Student loan discharge refers to the complete or partial cancellation of a borrower's obligation to repay their student loans under specific circumstances, such as disability, bankruptcy, or school closure. Disability-related discharge is a form of student loan discharge wherein a borrower's student loans are forgiven due to their total and permanent disability (TPD), which prevents them from engaging in gainful employment. For disabled borrowers, comprehending the discharge process is vital to alleviating financial burdens and ensuring a stable financial future, as well as avoiding unnecessary repayments on loans they may be eligible to have discharged. Federal student loans are government-funded loans that can be discharged due to disability, including Direct Loans, Federal Family Education Loans, and Perkins Loans. Direct Loans are federal loans offered by the Department of Education, available to eligible students and parents to help cover the cost of higher education, which can be discharged if the borrower becomes totally and permanently disabled. FFEL loans were government-backed loans issued by private lenders to help students finance their education, discontinued in 2010, but still eligible for disability discharge if the borrower is TPD. Perkins Loans were low-interest federal loans offered to students with significant financial need, discontinued in 2017; however, existing borrowers with TPD can still apply for a disability discharge. Private student loans are funded by private institutions, and their eligibility for disability discharge varies depending on the lender's policies. Each private lender has its own set of rules and guidelines regarding disability discharge, making it essential for borrowers to research their lender's specific policies to determine eligibility. Direct communication with the lender is crucial for borrowers seeking disability discharge, as it helps them understand the required documentation, application process, and potential alternatives. Total and permanent disability is a condition in which a person is unable to engage in any substantial gainful activity due to a physical or mental impairment that is expected to result in death. Further, it has lasted for a continuous period of at least 60 months, or can be expected to last for a continuous period of at least 60 months. Qualifying disabilities for student loan discharge due to TPD include, but are not limited to, severe physical disabilities, terminal illnesses, certain mental health conditions, and traumatic brain injuries. To apply for a disability discharge, borrowers must provide documentation from the Department of Veterans Affairs (VA), the Social Security Administration (SSA), or a certified physician, confirming their total and permanent disability status. Collecting the necessary documentation is the first step in the disability discharge process, which includes obtaining a disability determination from the VA, SSA, or a physician, and providing proof of income if required. Borrowers must submit documentation from the VA, SSA, or a physician that verifies their TPD status, depending on their specific circumstances, such as military service, social security benefits, or medical records. In some cases, borrowers may need to provide proof of income, typically through tax returns or pay stubs, to demonstrate their inability to engage in substantial gainful activity due to their disability. Borrowers must fill out the Total and Permanent Disability Discharge Application, providing personal information, details about their loans, and the nature of their disability, to apply for student loan discharge. Once the TPD Discharge Application is completed, borrowers must submit it, along with the required documentation, to their loan servicer or the Department of Education's TPD discharge processing center. After submitting the application, borrowers should expect to wait for approval, during which their application may be reviewed, and they may be asked to provide additional documentation or clarification. The loan forgiveness amount for disability discharge varies, but it generally covers the remaining balance on eligible student loans, providing significant financial relief to borrowers with disabilities. In some cases, the forgiven loan amount due to disability discharge may be considered taxable income by the IRS, which could result in a tax liability for the borrower, although recent changes have aimed to reduce this burden. If a borrowers' financial situation improves and they wish to pursue further education, they may need to re-establish eligibility for federal student aid by demonstrating that their disability has improved and they are now able to engage in gainful employment. Disability discharge can affect a borrower's credit score, depending on the reporting practices of their loan servicer, but typically, the discharged loans are reported as "paid in full" or "discharged due to disability," with little to no negative impact on credit. Income-driven repayment (IDR) plans can provide disabled borrowers with more manageable monthly payments by adjusting their payments based on their income and family size, offering a potential alternative to disability discharge. Deferment or forbearance allows borrowers to temporarily postpone or reduce their loan payments due to financial hardship or other qualifying reasons, providing short-term relief while they explore other options. Loan consolidation combines multiple federal student loans into a single loan with a fixed interest rate, potentially simplifying repayment and making it more manageable for borrowers with disabilities. Loan modification or refinancing involves changing the terms of a borrower's student loan, such as adjusting the interest rate or extending the repayment term, which can make repayment more manageable for those with disabilities. The Department of Education offers numerous resources for borrowers with disabilities, including information about the TPD discharge process, application forms, and guidance on eligibility requirements. Loan servicers can provide valuable assistance to borrowers seeking disability discharge by answering questions, guiding them through the application process, and offering support throughout the discharge process. Disability advocacy organizations can offer guidance, resources, and support for borrowers with disabilities navigating the student loan discharge process, helping them better understand their rights and options. College and university financial aid offices can provide information and assistance to borrowers with disabilities seeking loan discharge, as well as guidance on alternative repayment options and financial aid opportunities. Student loan discharge refers to the complete or partial cancellation of a borrower's obligation to repay their student loans under specific circumstances such as disability, bankruptcy, or school closure. Disability-related discharge is a form of student loan discharge wherein a borrower's student loans are forgiven due to their total and permanent disability, which prevents them from engaging in gainful employment. Federal student loans including Direct Loans, Federal Family Education Loans, and Perkins Loans are government-funded loans that can be discharged due to disability, while private student loans eligibility for disability discharge varies depending on the lender's policies. Borrowers seeking disability discharge must provide documentation from the Veterans Affairs, Social Security Administration, or a certified physician, confirming their total and permanent disability status, and follow a specific application process. In some cases, borrowers may also consider alternative options such as income-driven repayment plans, deferment or forbearance, loan consolidation, loan modification or refinancing. The Department of Education, loan servicers, disability advocacy organizations, and financial aid offices provide valuable resources and assistance for borrowers seeking disability discharge.What Is Student Loan Discharge?

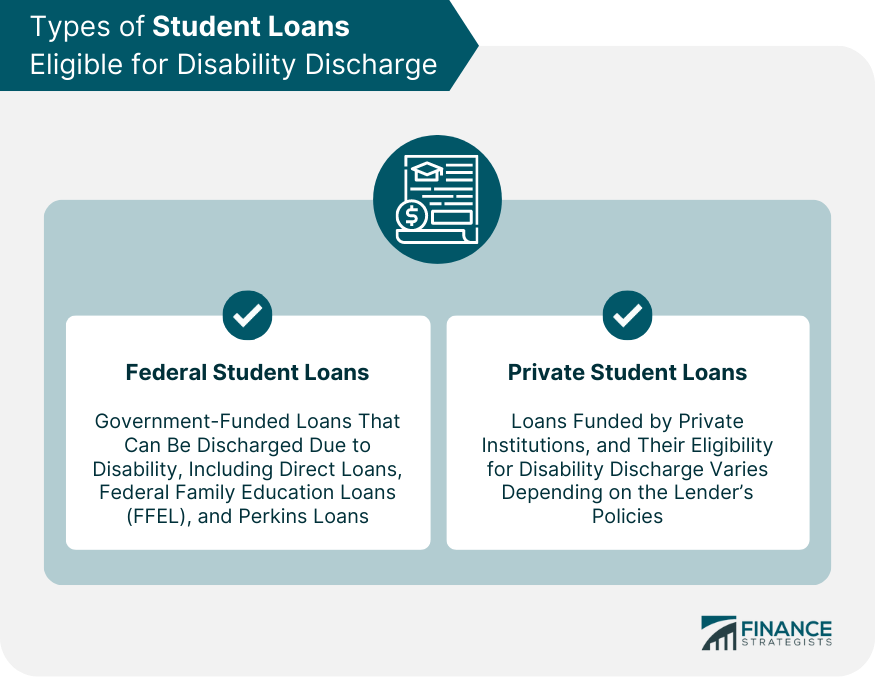

Types of Student Loans Eligible for Disability Discharge

Federal Student Loans

Direct Loans

Federal Family Education Loans (FFEL)

Perkins Loans

Private Student Loans

Varying Policies Among Lenders

Importance of Contacting the Lender

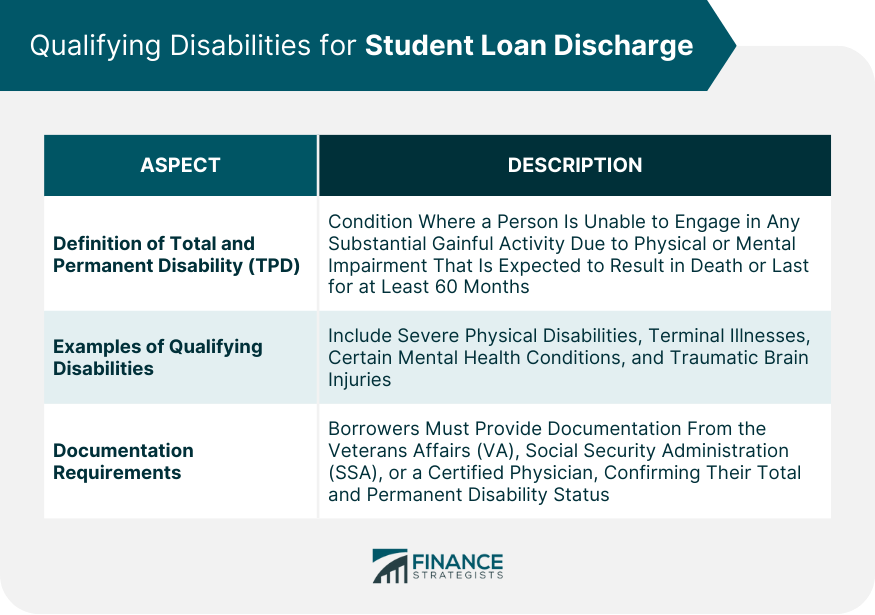

Qualifying Disabilities for Student Loan Discharge

Definition of Total and Permanent Disability

Examples of Qualifying Disabilities

Documentation Requirements

Application Process for Disability Discharge

Gathering Required Documentation

Disability Determination from the VA, SSA, or a Physician

Proof of Income (if Required)

Completing the TPD Discharge Application

Submitting the Application and Supporting Documents

Await Approval and Potential Review Process

Impact of Disability Discharge on Borrowers

Loan Forgiveness Amount

Tax Implications

Re-establishing Eligibility for Federal Student Aid

Credit Score Implications

Alternative Options for Borrowers with Disabilities

Income-Driven Repayment Plans

Deferment or Forbearance

Loan Consolidation

Loan Modification or Refinancing

Resources and Assistance for Borrowers Seeking Disability Discharge

Department of Education Resources

Student Loan Servicers

Disability Advocacy Organizations

Financial Aid Offices

Final Thoughts

Student Loan Discharge for Disability Discharge FAQs

A student loan discharge due to disability is a form of loan forgiveness granted to borrowers who have a total and permanent disability (TPD) that prevents them from engaging in gainful employment. To qualify, borrowers must provide documentation from the Department of Veterans Affairs (VA), the Social Security Administration (SSA), or a certified physician confirming their TPD status.

Federal student loans, including Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans, are eligible for disability discharge. Private student loans may also be eligible, but this depends on the specific lender's policies, so borrowers should contact their lender for more information.

To apply for a disability discharge, borrowers must complete the Total and Permanent Disability (TPD) Discharge Application, gather the required documentation (such as a disability determination from the VA, SSA, or a physician), and submit the application and supporting documents to their loan servicer or the Department of Education's TPD discharge processing center.

Receiving a student loan discharge due to disability can lead to the forgiveness of the remaining loan balance, providing significant financial relief. However, there may be tax implications, as the forgiven amount could be considered taxable income. Additionally, borrowers may need to re-establish eligibility for federal student aid if they wish to pursue further education in the future.

Alternative options for borrowers with disabilities include income-driven repayment plans, deferment or forbearance, loan consolidation, and loan modification or refinancing. These options can help borrowers manage their student loan repayments more effectively and alleviate financial burdens, even if they do not qualify for a disability discharge.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.