Mutual funds are investment schemes that pool money from various investors to purchase a diversified mix of assets like stocks, bonds, and other securities. Ideal for those lacking large capital or expertise for individual portfolio diversification, these funds are overseen by professional managers who make buying and selling decisions. Mutual funds are an accessible option for both novice and experienced investors, offering a practical way to participate in a range of investments. These funds cater to various investment objectives, from aggressive growth to conservative income generation, making them a versatile choice. The pooling of resources in mutual funds enables smaller individual investments to be part of a more substantial, diversified portfolio. Mutual funds work by allowing investors to buy shares, representing a fraction of the fund's holdings. This enables substantial diversification even with smaller individual investments. Fund managers strategically allocate pooled capital to balance risk and potential returns, basing decisions on thorough market analysis and the fund's goals. Mutual funds vary in their management approach; some are actively managed to outperform the market, while others, like index funds, passively track market indices, usually at lower costs. Investors earn returns from dividends, interest, and capital gains, shared proportionally after deducting fund expenses. Understanding the fee structure of mutual funds, including management and operational expenses, is crucial for evaluating their potential returns. Stocks represent fractional ownership in companies, offering investors a stake in the company's assets and earnings. When a company performs well, its stock value may rise, providing capital gains to investors. Conversely, poor performance can lead to a decrease in stock value. Stocks are known for their potential for higher returns compared to other investment types but come with higher risks due to market volatility. Prices are influenced by factors like company performance, economic conditions, and investor sentiment. For those with the right knowledge and risk tolerance, stocks can be a rewarding investment, offering direct involvement in the financial growth of a company. Investing in stocks involves purchasing shares through exchanges, giving investors a direct stake in the company's success. Stock prices are dynamic, changing continuously based on market conditions and company performance. Besides potential capital gains, some stocks offer dividends, providing an additional income stream to shareholders. Stock ownership often includes voting rights, allowing investors to influence company decisions. However, the stock market is known for its volatility, offering high rewards but also posing significant risks. Successful stock investing requires an understanding of market trends and individual company performance. Both mutual funds and stocks are avenues for growing wealth through financial market participation. They offer potential for financial growth but also carry risks, including the possibility of capital loss. Investors in both arenas must understand these risks and align their investment strategies with their financial goals and risk tolerance. While the potential for high returns exists in both, so does the need for careful consideration of market dynamics and personal financial objectives. The main difference between mutual funds and stocks lies in their management and investment approaches. Mutual funds are professionally managed, offering a simpler investment route for individuals. In contrast, stock investing requires personal decision-making and active involvement. Mutual funds provide automatic diversification, a crucial element for risk management, while creating a diversified stock portfolio requires deliberate strategy and effort. In terms of trading, mutual funds are traded once a day at a fixed price, whereas stocks offer real-time trading during market hours, providing greater flexibility. Fee structures also differ; mutual funds have ongoing management fees, while stock investments primarily incur transactional fees. Deciding between mutual funds and stocks involves considering several factors: investment goals, risk tolerance, time horizon, level of involvement, need for diversification, market knowledge, and time availability for management. Mutual funds are a fit for those seeking diversification with professional management, while stocks suit investors looking for higher returns and direct control over their investments. Understanding personal financial objectives and risk appetite is crucial in this decision-making process. A balanced investment portfolio might include a mix of both mutual funds and stocks, leveraging the unique benefits each offers to achieve a diversified and effective investment strategy. The choice between mutual funds and stocks should align with an investor's financial goals, risk tolerance, and level of engagement in managing their investments. Mutual funds offer a more hands-off approach with built-in diversification and professional management, making them suitable for those who prefer a more passive investment strategy. On the other hand, stocks provide the opportunity for higher returns and more direct control over investments but require a greater depth of market knowledge and acceptance of higher risks. A well-structured investment portfolio often includes a combination of both, utilizing the strengths of each to create a diversified and robust investment approach. This blend allows investors to balance risk and return, tailoring their portfolio to their specific financial goals and risk profile.Understanding Mutual Funds

How Mutual Funds Work

Understanding Stocks

How Investing in Stocks Works

Similarities Between Mutual Funds and Stocks

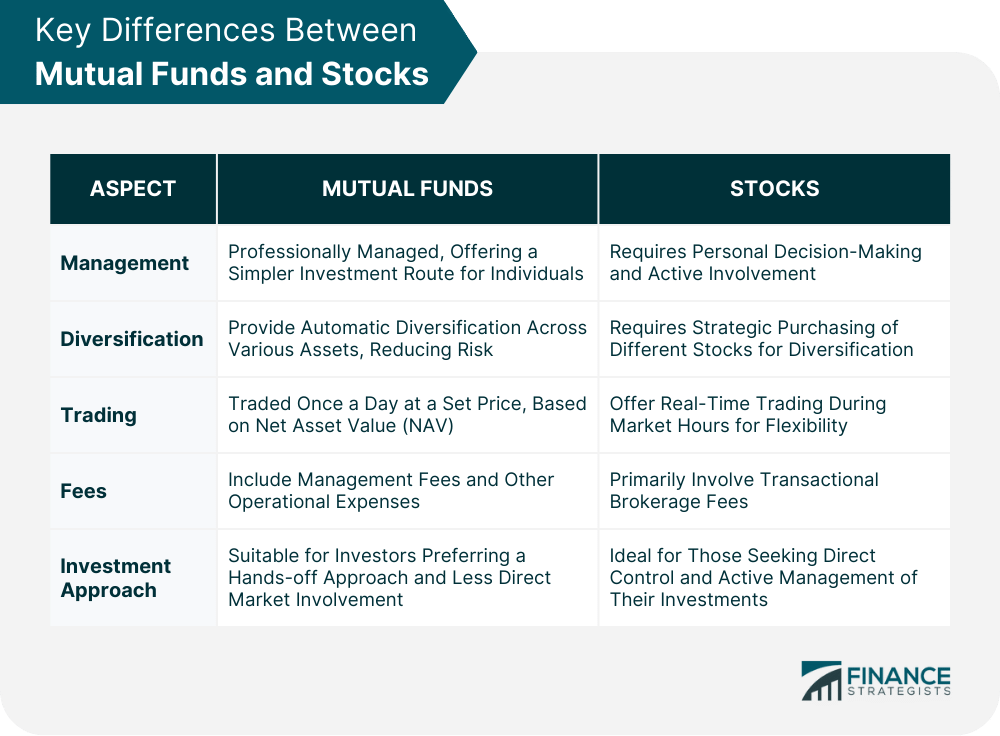

Key Differences Between Mutual Funds and Stocks

Choosing Between Mutual Funds and Stocks

Final Thoughts

Mutual Funds vs Stocks FAQs

The primary difference lies in management and control. Mutual funds are professionally managed and offer diversified portfolios, making them suitable for investors who prefer a hands-off approach. In contrast, investing in stocks involves selecting and managing individual stocks, offering more control but requiring more knowledge and active involvement.

Stocks typically offer higher potential returns but come with greater risk due to market volatility and the need for direct management. Mutual funds, on the other hand, provide more stable returns and lower risk through diversification and professional management.

Mutual funds usually have management fees and sometimes other charges like load fees, affecting the net return. Stocks involve brokerage fees for buying and selling but do not have ongoing management fees.

Mutual funds inherently offer diversification as they invest in a mix of various assets. This spreads the risk across different investments. In contrast, achieving diversification with stocks requires purchasing a range of different stocks, which demands strategic planning and market knowledge.

For beginners, mutual funds are generally more advisable due to their professional management, built-in diversification, and lower risk profile. They offer a simpler way to enter the investment world compared to stocks, which require more market knowledge and active management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.