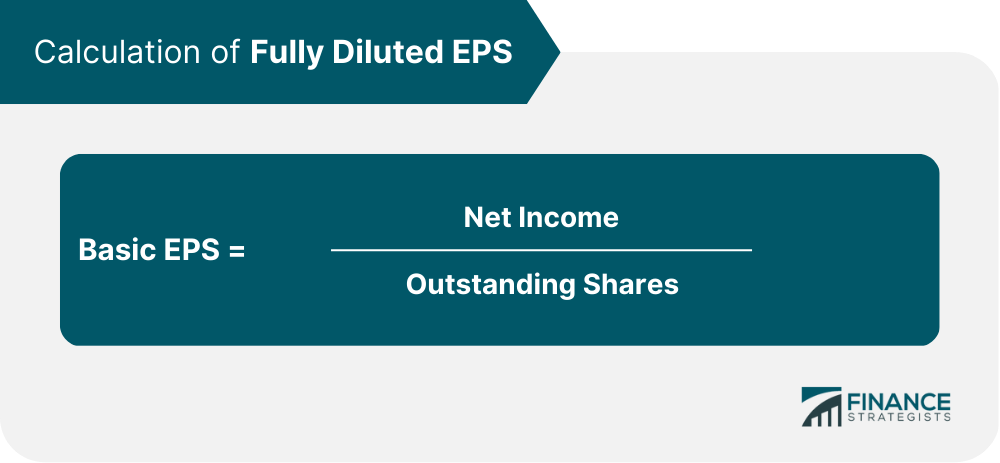

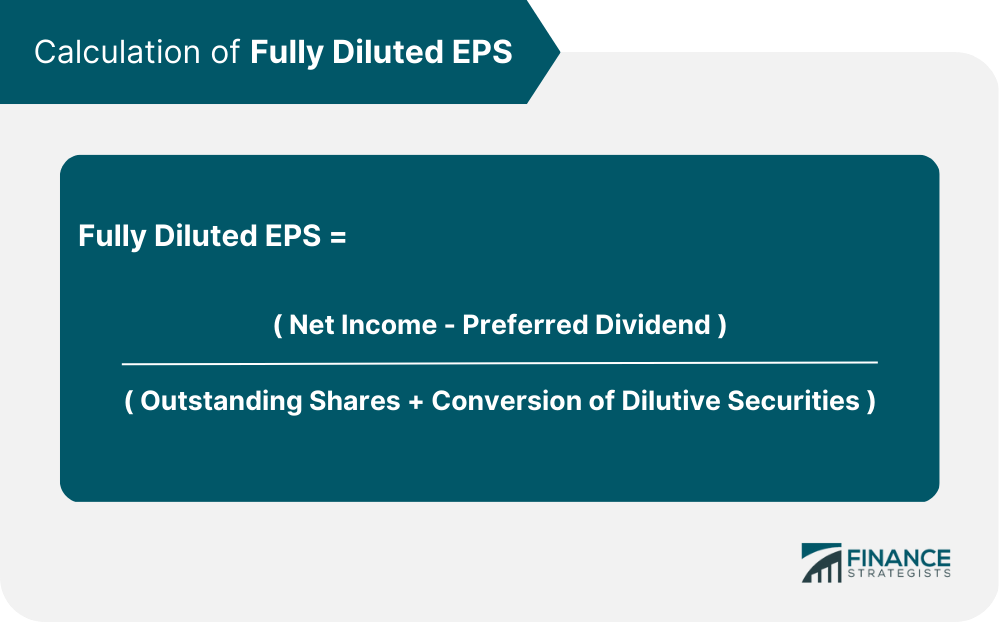

Fully diluted EPS is a financial metric used to assess a company's profitability and earnings per share. EPS is one of the most commonly used financial ratios to measure a company's financial health and performance. The EPS calculation takes into account the company's net income and the number of outstanding shares. The fully diluted EPS calculation goes a step further and considers the impact of all potentially dilutive securities on the number of outstanding shares. It is an essential financial metric for investors, analysts, and companies to assess the impact of various securities on the company's earnings per share. Basic EPS is calculated by dividing a company's net income by the number of outstanding shares. The formula for basic EPS is as follows: However, when a company has securities that can be converted into common stock, the number of outstanding shares increases, reducing the EPS. The fully diluted EPS calculation considers the potential dilution effect of all securities that could convert into common stock. The formula for fully diluted EPS is as follows: The fully diluted EPS formula is more complex than the basic EPS formula as it considers various securities that could convert into common stock. The denominator of the fully diluted EPS formula includes all common shares and potentially dilutive securities that could be converted into common shares. There are various types of securities that could impact the fully diluted EPS calculation. The most common types of securities include stock options, warrants, convertible preferred stocks, convertible bonds, and anti-dilution provisions. A stock option is a contract that gives an employee the right to buy company stock at a specified price. Stock options are often used as a form of employee compensation, and they can be exercised at a later date. When stock options are exercised, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. A warrant is a financial instrument that gives the holder the right to buy company stock at a specified price. Warrants are often issued as a part of a bond offering and can be exercised at a later date. When warrants are exercised, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. Convertible preferred stocks are a type of security that can be converted into common stock at a later date. When convertible preferred stocks are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. Convertible bonds are a type of bond that can be converted into common stock at a later date. When convertible bonds are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. Anti-dilution provisions are clauses in securities contracts that protect investors from dilution. Anti-dilution provisions can impact the fully diluted EPS calculation as they can affect the conversion price of the securities. Fully diluted EPS is an essential financial metric for investors as it provides a more accurate representation of a company's earnings per share. It is important to compare the fully diluted EPS of companies in the same industry to assess their financial health and performance. The fully diluted EPS metric is useful for comparing companies in the same industry. A higher fully diluted EPS indicates that the company is generating more earnings per share than its competitors. Investors can use this information to identify companies that are more profitable and have better financial performance. Fully diluted EPS can also impact the stock valuation of a company. Investors often use the price-to-earnings (P/E) ratio to value stocks. The P/E ratio is calculated by dividing the current stock price by the EPS. A higher fully diluted EPS can lead to a higher P/E ratio, indicating that investors are willing to pay more for a company's stock. Companies with low fully diluted EPS are riskier investments as they have lower earnings per share. This could indicate that the company is not generating enough profits or that it has a higher potential for dilution. Investors should be cautious when investing in companies with low fully diluted EPS as they may have a higher risk of poor financial performance. While fully diluted EPS is an important financial metric, it has some limitations that investors should be aware of. The fully diluted EPS calculation relies on assumptions and estimates, such as the conversion price of the securities and the number of shares that could be converted. These assumptions and estimates may not always be accurate, which can impact the accuracy of the fully diluted EPS calculation. Inflation and currency fluctuations can impact the fully diluted EPS calculation as they can affect the conversion price of the securities. This can make it difficult to compare fully diluted EPS across companies in different countries or regions. Non-recurring events and exceptional items can also impact the fully diluted EPS calculation. For example, if a company has a one-time gain from the sale of an asset, it may inflate the net income used in the fully diluted EPS calculation. This can make it difficult to compare fully diluted EPS across different periods. Industry-specific factors can also impact the fully diluted EPS calculation. For example, companies in the technology industry may have more stock options and warrants than companies in the manufacturing industry. This can make it difficult to compare fully diluted EPS across industries. Fully diluted EPS is an important financial metric for investors, analysts, and companies to assess a company's earnings per share. The fully diluted EPS calculation takes into account all potentially dilutive securities and provides a more accurate representation of a company's earnings per share. Investors should compare the fully diluted EPS of companies in the same industry to assess their financial health and performance. Fully diluted EPS can also impact the stock valuation of a company, and investors should be cautious when investing in companies with low fully diluted EPS. While fully diluted EPS is an important financial metric, it has some limitations that investors should be aware of, including assumptions and estimates in the calculation, inflation and currency fluctuations, non-recurring events and exceptional items, and industry-specific factors. By understanding the fully diluted EPS calculation and its limitations, investors can make more informed investment decisions. For investment guidance, consider speaking to a wealth management professional.What Is Fully Diluted EPS?

Calculation of Fully Diluted EPS

Types of Securities that Affect Fully Diluted EPS

Stock Options

Warrants

Convertible Preferred Stocks

Convertible Bonds

Anti-dilution Provisions

Importance of Fully Diluted EPS in Investment Decisions

Comparison of Fully Diluted EPS Across Companies

Impact of Fully Diluted EPS on Stock Valuation

Risks Associated with Investing in Companies with Low Fully Diluted EPS

Limitations of Fully Diluted EPS

Assumptions and Estimates in the Calculation

Inflation and Currency Fluctuations

Non-Recurring Events and Exceptional Items

Industry-Specific Factors

Final Thoughts

Fully Diluted EPS FAQs

Fully diluted EPS is a financial metric used to assess a company's profitability and earnings per share. It takes into account all potential dilutive securities that could convert into common stock and affect the number of outstanding shares.

Fully diluted EPS is important for investors, analysts, and companies to assess the impact of various securities on the company's earnings per share. It is also useful for comparing companies in the same industry and can impact the stock valuation of a company.

Securities that can affect fully diluted EPS include stock options, warrants, convertible preferred stocks, convertible bonds, and anti-dilution provisions.

The limitations of fully diluted EPS include assumptions and estimates in the calculation, inflation and currency fluctuations, non-recurring events and exceptional items, and industry-specific factors.

Fully diluted EPS is calculated by subtracting preferred dividends from net income and then dividing the result by the sum of outstanding shares and potential dilutive securities. The formula for fully diluted EPS is (Net income - Preferred dividends) / (Outstanding shares + Conversion of dilutive securities).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.