Fiscal policy refers to the governmental use of taxation and spending to influence the conditions of the economy. Typically, fiscal policy comes into play during a recession or a period of inflation, where conditions are escalating quickly enough to warrant government intervention. A good application of fiscal policy, in theory, should be able to stabilize a teetering economy and facilitate continued growth. Fiscal policy revolves around government decisions on taxation, spending, and borrowing. By manipulating these levers, governments influence economic activity, direct and indirect, in an attempt to manage business cycles, control inflation, or even address unemployment. The purpose of fiscal policy is to implement artificial measures to prevent an economic collapse and to promote healthy and steady economic growth. Fiscal policies can be either expansionary or contractionary. One primary aim of fiscal policy is to foster sustainable economic growth while ensuring stability. But achieving this delicate balance is akin to tightrope walking. Increase government spending, and you might spur growth. Do it recklessly, and you could trigger inflation. Conversely, cutting spending or raising taxes might rein in an overheated economy, but risk stalling growth. It's a dance of precision, requiring astute judgment and, often, a fair bit of foresight. Full employment doesn't mean a zero unemployment rate but rather when all available labor resources are being used efficiently. Fiscal policy plays a role here too. By investing in infrastructure or providing tax incentives for businesses, governments can stimulate job creation. However, the challenge lies in ensuring these jobs are sustainable and not just short-term fixes. Through its instruments, the government can influence demand, ensuring it doesn't outstrip supply to a point where prices surge uncontrollably. Similarly, it can act to stimulate demand during deflationary phases, ensuring prices don't plummet. The gap between the rich and poor is a growing concern worldwide. Fiscal policy has a role in bridging this chasm. Through progressive taxation or targeted welfare programs, governments can redistribute wealth, ensuring a more equitable society. But it's not just about taking from the rich and giving to the poor. It's about creating opportunities, fostering an environment where everyone has a shot at success. It's not just about how much a government spends but where it allocates its resources. Infrastructure, healthcare, defense, education—the choices are vast, each with its ramifications on the economy. Government spending can be a catalyst, igniting growth in sectors, creating jobs, and fostering innovation. Conversely, cutbacks in areas can signal a shift in priorities, often with ripple effects throughout the economy. Taxes—they're inevitable. But they're also a potent tool in a government's fiscal arsenal. By tweaking tax rates, governments can influence both individual and corporate behavior. Reduced taxes can spur spending and investment, acting as a boost to economic activity. Conversely, increased taxes can cool down an overheating economy or be used to fund crucial government programs. Borrowing is a double-edged sword. On one hand, it allows governments to fund large projects and stimulate growth. On the other, excessive debt can hamper economic activity, leading to long-term fiscal strain. Effective debt management ensures that borrowing serves its purpose without endangering future financial stability. It's a balancing act of weighing immediate needs against long-term sustainability. Expansionary policy, which is the more common of the two, is when the government responds to recession by lowering taxes and increasing government spending. The principle at play is that when taxes are lowered, consumers have more money in their pockets to spend or invest, which increases the demand for products and securities. Increasing demand for goods, as well as increased government spending, leads firms to hire more employees, lowering unemployment, as well as compete for employees more fiercely, which can increase wages. This gives consumers yet more funds to spend, hopefully pulling the economy out of recession over time. This is known as a virtuous cycle. Contractionary policies are applied during a period of inflation. During this the government may reduce spending on public projects or even reduce public-sector wages or the size of the workforce. Contractionary policies are uncommon, though, because the preferred approach to reigning in rapid growth is to institute a monetary policy to increase the cost of borrowing. Not all fiscal policies involve aggressive maneuvers. A neutral fiscal policy is the Goldilocks of fiscal strategies—not too expansionary, not too contractionary, but just right. It aims to balance the budget, ensuring that government spending matches revenue. In periods of economic stability, a neutral approach avoids rocking the boat, maintaining the status quo and allowing the market forces to operate unhindered. Business cycles are inevitable, but their extremities can be managed. Fiscal policy acts as a buffer, cushioning the economy during downturns and ensuring it doesn't overheat during booms. By reacting proactively to economic indicators, governments can mitigate the impacts of recessions, ensuring shorter and less severe downturns. Unlike monetary policy, which often uses broad strokes, fiscal policy can be laser-focused. Whether it's a struggling sector, a burgeoning industry, or a specific demographic, fiscal measures can be tailored to address precise challenges or opportunities. This ability to zoom in ensures efficient resource allocation, maximizing impact where it's needed most. The economic landscape is ever-evolving, and fiscal policy offers the agility to adapt. Governments can quickly introduce or modify fiscal measures in response to emerging challenges or changing circumstances. This dynamism ensures that fiscal policy remains relevant, addressing the pressing needs of the hour. The free market is efficient, but it's not perfect. There are areas, like public goods and services, where the market might fail. Fiscal policy steps in here, funding essential services like defense, public transport, or healthcare, ensuring societal well-being. Moreover, by managing these goods and services, the government can ensure equity, accessibility, and quality. Economies are like supertankers—they don't turn on a dime. When fiscal measures are introduced, there's often a lag before their impact is felt. This delay can sometimes mean that the measures, though well-intended, end up being ill-timed. As a result, the challenge lies in anticipating future scenarios and crafting policy that remains relevant when its effects finally ripple through the economy. Economics and politics are deeply intertwined. Fiscal decisions, while economically sound, might not always be politically popular. Leaders often face the dilemma of short-term popularity versus long-term economic gain. Moreover, frequent changes in administration can lead to inconsistent fiscal policies, hampering long-term planning and stability. It sounds counterintuitive, but sometimes government intervention can stifle private sector activity. By borrowing heavily, governments might drive up interest rates, making borrowing costlier for businesses. Similarly, aggressive government involvement in certain sectors might deter private investment, undermining the very growth the policy aimed to achieve. A tax break for one sector might come at the expense of another. Increased spending in one area might mean cutbacks in another. The challenge is to ensure that these decisions don't disproportionately impact certain demographics or sectors, leading to increased inequalities or economic imbalances. Fiscal policy employs taxation and spending to influence the economy and serves to stabilize it during downturns and promote growth. Advantages include economic stabilization, targeted interventions, flexibility, and managing public goods. Fiscal measures cushion the economy during recessions, ensuring shorter and less severe downturns. Targeted approaches allow for efficient resource allocation, maximizing impact. Fiscal policy's adaptability addresses emerging challenges effectively. It manages crucial public goods and services, ensuring societal well-being and equitable development. Challenges include time lags, political considerations, crowding out private sector activity, and managing distributional impacts. Despite these hurdles, fiscal policy remains essential in fostering economic stability and growth while striving for equitable outcomes. Crafting effective policies requires sound economic judgment, foresight, and a commitment to long-term stability and welfare.Fiscal Policy Definition

Fiscal Policy Purpose and Objectives

Economic Growth and Stability

Full Employment

Price Stability

Income Distribution

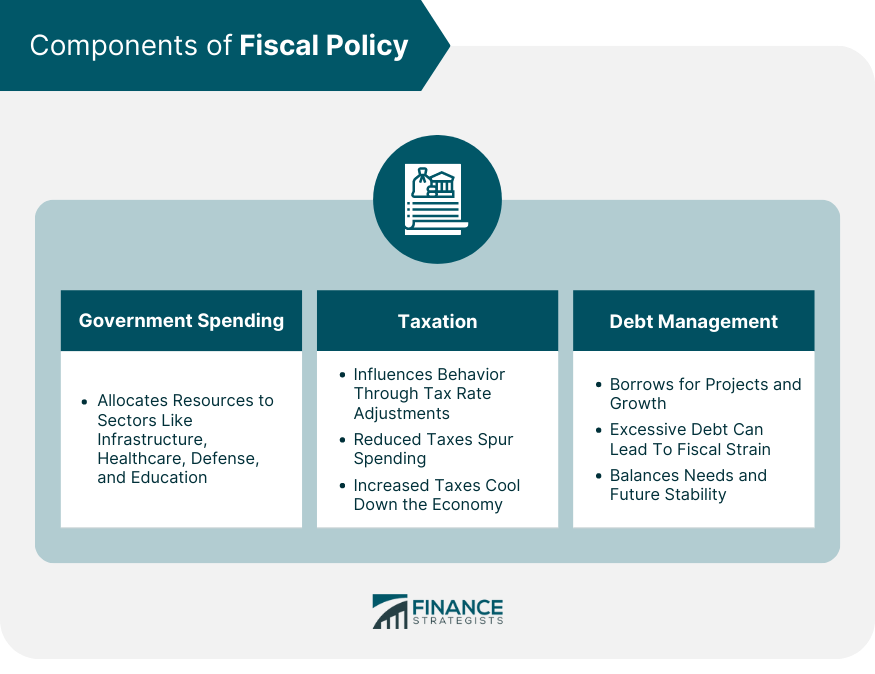

Components of Fiscal Policy

Government Spending

Taxation

Debt Management

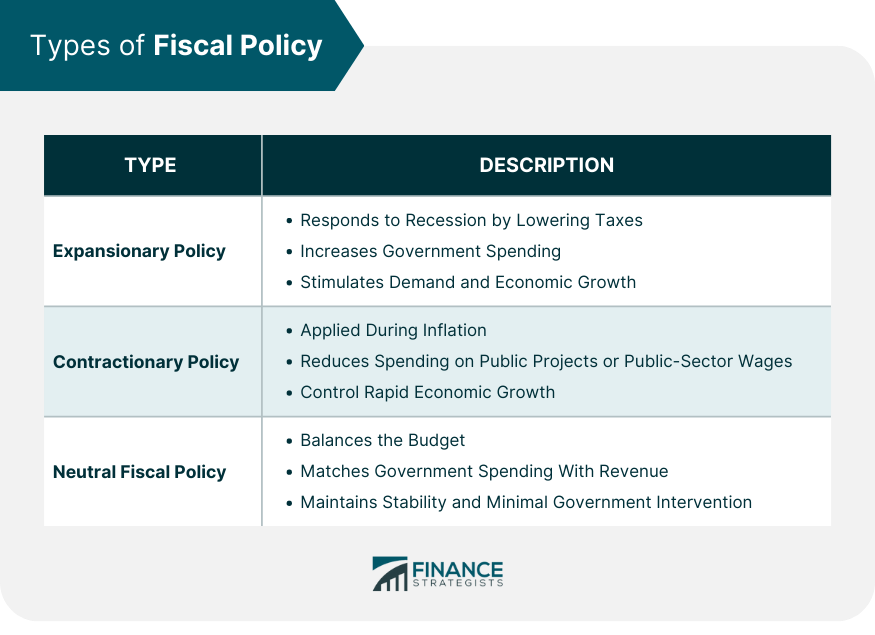

Types of Fiscal Policy

Expansionary Policy

Contractionary Policy

A Neutral Fiscal Policy

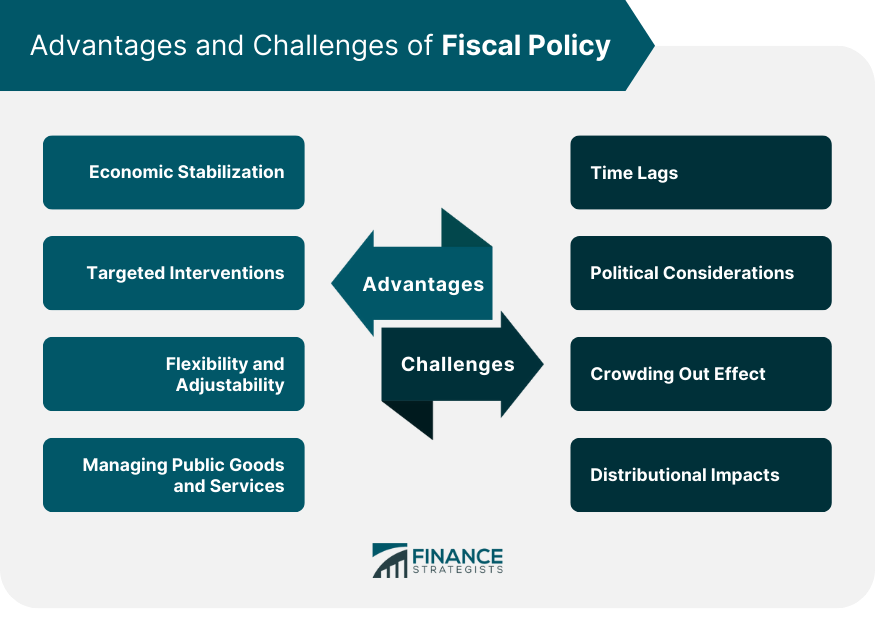

Advantages of Fiscal Policy

Economic Stabilization

Targeted Interventions

Flexibility and Adjustability

Managing Public Goods and Services

Challenges of Fiscal Policy

Time Lags

Political Considerations

Crowding Out Effect

Distributional Impacts

Conclusion

Fiscal Policy FAQs

Fiscal policy refers to the governmental use of taxation and spending to influence the conditions of the economy.

Typically, fiscal policy comes into play during a recession or a period of inflation, where conditions are escalating quickly enough to warrant government intervention.

The purpose of fiscal policy is to implement artificial measures to prevent an economic collapse and to promote healthy and steady economic growth.

The two main policy types are expansionary and contractionary policies.

Contractionary policies are uncommon because the preferred approach to reigning in rapid growth and inflation is to institute a monetary policy to increase the cost of borrowing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.