Correcting a Top-Heavy status is crucial for maintaining the tax-advantaged status of a retirement plan, promoting fairness among plan participants, and ensuring compliance with applicable laws and regulations. A Top-Heavy retirement plan is a plan in which a substantial portion of the assets are attributable to key employees, as defined by the Internal Revenue Service (IRS). Top-Heavy plans can create compliance issues and may result in unfavorable consequences for both plan sponsors and participants. A retirement plan that is deemed Top-Heavy must meet specific requirements to ensure equitable benefits for all participants. Failure to comply with these requirements may result in penalties, plan disqualification, and other negative consequences. To determine whether a retirement plan is Top-Heavy, plan sponsors must first identify key employees and non-key employees. Key employees typically include officers, owners, and highly compensated employees. The Top-Heavy ratio is calculated by dividing the total account balances of key employees by the total account balances of all plan participants. A retirement plan is considered Top-Heavy if the Top-Heavy ratio exceeds 60%. Top-Heavy testing is typically performed annually, with the testing date coinciding with the end of the plan year. Plan sponsors can correct a Top-Heavy status by making non-elective contributions to the accounts of non-key employees. These contributions must be at least 3% of the employee's compensation. Alternatively, plan sponsors can increase matching contributions for non-key employees to help balance the plan's asset distribution. Modifying the plan's vesting schedule can help address Top-Heavy concerns by allowing non-key employees to access their employer contributions more quickly. Adjusting plan eligibility requirements, such as reducing the minimum age or service requirements, can encourage broader participation among non-key employees, potentially reducing the plan's Top-Heavy ratio. Plan sponsors can issue corrective distributions to key employees for excess contributions, reducing the Top-Heavy ratio by reallocating plan assets. Similarly, corrective distributions can be made for excess aggregate contributions, which include both employee deferrals and employer matching contributions. Expanding the availability of loans and distributions to non-key employees can help balance the plan's asset distribution and address Top-Heavy concerns. Plan sponsors may need to adjust contribution limits and allocations to ensure equitable distribution of plan benefits and avoid Top-Heavy issues. Plan sponsors must comply with IRS regulations regarding Top-Heavy status, including annual testing and implementing any necessary corrective actions. Retirement plans must also comply with DOL regulations, which govern fiduciary responsibilities, reporting and disclosure requirements, and other aspects of plan administration. Plan sponsors must maintain accurate records and documentation related to Top-Heavy testing and corrections, and may need to report corrective actions to the IRS and DOL as required. TPAs can assist plan sponsors in determining whether their plan is top-heavy based on the relevant IRC rules. They can review the plan's contribution and benefit allocations, as well as employee data, to determine whether the plan meets the top-heavy threshold. TPAs can help plan sponsors calculate the minimum contributions or benefits required for non-key employees to satisfy the top-heavy rules. They can ensure that the contributions are calculated correctly and comply with IRC requirements. TPAs can work with plan sponsors to design plan features that can help reduce top-heaviness. For example, they can suggest safe harbor contributions or a qualified automatic contribution arrangement (QACA) to provide additional benefits to non-key employees. If a plan is found to be top-heavy, TPAs can recommend corrective actions to the plan sponsor. This may include making additional contributions to non-key employees, amending the plan to change the allocation method or implementing other plan features that can help reduce top-heaviness. TPAs can assist plan sponsors in reporting top-heavy status to the IRS and in ensuring compliance with other relevant rules, such as the annual nondiscrimination testing requirements. The best way to prevent a plan from becoming top-heavy is to design it with a balanced allocation of benefits or contributions. This means that the plan should provide reasonable benefits to all employees, not just the highly compensated or key employees. One of the most effective ways to prevent top-heavy status is to offer safe harbor contributions. These are employer contributions that meet specific IRS requirements, such as a 3% non-elective contribution or a matching contribution. Safe harbor contributions can ensure that non-highly compensated employees receive a minimum level of contributions and benefits. A Qualified Automatic Contribution Arrangement (QACA) is a type of safe harbor plan that requires automatic enrollment of eligible employees and a default contribution rate. This can encourage non-highly compensated employees to participate in the plan and receive additional contributions. Social Security integration is a method of calculating employer contributions based on a participant's earnings and Social Security benefits. This can help ensure that contributions are allocated fairly to all employees and prevent top-heavy status. Plan sponsors should monitor their plan regularly to ensure that it remains compliant with IRS rules and regulations. This includes monitoring contribution and benefit allocations, as well as employee data. If a plan is at risk of becoming top-heavy, the plan sponsor can take corrective actions to prevent it from happening. Nondiscrimination testing is required by the IRS to ensure that a plan does not discriminate in favor of highly compensated employees. Plan sponsors should conduct testing annually to identify any potential issues with plan design or administration and take corrective actions as needed. Correcting a Top-Heavy status is essential for maintaining the tax-advantaged status of retirement plans, ensuring equitable benefits for all participants, and complying with applicable laws and regulations. Plan sponsors can employ a variety of correction strategies to address Top-Heavy issues, including increasing employer contributions, modifying plan design, and implementing corrective distributions. Proactive prevention strategies, such as thoughtful plan design and regular monitoring of plan demographics, can help minimize the risk of future Top-Heavy concerns. Compliance with IRS and DOL regulations is crucial for plan sponsors seeking to correct or prevent Top-Heavy issues. Working with TPAs can provide valuable assistance in navigating these complex requirements and ensuring successful outcomes for plan sponsors and participants.What Is Top-Heavy Correction?

Top-Heavy Test

Testing Methodology

Key Employees vs Non-key Employees

Top-Heavy Ratio Calculation

Threshold for Top-Heavy Status

Frequency and Timing of Testing

Top-Heavy Correction Options

Increased Employer Contributions

Non-elective Contributions

Matching Contributions

Plan Design Changes

Vesting Schedules

Plan Eligibility Requirements

Corrective Distributions

Excess Contributions

Excess Aggregate Contributions

Benefits, Rights, and Features Testing Adjustments

Availability of Loans and Distributions

Contribution Limits and Allocations

Compliance and Regulatory Requirements

Internal Revenue Service (IRS) Regulations

Department of Labor (DOL) Regulations

Documentation and Reporting Requirements

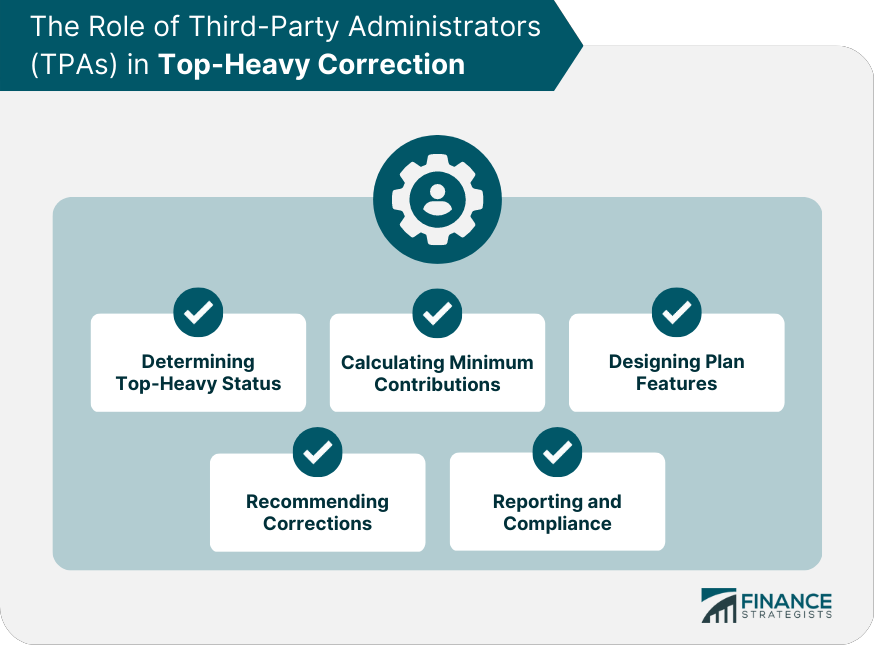

The Role of Third-Party Administrators (TPAs) in Top-Heavy Correction

Determining Top-Heavy Status

Calculating Minimum Contributions

Designing Plan Features

Recommending Corrections

Reporting and Compliance

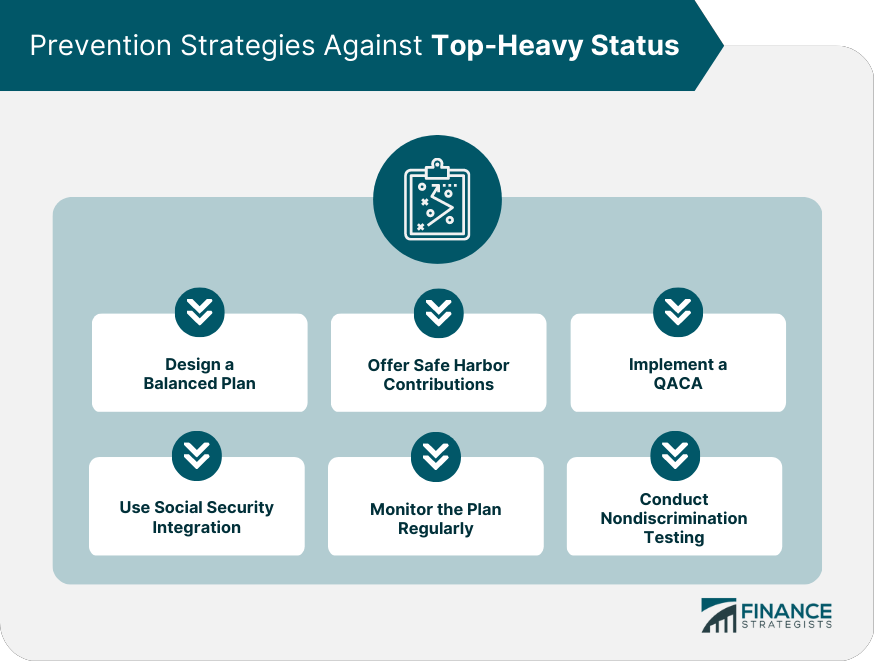

Prevention Strategies Against Top-Heavy Status

Design a Balanced Plan

Offer Safe Harbor Contributions

Implement a QACA

Use Social Security Integration

Monitor the Plan Regularly

Conduct Nondiscrimination Testing

Conclusion

Top-Heavy Correction FAQs

Top-Heavy Correction is a corrective action taken by an employer to ensure that a qualified retirement plan does not violate top-heavy rules under the Internal Revenue Code.

Top-Heavy Rules are IRS regulations that require qualified retirement plans to meet certain requirements to prevent discrimination against non-key employees. The rules consider a plan to be top-heavy if more than 60% of the plan's assets are attributable to key employees.

A Top-Heavy Correction is needed when a plan is deemed top-heavy and does not meet the top-heavy rules under the Internal Revenue Code.

If a plan is deemed top-heavy and does not meet the top-heavy rules, the employer may face penalties, including tax consequences and disqualification of the plan.

No, not all qualified retirement plans are subject to top-heavy rules. Top-heavy rules apply only to defined contribution plans, such as 401(k) plans, profit-sharing plans, and money purchase pension plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.