Feed-In Tariff (FIT) is a policy mechanism designed to promote the growth of renewable energy sources by offering long-term contracts to energy producers. Under this framework, electricity generated from renewable sources is purchased at a predetermined rate, typically higher than the market price, to encourage investment and development of clean energy infrastructure. FIT programs incentivize renewable energy production by guaranteeing favorable financial returns for investors. As a result, they have become an essential tool for governments and policymakers seeking to transition towards greener and more sustainable energy systems. These programs have been implemented in many countries worldwide, and their effectiveness depends on various factors, including the tariff rate, contract duration, and regulatory framework. In the context of wealth management, FIT serves as an attractive investment opportunity, providing a stable and predictable revenue stream for those who invest in renewable energy projects. This financial instrument allows investors to diversify their portfolio while contributing to the global shift towards clean energy and reducing carbon emissions. Moreover, FIT-backed investments are known to mitigate risks associated with volatile energy markets and regulatory changes. The long-term nature of these contracts ensures consistent cash flows, enabling investors to make strategic decisions regarding their wealth management plans. The concept of Feed-In Tariff originated in the United States during the late 1970s as a response to the energy crisis. Policymakers sought to encourage renewable energy production by offering attractive prices to independent power producers. This approach gained traction in Europe during the 1990s, with Germany becoming the first country to adopt a comprehensive FIT program in 2000. Since then, numerous countries have implemented their own FIT schemes to foster the growth of renewable energy sources, such as solar, wind, hydro, and biomass. These policies have played a critical role in increasing the share of renewables in the global energy mix and driving down the cost of clean energy technologies. The initial success of FIT policies in Germany and other European countries inspired other nations to follow suit. Early adopters, such as Spain and Italy, experienced rapid growth in renewable energy production, which led to the creation of new jobs and reduced reliance on fossil fuels. These countries have set a precedent for implementing FIT programs, demonstrating the potential for significant economic and environmental benefits. As FIT policies became more widespread, they evolved to address the unique energy landscapes of each country. For instance, some nations introduced capacity caps, while others established technology-specific tariffs to support the development of diverse renewable energy sources. Feed-In Tariff policies function by offering long-term contracts to renewable energy producers, guaranteeing a fixed rate for electricity generated from eligible sources. Typically, this rate is higher than the prevailing market price, creating an economic incentive for investors to develop renewable energy projects. The additional cost incurred by utilities is then passed on to consumers, spreading the financial burden of supporting clean energy development across the population. In order to ensure fair competition and promote efficiency, FIT programs often include a degression mechanism, which gradually reduces the tariff rate over time. This encourages renewable energy producers to continually improve their technology and lower costs, while still enjoying the benefits of a stable and predictable revenue stream. FIT policies cover a wide range of renewable energy technologies, such as solar photovoltaic, wind, hydro, biomass, and geothermal power. By offering financial incentives for a variety of clean energy sources, governments can diversify their energy mix and reduce dependence on fossil fuels. Each technology may be subject to different tariff rates, depending on factors such as resource availability, cost competitiveness, and local environmental impacts. This flexibility allows FIT programs to be tailored to the specific needs and goals of each country or region. The tariff structure of FIT policies is a critical component that determines the level of financial support provided to renewable energy producers. Tariffs can be set in various ways, including fixed rates, premium payments, or a combination of both. Fixed rates are predetermined prices for electricity generated from eligible sources, while premium payments involve offering a bonus on top of the market price. In some cases, tariffs may also vary based on project size, location, or resource availability. This approach enables governments to target specific areas or technologies that require additional support or are deemed more strategic for achieving national renewable energy goals. The contract duration of FIT programs plays a significant role in determining the attractiveness of renewable energy investments. Longer contracts offer greater financial security for investors, as they guarantee a stable revenue stream for an extended period. Typical contract lengths range from 10 to 25 years, although the specific duration depends on the jurisdiction and the technology involved. A longer contract duration can help reduce risks associated with policy uncertainty and market volatility. However, it is essential to balance this stability with the need to adapt to evolving market conditions and technological advancements in the renewable energy sector. Apart from the guaranteed tariffs, FIT programs often include additional incentives and subsidies to further encourage investment in renewable energy projects. These may come in the form of tax credits, grants, low-interest loans, or reduced permitting fees. Such incentives help lower the financial barriers to entry and make renewable energy projects more economically viable for investors. By offering a comprehensive package of financial support, FIT policies can drive significant growth in renewable energy capacity, contribute to job creation, and stimulate innovation in the clean energy sector. FIT policies have proven to be an effective means of attracting private investment in the renewable energy sector. By offering long-term contracts and guaranteed returns, they provide a strong financial incentive for investors to allocate resources towards clean energy projects. This investment not only supports the transition to a low-carbon economy but also helps diversify investor portfolios and generate attractive risk-adjusted returns. The predictable cash flows generated by these investments allow investors to plan their wealth management strategies more effectively, while also benefiting from the positive environmental and social impact of supporting clean energy development. FIT-backed investments offer a unique advantage in terms of risk mitigation. The long-term nature of the contracts and the guaranteed tariffs ensure a steady stream of income, which can help investors weather economic downturns and market volatility. Additionally, these investments contribute to the diversification of an investment portfolio, reducing overall risk exposure. Investing in renewable energy projects supported by FIT policies contributes to the global shift towards clean energy and helps combat climate change. As investors increasingly prioritize environmental, social, and governance (ESG) factors in their wealth management strategies, FIT-backed investments offer an attractive opportunity to align financial returns with sustainable development goals. One of the primary challenges associated with FIT programs is the high initial cost of renewable energy projects. Although the cost of clean energy technologies has decreased significantly in recent years, large-scale deployment still requires substantial upfront investment. This can create financial barriers for smaller investors or those with limited access to capital. While FIT programs offer a degree of stability for renewable energy investors, they are not immune to market volatility and price fluctuations. Changes in energy markets, driven by factors such as global economic trends, geopolitical events, or technological advancements, can impact the long-term viability of FIT-backed projects and pose risks for investors. The effectiveness of FIT policies is largely dependent on the regulatory and policy environment in which they are implemented. Changes in government priorities, regulatory frameworks, or political landscapes can lead to modifications or even termination of FIT programs. This uncertainty can create challenges for investors and hinder the long-term growth of renewable energy markets. As the renewable energy sector continues to evolve rapidly, there is a risk that technologies supported by current FIT policies may become obsolete or less competitive over time. This can impact the long-term profitability of FIT-backed investments, as newer and more efficient technologies enter the market. Investors need to carefully consider the potential for technological advancements and their implications for renewable energy projects. A Feed-In Tariff (FIT) is a policy mechanism that provides incentives for renewable energy generation by offering a fixed payment rate for electricity fed into the grid from renewable sources. FIT programs work by guaranteeing a premium rate for renewable energy producers, ensuring a stable income over a specific duration. The components of a FIT include setting a tariff rate, contract duration, and establishing a regulatory framework. The benefits of FIT programs include encouraging the development and deployment of renewable energy technologies, reducing reliance on fossil fuels, and contributing to a more sustainable and low-carbon energy system. FIT programs also face challenges. Grid integration can be complex, as accommodating intermittent renewable energy sources requires infrastructure and system upgrades. Market design is also a challenge, as FITs may disrupt traditional energy markets and require careful coordination.What Is Feed-In Tariff (FIT)?

Importance of FIT in Wealth Management

Historical Background

Origins and Development of FIT

Early Adoption and Implementation

How Feed-In Tariff (FIT) Works

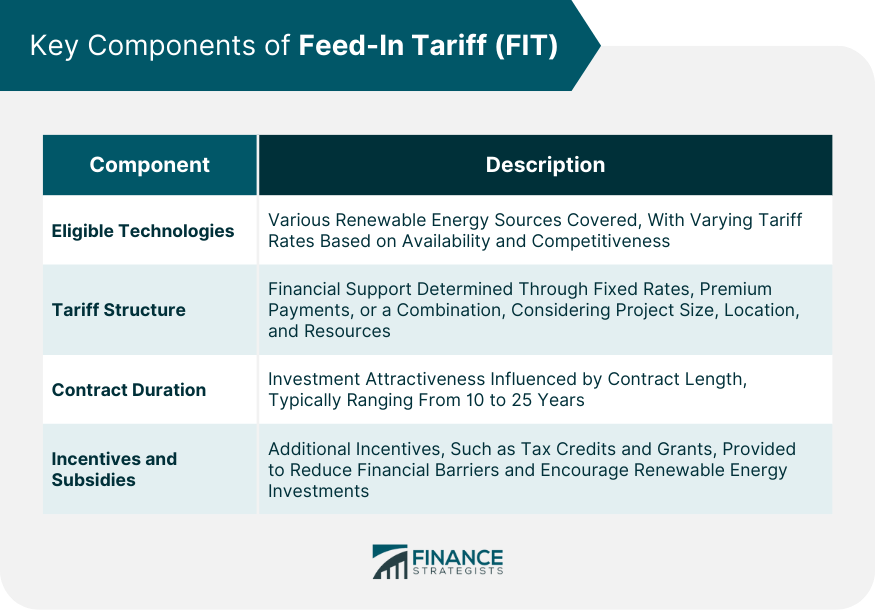

Key Components of FIT

Eligible Technologies

Tariff Structure

Contract Duration

Incentives and Subsidies

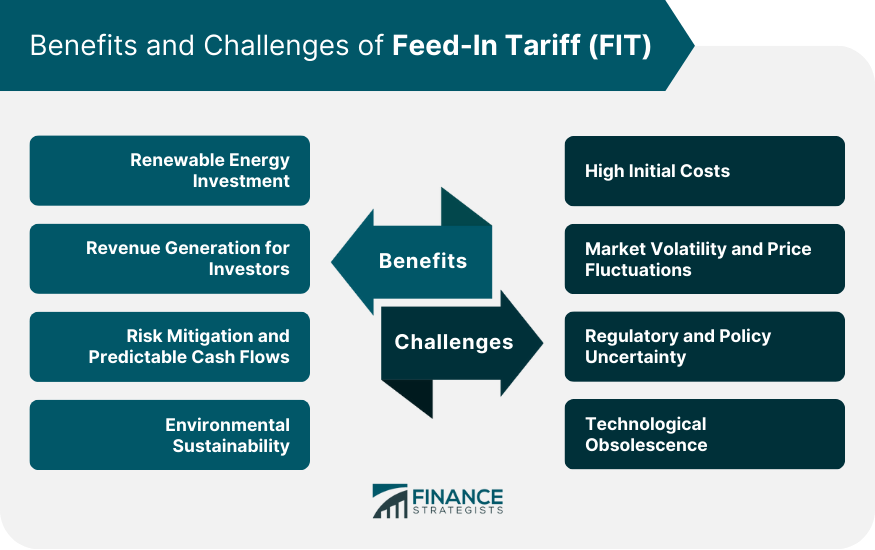

Benefits of FIT in Wealth Management

Renewable Energy Investment

Revenue Generation for Investors

Risk Mitigation and Predictable Cash Flows

Environmental Sustainability

Challenges and Limitations of FIT

High Initial Costs

Market Volatility and Price Fluctuations

Regulatory and Policy Uncertainty

Technological Obsolescence

Conclusion

Feed-In Tariff (FIT) FAQs

A feed-in tariff (FIT) is a policy mechanism that offers guaranteed payments to renewable energy producers for the electricity they generate.

Under a FIT scheme, renewable energy producers are paid a fixed price for the electricity they generate and feed into the grid for a specified contract duration.

Feed-In Tariffs provide benefits such as incentivizing renewable energy investment, ensuring predictable cash flows, promoting sustainability, and reducing greenhouse gas emissions.

Risks of FIT schemes include high initial costs, market volatility, regulatory uncertainties, and the potential for technological obsolescence.

Yes, many countries have implemented Feed-In Tariff programs as a means to accelerate the adoption of renewable energy sources and promote sustainable energy production.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.