End-of-life care planning refers to the process of making decisions about the type of care a person wishes to receive towards the end of their life. This can include discussions about the individual's preferences for medical treatment, pain management, and other aspects of care, as well as identifying a person who can make decisions on their behalf if they become unable to do so. The goal of end-of-life care planning is to ensure that a person's wishes are respected and that they receive care that aligns with their values and preferences, even when they are no longer able to communicate them effectively. It can help ease the burden on family members and healthcare providers by clarifying the individual's wishes in advance and providing guidance on how to proceed in difficult situations. End-of-life care planning encompasses a range of decisions and considerations, including: Medical Care Preferences: Determining the type and extent of medical treatments an individual desires at the end of their life. Financial Considerations: Allocating financial resources for end-of-life care and related expenses. Legal Documentation: Creating binding documents to ensure that an individual's end-of-life preferences are respected and followed. A living will is a legal document that specifies an individual's preferences for medical treatment at the end of their life. This document can provide guidance to healthcare providers and family members, helping to ensure that an individual's wishes are respected. A durable power of attorney for health care, also known as a health care proxy, authorizes a trusted person to make medical decisions on behalf of the grantor if they become unable to communicate their wishes. This document is crucial for ensuring that an individual's end-of-life care preferences are followed. Planning for funeral and burial expenses is an essential aspect of end-of-life care planning. Pre-planning allows individuals to make their own arrangements, ensuring that their final wishes are carried out. Funding these arrangements in advance can help reduce the financial burden on surviving family members. Discussing funeral and burial preferences with family members is essential to ensure that an individual's wishes are understood and respected. This conversation should be open and honest, allowing for the expression of personal values and desires. Purchasing long-term care insurance can help cover the costs of nursing homes, assisted living facilities, and other long-term care services. This type of insurance can provide financial protection and peace of mind for both the individual and their loved ones. Life insurance policies can provide financial support to beneficiaries after an individual's death. These funds can be used to cover funeral and burial expenses, pay off debts, and provide ongoing financial support for dependents. Retirement savings can also play a role in end-of-life care planning. It is essential to consider how these funds will be allocated in the event of an individual's death or incapacitation, ensuring that their financial goals are met and their loved ones are provided for. Including charitable bequests in an estate plan can help individuals leave a lasting legacy and support causes that align with their values. Bequests can be made through a will or trust, designating a specific dollar amount or a percentage of the estate's value to a chosen charity. Charitable trusts can be an effective way to combine estate planning and philanthropy. These trusts can provide tax benefits, support charitable organizations, and ensure that an individual's wealth is used in accordance with their values and priorities. An estate planning attorney can provide valuable guidance and support in integrating end-of-life care planning into an individual's overall estate plan. These professionals can help draft legally binding documents, ensuring that an individual's wishes are respected and followed. Regularly reviewing and updating end-of-life care and estate planning documents is essential to ensure that they remain legally binding and accurately reflect an individual's wishes. Life events, such as marriage, divorce, or the birth of a child, may necessitate changes to these documents. A team of financial and legal professionals can provide comprehensive guidance in end-of-life care planning and estate planning. These experts can collaborate to develop a well-coordinated strategy that addresses both financial and personal considerations. Open communication with family members is crucial when it comes to end-of-life care planning. Sharing one's wishes and preferences can help ensure that they are understood and respected, reducing the potential for conflicts and misunderstandings. In addition to discussing end-of-life care plans with family members, it is essential to share relevant documents with the appropriate parties, such as healthcare providers, attorneys, and financial advisors. This ensures that all involved parties are aware of an individual's preferences and can act accordingly. Regularly reviewing and updating end-of-life care and estate planning documents ensures that they remain current and accurately reflect an individual's wishes. This process should involve ongoing communication with family members and professional advisors. End-of-life care planning is crucial for a well-rounded approach to end-of-life decisions. Addressing key aspects, such as medical care preferences, financial considerations, legal documentation, and charitable giving, ensures that an individual's wishes are respected and followed. By effectively communicating these preferences with family members and relevant professionals, individuals can reduce the emotional and financial burden on their loved ones while preserving their assets and legacy. Taking the time to incorporate end-of-life care planning into your estate plan is essential for a comprehensive and coordinated strategy that respects your values and provides peace of mind for you and your family.Definition of End-Of-Life Care Planning

Components of End-Of-Life Care Planning

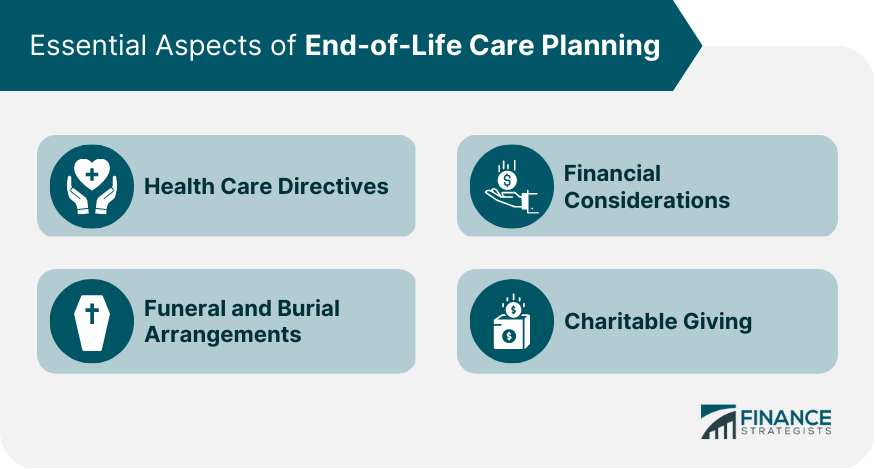

Essential Aspects of End-Of-Life Care Planning

Health Care Directives

Living Wills

Durable Power of Attorney for Health Care

Funeral and Burial Arrangements

Pre-planning and Funding

Communicating Wishes to Family Members

Financial Considerations

Long-Term Care Insurance

Life Insurance

Retirement Savings

Charitable Giving

Bequests

Charitable Trusts

Legal Documentation and Professional Assistance

Working With an Estate Planning Attorney

Ensuring Documents Are Up-To-Date and Legally Binding

Collaborating With Financial Advisors, Accountants, and Other Professionals

Communicating End-Of-Life Care Plans

Importance of Discussing Plans With Family Members

Sharing Documents With Relevant Parties

Regularly Reviewing and Updating Plans

Final Thoughts

End-Of-Life Care Planning FAQs

End-of-life care planning is a critical aspect of estate planning that ensures an individual's medical, financial, and personal preferences are respected during their final days. By integrating end-of-life care planning into estate planning, individuals can reduce the emotional and financial burden on their loved ones while effectively managing their resources and preserving their legacy.

End-of-life care planning allows individuals to specify their preferences for medical treatments at the end of their life. By creating legal documents such as living wills and durable power of attorney for health care, individuals can provide guidance to health care providers and family members, ensuring that their wishes are respected and followed.

End-of-life care planning addresses financial considerations such as long-term care insurance, life insurance, and retirement savings. By allocating financial resources for end-of-life care and related expenses, individuals can ensure their loved ones are not burdened with unexpected costs and that their assets are preserved for beneficiaries.

End-of-life care planning can be integrated into charitable giving through the inclusion of bequests and the establishment of charitable trusts. These mechanisms allow individuals to support causes that align with their values, leave a lasting legacy, and potentially receive tax benefits as part of their estate plan.

Communication is crucial in end-of-life care planning to ensure that an individual's wishes are understood and respected by family members and other involved parties. Individuals can share their end-of-life care plans by discussing their preferences with family members, providing relevant legal documents to healthcare providers, attorneys, and financial advisors, and regularly reviewing and updating their plans with all parties involved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.