A plan document amendment refers to a formal change or modification made to a company's benefit plan documentation. This can include retirement plans, health plans, and other employee benefit programs. Amendments are crucial for maintaining plan compliance, reflecting changes in laws and regulations, or modifying plan design to align with company objectives. Plan document amendments are essential for ensuring compliance with ever-changing laws and regulations. They help companies avoid potential legal and financial consequences and ensure the smooth administration of benefit plans. Amendments also help maintain employee satisfaction by keeping benefit plans up-to-date and relevant. Legislation and regulations governing employee benefit plans may change over time, necessitating plan document amendments to ensure compliance with current laws. Companies may need to amend plan documents to align with updated policies, such as those related to employee eligibility or vesting schedules. Organizations may decide to modify plan designs to enhance benefits, reduce costs, or streamline administration. This may require amendments to plan documents to accurately reflect these changes. Changes in the administration of a plan, such as switching to a new service provider or adopting new technology, may necessitate plan document amendments to ensure accuracy and compliance. Plan documents may need to be amended to correct errors, clarify ambiguities, or resolve inconsistencies, ensuring clear and accurate plan administration. These amendments are initiated by the plan sponsor and are not required by law. They may involve changes to plan design, administrative procedures, or other plan provisions. Required amendments are legally mandated changes that must be made to ensure compliance with laws and regulations governing employee benefit plans. Interim amendments are temporary changes made to a plan document in response to new legislation or regulations, pending the issuance of final guidance or permanent amendments. Restatements involve a comprehensive revision of a plan document, incorporating all prior amendments and any additional changes necessary to maintain compliance and reflect current plan provisions. Regular plan reviews, consultation with legal counsel or benefits experts, and staying current with legislative and regulatory updates can help identify the need for plan document amendments. Ensure that the amendment complies with relevant laws and regulations, and consult with legal counsel if necessary. Review the amendment for compliance with applicable regulations, such as those from the Internal Revenue Service (IRS) or the Department of Labor (DOL). Obtain approval from the appropriate internal stakeholders, such as human resources, finance, or legal departments. Notify plan participants of the amendment, outlining any changes to their benefits or plan administration and providing relevant resources for additional information. Implement the amendment by updating plan documents, administrative procedures, and any necessary systems or technology. Maintain thorough documentation of the amendment process, including drafts, approvals, and final versions of the amended plan document. Conduct periodic reviews of plan documents to identify potential issues or areas for improvement, ensuring proactive and timely amendments. Collaborate with legal counsel or benefits experts to identify necessary amendments and ensure compliance with laws and regulations. Communicate amendments clearly and effectively to plan participants, explaining the impact on their benefits and addressing any questions or concerns they may have. Implement amendments promptly to ensure compliance with applicable laws and regulations and minimize disruption to plan administration and participants. Maintain detailed records of the amendment process, including all drafts, approvals, and final versions of the amended plan document, to facilitate future reviews and audits. Failure to amend plan documents in accordance with current laws and regulations can result in noncompliance, leading to potential legal and financial consequences. Plan sponsors and fiduciaries may be held liable for losses incurred by plan participants due to improper amendments or failure to amend plan documents as required. Poor communication or inadequate explanation of plan document amendments can lead to confusion and dissatisfaction among plan participants, potentially affecting employee morale and retention. Noncompliance with plan document amendment requirements can result in financial penalties imposed by regulatory agencies, such as the IRS or DOL. Failure to make necessary plan document amendments can jeopardize a plan's tax-qualified status, which may result in significant tax consequences for both the plan sponsor and participants. Plan document amendments are essential for maintaining compliance with changing laws and regulations and ensuring up-to-date benefit plans. Types of amendments include discretionary, required, interim, and restatements. The amendment process involves identifying the need, drafting the amendment, internal review and approval, communication with participants, implementation, and record-keeping. Best practices include regular plan reviews, consultation with legal counsel or benefits experts, clear communication with plan participants, timely implementation, and documentation and record-keeping. Risks and consequences of noncompliance with plan document amendments include noncompliance with laws and regulations, fiduciary liability, participant confusion or dissatisfaction, financial penalties, and loss of plan qualification status.Plan Document Amendments Overview

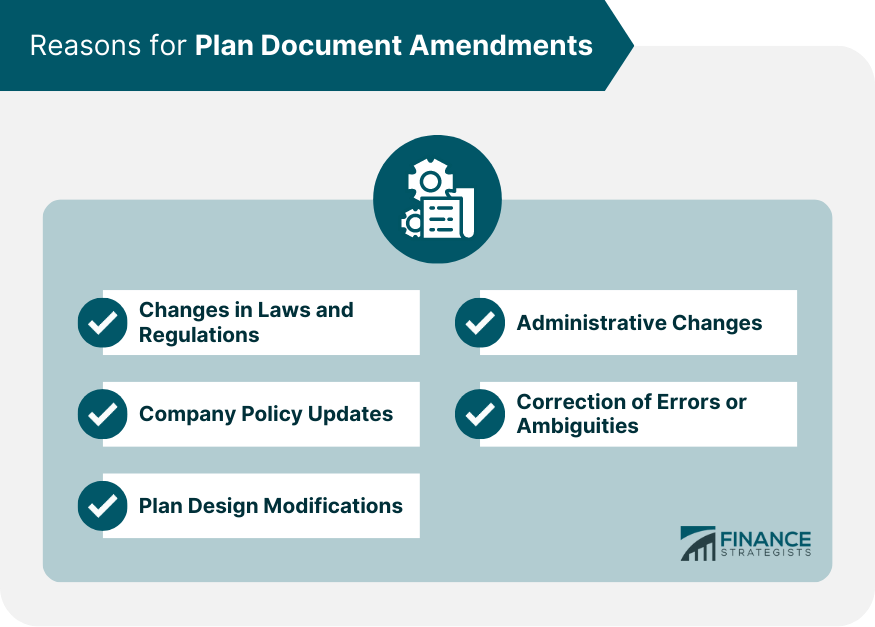

Reasons for Plan Document Amendments

Changes in Laws and Regulations

Company Policy Updates

Plan Design Modifications

Administrative Changes

Correction of Errors or Ambiguities

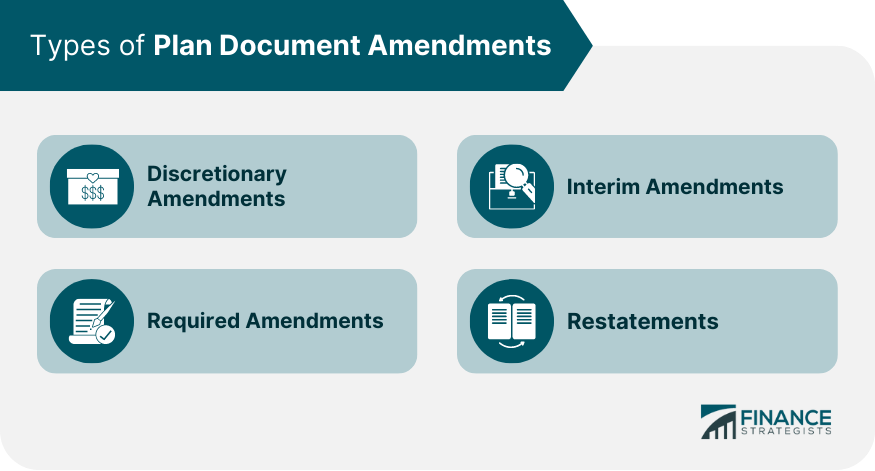

Types of Plan Document Amendments

Discretionary Amendments

Required Amendments

Interim Amendments

Restatements

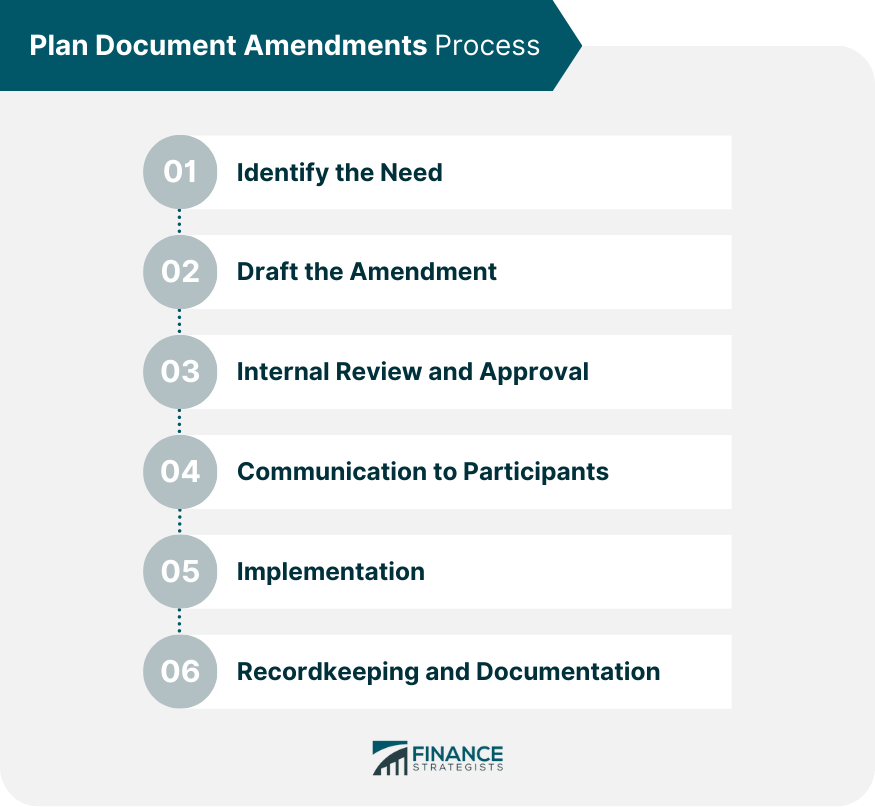

Plan Document Amendment Process

Identifying the Need for Amendments

Drafting the Amendment

Legal Considerations

Compliance With Regulations

Internal Review and Approval

Communication to Plan Participants

Implementation of the Amendment

Recordkeeping and Documentation

Best Practices for Plan Document Amendments

Regular Plan Reviews

Consultation With Legal Counsel or Benefits Experts

Clear Communication With Plan Participants

Timely Implementation

Documentation and Recordkeeping

Potential Risks and Consequences

Noncompliance With Laws and Regulations

Fiduciary Liability

Participant Confusion or Dissatisfaction

Financial Penalties

Loss of Plan Qualification Status

Bottom Line

Plan Document Amendments FAQs

Plan Document Amendments are often made to ensure compliance with changes in laws and regulations, align with updated company policies, modify plan designs, incorporate administrative changes, or correct errors and ambiguities in existing plan documents.

There are four main types of Plan Document Amendments: discretionary amendments, which are initiated by the plan sponsor; required amendments, which are legally mandated changes; interim amendments, which are temporary changes pending final guidance; and restatements, which involve comprehensive revisions of plan documents.

The process for implementing Plan Document Amendments includes identifying the need for amendments, drafting the amendment, obtaining internal review and approval, communicating the changes to plan participants, implementing the amendment, and maintaining appropriate recordkeeping and documentation.

Failure to make necessary Plan Document Amendments can result in noncompliance with laws and regulations, fiduciary liability, participant confusion or dissatisfaction, financial penalties, and loss of a plan's tax-qualified status.

Best practices for managing Plan Document Amendments effectively include conducting regular plan reviews, consulting with legal counsel or benefits experts, clearly communicating changes to plan participants, implementing amendments promptly, and maintaining thorough documentation and recordkeeping of the amendment process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.