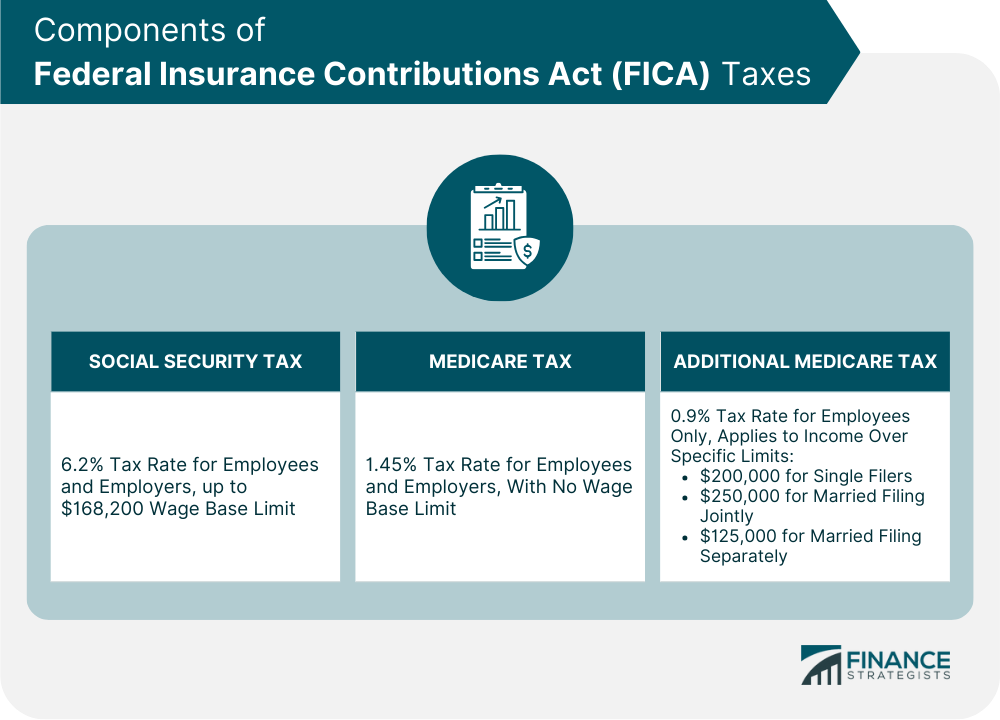

It is a United States federal law that mandates payroll taxes be paid by employees and employers to fund two major federal programs: Social Security and Medicare. The Social Security program provides retirement, disability, and survivor benefits for eligible individuals, while Medicare provides healthcare coverage for individuals aged 65 or older, as well as some individuals with disabilities or certain medical conditions. FICA taxes are automatically deducted from an employee's paycheck and are split between the employer and employee, with each party responsible for paying a specific percentage of the total tax. FICA taxes consist of two main components: Social Security tax and Medicare tax. Each tax has specific rates and limits that determine the amount contributed by employees and employers. The Social Security tax is designed to fund the Social Security program, which provides financial support to retirees, disabled individuals, and their dependents. Social Security offers a range of benefits, including retirement income, disability benefits, and survivor benefits for eligible family members. The program is critical for ensuring the financial well-being of millions of Americans who rely on these benefits. As of 2024, the Social Security tax rate is 6.2% for both employees and employers, up to a wage base limit of $168,600. This means that once an employee's wages reach this limit, no additional Social Security taxes are withheld for the remainder of the year. The Medicare tax funds the Medicare program, which provides health insurance coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities. Medicare helps cover a range of healthcare services, including hospital care, physician services, prescription drugs, and preventive care. The program plays a vital role in ensuring access to healthcare for millions of Americans. The Medicare tax rate is 1.45% for both employees and employers, with no wage base limit. This means that Medicare taxes are withheld from an employee's entire wages, regardless of the amount earned. In addition to the standard Medicare tax, certain high-income earners are subject to an Additional Medicare Tax. The Additional Medicare Tax was introduced to help fund the Medicare program and ensure its financial stability. It applies to individuals with wages, compensation, or self-employment income exceeding specific thresholds. The Additional Medicare Tax rate is 0.9% and only applies to the employee's share of the tax. The income thresholds for this tax are $200,000 for single filers, $250,000 for married filing jointly, and $125,000 for married filing separately. Both employees and employers have responsibilities when it comes to calculating, withholding, and reporting FICA taxes. FICA taxes are automatically withheld from an employee's wages by the employer, based on the applicable tax rates and wage limits. The withheld amounts are reported on the employee's paystub. At the end of each year, employers must provide employees with a Form W-2, which reports the total amount of wages earned and FICA taxes withheld during the year. Employees use this information to complete their individual income tax returns. Employers are responsible for calculating their share of FICA taxes and remitting these payments to the IRS. The employer's contribution rates are the same as the employee's rates for both Social Security and Medicare taxes. Employers are required to report their FICA tax liabilities and payments on a quarterly basis using Form 941, the Employer's Quarterly Federal Tax Return. Small employers with an annual FICA tax liability of $1,000 or less may file Form 944, the Employer's Annual Federal Tax Return, instead of Form 941. These forms provide the IRS with information about the employer's total payroll, FICA tax liability, and tax payments made during the reporting period. There are certain individuals and groups exempt from FICA taxes, as well as specific considerations for self-employed individuals. Nonresident aliens working in the United States are generally exempt from FICA taxes, with some exceptions. For instance, nonresident aliens who are employees of foreign governments or international organizations are subject to FICA taxes. Members of certain religious groups, such as the Amish or Mennonite communities, may be exempt from FICA taxes if they have established religious objections to receiving Social Security or Medicare benefits. Students working for the educational institution they attend may be exempt from FICA taxes if their employment is part of a work-study program or the work is incidental to their educational pursuits. Additionally, some other groups, such as certain foreign agricultural workers, are exempt from FICA taxes. Self-employed individuals are not subject to FICA taxes; instead, they must pay self-employment tax, which funds both Social Security and Medicare programs. The self-employment tax rate is 15.3%, which is equal to the combined employee and employer FICA tax rates. Self-employed individuals calculate and pay self-employment tax using Schedule SE and Form 1040, the U.S. Individual Income Tax Return. The tax is calculated based on the individual's net income from self-employment, subject to the same wage base limits as FICA taxes. Schedule SE is used to calculate the self-employment tax liability, while Form 1040 is used to report and pay the tax. Self-employed individuals must also report their self-employment income on Form 1040, Schedule C or Schedule F, depending on the nature of their business activities. The IRS plays a crucial role in enforcing FICA tax compliance and addressing non-compliance issues. The IRS is responsible for monitoring FICA tax compliance, investigating potential violations, and taking enforcement actions when necessary. This includes conducting audits, assessing penalties, and pursuing legal action against non-compliant employers and individuals. Employers and individuals who fail to comply with FICA tax requirements may face various penalties, including fines, interest, and criminal prosecution in severe cases. These penalties can be substantial and may have long-lasting consequences for both the employer and the individual. If an employer or individual disagrees with the IRS's assessment of their FICA tax liability, they have the right to dispute the matter through administrative appeals or by taking the issue to court. It is essential to seek professional advice when dealing with FICA tax disputes to ensure the best possible outcome. FICA taxes are crucial for funding essential social programs that benefit millions of Americans, including Social Security and Medicare. It is vital for both employees and employers to be well-informed about their responsibilities concerning FICA tax compliance, ensuring proper funding for these programs and avoiding potential penalties for non-compliance. As the landscape of FICA taxes continues to evolve, staying up to date with the latest developments is essential for informed decision-making regarding financial planning and obligations. Understanding the intricacies of FICA taxes enables individuals and businesses to navigate the ever-changing landscape of payroll taxes effectively. Employees and employers must remain vigilant about potential changes to FICA tax rates, limits, and the implications for Social Security and Medicare programs. By staying informed and adapting to these changes, employees can adjust their retirement savings strategies, while employers can reevaluate their payroll processes and budgeting to accommodate changes in FICA tax liabilities.What Is the Federal Insurance Contributions Act (FICA)?

Components of FICA Taxes

Social Security Tax

Purpose and Benefits

Contribution Rates and Limits

Medicare Tax

Purpose and Benefits

Contribution Rates and Limits

Additional Medicare Tax

Purpose and Applicability

Contribution Rates and Thresholds

FICA Tax Calculation and Reporting

Employee Contributions

Calculation and Withholding

Reporting on Form W-2

Employer Contributions

Calculation and Payment

Reporting on Form 941 or Form 944

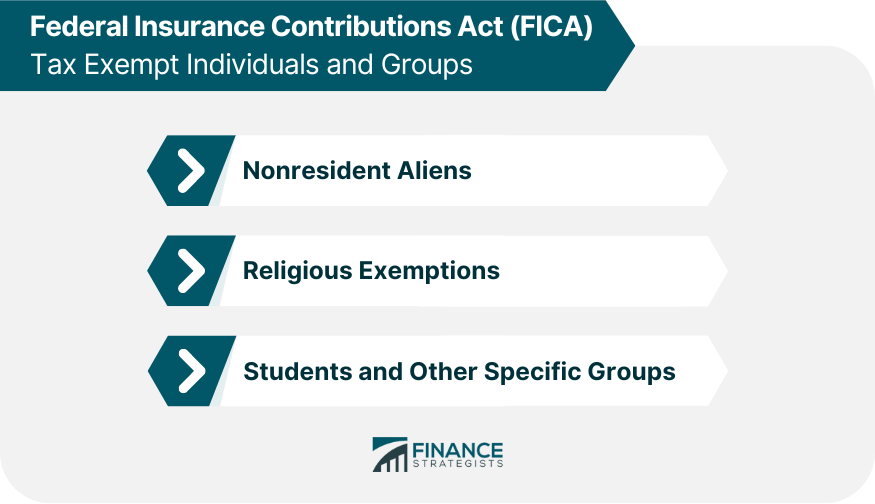

FICA Tax Exemptions and Special Considerations

Exempt Individuals and Groups

Nonresident Aliens

Religious Exemptions

Students and Other Specific Groups

Self-Employed Individuals

Self-Employment Tax and FICA

Calculation and Payment of Self-Employment Tax

Reporting on Schedule SE and Form 1040

FICA Tax Compliance and Enforcement

IRS Role in FICA Tax Enforcement

Penalties for Non-compliance

Resolving FICA Tax Disputes

Conclusion

Federal Insurance Contributions Act (FICA) FAQs

Federal Insurance Contributions Act (FICA) is a federal payroll tax law that requires employers and employees to contribute to Social Security and Medicare programs. It was enacted in 1935 as part of the Social Security Act.

The purpose of FICA is to fund Social Security and Medicare programs. Social Security provides retirement, disability, and survivor benefits to eligible workers and their families. Medicare provides health insurance to eligible individuals who are 65 years or older, as well as to certain disabled individuals. FICA taxes help to finance these programs.

FICA is composed of two parts: the Social Security tax and the Medicare tax. The Social Security tax is 12.4% of an employee's income, with 6.2% paid by the employee and 6.2% paid by the employer. The Medicare tax is 2.9% of an employee's income, with 1.45% paid by the employee and 1.45% paid by the employer.

FICA applies to all employees in the United States, regardless of their citizenship status, as long as they are earning income from an employer. Self-employed individuals are also required to pay both the employer and employee portion of FICA.

The maximum amount of earnings subject to Social Security tax changes annually. In 2024, the maximum amount of earnings subject to Social Security tax is $168,600. There is no maximum for Medicare tax; all earnings are subject to the tax.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.