A Plan Compliance Calendar is a tool used in retirement planning to ensure that a retirement plan, such as a 401(k) or a pension plan, remains in compliance with various rules and regulations set by the Internal Revenue Service (IRS), the Department of Labor (DOL), and other relevant authorities. The calendar serves as a schedule of important deadlines and tasks that must be completed throughout the year to maintain the plan's tax-advantaged status and to avoid penalties or fines for non-compliance. The first step in creating a plan compliance calendar is to identify important dates and deadlines related to retirement planning. These may include: 1. IRS Deadlines: Be aware of tax filing deadlines and Required Minimum Distributions (RMDs). 2. Financial Institution Deadlines: Know the deadlines for making contributions to various retirement accounts, such as IRAs and 401(k)s. 3. Personal Milestones: Include important personal dates, such as planned retirement age and key financial goals. There are several ways to create a plan compliance calendar, including: Physical Calendars: A traditional paper calendar can be used to track important dates. Digital Calendars and Apps: Use electronic calendars or specialized apps designed for retirement planning to set reminders and track progress. Hybrid Solutions: Combine physical and digital tools to create a customized plan compliance calendar that suits your needs. To ensure your plan compliance calendar remains accurate and up-to-date, establish a routine for reviewing and updating it: Quarterly Check-Ins: Assess your progress and make any necessary adjustments to your calendar. Annual Assessments: Conduct a thorough review of your retirement plan and make any necessary updates to your calendar. A key aspect of retirement planning is contributing to various retirement accounts. Be aware of the deadlines for making contributions to the following accounts: 401(k)s and other employer-sponsored plans As you approach retirement, be prepared for the RMDs from your retirement accounts: RMD Deadlines: Know when you must start taking RMDs and be aware of any annual deadlines. RMD Calculations: Understand how to calculate the required amount for each RMD. Stay informed about tax deadlines related to retirement accounts, such as annual filing dates and deadlines for making contributions. Familiarize yourself with the tax forms associated with your retirement accounts, such as Form 1040, Form 8606, and Form 5498. Understand the tax implications of withdrawing money from your retirement accounts, including potential penalties and the impact on your overall tax liability. Seek professional advice to ensure your retirement planning is on track and to help you make informed decisions about your plan compliance calendar. Work with a tax professional to ensure you are accurately reporting your retirement account activity and taking advantage of any available tax benefits. Schedule regular meetings with your financial and tax professionals to review your plan compliance calendar and make any necessary adjustments. Assess all potential sources of retirement income, such as Social Security benefits, pensions, and personal savings. Understand when you will be eligible for Social Security benefits and how to maximize your benefit amount. Plan for the financial impact of healthcare and long-term care expenses in retirement, including Medicare, supplemental insurance, and long-term care insurance options. Monitor your progress towards retirement planning goals by tracking accomplishments and making necessary adjustments to your plan compliance calendar. Acknowledge and celebrate milestones along your retirement planning journey, such as achieving specific financial goals or reaching a target retirement savings balance. Recognize that your retirement planning needs may evolve over time due to life changes, such as marriage, divorce, or changes in employment. Update your plan compliance calendar accordingly to reflect these changes and maintain alignment with your goals. A Plan Compliance Calendar ensures retirement plan compliance with deadlines and tasks to avoid penalties. It includes essential components like regular reviews, retirement savings contribution deadlines, RMDs, tax implications, and reporting. Retirement planning milestones include social security benefits, healthcare, and long-term care costs. It's important to track progress, celebrate milestones and adapt the calendar to life changes and goals. To create a plan compliance calendar, identify key dates and deadlines, and create a calendar format using physical, digital, or hybrid tools. Coordination with financial and tax professionals and regular meetings are important to ensure plan compliance. Quarterly check-ins and annual assessments are necessary for the calendar's accuracy and updating.Definition of Plan Compliance Calendar

Setting up a Plan Compliance Calendar

Identifying Key Dates and Deadlines

Creating a Calendar Format

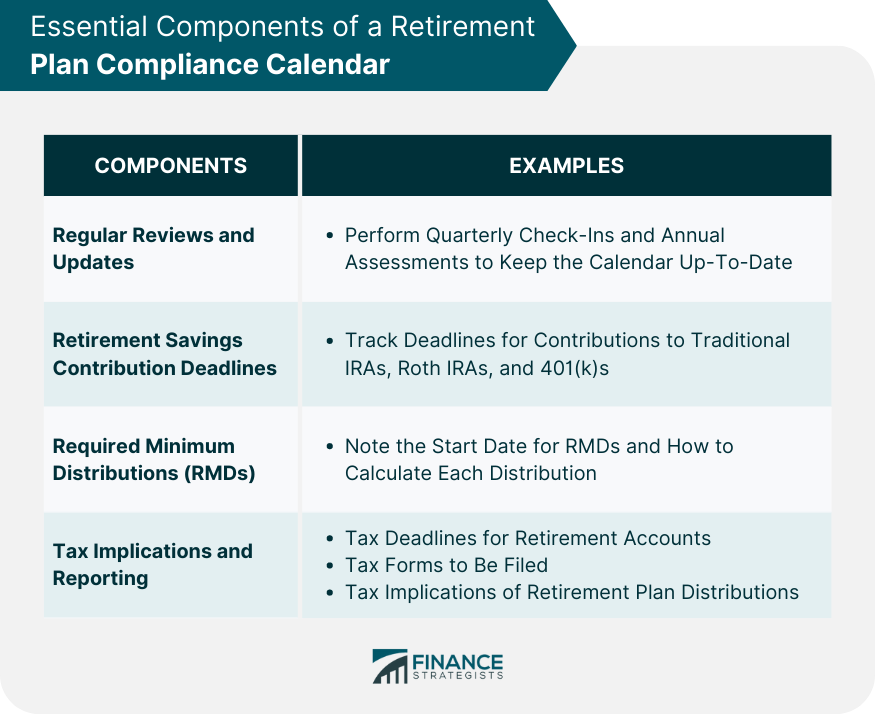

Essential Components of a Retirement Plan Compliance Calendar

Regular Reviews and Updates

Retirement Savings Contribution Deadlines

Required Minimum Distributions (RMDs)

Tax Implications and Reporting

Tax Deadlines for Retirement Accounts

Tax Forms to Be Filed

Tax Implications of Retirement Plan Distributions

Coordination With Financial Professionals for Plan Compliance Calendar

Consulting With a Financial Planner or Advisor

Engaging With Tax Professionals

Regular Meetings to Ensure Plan Compliance

Additional Retirement Planning Milestones for Plan Compliance Calendar

Evaluating Retirement Income Sources

Planning for Social Security Benefits

Addressing Healthcare and Long-Term Care Costs

Monitoring Plan Compliance Calendar Progress

Tracking Accomplishments and Adjustments

Celebrating Milestones

Adapting the Calendar to Life Changes and Goals

Bottom Line

Plan Compliance Calendar FAQs

A Plan Compliance Calendar is a tool that helps individuals track important deadlines and milestones related to their retirement planning. By maintaining a Plan Compliance Calendar, individuals can ensure they are on track to meet their financial goals and adhere to tax and regulatory requirements.

To create a Plan Compliance Calendar, start by identifying key dates and deadlines, such as IRS deadlines, financial institution deadlines, and personal milestones. Then, choose a calendar format that suits your needs, such as a physical calendar, digital calendar, or a hybrid solution.

Essential components of a Plan Compliance Calendar for retirement planning include regular reviews and updates, retirement savings contribution deadlines, required minimum distributions (RMDs), tax implications and reporting, coordination with financial professionals, and additional retirement planning milestones.

To keep your Plan Compliance Calendar up-to-date and accurate, establish a routine for reviewing and updating it, such as quarterly check-ins and annual assessments. Additionally, consult with financial and tax professionals to ensure your calendar is aligned with your goals and adheres to all relevant tax and regulatory requirements.

To adapt your Plan Compliance Calendar to life changes and evolving retirement goals, monitor your progress towards financial objectives, celebrate milestones, and make necessary adjustments to your calendar. Update your calendar to reflect changes in your personal situation, such as marriage, divorce, or changes in employment, and consult with financial professionals to ensure your retirement planning remains on track.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.