Climate bonds are debt instruments issued by governments, corporations, or financial institutions to fund projects with positive environmental impacts. They typically focus on renewable energy, clean transportation, sustainable agriculture, and other low-carbon initiatives. These bonds appeal to environmentally conscious investors who want to support sustainable projects while receiving a financial return. The primary purpose of climate bonds is to mobilize private capital for environmentally beneficial projects, helping to bridge the funding gap for climate change mitigation and adaptation. They also raise awareness about climate change and promote transparency in environmental finance. Additionally, climate bonds provide issuers with an opportunity to diversify their funding sources and attract a broader range of investors. Climate bonds can be categorized based on their use of proceeds, issuer, or targeted sectors. Some common types include green bonds, social bonds, and sustainability bonds. Green bonds finance projects with clear environmental benefits, while social bonds support projects with positive social outcomes. Sustainability bonds combine both environmental and social objectives. To ensure credibility and transparency, various organizations have developed standards and certification schemes for climate bonds. The Climate Bonds Initiative (CBI) is an international, investor-focused nonprofit organization that promotes the use of climate bonds to finance the global transition to a low-carbon economy. They have developed the Climate Bonds Standard, a detailed framework that defines eligibility criteria for green bond projects and provides guidance on disclosure and reporting. The International Capital Market Association (ICMA) is a self-regulatory organization that aims to promote the efficient functioning of global capital markets. They have developed the Green Bond Principles, a set of voluntary guidelines that recommend transparency, disclosure, and reporting practices for green bond issuers. The Green Bond Principles (GBP), established by the ICMA, provide a framework for the issuance of green bonds. These principles outline the key components of green bonds, including the use of proceeds, project evaluation and selection, management of proceeds, and reporting. The Social Bond Principles (SBP), also developed by the ICMA, are a set of guidelines designed for the issuance of social bonds. These principles aim to promote transparency and integrity in the social bond market by providing guidance on the selection of projects, management of proceeds, and reporting. The Sustainability Bond Guidelines (SBG), created by the ICMA, offer guidance for issuers of sustainability bonds, which combine both environmental and social objectives. These guidelines help issuers ensure that their bonds meet market expectations for transparency, disclosure, and reporting. The process of issuing a climate bond typically involves several key steps, from project identification to post-issuance reporting. Before issuing a climate bond, the issuer must identify eligible projects, assess their environmental impact, and obtain external reviews to ensure compliance with relevant standards. Project Identification: Issuers need to select projects with clear environmental benefits that align with the bond's objectives. Issuer Eligibility: The issuer must meet certain criteria, such as financial standing and creditworthiness, to be eligible for issuing a climate bond. External Review: Independent third parties, such as auditors or rating agencies, may review the bond's environmental impact and compliance with standards to ensure transparency and credibility. During the bond issuance phase, the issuer works with underwriters, legal advisors, and marketing teams to price, document, and promote the climate bond. Pricing and Underwriting: The issuer collaborates with underwriters to determine the bond's interest rate, maturity, and other terms, taking into consideration market conditions and investor demand. Legal Documentation: Issuers must prepare legal documents, such as the prospectus and bond indenture, which outline the terms and conditions of the bond offering and provide relevant information to investors. Marketing and Investor Engagement: To generate interest in the bond, issuers engage in marketing campaigns and investor roadshows, highlighting the environmental benefits of the projects being financed. After issuing a climate bond, the issuer must meet ongoing reporting and verification requirements to demonstrate the bond's environmental impact and compliance with standards. Monitoring and Reporting: Issuers are required to track the progress of funded projects and provide regular updates on the environmental impact and use of proceeds to investors and other stakeholders. Impact Assessment: Issuers should conduct impact assessments to evaluate the effectiveness of the bond in achieving its environmental objectives and to inform future project selection. Verification and Assurance: Independent third parties may verify the issuer's compliance with relevant standards and provide assurance on the accuracy of the reported environmental impact. Climate bonds offer numerous benefits to issuers, investors, and the environment. Climate bonds help finance projects that contribute to reducing greenhouse gas emissions, conserving natural resources, and promoting sustainable development. They play a crucial role in the global effort to combat climate change and transition to a low-carbon economy. Climate bonds can provide competitive financial returns for investors, as they typically offer similar yields and risk profiles as traditional bonds. They also help diversify investment portfolios by providing exposure to the growing green economy. Issuing climate bonds can enhance an organization's reputation and demonstrate its commitment to sustainability. This can help attract environmentally conscious investors, customers, and employees, as well as improve stakeholder relations. As governments around the world implement stricter environmental regulations, issuing climate bonds can help organizations meet these requirements and avoid potential penalties. Despite their benefits, climate bonds face certain challenges and criticisms. Some issuers may use climate bonds as a form of greenwashing, exaggerating the environmental benefits of their projects or misallocating funds. This can undermine the credibility of the climate bond market and diminish investor confidence. Although the climate bond market has grown rapidly in recent years, it remains a small fraction of the overall bond market. This limits the amount of capital available for environmentally beneficial projects and may constrain the growth of the green economy. The absence of universally accepted standards for climate bonds can create confusion among issuers and investors, potentially hindering market development. Efforts to harmonize standards and certification schemes are ongoing, but progress has been slow. The process of issuing a climate bond can be complex and costly, particularly for smaller issuers. This may discourage some organizations from pursuing climate bond financing, even if they have eligible projects. Climate bonds are debt instruments that are issued by governments, corporations, or financial institutions to fund projects with positive environmental impacts, such as renewable energy, clean transportation, and sustainable agriculture. To ensure credibility and transparency, various organizations have developed standards and certification schemes for climate bonds. The process of issuing a climate bond involves several key steps, from project identification to post-issuance reporting. Climate bonds offer numerous benefits to issuers, investors, and the environment, including environmental impact, financial performance, reputation and branding, and regulatory compliance. Efforts to harmonize standards and certification schemes are ongoing, and the growth of the climate bond market presents a significant opportunity for mobilizing private capital for environmentally beneficial projects. What Are Climate Bonds?

Climate Bond Standards and Certification

Climate Bonds Initiative (CBI)

International Capital Market Association (ICMA)

Green Bond Principles (GBP)

Social Bond Principles (SBP)

Sustainability Bond Guidelines (SBG)

Climate Bond Issuance Process

Pre-Issuance Steps

Bond Issuance

Post-Issuance Requirements

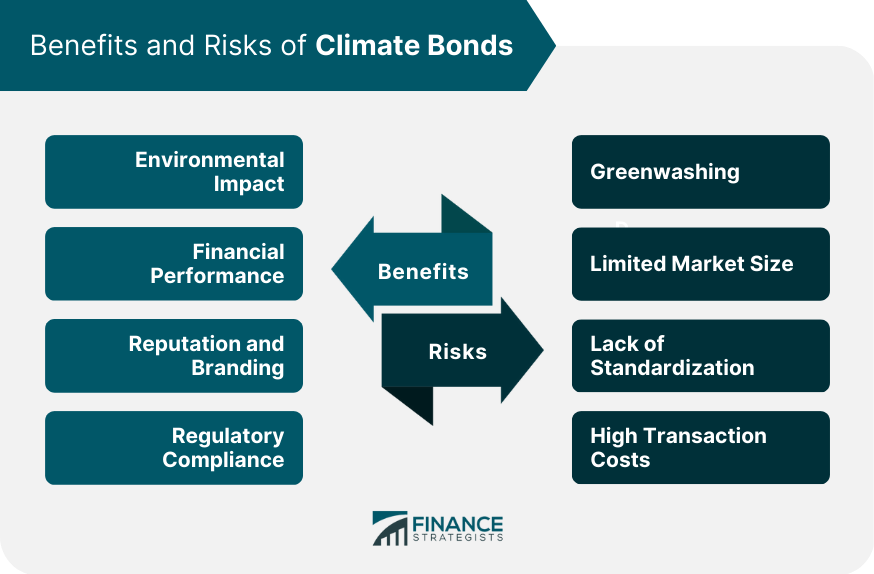

Benefits of Climate Bonds

Environmental Impact

Financial Performance

Reputation and Branding

Regulatory Compliance

Risks and Challenges of Climate Bonds

Greenwashing

Limited Market Size

Lack of Standardization

High Transaction Costs

Conclusion

These bonds help bridge the funding gap for climate change mitigation and adaptation, raise awareness about climate change, and promote transparency in environmental finance.

However, they also face certain challenges and criticisms, such as greenwashing, limited market size, lack of standardization, and high transaction costs.

As the world faces the urgent challenges of climate change, climate bonds are poised to play a crucial role in the transition to a low-carbon economy.

Climate Bonds FAQs

Climate bonds are fixed income securities designed to fund projects that mitigate climate change or help adapt to its impacts.

Investing in climate bonds helps finance green projects, diversify portfolios, and potentially generate attractive returns while supporting sustainable development.

Climate bonds are exposed to market and credit risks, and the green credentials of the underlying projects may be subject to scrutiny.

Climate bonds are certified against criteria developed by the Climate Bonds Initiative (CBI), an international not-for-profit organization.

Issuers are required to disclose the use of proceeds and provide regular reporting on the environmental impact of the projects financed by climate bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.