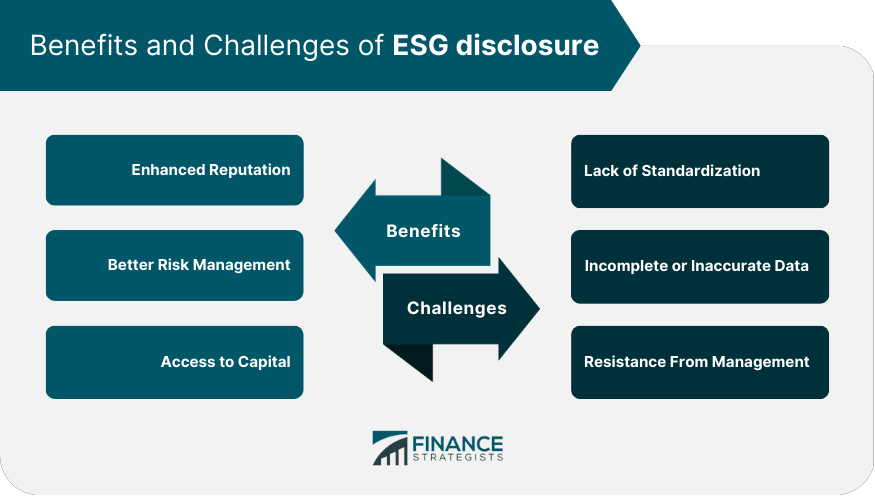

ESG disclosure refers to the public reporting of a company's environmental, social, and governance (ESG) performance. It has become increasingly important in recent years as investors and stakeholders demand more information about a company's non-financial performance. ESG disclosure is a critical aspect of corporate transparency and accountability, and it can help companies build trust and credibility with investors and other stakeholders. The information disclosed can be used by investors to make informed investment decisions, while stakeholders such as customers, employees, and communities can use the information to assess a company's social and environmental impact. ESG disclosure is important because it provides transparency and accountability to stakeholders, including investors, customers, employees, and communities. ESG disclosure helps these stakeholders to assess a company's social and environmental impact, and make informed decisions about their engagement with the company. ESG disclosure can help companies to identify and manage ESG risks and opportunities. This can lead to better risk management, improved efficiency, and reduced costs. ESG disclosure can improve a company's reputation, attract more investors and customers, and improve employee retention. ESG disclosure typically consists of three main components: environmental factors, social factors, and governance factors. This refers to a company's impact on the natural environment. This includes the company's use of natural resources, its emissions and waste, and its approach to managing environmental risks. Companies may disclose information about their energy consumption, greenhouse gas emissions, water usage, waste management, and environmental policies and procedures. This refers to a company's impact on society, including its employees, customers, and communities. This includes information about a company's labor practices, such as employee diversity and inclusion, health and safety, and employee training and development. It may also include information about a company's relationships with its customers and suppliers, and its impact on local communities. Governance factors refer to a company's management structure and practices. This includes information about a company's board of directors, executive compensation, and shareholder rights. It may also include information about a company's approach to risk management, corporate strategy, and ethical behavior. There are several standards for ESG disclosure, which aim to provide guidance and consistency in the reporting of ESG performance. The Global Reporting Initiative (GRI) is a widely recognized standard for ESG disclosure. The GRI provides a framework for companies to report on their ESG performance, including guidance on reporting principles, indicators, and stakeholder engagement. The Sustainability Accounting Standards Board (SASB) is another standard for ESG disclosure. The SASB provides a set of industry-specific standards for ESG reporting, which focus on financially material issues that are relevant to each industry. The Task Force on Climate-related Financial Disclosures (TCFD) is a standard for climate-related ESG disclosure. The TCFD provides recommendations for companies to disclose information about the financial risks and opportunities related to climate change. ESG disclosure can provide several benefits to companies that disclose their ESG performance. Enhanced reputation is one benefit of ESG disclosure. Companies that disclose their ESG performance are seen as more transparent and accountable, which can improve their reputation with stakeholders. This can attract more investors and customers, and improve employee retention. Better risk management is another benefit of ESG disclosure. Companies that disclose their ESG performance can identify and manage ESG risks and opportunities more effectively. This can lead to improved efficiency, reduced costs, and a more resilient business model. Access to capital is a third benefit of ESG disclosure. Investors are increasingly looking for companies that have strong ESG performance, and are willing to pay a premium for these companies. Companies that disclose their ESG performance may have access to a wider range of investors, and may be able to secure financing at a lower cost. ESG disclosure is not without its challenges. Some of the challenges of ESG disclosure include: There is currently no universally accepted standard for ESG reporting, which can make it difficult for stakeholders to compare the ESG performance of different companies. This can also make it difficult for companies to know what information to disclose and how to disclose it. ESG disclosure relies on accurate and complete data. However, some companies may not have access to all the data they need to report on their ESG performance, or may not have the systems in place to collect this data. This can lead to incomplete or inaccurate ESG reporting. Some companies may be resistant to ESG disclosure, either because they do not see the value in it, or because they are concerned about the potential negative impact on their reputation. This can make it difficult to get buy-in from senior management for ESG disclosure initiatives. ESG disclosure has become increasingly important in recent years as investors and stakeholders demand more information about a company's non-financial performance. ESG disclosure provides transparency and accountability to stakeholders, including investors, customers, employees, and communities, and can help companies to identify and manage ESG risks and opportunities. ESG disclosure typically consists of three main components: environmental factors, social factors, and governance factors, and there are several standards for ESG disclosure, including the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). ESG disclosure can provide several benefits to companies that disclose their ESG performance, such as enhanced reputation, better risk management, and access to capital. However, ESG disclosure is not without its challenges, such as a lack of standardization, incomplete or inaccurate data, and resistance from management. Despite these challenges, the benefits of ESG disclosure can ultimately lead to a more sustainable and responsible business model that benefits companies, investors, and stakeholders alike.What Is an ESG Disclosure?

These non-financial performance areas have been identified as important factors that can significantly impact a company's long-term success and sustainability.

By providing more information about their non-financial performance, companies can demonstrate their commitment to sustainability and responsible business practices, which can ultimately benefit their long-term success.Importance of ESG Disclosure

Components of ESG Disclosure

Environmental Factors

Social Factors

Governance Factors

Standards for ESG Disclosure

Global Reporting Initiative (GRI)

Sustainability Accounting Standards Board (SASB)

Task Force on Climate-related Financial Disclosures (TCFD)

Benefits of ESG Disclosure

Enhanced Reputation

Better Risk Management

Access to Capital

Challenges of ESG Disclosure

Lack of Standardization

Incomplete or Inaccurate Data

Resistance From Management

Final Thoughts

ESG Disclosure FAQs

ESG disclosure is the public reporting of a company's environmental, social, and governance (ESG) performance. It provides transparency and accountability to stakeholders, including investors, customers, employees, and communities.

ESG disclosure is important because it allows stakeholders to assess a company's social and environmental impact, and make informed decisions about their engagement with the company. It also helps companies to identify and manage ESG risks and opportunities, improve their reputation, and attract more investors and customers.

ESG disclosure typically consists of three main components: environmental factors, social factors, and governance factors. Environmental factors refer to a company's impact on the natural environment, social factors refer to a company's impact on society, and governance factors refer to a company's management structure and practices.

There are several standards for ESG disclosure, including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD). These standards provide guidance and consistency in the reporting of ESG performance.

Challenges of ESG disclosure include a lack of standardization, incomplete or inaccurate data, and resistance from management. However, companies that adopt best practices for ESG reporting can overcome these challenges and fully realize the benefits of ESG disclosure.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.