receive them. You can select a trusted relative or friend to take charge of this as part of your estate plan. Since estates can sometimes include debt, estate planning can help ensure that the beneficiaries are protected from creditors and lawsuits. An estate plan also gives you peace of mind since your children, if you have any, will be cared for in the manner you specify. In case both you and your spouse pass away with children below 18, you must name guardians as part of your estate plan. Otherwise, the courts will choose who will take custody of your children. Estate planning cuts the time and cost of dying intestate, which happens when you die without leaving a will. When you die "intestate," state law dictates what happens to your assets and who gets them. The case will be sent to probate court. No one can touch your assets or follow your orders during this time. Everything is on hold until the court reviews your estate, applies state laws, pays off debts, and allocates your assets. It can take months or years for prominent cities and wealthy regions to complete this process. Furthermore, legal fees and other related expenses can be pretty high. Several forms of taxes are collected when distributing an estate to the designated beneficiaries. There are estate taxes, which are paid before the distribution by the estate. There are also inheritance taxes paid after the distribution by the beneficiaries. Depending on the state where you reside, you may have to pay both estate taxes and inheritance taxes. There are ways to pass on your property without the state or federal governments taking a huge chunk in the form of taxes. Trusts, irrevocable gifts, and joint accounts are viable options you can carry out with an estate plan. An estate plan may help prevent disagreement among family members because your wishes will be made clear, and some tough financial decisions can be taken care of ahead of time. For instance, you can tailor arrangements for a child with health difficulties or one who might benefit from not inheriting a lump sum. You can also provide more to the child who cared for you the most as you aged or less to the child whose education you sponsored while contributing less to their siblings. There are various legal documents that you should consider including in your estate plan. These include: Trusts are legal arrangements that provide for the administration and distribution of an individual's assets both before and after death. If managed well, the establishment of trusts can reduce the taxes levied on an estate. Creating a trust assigns a third party, a trustee, who will manage your assets on behalf of your beneficiaries. While you are still living, you can act as the trustee of your own trust. Afterward, you can appoint a replacement trustee to administer the trust in your stead. In contrast, a will allows you to prepare for what happens after your death. Aside from distributing your assets, you can also choose guardians for your children using your will. A will assigns a third party, an executor, to ensure its terms are carried out. An executor's responsibilities include collecting assets, distributing assets to beneficiaries, and paying debts to creditors. Note that you cannot designate guardianship for minor children under a trust; you can only do so via a will. This is one of the common reasons why some people utilize both wills and trusts. Beneficiary designations provide the ability to transfer assets directly to specific individuals, with or without the existence of a will. This happens when you open a bank account, retirement account, or life insurance policy and are asked to designate beneficiaries in the event of your death. As part of your estate plan, you can regularly review the beneficiary designations of these accounts and update them if needed. A beneficiary designate will typically precede what is written in a will. This is because the entity responsible for administering the account, such as a bank or life insurance company, will transfer the asset to the chosen beneficiary. Therefore, it is essential to ensure that the directives left behind will correspond with the beneficiary designations in your other accounts to avoid conflict. To simplify matters, you may also choose your estate as the beneficiary of these accounts. This means that assets transfer to the estate, not to any particular individual. They will then be distributed based on the terms of your will. A durable power of attorney (POA) grants your chosen agent the authority to make business, financial, and legal decisions on your behalf, especially in the event of physical or mental incapacity. After reaching an agreement, you can arrange to have your agent’s powers take effect immediately, at a later date, or in the event of your incapacity. Once given, powers will stay in effect until revoked, the contract expires (if one exists), or you pass away. A durable power of attorney may cover decisions involving government benefits, banking, retirement programs, and insurance. A healthcare power of attorney gives your chosen agent the authority to make healthcare decisions on your behalf if you cannot do so. With an estate plan, you can discuss your desires with your agent ahead of time and put these specifics into writing. This will allow the agent to ensure that your wishes are carried out when the time comes to act on them. Typically, these healthcare decisions pertain to end-of-life care, such as whether you wish to be kept alive through artificial means or whether you wish to die at home. This is most applicable if you are terminally ill and unable to communicate your wishes to your loved ones. A letter of intent is a personal addition that you can make to the formal documentation of your estate plan. Although not legally valid, it can provide your executor and heirs with further information about your wishes for specific assets. For example, you can leave your house to one of your children and request them to keep it in the family and not sell it, even in the future. Or you may use the letter of intent to detail arrangements you would like to be made for your funeral. This document may also guide probate court on your wishes, should your will somehow be declared invalid. Although this condition is included in the majority of wills and trusts, some do not include it. If you already have small children or are thinking about having children, choosing a guardian for them is a crucial decision that is sometimes disregarded. In addition to the primary guardian, you may also want to designate a backup or contingent guardian. You can select people who hold the same values as you, are in a stable financial position, and genuinely desire to raise children. Without these designations, the court may choose a guardian for your children you do not approve of, or in extreme circumstances, your children might become wards of the state. It is vital to choose a financial professional who is experienced in estate planning and knows the laws in your state to help you through this process. While some people may try to save money by using online documents or forms, it is not advisable. The laws may vary from state to state, and an online document may not be valid in your state. In addition, an online form cannot give you the personalized advice that an experienced attorney can provide. The fees for estate planning services vary depending on the complexity of your estate and the type of service you need. Financial professionals may charge either an hourly rate, a flat fee, or a contingency fee for estate planning services. Some estate planners have a fixed hourly fee determined by their level of expertise and previous work experience. If the details of your estate plan need additional time or effort owing to its complexity, an hourly rate may also be imposed on the services rendered. Your estate planner may also ask for a retainer fee before beginning work for you. Thus, the total charge of their services will be a combination of the retainer fee, which was paid upfront, and the accumulated hourly fees, which will be billed later. An estate planner may charge a flat fee for their services which is based on their experience. A portion of this fee may need to be paid in advance. Before you agree to a fixed price, ask what services are included because they can differ from one financial professional to another. For instance, most flat fees include wills and powers of attorney. However, other services like notarizing or establishing trusts might not be included. Contingency fees work somewhat like a commission. When you win a court case and are awarded compensation, part of this money may go to a contingency fee. Estate planners rarely employ contingency fees. However, probate attorneys may use this fee while settling an estate. Creating an estate plan can be a complex task, but it is an important one. Here are some of the things you need to perform and consider when creating an estate plan. The first step in creating an estate plan is to conduct an inventory of your assets. This includes real estate, savings, investments, and personal belongings. You must also list your debts, including mortgages, loans, and credit card balances. This will give you a clear picture of your financial worth and help you determine how your assets will be managed and distributed after your death. The next step is to choose your beneficiaries. This includes family members, friends, charities, and other organizations. You can assign who will receive your assets after your death. You also need to consider how you want your assets to be distributed. For example, you may want your spouse to receive all of your assets if you die first. Or you may want your assets to be divided equally among your children. The next step is to review your retirement accounts and insurance policies and update your beneficiaries list if needed. This includes 401(k)s, individual retirement arrangements (IRAs), and annuities. Doing this will ensure that your beneficiaries are financially provided for in the case of your passing. Every day, an excessive amount of unnecessary probate is performed on various investments, including stock, bonds, and individual brokerage accounts. If you are the owner of these accounts, you can set them up — or alter them — to have a transfer on death (TOD) designation. This designation enables beneficiaries to acquire assets without going through the lengthy and costly probate process. Get in touch with your bank or custodian to set this up on your accounts. When creating your estate plan, you need to choose a responsible executor and inform them of your desire to appoint them. After your death, this individual will be responsible for managing your assets and ensuring that your wishes are fulfilled. Therefore, you need to choose someone who is organized and has the time to dedicate to this role. You also need to ensure that this person is financially responsible and can make sound decisions. Once you have taken all these steps, you must complete the necessary documents. This might include a will, trust, and healthcare or durable power of attorney. You may also include a letter of intent and a guardianship designation if you have minor children you want to be cared for properly. It is essential to review your estate plan regularly. This will ensure that it is up to date and reflects your current wishes. You should review your estate plan whenever a significant life event occurs, such as getting married, having children, or buying a new home. Even though you might believe that you have thought of everything, it is probably a good idea to discuss your estate plan with a financial planner or an estate attorney. They will be able to give you professional advice ensuring that your estate plan complies with the law. Estate planning can be a complex process, so getting all the help you can is important. Here are a few estate planning tips to keep in mind: Estate planning can be a complex process, but it is crucial to have a plan in place. By taking the time to understand the process and make informed decisions, you can ensure that your wishes and plans will be carried out after your death. If you need assistance with estate planning, a number of professionals can help. Estate planners come from various backgrounds, including law, accounting, and financial planning. When choosing an estate planner, it is vital to find someone who specializes in estate planning and has experience dealing with the specific laws in your state. It is also a great idea to find someone you can trust who will be ready to answer any questions you have. Make sure to check their experience and credentials before making a decision. You want to work with a qualified financial professional to help you with this critical task. It is also essential to ask how they will charge for their services. Estate planners typically charge either an hourly rate, a flat fee, or a contingency fee. Make sure to ask about all the fees involved, so there are no surprises later on. You can ask your family and friends for recommendations or search online for estate planners in your area. Estate planning is the process of organizing, managing, and assigning your assets in preparation for your death or possible incapacitation. It includes the creation of documents such as wills, trusts, letters of intent, and healthcare or durable powers of attorney. Estate planning is an important process that everyone should go through. Whether you have a large or small estate, planning for it can help protect your assets, secure your beneficiaries, save time or money, reduce taxes and lessen family disputes. Several professionals can help you with estate planning, including financial professionals, estate planning lawyers, and accountants. Their fee structures vary depending on the complexity of your estate and the type of service you need. They may generally charge either an hourly rate, a flat fee, or a contingency fee. When choosing an estate planner, it is essential to find someone who is qualified and whom you can trust. Estate planning can be complex, but with the help of trusted professionals, you can ensure that your wishes and plans will be carried out after your death.What Is Estate Planning?

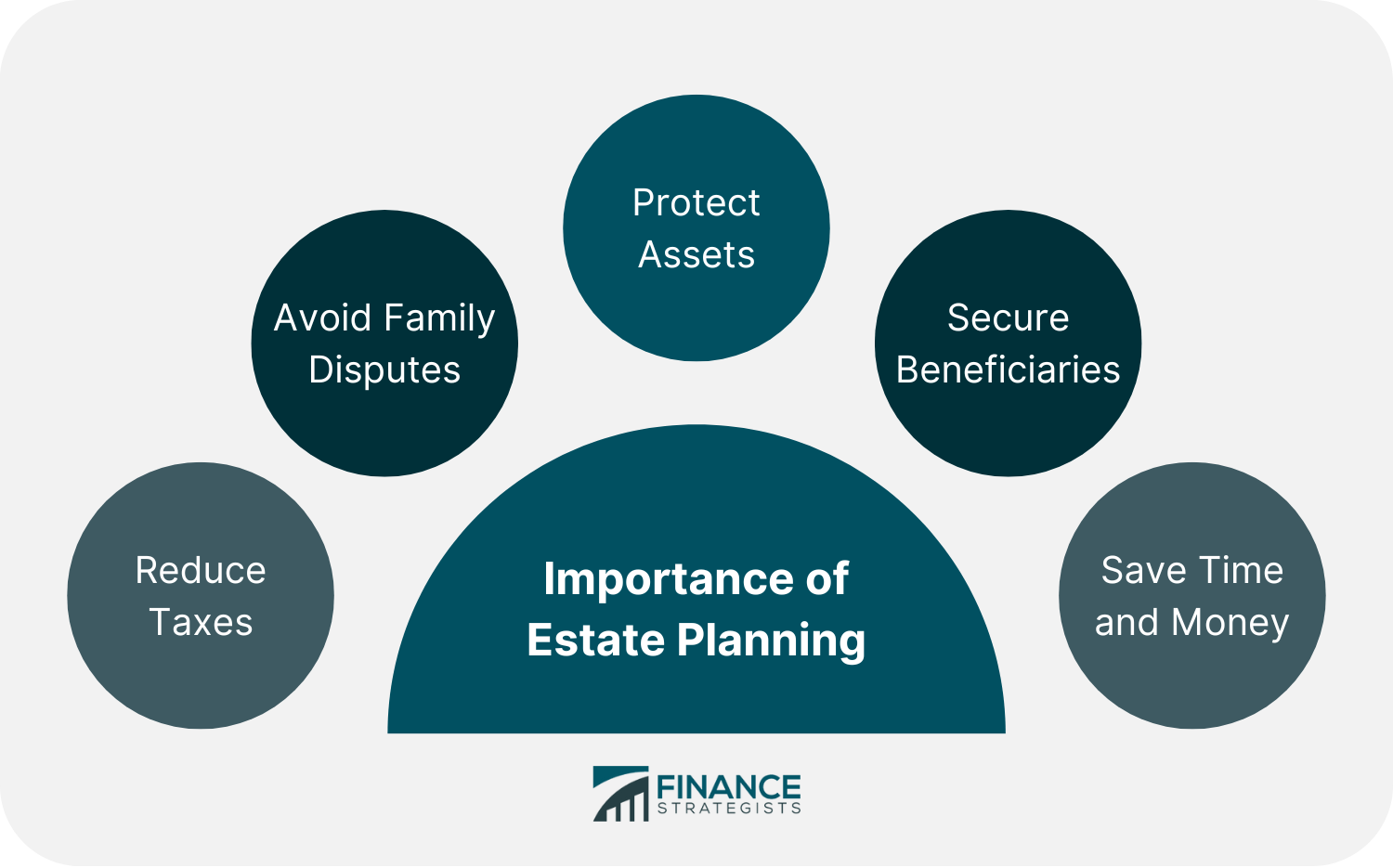

Importance of Estate Planning

Protect Assets

Secure Beneficiaries

Save Time and Money

Reduce Taxes

Avoid Family Disputes

Estate Planning Checklist

Wills and Trusts

Beneficiary Designations

Durable Power of Attorney

Healthcare Power of Attorney

Letter of Intent

Guardianship Designations

Estate Planning Fees

Hourly Rate

Flat Fee

Contingency Fee

How to Create an Estate Plan

Conduct an Inventory of Assets

Choose Your Beneficiaries

Review Retirement Accounts and Insurance

Appoint Transfer on Death Designations

Choose a Responsible Executor

Complete Important Documents

Regularly Review Your Estate Plan

Consult With a Financial Professional

Estate Planning Tips

Finding an Estate Planner

Final Thoughts

Estate Planning FAQs

Estate planning is the process of organizing, managing, and assigning your assets in preparation for your death or possible incapacitation. It even involves the settlement of estate taxes and the arrangement of funeral proceedings. A will, on the other hand, is just one part of the estate planning process. It is a document that specifies who will inherit your assets and other belongings after you pass away.

Estate planning is important because it allows you to control what happens to your assets after you die. Estate planning also allows you to decide who will care for your children and other dependents if you can no longer do so.

Your estate plan should include a will, durable and healthcare power of attorney, and beneficiary and guardianship designations. Depending on your assets and the size of your estate, setting up trusts could also be an excellent option to include in your estate planning.

Estate planning fees are typically charged at an hourly rate, a flat fee, or a contingency fee. Make sure to ask about all the costs involved, so there are no surprises later.

Estate planning is for everyone. Even if you do not have many assets, it is essential to have a plan in place for your belongings and your dependents when you die. This could protect your heirs from significant tax burdens and secure the future of any minor children.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.