Credit counseling is a service designed to help individuals and families navigate complex financial situations by providing education, guidance, and personalized advice. The primary goal of credit counseling is to help clients make informed decisions about their personal finances, manage their debts, create budgets, and improve their credit scores. Non-profit agencies, for-profit companies, or online platforms often offer credit counseling services. Credit counseling services can vary in format and focus. Understanding the distinctions between these services is essential to make the best choice for your financial situation. These agencies typically provide free or low-cost services to clients. Donations, grants, or fees from creditors fund them. Non-profit agencies often offer a wide range of services, including budgeting assistance, debt management, and financial education. For-profit companies provide similar services as non-profit agencies, but they operate with the goal of making a profit. These companies may charge higher fees for their services and may focus on specific financial products or services. Online platforms offer credit counseling services through digital means, such as video calls, chat, and email. These services can be more convenient for some clients but may not provide the same level of personal interaction as face-to-face counseling. It is essential to consider the advantages and disadvantages of each service type when choosing a credit counseling provider. Factors to consider include cost, accessibility, and the range of services offered. The credit counseling process typically consists of three main steps: initial consultation, development of a personalized action plan, and ongoing support. During the initial consultation, a credit counselor will review your financial situation, including income, expenses, and debt. They may also request copies of your credit reports to understand your financial history fully. The counselor will review your credit reports to identify any errors, negative information, or areas for improvement. They will also explain how your credit score is calculated and how to improve it. The counselor will help you create a realistic budget that reflects your financial goals. They may also suggest ways to reduce expenses and increase savings. Various debt management strategies, such as debt consolidation, balance transfers, or negotiating lower interest rates with creditors, may be recommended. The counselor will help you determine the best approach for your situation. The counselor will provide guidance on improving your credit score, such as paying bills on time, reducing credit utilization, and diversifying your credit mix. After the initial consultation and development of an action plan, the credit counseling agency may provide ongoing support and follow-up to ensure your financial goals are being met. A debt management plan is a formal agreement between you and your creditors, facilitated by a credit counseling agency, to help you pay off your debts within a specified time frame. DMPs can help clients reduce interest rates, waive fees, and establish a consistent repayment schedule. This can make it easier to pay off debts and improve credit scores over time. The credit counseling agency will negotiate with your creditors to establish a repayment plan that fits your budget and financial goals. Once an agreement is reached, you will make monthly payments to the credit counseling agency, which will then distribute the funds to your creditors. Not all clients are eligible for a DMP. Eligibility depends on factors such as the type and amount of debt, financial stability, and the willingness of creditors to participate in the program. DMPs can offer significant benefits like lower interest rates and a structured repayment plan. However, they may also have drawbacks, including potential damage to your credit score, restrictions on new credit, and fees associated with the program. When selecting a credit counseling agency, evaluating their credentials, comparing fees and costs, and identifying any potential red flags are essential. Ensure the agency is accredited by reputable organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Counselors should also be certified in credit counseling or financial education. Research the agency's reputation through online reviews, testimonials, and any complaints filed with the Better Business Bureau (BBB). Compare the fees and costs associated with different credit counseling agencies. Non-profit agencies typically offer lower fees, while for-profit companies may charge higher rates for their services. Be cautious of agencies that demand upfront payment, guarantee to eliminate your debts, or pressure you into signing up for their services. These may be signs of a disreputable organization. Consider your specific financial situation and goals when choosing a credit counseling agency. Ensure that the agency offers the services and support that you need to achieve your objectives. In addition to credit counseling, other financial assistance resources may be available to help you manage your finances and achieve your goals. Federal, state, and local government agencies may offer financial assistance programs like debt relief grants, housing assistance, and student loan forgiveness programs. Non-profit organizations may provide financial assistance through grants, scholarships, and low-interest loans. These organizations often focus on specific populations, such as low-income families or individuals with disabilities. Financial coaching and education services can help you develop the skills and knowledge needed to manage your finances effectively. Community organizations, educational institutions, or private companies may offer these services. Seeking professional guidance through credit counseling can be an invaluable step toward achieving financial stability. By understanding the different types of credit counseling services, the process involved, and how to choose the right agency, you can set yourself on the path to long-term financial success. Remember to maintain the healthy financial habits you develop during credit counseling to ensure lasting financial stability. Do not wait any longer to take control of your finances. Reach out to a trusted banking professional today and embark on your journey toward a secure financial future. Their expert guidance and personalized support can make all the difference in helping you achieve your financial goals.What Is Credit Counseling?

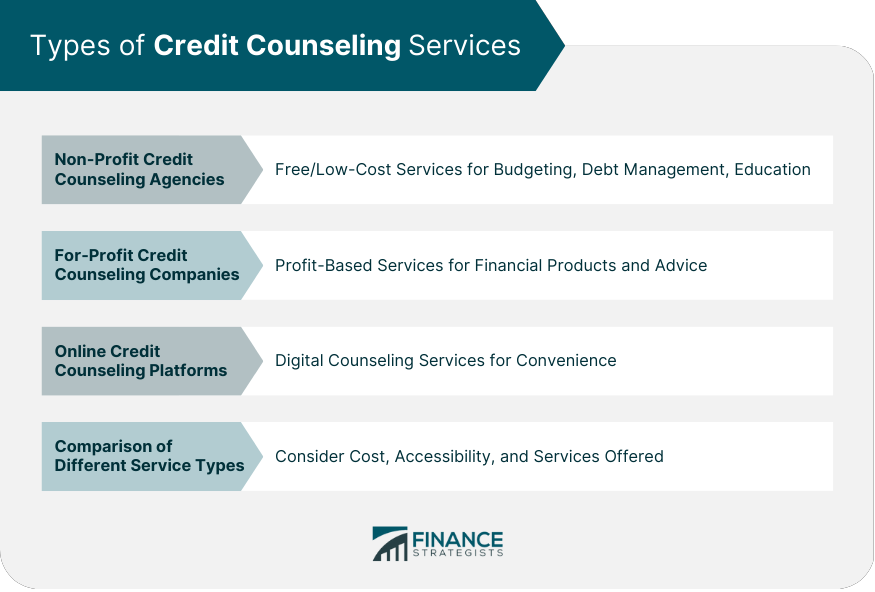

Types of Credit Counseling Services

Non-Profit Credit Counseling Agencies

For-Profit Credit Counseling Companies

Online Credit Counseling Platforms

Comparison of Different Service Types

Credit Counseling Process

Initial Consultation

Assessing the Client's Financial Situation

Reviewing Credit Reports

Developing a Personalized Action Plan

Budgeting and Expense Reduction

Debt Management Strategies

Score Improvement

Ongoing Support and Follow-Up

Debt Management Plans (DMPs)

Purpose and Benefits of DMPs

How DMPs Work

Eligibility for a DMP

Pros and Cons of DMPs

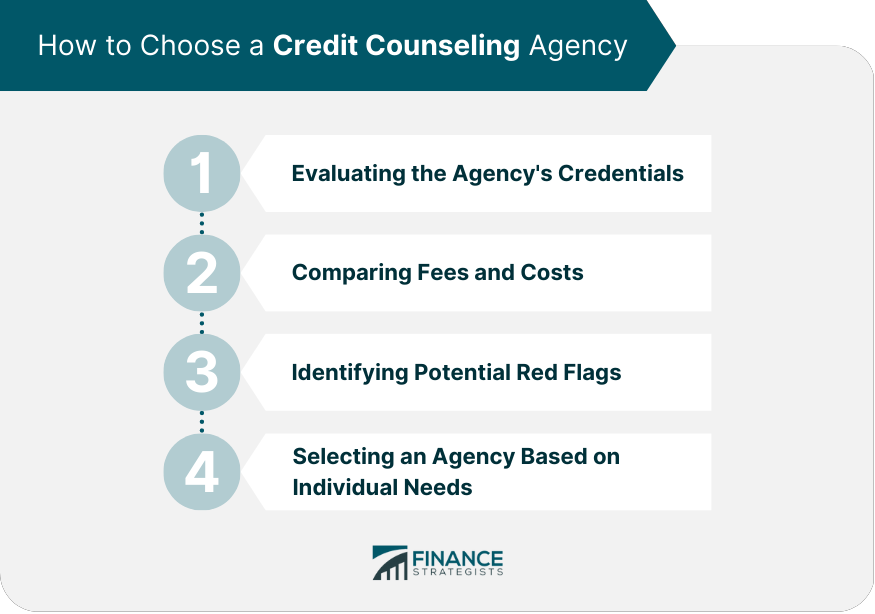

Choosing a Credit Counseling Agency

Evaluating the Agency's Credentials

Comparing Fees and Costs

Identifying Potential Red Flags

Selecting an Agency Based on Individual Needs

Other Financial Assistance Resources

Government Programs and Resources

Non-Profit Financial Assistance Organizations

Financial Coaching and Education Services

Conclusion

Credit Counseling FAQs

Credit counseling services primarily educate clients about personal finance and provide tailored advice to help them make informed decisions for their specific financial situations.

To determine if a credit counseling agency is reputable, check for accreditation from organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA), verify counselor certifications, and research their reputation through online reviews and the Better Business Bureau (BBB).

No, a credit counseling agency cannot guarantee to eliminate your debts. Be cautious of any agency that makes such promises, as it may be a red flag indicating a disreputable organization.

A credit counseling agency typically offers a range of services, including initial consultation and assessment, personalized action plan development (including budgeting, expense reduction, and debt management strategies), credit score improvement guidance, and ongoing support and follow-up.

Yes, there are several alternatives to credit counseling, including government programs and resources, non-profit financial assistance organizations, and financial coaching and education services offered by community organizations, educational institutions, or private companies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.