The Actual Deferral Percentage (ADP) Test is a mandatory annual nondiscrimination test conducted by the Internal Revenue Service (IRS). It ensures that 401(k) retirement plans do not disproportionately favor Highly Compensated Employees (HCEs) over Non-highly Compensated Employees (NHCEs). The test compares the average deferral rates of the two groups to ensure fairness and compliance with the Employee Retirement Income Security Act (ERISA) and IRS regulations. The primary purpose of the ADP Test is to prevent discriminatory practices in retirement plan benefits, ensuring that all employees have equal access to retirement savings opportunities. By monitoring the contributions of HCEs and NHCEs, the test helps maintain a balanced and fair retirement plan for all employees. The ADP Test is governed by the IRS under section 401(k)(3) of the Internal Revenue Code and falls within the broader scope of ERISA, which provides guidelines and regulations for retirement plans to ensure fairness and protect employee interests. The Annual Deferral Percentage is calculated based on the employee contributions to the retirement plan, expressed as a percentage of the employee's compensation. This percentage is then compared to the percentage contributed by HCEs, who are defined as those employees who own more than 5% of the company, earn over $155,000 (as of 2024). Similarly, they can be among the top 20% of earners in the company. The ADP of NHCEs cannot exceed the ADP of HCEs by more than 1.25 times. To better understand the Annual Deferral Percentage, it is essential to examine its components, which include: Elective deferrals are contributions that employees voluntarily choose to make to their retirement accounts. These contributions are typically made on a pre-tax basis, meaning they reduce an employee's taxable income and provide tax benefits. Elective deferrals are subject to annual contribution limits set by the Internal Revenue Service (IRS) and are an essential component of the ADP calculation. Matching contributions are contributions made by employers to an employee's retirement account that match a portion of their elective deferrals. For example, an employer may match 50 cents for every dollar contributed by the employee, up to a specific limit. Matching contributions are an incentive for employees to save for retirement and can help increase their retirement savings. Non-elective contributions are contributions made by employers to an employee's retirement account that are not based on the employee's elective deferrals. These contributions may be a set amount or a percentage of an employee's compensation. Non-elective contributions are an essential component of the ADP calculation, as they help increase the amount of money in an employee's retirement account. Highly compensated employees are defined as employees who earned more than a specified amount in the previous year or are deemed to be an officer or owner of the company. HCEs are subject to additional IRS regulations and restrictions when it comes to retirement plan contributions. The ADP calculation ensures that HCEs do not disproportionately benefit from the tax advantages of retirement plans. To ensure compliance with federal regulations, defined contribution plans must undergo annual testing to determine if the ADP for non-HCEs is within certain limits. The test compares the ADP for non-HCEs to the ADP for HCEs to ensure that the contribution percentages are not disproportionately favoring HCEs. If the ADP for non-HCEs is too low, the plan may need to make additional contributions to their retirement accounts. 1. Data Collection: Gather necessary employee data, including compensation, elective deferrals, and any applicable employer contributions. 2. Calculating Deferral Percentages: Calculate the deferral percentages for each employee, then determine the average deferral percentages for HCEs and NHCEs. 3. Comparing HCEs and NHCEs Deferral Rates: Compare the average deferral percentages of the two groups to determine if the plan meets the ADP Test requirements. The plan passes the ADP Test if the HCEs' average deferral rate does not exceed the NHCEs' average deferral rate by more than the allowable percentage based on the applicable test formula. If the plan fails the ADP Test, corrective actions must be taken to bring the plan into compliance. These actions may include refunding excess contributions, increasing employer contributions to NHCEs, or restructuring the plan. 1. Refunding Excess Contributions: Refund excess contributions made by HCEs to bring the plan into compliance. 2. Employer Contributions to NHCEs: Increase employer contributions to NHCEs, such as through a qualified nonelective contribution (QNEC), to balance deferral rates. 3. Plan Restructure: Modify the plan design to address the issues that led to the ADP Test failure, potentially preventing future failures. If a plan fails the ADP Test, corrective actions must be taken within 2.5 months after the close of the plan year, or an extended deadline of six months may be available if certain conditions are met. Failure to meet these deadlines may result in penalties and tax implications for both the employer and affected employees. Safe Harbor 401(k) plans are designed to automatically pass the ADP Test by meeting specific employer contribution and vesting requirements. These plans require employers to make mandatory contributions, either through matching or nonelective contributions, which must be fully vested immediately. Safe harbor plans offer the advantage of avoiding the annual ADP Test and the potential need for corrective actions. However, they also require mandatory employer contributions, which may not be suitable for all businesses. Savings Incentive Match Plans for Employees (SIMPLE) and Simplified Employee Pension (SEP) plans are alternatives to traditional 401(k) plans, primarily designed for small businesses. These plans are generally exempt from ADP Testing and have different contribution and administrative requirements. SIMPLE and SEP plans are typically simpler and less expensive to administer than 401(k) plans. However, they may also have lower contribution limits and fewer features, making them less suitable for larger organizations or those seeking a more comprehensive retirement plan offering. Employers should design their retirement plans with fairness and compliance in mind, ensuring that plan provisions do not disproportionately favor HCEs. Clear communication of plan rules, benefits, and eligibility to employees can help encourage participation and prevent potential ADP Test failures. Providing employees with education about the importance of retirement savings and the benefits of participating in the plan can help increase overall deferral rates, potentially reducing the risk of ADP Test failure. Regularly reviewing plan data, employee contributions, and deferral rates can help employers identify potential issues before they lead to ADP Test failures. Staying informed about regulatory updates and changes to compensation thresholds is also essential for maintaining compliance. The Actual Deferral Percentage Test is an annual IRS-mandated test that ensures 401(k) retirement plans do not discriminate in favor of HCEs over NHCEs. The ADP calculation is based on the percentage of employee and employer contributions, including Elective Deferrals, Matching Contributions, and Non-Elective Contributions. HCEs are subject to additional IRS regulations and restrictions when it comes to retirement plan contributions. To pass the ADP Test, the HCEs' average deferral rate cannot exceed the NHCEs' average deferral rate by more than the allowable percentage. Safe Harbor 401(k) plans, SIMPLE, and SEP plans are alternative retirement plans that may be exempt from ADP testing. Employers should design their retirement plans with fairness and compliance in mind, provide education to employees, and monitor and maintain compliance.Definition of Actual Deferral Percentage (ADP) Test

Purpose of the ADP Test

Legal Framework and Regulations

Calculation Method

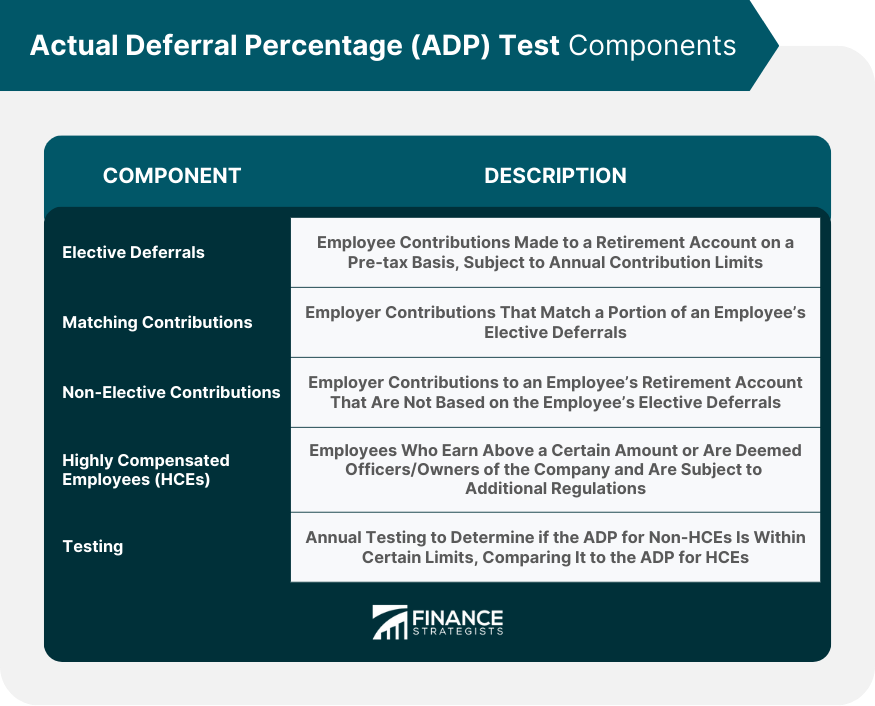

ADP Test Components

Elective Deferrals

Matching Contributions

Non-Elective Contributions

Highly Compensated Employees (HCEs)

Testing

Performing the ADP Test

Steps to Conduct the Test

Test Result Interpretation

Pass Criteria

Failure Consequences and Corrective Actions

Corrective Actions for a Failed ADP Test

Types of Corrective Actions

Deadlines and Reporting Requirements

Alternatives to ADP Testing

Safe Harbor 401(k) Plans

Definition and Characteristics

Benefits and Drawbacks

SIMPLE and SEP Plans

Overview and Eligibility

Comparison with 401(k) Plans

Best Practices for Employers

Plan Design and Communication

Employee Education and Engagement

Monitoring and Compliance

Bottom Line

Actual Deferral Percentage (ADP) Test FAQs

The Actual Deferral Percentage (ADP) Test is an annual IRS-mandated nondiscrimination test for 401(k) retirement plans, ensuring that the plan does not disproportionately favor highly compensated employees (HCEs) over non-highly compensated employees (NHCEs). It helps maintain a fair and balanced retirement plan for all employees.

Deferral percentages for the ADP Test are calculated by dividing an employee's elective deferral contributions for a plan year by their total compensation for the same year. Employer matching contributions and other applicable contributions may also be considered, depending on the plan provisions.

If a 401(k) plan fails the ADP Test, corrective actions must be taken to bring the plan into compliance. These actions may include refunding excess contributions made by HCEs, increasing employer contributions to NHCEs, or restructuring the plan. Failure to take corrective actions within the required deadlines may result in penalties and tax implications.

Safe harbor 401(k) plans, Savings Incentive Match Plan for Employees (SIMPLE), and Simplified Employee Pension (SEP) plans are alternatives to traditional 401(k) plans that generally bypass the ADP Test. Safe harbor plans require specific employer contributions and immediate vesting, while SIMPLE and SEP plans are designed primarily for small businesses with different contribution and administrative requirements.

Employers can avoid failing the ADP Test by designing retirement plans with fairness and compliance in mind, communicating plan rules and benefits clearly to employees, providing education on retirement savings, and regularly monitoring plan data, employee contributions, and deferral rates to identify potential issues before they result in test failures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.