Monetized installment sales (MIS) are financial arrangements that allow sellers to defer taxes on capital gains while receiving immediate liquidity. This type of transaction involves an installment sales contract, a third-party intermediary, and a monetization loan. MIS provides an effective way for sellers to manage their tax liabilities while maintaining access to funds. Benefits include deferred tax payments, immediate liquidity, and flexibility for both parties involved in the transaction. In a monetized installment sale, the seller agrees to accept payments over time while the buyer acquires the asset. Both parties enter into an installment sales contract, which outlines the terms and conditions of the sale. This legal document governs the sale, including the purchase price, payment terms, and other relevant details. The installment sales contract is crucial to ensuring the transaction complies with IRS guidelines. A third-party intermediary is essential in an MIS transaction to facilitate the transfer of funds and mitigate risks. The intermediary typically holds the buyer's payments in escrow, ensuring compliance with tax laws and reducing risk for both parties. The monetization loan provides the seller with immediate liquidity by lending the present value of the installment sales contract. This loan is secured by the contract itself and is repaid using the installment payments received from the buyer. The MIS process begins with the seller and buyer negotiating the terms of the sale. They must agree on the purchase price, payment schedule, and other relevant aspects of the transaction. Once the terms are agreed upon, the seller and buyer sign the installment sales contract. This contract solidifies the terms and sets the transaction in motion. The third-party intermediary steps in to manage the funds and ensure compliance with tax laws. They hold the buyer's installment payments in escrow, making disbursements to the seller as agreed upon in the contract. The seller applies for a monetization loan, which is approved based on the value of the installment sales contract. Once approved, the loan proceeds are disbursed to the seller, providing immediate liquidity. The seller repays the monetization loan using the installment payments received from the buyer. The repayment schedule is typically aligned with the installment sales contract, ensuring a smooth and timely repayment process. MIS transactions allow sellers to defer taxes on capital gains by spreading the gain recognition over the life of the installment contract. This can lead to significant tax savings and improved cash flow for the seller. The IRS has specific guidelines and requirements for MIS transactions, which must be followed to ensure tax deferral benefits. These include properly structured installment sales contracts and compliance with IRC Section 453. Despite the tax deferral benefits, MIS transactions can carry some tax liabilities and risks. These include potential changes in tax laws, increased scrutiny from the IRS, and the possibility of a buyer default. Sellers participating in MIS transactions must adhere to IRS reporting requirements. This typically involves filing Form 6252, which details information about the installment sale and includes relevant information on the seller's annual tax return. One of the primary advantages of MIS transactions is the immediate liquidity provided to the seller. The monetization loan allows sellers to access funds upfront, which can be used for investments, debt repayment, or other financial needs. MIS transactions enable sellers to defer taxes on capital gains, potentially reducing their overall tax burden. By spreading the gain recognition over the life of the installment contract, sellers can benefit from improved cash flow and tax management. MIS transactions offer flexibility for both buyers and sellers, as they can negotiate terms that suit their individual needs. This can include customized payment schedules, interest rates, and other unique aspects of the transaction. By involving a third-party intermediary and utilizing a monetization loan, MIS transactions help to mitigate risks and improve cash flow for sellers. This can be particularly beneficial for individuals or businesses with large capital gains. MIS transactions can be more complex than traditional sales, requiring additional legal and financial expertise. This can lead to increased costs and potential delays in the transaction process. The use of a third-party intermediary introduces additional risk to the transaction. Sellers must rely on the intermediary to manage funds and ensure compliance with tax laws, which can expose them to potential issues. Changes in tax laws can impact the tax deferral benefits of MIS transactions. Sellers should be aware of the potential for changes in legislation and consult with tax professionals to stay informed. There is a risk of buyer default in MIS transactions, which can leave sellers with uncollected payments and outstanding loan balances. Sellers must carefully assess the creditworthiness of buyers to mitigate this risk. Traditional installment sales allow sellers to defer taxes on capital gains but do not provide immediate liquidity, as payments are received over time. 1031 exchanges enable property owners to defer taxes on capital gains by reinvesting the proceeds into like-kind properties. This option is specific to real estate transactions and has strict requirements and deadlines. Seller financing involves the seller providing a loan to the buyer to facilitate the purchase, allowing the seller to defer taxes on capital gains. However, it does not provide immediate liquidity. Outright sales involve the transfer of an asset in exchange for immediate payment. While this provides immediate liquidity, it does not offer tax deferral benefits. Monetized installment sales offer a unique solution for sellers seeking to defer taxes on capital gains while maintaining access to immediate liquidity. With benefits such as tax deferral, flexibility, and improved cash flow, MIS transactions can be attractive for various types of sales and transfers. However, the complexity, reliance on third-party intermediaries, and potential risks must also be considered. Those considering a monetized installment sale should carefully assess their financial goals and weigh the advantages and disadvantages. Working with experienced tax professionals, legal advisors, and financial planners is essential to ensure a successful and compliant transaction. As tax laws and financial markets continue to evolve, monetized installment sales may see further developments and refinements. Staying informed about new trends and legislative changes is crucial for sellers and buyers interested in this financial strategy. If you are considering a monetized installment sale, it is essential to consult with experienced tax planning professionals. Reach out to a trusted tax advisor or financial planner to discuss your unique situation and explore the potential benefits and drawbacks of engaging in a monetized installment sale transaction.What Are Monetized Installment Sales?

Key Components of Monetized Installment Sales

Seller and Buyer Roles

Installment Sales Contract

Third-Party Intermediary Involvement

Monetization Loan

Process of Monetized Installment Sales

Seller and Buyer Negotiation

Execution of Installment Sales Contract

Involvement of Third-Party Intermediary

Monetization Loan Approval and Disbursement

Repayment of Monetization Loan

Tax Implications of Monetized Installment Sales

IRS Guidelines and Requirements

Potential Tax Liabilities and Risks

Reporting Requirements

Advantages of Monetized Installment Sales

Immediate Liquidity for Sellers

Deferred Tax Payments

Flexibility for Buyers and Sellers

Reduced Risk and Improved Cash Flow

Disadvantages and Potential Risks

Complexity of Transactions

Reliance on Third-Party Intermediaries

Potential for Changes in Tax Laws

Risk of Buyer Default

Alternatives to Monetized Installment Sales

Traditional Installment Sales

1031 Exchanges

Seller Financing

Outright Sales

Final Thoughts

Monetized Installment Sales FAQs

Monetized installment sales (MIS) are financial arrangements that allow sellers to defer taxes on capital gains while receiving immediate liquidity. This type of transaction involves an installment sales contract, a third-party intermediary, and a monetization loan.

The key components of MIS include seller and buyer roles, an installment sales contract, third-party intermediary involvement, and a monetization loan.

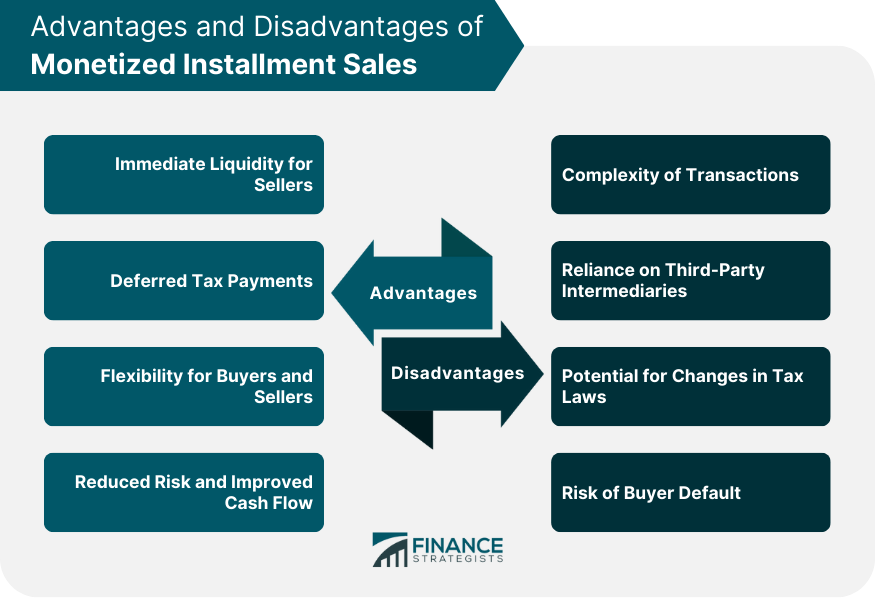

The advantages of MIS include immediate liquidity for sellers, deferred tax payments, flexibility for buyers and sellers, and reduced risk and improved cash flow.

The potential risks of MIS include the complexity of transactions, reliance on third-party intermediaries, potential changes in tax laws, and the risk of buyer default.

MIS transactions can be used in various types of sales and transfers, including real estate transactions, business sales and transfers, large-ticket item sales, and succession planning. Alternatives to MIS include traditional installment sales, 1031 exchanges, seller financing, and outright sales.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.