A life insurance annuity is a unique product that combines life insurance and an annuity. It is essentially a contract between an individual and an insurance company where the individual makes a lump sum payment or a series of payments. In return, the insurer promises to make periodic payments to the individual beginning immediately or at some future date. When you purchase a life insurance annuity, you pay premiums just as you would for a regular life insurance policy. However, instead of just a death benefit paid to your beneficiaries upon your demise, the premiums you pay are invested by the insurance company, and the earnings are used to pay you an income stream at a specified future date. This unique combination allows the policyholder to secure life insurance coverage and receive a steady income during retirement. Traditional life insurance annuities essentially combine the benefits of an annuity with a life insurance policy. These products provide a death benefit like a life insurance policy, and they also offer the advantage of annuity payments during the lifetime of the policyholder. They generally come in two forms: immediate life annuities and deferred life annuities. These annuities begin making payments to the policyholder immediately after the policy is purchased. They're typically bought with a lump sum and are a popular choice for individuals who are already in retirement and want to secure a steady stream of income. These annuities begin making payments at a future date chosen by the policyholder. Until then, the money invested in the annuity grows on a tax-deferred basis. These are often chosen by individuals who want to supplement their income in the future. Hybrid life insurance annuities, also known as asset-based or linked-benefit policies, combine life insurance with long-term care insurance. These products offer a death benefit, potential cash value growth, and a pool of money for long-term care if needed. These hybrid products are often based on a universal life insurance policy, with a long-term care rider attached to it. Policyholders can use the long-term care benefits if needed, and if these benefits are not fully used, the remaining amount is paid out as a death benefit to the policyholder's beneficiaries. This type of policy provides a death benefit, a cash value component, and a long-term care benefit. The long-term care benefit typically is a multiplier of the premium paid, providing several times the policy's value in long-term care benefits. This hybrid policy offers the benefits of an annuity—guaranteed income—with long-term care coverage if needed. If you need long-term care, the policy can pay out more than the cash value to cover these costs. While traditional life insurance focuses on providing financial protection for your dependents in case of your death, life insurance annuity offers a dual benefit. It provides a death benefit like traditional life insurance and guarantees an income stream during your retirement years. Generally, life insurance annuities are more expensive than traditional life insurance policies due to the investment component and the annuity payout feature. However, this additional cost can be offset by the potential gains and tax advantages of the annuity. The risk and return profile of life insurance annuities differs from traditional life insurance policies. While traditional life insurance policies provide a guaranteed death benefit, the return on life insurance annuities depends on the type of annuity chosen - fixed, variable, or indexed. Life insurance annuities, particularly variable annuities, can be compared with mutual funds. Both offer a range of investment options and potential for growth. However, mutual funds do not offer the same guarantees or tax advantages as life insurance annuities. While stocks and bonds offer potentially higher returns, they also come with higher risks. Conversely, life insurance annuities provide a guaranteed return, though it is often lower. Retirement accounts like 401k and IRA also offer tax advantages. However, they come with contribution limits and restrictions on withdrawals. In contrast, life insurance annuities do not have contribution limits and offer greater flexibility on withdrawals, albeit with potential surrender charges. One of the most attractive benefits of a life insurance annuity is the guaranteed income stream it can provide during retirement. This feature ensures a steady flow of income during the retirement years, which can help cover living expenses and provide financial security. Like traditional life insurance, life insurance annuities provide a death benefit that is paid out to your beneficiaries upon your death. This benefit offers a financial safety net for your loved ones, providing peace of mind that they will have financial resources available to them in the event of your passing. The cash value component of a life insurance annuity grows on a tax-deferred basis. This means that you won't owe taxes on the interest, dividends, or capital gains accruing in the policy until you withdraw funds. This tax deferral can help the cash value of the policy grow more rapidly than it might in a taxable account. Life insurance annuities can offer a level of flexibility not found in many other financial products. For example, some policies allow you to adjust the death benefit or premium payments over time to fit your changing needs and circumstances. In some jurisdictions, the cash value of a life insurance annuity is protected from creditors. This protection can make life insurance annuities an attractive option for those looking for ways to safeguard their assets. Unlike certain retirement accounts such as 401(k)s and IRAs, life insurance annuities don't have annual contribution limits. This feature makes them a useful tool for high-income earners who want to save more for retirement than is allowed in traditional retirement accounts. Life insurance annuities can have a variety of fees associated with them. These may include mortality and expense risk charges, administrative fees, underlying fund expenses for variable annuities, and potential surrender charges for early withdrawal. These fees can eat into the potential growth of your investment and make life insurance annuities more expensive compared to other investment vehicles. Surrender charges are fees imposed for early withdrawal from an annuity contract. If you withdraw money from your annuity before a certain period, usually within the first five to seven years, you could be hit with these charges. This lack of liquidity can be a significant disadvantage, especially in case of an unexpected financial need. Life insurance annuities can be complex financial products. The contract can be hard to understand with various fees, charges, and provisions. Misunderstanding these details can lead to unexpected costs or lower returns. While fixed annuities offer guaranteed returns, variable and indexed annuities can lose value if the underlying investments perform poorly. This means there's a risk you could lose money, including your original investment. While your money grows tax-deferred in a life insurance annuity, withdrawals are taxed as ordinary income. This could be a disadvantage if your tax rate at the time of withdrawal is higher than it would have been at the time of investment. Additionally, if you withdraw funds before age 59.5, you may have to pay a 10% early withdrawal penalty. When buying a life insurance annuity, it's essential to research various insurance providers to compare their financial strength, product offerings, fees, and customer service. Independent rating agencies like A.M. Best and Standard & Poor's can provide valuable information about the financial strength of insurance companies. Before purchasing an annuity, it's crucial to understand the contract fully. This includes the terms of the annuity, the rate of return, the payout options, the fees and charges, and the surrender period. Consult a financial advisor or attorney if necessary. Once you have chosen a provider and understood the contract, you can proceed to make the purchase. This typically involves filling out an application and making the initial payment or setting up a payment schedule. Life insurance annuities provide a unique combination of life insurance coverage and a guaranteed income stream during retirement. They offer the dual benefit of a death benefit similar to traditional life insurance policies and a steady stream of income for policyholders. Traditional and hybrid life insurance annuities cater to different needs, with traditional options offering immediate or deferred payments, while hybrid annuities include long-term care coverage. While life insurance annuities may be more expensive compared to traditional life insurance due to additional features and investment components, they come with potential gains and tax advantages that can offset the higher cost. However, it is crucial to be aware of the drawbacks of life insurance annuities, including high fees, surrender charges for early withdrawal, complexity, risk of loss, and tax implications for withdrawals. When purchasing a life insurance annuity, it is recommended to thoroughly research and select a reputable provider based on financial strength, product offerings, fees, and customer service. Understanding the contract and seeking professional advice, if necessary, is essential to make an informed decision. Ultimately, life insurance annuities can serve as a valuable financial tool for individuals seeking both life insurance coverage and a reliable income source in their retirement years.What Is a Life Insurance Annuity?

Types of Life Insurance Annuities

Traditional Life Insurance Annuities

Immediate Life Annuities

Deferred Life Annuities

Hybrid Life Insurance Annuities

Hybrid Life/Long-Term Care Insurance

Annuity With Long-Term Care Rider

Life Insurance Annuity vs Traditional Life Insurance

Structure and Purpose

Cost

Risk and Return

Life Insurance Annuity vs Other Investment Vehicles

Mutual Funds

Stocks and Bonds

Retirement Accounts

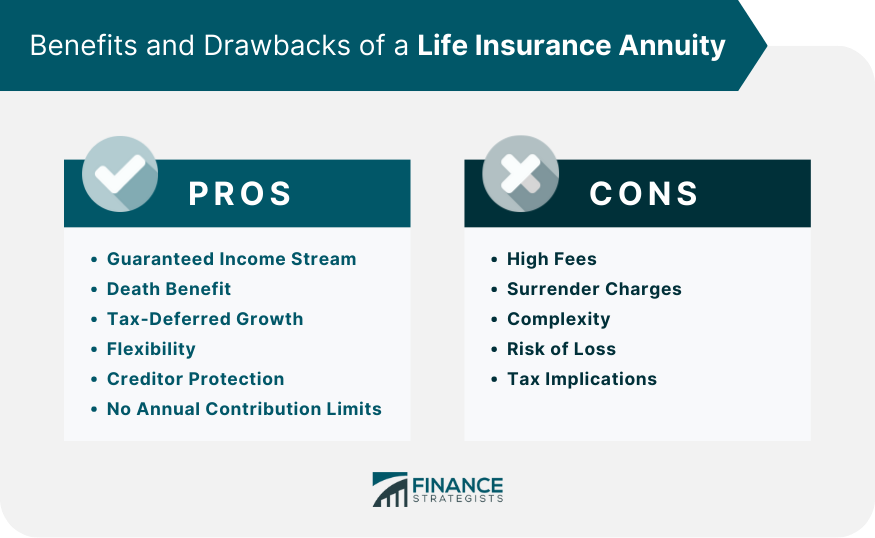

Benefits of Life Insurance Annuities

Guaranteed Income Stream

Death Benefit

Tax-Deferred Growth

Flexibility

Creditor Protection

No Annual Contribution Limits

Drawbacks of Life Insurance Annuities

High Fees

Surrender Charges

Complexity

Risk of Loss

Tax Implications

How to Buy a Life Insurance Annuity

Choose the Right Provider

Understand the Contract

Make the Purchase

Final Thoughts

Life Insurance Annuity FAQs

The main difference is that a life insurance annuity offers both a death benefit and a guaranteed income stream during retirement, while traditional life insurance focuses solely on providing a death benefit to beneficiaries.

Yes, in most cases, you can access the cash value of a life insurance annuity through withdrawals or loans. However, it's important to note that early withdrawals or loans may be subject to fees and penalties.

The cash value growth of a life insurance annuity is tax-deferred, meaning you won't owe taxes on the interest, dividends, or capital gains until you make withdrawals. However, once you withdraw funds, they are generally taxed as ordinary income.

Yes, many life insurance annuities offer flexibility. You may be able to adjust the death benefit, premium payments, or even choose different payout options to align with your evolving financial circumstances.

It is vital to research and compare different insurance providers. Factors to consider include their financial strength, product offerings, fees, and customer service. Independent rating agencies like A.M. Best and Standard & Poor's can provide valuable information about the financial strength of insurance companies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.