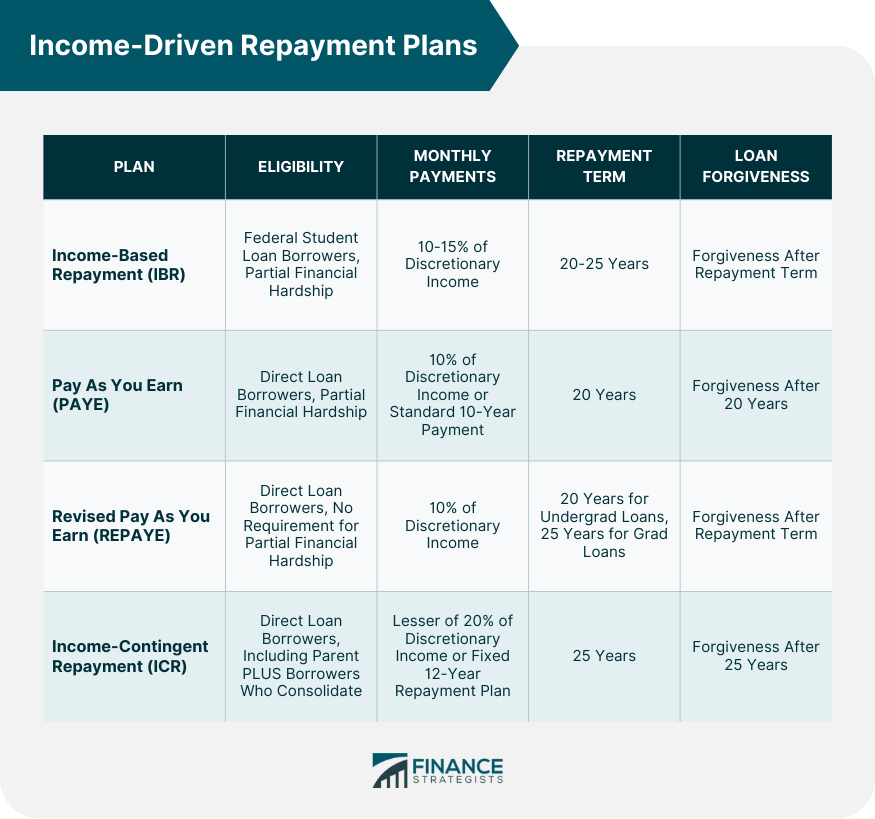

Income-driven repayment plans are federal student loan repayment plans that base your monthly payment on your income, family size, and other factors. These plans can make your monthly payments more manageable and extend your repayment term but may result in paying more interest over time. Income-Based Repayment (IBR) is available to borrowers with federal student loans, including Direct and FFEL loans. Eligibility is determined based on a borrower's debt-to-income ratio, requiring a "partial financial hardship." Under IBR, monthly payments are set at either 10% or 15% of discretionary income, depending on when the borrower first received their loans. The payment amount is based on a borrower's income, family size, and state of residence. The repayment term for IBR is 20 or 25 years, depending on when the borrower first received their loans. After completing the repayment term, any remaining loan balance will be forgiven. However, this forgiven amount may be subject to income tax. Pay As You Earn (PAYE) is available to borrowers with Direct Loans who demonstrate a "partial financial hardship." Under PAYE, monthly payments are set at 10% of discretionary income, and are never more than the standard 10-year repayment plan amount. The repayment term for PAYE is 20 years. Any remaining loan balance after 20 years of qualifying payments will be forgiven. As with IBR, this amount may be subject to income tax. Revised Pay As You Earn (REPAYE) is available to borrowers with Direct Loans, regardless of when they first received their loans. There is no requirement to demonstrate a "partial financial hardship" for this plan. Monthly payments under REPAYE are set at 10% of discretionary income. The repayment term for REPAYE is 20 years for undergraduate loans and 25 years for graduate loans. Any remaining loan balance after the repayment term is completed will be forgiven. The forgiven amount may be subject to income tax. Income-Contingent Repayment (ICR) is available to borrowers with Direct Loans, including Parent PLUS borrowers who consolidate their loans into a Direct Consolidation Loan. Under ICR, monthly payments are the lesser of 20% of discretionary income or the amount a borrower would pay on a fixed 12-year repayment plan, adjusted based on income. The repayment term for ICR is 25 years. After 25 years of qualifying payments, any remaining loan balance will be forgiven. The forgiven amount may be subject to income tax. To apply for an income-driven repayment plan, borrowers must provide documentation of their income, such as tax returns or pay stubs, as well as information about their family size. There is no specific deadline for applying for an income-driven repayment plan. However, borrowers are encouraged to apply as soon as they begin experiencing financial difficulty or anticipate changes in their financial situation. To apply for an income-driven repayment plan, borrowers must complete the Income-Driven Repayment Plan Request form, which can be found on the Federal Student Aid website. This form can be submitted online or by mail. Borrowers are required to recertify their income and family size annually. Failure to recertify on time may result in increased monthly payments and loss of progress towards loan forgiveness. Income-driven repayment plans make monthly payments more manageable by tying them to a borrower's income and family size. Borrowers may qualify for loan forgiveness after completing the repayment term under an income-driven repayment plan. Income-driven repayment plans provide flexibility for borrowers, as monthly payments can change with income and family size fluctuations. Income-driven repayment plans typically have longer repayment terms than standard repayment plans, which can result in more interest paid over the life of the loan. Due to the longer repayment term, borrowers may end up paying more in interest over the life of the loan compared to a standard repayment plan. Forgiven loan balances under income-driven repayment plans may be considered taxable income, resulting in tax liability for borrowers. A Standard Repayment Plan requires fixed monthly payments over a 10-year term, resulting in the loan being paid off in the shortest time and with the least amount of interest. Under a Graduated Repayment Plan, monthly payments start low and increase every two years. This plan is ideal for borrowers who expect their income to grow over time. An Extended Repayment Plan allows borrowers to repay their loans over a period of up to 25 years, with either fixed or graduated payments. This option is suitable for those with high loan balances who need a longer repayment term. Refinancing federal student loans with a private lender can result in a lower interest rate and customized repayment terms. However, borrowers should be aware that refinancing federal loans with a private lender means losing access to federal benefits, such as income-driven repayment plans and loan forgiveness programs. When selecting a repayment plan, borrowers should consider their current financial situation and long-term financial goals. A high debt-to-income ratio may indicate that an income-driven repayment plan would be the most suitable option. Borrowers with unstable job situations may benefit from the flexibility of income-driven repayment plans. Those with strong potential for income growth may prefer a Graduated Repayment Plan or consider refinancing with a private lender. Income-driven repayment plans are federal student loan repayment plans that base monthly payments on a borrower's income, family size, and other factors. There are four types of income-driven repayment plans available: Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each of these plans has its own eligibility requirements, monthly payments, repayment terms, and loan forgiveness options. To apply for an income-driven repayment plan, borrowers must provide documentation of their income and family size and complete the Income-Driven Repayment Plan Request form. While income-driven repayment plans can make monthly payments more manageable and offer loan forgiveness options, they also come with disadvantages, such as longer repayment periods and potential tax implications for loan forgiveness. Borrowers should consider their financial situation, debt-to-income ratio, job stability, and potential for income growth when selecting a repayment plan. Alternatives to income-driven repayment plans include the Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, and refinancing through private lenders.What Are Income-Driven Repayment Plans?

Types of Income-Driven Repayment Plans

Income-Based Repayment (IBR)

Eligibility Requirements

Calculation of Monthly Payments

Repayment Term

Loan Forgiveness

Pay As You Earn (PAYE)

Eligibility Requirements

Calculation of Monthly Payments

Repayment Term

Loan Forgiveness

Revised Pay As You Earn (REPAYE)

Eligibility Requirements

Calculation of Monthly Payments

Repayment Term

Loan Forgiveness

Income-Contingent Repayment (ICR)

Eligibility Requirements

Calculation of Monthly Payments

Repayment Term

Loan Forgiveness

Application Process for Income-Driven Repayment Plans

Necessary Documentation

Timing and Deadlines

How to Apply

Annual Recertification Process

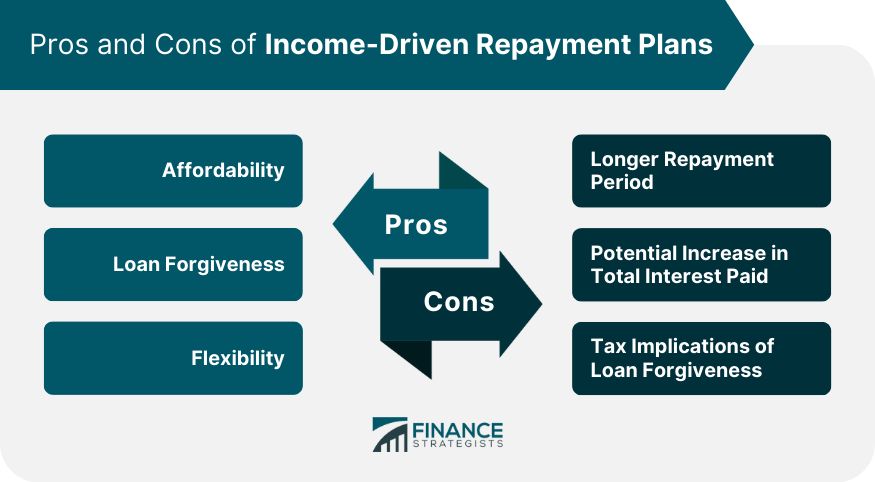

Pros and Cons of Income-Driven Repayment Plans

Pros

Affordability

Loan Forgiveness

Flexibility

Cons

Longer Repayment Period

Potential Increase in Total Interest Paid

Tax Implications of Loan Forgiveness

Alternatives to Income-Driven Repayment Plans

Standard Repayment Plan

Graduated Repayment Plan

Extended Repayment Plan

Refinancing Through Private Lenders

Factors to Consider When Choosing a Repayment Plan

Financial Situation and Goals

Debt-to-Income Ratio

Job Stability

Potential for Income Growth

Conclusion

Income-Driven Repayment Plans FAQs

Income-driven repayment plans are federal student loan repayment plans that base your monthly payment on your income, family size, and other factors, and extend your repayment term up to 20 or 25 years.

Most federal student loan borrowers are eligible for at least one income-driven repayment plan. You must have a partial financial hardship to qualify for some plans, such as the Income-Based Repayment (IBR) and Pay As You Earn (PAYE) plans.

Your monthly payment amount under an income-driven repayment plan will be based on a percentage of your discretionary income, which is the difference between your adjusted gross income and 150% of the poverty guideline for your family size and state. The percentage varies by plan, ranging from 10% to 20% of your discretionary income.

Yes, you may pay more interest over the life of your loan if you choose an income-driven repayment plan because your monthly payment may not cover all the interest that accrues. However, the longer repayment term may lower your monthly payment and make it more manageable.

You can apply for an income-driven repayment plan online through the Federal Student Aid website or by contacting your loan servicer. You will need to provide information about your income, family size, and other factors to determine your eligibility and monthly payment amount.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.