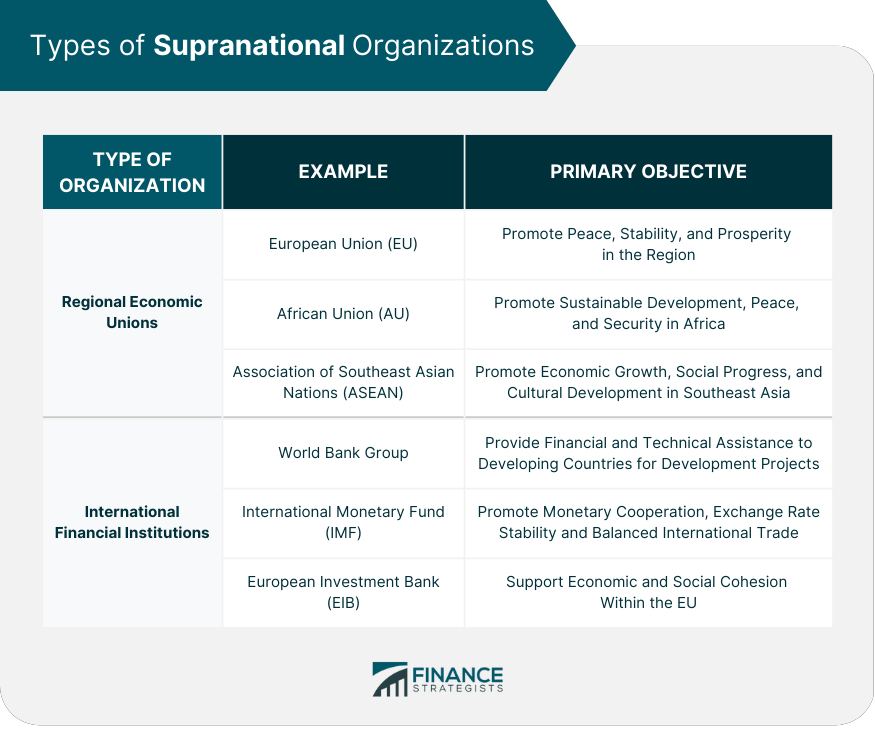

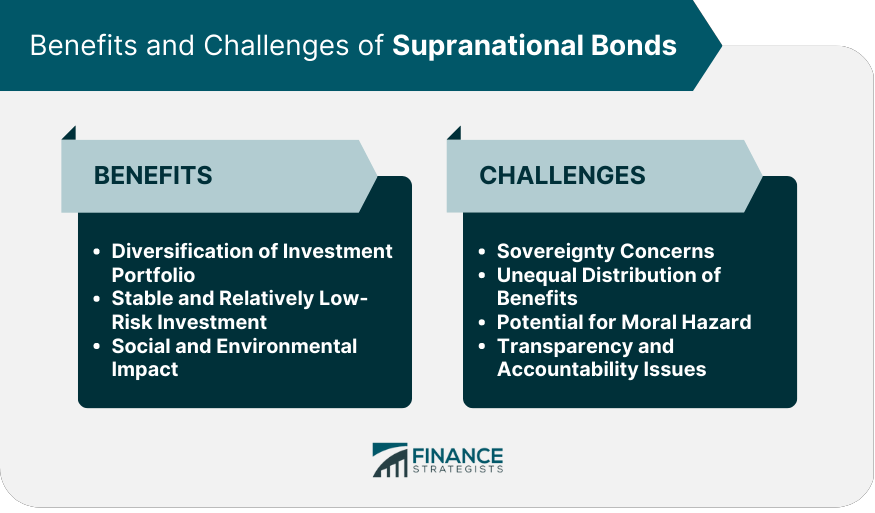

Supranational bonds are debt instruments issued by supranational organizations, which are institutions created by the governments of several countries to promote economic, political, and social cooperation. These bonds play a crucial role in the global economy by providing financing for development projects, addressing social and environmental issues, and fostering economic stability. The European Union is a political and economic union of 27 European countries that aims to promote peace, stability, and prosperity in the region. It is one of the largest issuers of supranational bonds. The African Union is a continental union consisting of 55 member states in Africa. Its primary objective is to promote sustainable development, peace, and security across the continent. ASEAN is a regional intergovernmental organization comprising ten Southeast Asian countries. It aims to promote economic growth, social progress, and cultural development in the region. The World Bank Group is an international financial institution that provides financial and technical assistance to developing countries for development projects. The IMF is an international organization that promotes monetary cooperation, exchange rate stability, and balanced international trade. The EIB is the European Union's long-term lending institution that supports economic and social cohesion within the EU. Supranational organizations issue bonds to raise funds for large-scale infrastructure projects such as transportation, energy, and telecommunications. These bonds also finance initiatives that address pressing social and environmental issues, such as poverty alleviation, education, and climate change. Supranational bonds provide resources for programs aimed at fostering economic development and stability in member countries. Investing in supranational bonds can help diversify an investment portfolio by providing exposure to different regions and sectors. Supranational bonds are considered relatively low-risk investments due to the strong backing from their member countries. Investors can support social and environmental causes by investing in green, social, and sustainability bonds. Some critics argue that supranational organizations may infringe upon the sovereignty of their member countries, potentially leading to a loss of control over domestic economic and political decisions. There are concerns that the benefits of supranational bonds may not be equally distributed among all member countries, with wealthier nations receiving a disproportionate share of the advantages. The issuance of supranational bonds may create a moral hazard, as governments might rely on these bonds to finance unsustainable projects or delay necessary economic reforms. Supranational organizations may face challenges related to transparency and accountability, as their decision-making processes can be complex and not easily understood by the public. The ESM is a crisis resolution mechanism for euro area countries that provides financial assistance to its members in times of need. Its bonds played a significant role in helping countries such as Greece, Ireland, and Portugal during the European debt crisis. The World Bank has been a pioneer in issuing green bonds, which finance projects aimed at addressing climate change and other environmental challenges. These bonds have been instrumental in mobilizing private sector capital for climate-related projects. The AfDB has issued social bonds to finance projects that improve living conditions and economic opportunities for people in Africa. These bonds support initiatives in areas such as healthcare, education, and access to clean water. The global economic landscape is constantly changing, and supranational bonds will need to adapt to these shifts to remain relevant and effective. For instance, emerging market economies are becoming increasingly important players in the global economy and may have a growing influence on supranational bond issuance. As the world becomes more aware of environmental and social challenges, there is potential for significant growth in the issuance of green, social, and sustainability bonds. Technological advancements and financial innovation may lead to new types of supranational bonds, such as blockchain based bonds or bonds with innovative risk-sharing structures. Supranational bonds play a vital role in promoting global economic stability, development, and cooperation. They provide funding for essential projects, address social and environmental issues, and offer a relatively low-risk investment opportunity for investors. Despite some challenges and criticisms, supranational bonds are expected to remain an important component of the global financial landscape in the years to come.What Are Supranational Bonds?

Types of Supranational Organizations

Regional Economic Unions

European Union (EU)

African Union (AU)

Association of Southeast Asian Nations (ASEAN)

International Financial Institutions

World Bank Group

International Monetary Fund (IMF)

European Investment Bank (EIB)

Issuance of Supranational Bonds

Purpose of Bond Issuance

Financing Infrastructure Projects

Addressing Social and Environmental Issues

Supporting Economic Development and Stability

Benefits of Supranational Bonds

Diversification of Investment Portfolio

Stable and Relatively Low-Risk Investment

Social and Environmental Impact

Challenges and Criticisms of Supranational Bonds

Sovereignty Concerns

Unequal Distribution of Benefits

Potential for Moral Hazard

Transparency and Accountability Issues

Case Studies and Examples

European Stability Mechanism (ESM) Bonds

World Bank's Green Bonds

African Development Bank (AfDB) Social Bonds

Future Outlook for Supranational Bonds

Impact of Evolving Global Economic Landscape

Potential for Growth in Green and Social Bonds

Innovations in Bond Structures and Financing Mechanisms

Conclusion

Supranational Bonds FAQs

Supranational bonds are debt instruments issued by supranational organizations, which are institutions created by multiple governments to promote economic, political, and social cooperation. These bonds play a critical role in the global economy by providing financing for development projects, addressing social and environmental issues, and fostering economic stability.

Supranational organizations, such as the European Union (EU), African Union (AU), Association of Southeast Asian Nations (ASEAN), World Bank Group, International Monetary Fund (IMF), and European Investment Bank (EIB), issue supranational bonds. The bonds are issued to finance large-scale infrastructure projects, address social and environmental issues, and support economic development and stability.

There are various types of supranational bonds available for investors, including sovereign bonds, green bonds, social bonds, and sustainability bonds. Sovereign bonds are issued by national governments, while green, social, and sustainability bonds finance projects with positive environmental, social, and combined environmental and social benefits, respectively.

Investing in supranational bonds offers several benefits, including diversification of investment portfolios, stable and relatively low-risk investments, and the opportunity to support social and environmental causes. These bonds are typically backed by multiple countries, which contributes to their lower risk profile compared to individual sovereign bonds.

Challenges and criticisms of supranational bonds include concerns over sovereignty, unequal distribution of benefits, potential for moral hazard, and transparency and accountability issues. Critics argue that supranational organizations may infringe upon the sovereignty of member countries, create imbalances in the distribution of benefits, encourage reckless financing behavior, and lack adequate transparency in their decision-making processes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.