Financial planning for first responders refers to the process of assessing the unique financial needs and challenges faced by first responders, establishing financial goals, creating a budget, saving for emergencies and retirement, investing in long-term stability, and reviewing and adjusting the financial plan as needed. The goal is to help first responders achieve financial security and stability, and to ensure that they are well-prepared for any financial challenges that may arise in the future. First responders face unique financial challenges, including irregular schedules, long hours, and potential physical and emotional trauma. Prioritizing financial planning can help first responders manage these challenges and achieve financial stability. First responders face several financial challenges, including low pay, long hours, and a high-risk work environment. These challenges can impact their financial stability and make it challenging to achieve their long-term financial goals. First responders have unique financial needs, such as disability insurance, life insurance, and retirement planning. Addressing these specific financial needs is crucial to ensure financial stability and security for themselves and their families. Addressing financial needs is essential for first responders to achieve financial stability and security. By creating a financial plan that addresses their unique financial challenges and needs, first responders can manage their finances effectively and achieve their long-term financial goals. Assessing the current financial situation is essential for first responders to understand their income, expenses, debts, and assets. This information can help them create a realistic financial plan that aligns with their long-term financial goals. Establishing financial goals is an essential step in the financial planning process for first responders. It involves identifying the specific financial objectives that they want to achieve, such as paying off debt, saving for emergencies, or investing in retirement. By setting clear and measurable financial goals, first responders can create a roadmap that will help them to focus their financial efforts and make informed decisions. Creating a budget and tracking expenses is an essential part of financial planning for first responders. By creating a budget and tracking expenses, first responders can manage their money effectively and ensure they are living within their means. Saving for emergencies and retirement is crucial for first responders to ensure financial stability and security. First responders should consider creating an emergency fund and investing in retirement plans that align with their long-term financial goals. Investing in long-term financial stability, such as real estate or stocks, can help first responders achieve their long-term financial goals. First responders should seek professional financial advice and consider their investment options carefully. Reviewing and adjusting the financial plan is crucial for first responders to ensure its effectiveness and alignment with their changing financial needs. First responders should review their financial plan regularly and adjust it accordingly. Government programs and benefits, such as retirement plans and health insurance, can provide financial stability and security for first responders. First responders should research and take advantage of these programs and benefits. Financial advisors and planning services can provide specialized expertise and support for first responders' financial planning needs. First responders should seek professional financial advice when necessary. Retirement plans and investment options, such as 401(k) plans or individual retirement accounts (IRAs), can provide long-term financial stability for first responders. First responders should research their investment options and create a diversified portfolio that aligns with their long-term financial goals. Education and training resources, such as financial planning courses or workshops, can provide first responders with the knowledge and skills necessary to create a strong financial plan. First responders should seek out these resources and take advantage of them. Financial planning is crucial for first responders to manage their finances effectively, achieve their long-term financial goals, and ensure financial stability and security for themselves and their families. First responders face unique financial challenges and have specific financial needs that must be addressed through financial planning. By following the steps to create a financial plan, including assessing their current financial situation, establishing financial goals, creating a budget and tracking expenses, saving for emergencies and retirement, investing in long-term financial stability, and reviewing and adjusting their financial plan, first responders can achieve financial stability and success. There are also resources available to first responders for financial planning, including government programs and benefits, financial advisors and planning services, retirement plans and investment options, and education and training resources. First responders should take advantage of these resources to create a strong financial plan that addresses their unique financial challenges and needs. Creating a strong financial plan and utilizing available resources allow first responders can manage their finances effectively, achieve their long-term financial goals, and ensure financial stability and security for themselves and their families.Definition of Financial Planning for First Responders

Financial planning is essential for first responders to manage their finances effectively, achieve their long-term financial goals, and ensure financial stability and security for themselves and their families.Understanding the Financial Needs of First Responders

Overview of Financial Challenges Faced by First Responders

Specific Financial Needs of First Responders

Importance of Addressing Financial Needs to Ensure Stability and Security

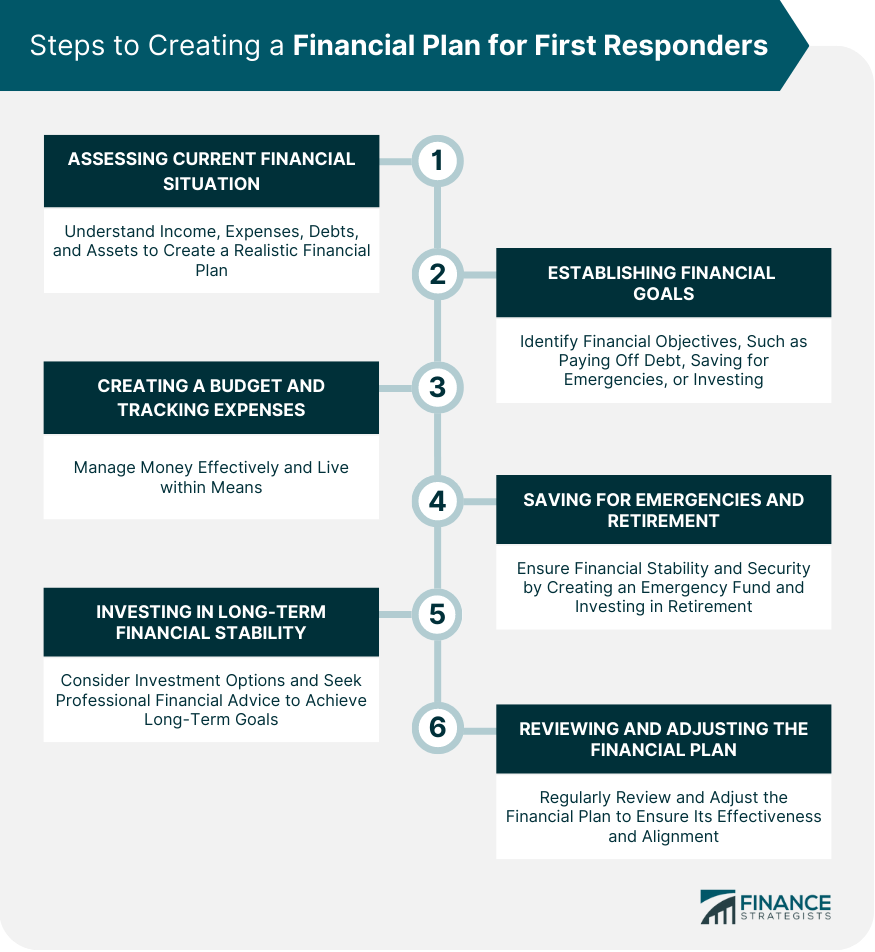

Steps to Creating a Financial Plan for First Responders

Assessing Current Financial Situation

Establishing Financial Goals

Creating a Budget and Tracking Expenses

Saving for Emergencies and Retirement

Investing in Long-Term Financial Stability

Reviewing and Adjusting the Financial Plan

Resources Available to First Responders for Financial Planning

Government Programs and Benefits

Financial Advisors and Planning Services

Retirement Plans and Investment Options

Education and Training Resources

Conclusion

Financial Planning for First Responders FAQs

Financial planning for first responders refers to the process of assessing the unique financial needs and challenges faced by first responders, establishing financial goals, creating a budget, saving for emergencies and retirement, investing in long-term stability, and reviewing and adjusting the financial plan as needed.

Financial planning is crucial for first responders as it helps them to secure their future, create a budget, save for emergencies, and invest in long-term stability.

First responders can create a financial plan by assessing their current financial situation, establishing financial goals, creating a budget, saving for emergencies and retirement, investing for long-term stability, and reviewing and adjusting their plan as needed.

First responders have access to a variety of resources including government programs and benefits, financial advisors and planning services, retirement plans and investment options, and education and training resources.

Yes, working with a financial advisor can provide first responders with personalized guidance and advice to help them make informed financial decisions, plan for their future, and achieve their financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.