Plan document updates refer to revisions or changes made to the written document that outlines the terms and conditions of a particular retirement or employee benefit plan. These updates can be made for various reasons, such as changes in regulatory requirements, changes in the company's policies, or changes in the plan's operations. Plan Document Updates are essential for ensuring that the plan remains in compliance with applicable laws and regulations and that plan participants are provided with accurate information about their benefits. Plan document updates in retirement planning are paramount. They guarantee that the plan remains accurate and aligned with one's retirement goals, taking into consideration the evolving dynamics of personal life, market conditions, and legal landscape. It is important for plan sponsors to regularly review and update their plan documents to ensure that they reflect current laws and regulations and are consistent with the plan's actual operations. Failure to update plan documents can result in legal and regulatory compliance issues, which could lead to fines, penalties, and potential litigation. Life circumstances change over time. Marriage, childbirth, divorce, or the death of a spouse can significantly impact retirement needs and plans. Regular plan document updates ensure that the retirement plan stays in line with these changes. Laws and regulations governing retirement plans frequently change. Regular updates are necessary to ensure that the plan remains compliant and takes advantage of any potential benefits or avoids penalties associated with these changes. Regular updates allow for the adjustment of contributions and investment strategies, ensuring that retirement savings are optimized for the best possible outcome. The first step involves a thorough review of the existing plan to understand its current state and effectiveness in achieving retirement goals. Next, areas that require updates are identified. These could be due to changes in personal circumstances, financial conditions, or regulatory changes. Finally, the necessary changes are implemented in the plan documents, ensuring that they accurately represent the updated plan. Personal updates are changes related to the plan participant's personal circumstances that could impact their retirement planning. Examples of personal updates include changes in marital status, the number of dependents, or health conditions. These updates need to be reflected in the plan documents to ensure that the plan participant's benefits are accurate and up-to-date. Financial updates are changes related to the plan participant's financial situation, which could impact their retirement planning. Examples of financial updates include changes in income, expenses, debt, or personal assets. These updates need to be reflected in the plan documents to ensure that the plan participant's benefits and contributions are accurately aligned with their current financial situation. Investment updates are changes related to the plan participant's investment preferences, asset allocation, or risk tolerance, which could impact their retirement planning. These updates need to be reflected in the plan documents to ensure that the plan's investment strategy remains aligned with the retirement goals of the plan participant. Legislative updates are changes related to tax laws, contribution limits, or other retirement rules that could impact the retirement plan. These updates need to be reflected in the plan documents to ensure that the plan remains compliant and beneficial for the plan participant. For example, if there is a change in the contribution limits, the plan document needs to be updated to reflect the new limit so that the plan participant can make informed decisions about their contributions. Failure to update retirement plan documents can lead to potential risks such as non-compliance with laws, suboptimal investment strategy, or misalignment with retirement goals. Neglecting plan document updates can also result in missed opportunities for maximizing the growth of retirement savings, thus affecting the quality of life during retirement. While the frequency of plan document updates may vary based on individual circumstances, it is generally advisable to review and update the retirement plan at least annually, or whenever a significant life event occurs. Engaging with professionals can provide valuable insights and guidance on when and how to update the plan documents. They can also help identify potential improvements or adjustments that could enhance the effectiveness of the retirement plan. Some financial institutions and retirement plan providers offer dedicated plan document update services. These services can simplify the process of updating plan documents and ensure that they remain compliant with the latest regulations and best practices. Plan document updates are crucial for retirement planning to ensure compliance with laws and regulations, alignment with changing personal circumstances, and optimizing retirement savings. Failure to update plan documents can lead to potential legal and financial risks. Regular review and updates, consulting with professionals, and utilizing dedicated plan document update services are best practices to ensure effective retirement planning. Personal, financial, investment, and legislative updates are the four types of plan document updates, and they need to be reflected accurately to provide the plan participants with up-to-date information about their retirement benefits. Overall, keeping plan documents up-to-date is essential for effective retirement planning and ensuring a comfortable retirement.Definition of Plan Document Updates

Importance of Plan Document Updates

Role of Plan Document Updates

Keeping Retirement Plans Aligned With Changing Life Circumstances

Adjusting for Legislative and Regulatory Changes

Ensuring Retirement Savings are Optimized

Process of Plan Document Updates

Reviewing the Current Retirement Plan

Identifying Areas for Update

Implementing Changes in the Plan Documents

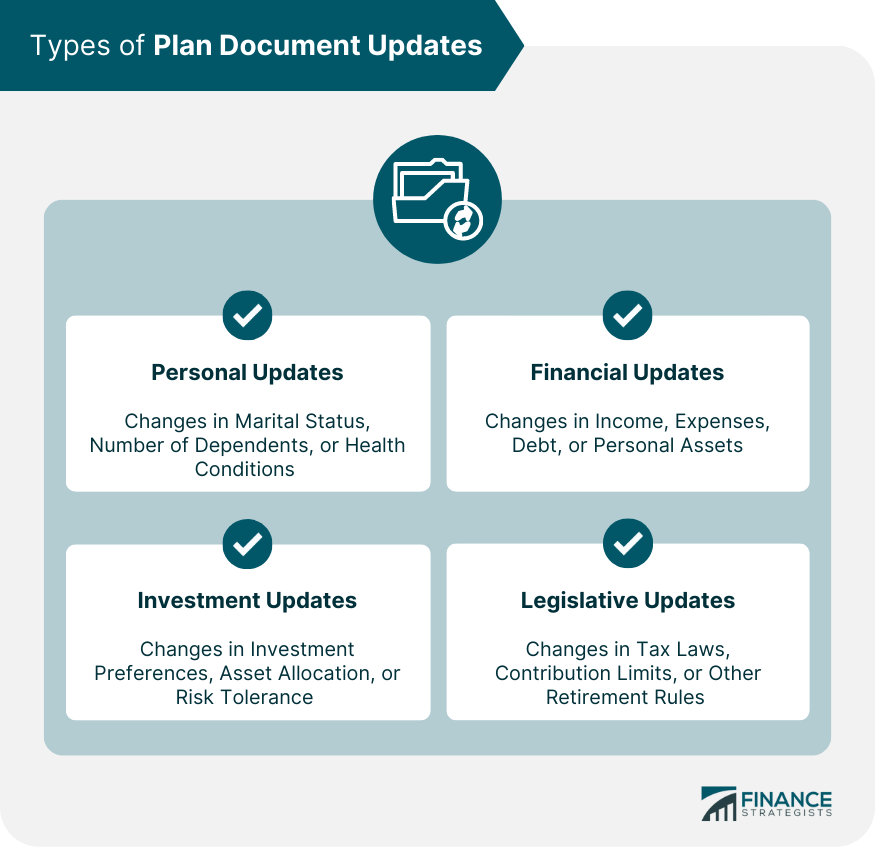

Types of Plan Document Updates

Personal Updates

Financial Updates

Investment Updates

Legislative Updates

Impact of Not Regularly Updating Plan Documents

Potential Risks and Consequences

Missed Opportunities for Optimal Growth of Retirement Savings

Best Practices for Plan Document Updates

Frequency of Review and Update

Consulting With Financial Advisors or Retirement Plan Experts

Utilizing Plan Document Update Services

Conclusion

Plan Document Updates FAQs

Plan Document Updates refer to the periodic revisions made to a retirement plan to reflect changes in personal circumstances, financial conditions, or legislative rules. They are important in retirement planning to ensure the plan remains accurate, relevant, and compliant with regulations, as well as aligned with one's retirement goals and evolving life dynamics.

While the frequency of Plan Document Updates may vary based on individual circumstances, it is generally advisable to review and update your retirement plan at least annually or whenever a significant life event occurs. Regular updates will help keep your retirement plan aligned with your goals and personal situation.

During Plan Document Updates, you should consider changes in personal circumstances (e.g., marital status, dependents), financial conditions (e.g., income, expenses), investment preferences (e.g., risk tolerance, asset allocation), and legislative rules (e.g., tax laws, retirement regulations). Addressing these changes in the plan documents ensures your retirement plan remains relevant and effective.

Yes, technology can assist with Plan Document Updates in retirement planning. Advanced tools and platforms, powered by artificial intelligence and machine learning, can provide personalized retirement planning advice and help automate the process of updating plan documents. These technologies can also identify changes in personal circumstances, financial conditions, or regulatory requirements, prompting individuals to update their plans accordingly.

Consulting with financial advisors or retirement plan experts can be valuable during Plan Document Updates. Professionals can provide insights and guidance on when and how to update the plan documents, as well as help identify potential improvements or adjustments that could enhance the effectiveness of your retirement plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.