The debt avalanche method is a debt repayment strategy designed to help individuals pay off their debts in an efficient and cost-effective manner. By prioritizing debts with the highest interest rates, the debt avalanche method can save money on interest payments and shorten the time it takes to become debt-free. The first step in implementing the debt avalanche method is to list all outstanding debts. Organize these debts by interest rate, with the highest interest rate at the top of the list. This will help you prioritize which debts to pay off first. Next, assess your income and expenses to determine your monthly debt payment budget. Allocate enough funds to cover the minimum payments on all of your debts. Additionally, set aside extra funds to target the highest-interest debt for accelerated repayment. With your monthly debt payment budget established, apply the extra funds you've set aside to the debt with the highest interest rate. Continue making minimum payments on all other debts. Focus on paying off the highest-interest debt until it is completely paid off. Once the highest-interest debt is paid off, repeat the process with the next highest-interest debt on your list. Allocate the additional funds to this new debt and continue paying the minimum on your remaining debts. Follow this process until all debts are paid off. One of the most significant benefits of the debt avalanche method is the potential to save money on interest payments. By focusing on the highest-interest debt first, you can minimize the total amount of interest paid over the course of your debt repayment journey. The debt avalanche method can also help you pay off your debts faster than other strategies, such as the debt snowball method. By tackling high-interest debts first, you reduce the overall balance more quickly and accelerate your path to becoming debt-free. Using the debt avalanche method encourages responsible financial behavior by prioritizing interest rates and focusing on the long-term financial impact of debt repayment decisions. The debt avalanche method offers a clear, strategic approach to debt repayment, allowing individuals to follow a structured plan that can lead to successful debt elimination. The debt avalanche method requires discipline and commitment to follow through with the strategy, as it may take longer to experience small "wins" compared to other methods like the debt snowball. Individuals who need immediate motivation or who have difficulty sticking to a plan may find the debt avalanche method challenging, as it prioritizes long-term financial benefits over short-term emotional rewards. Creating a budget and tracking expenses can help you stay on top of your debt repayment plan and ensure you have enough funds allocated to pay off your debts efficiently. Making debt repayment a priority in your financial goals can help you stay committed to the debt avalanche method and increase your chances of success. Celebrating milestones and progress along your debt repayment journey can help keep you motivated and focused on your ultimate goal of becoming debt-free. If you find the debt avalanche method difficult to implement or manage on your own, consider seeking professional financial advice. A financial advisor or credit counselor can help you create a personalized debt repayment plan and provide guidance on how to stay on track. The debt avalanche method is a debt repayment strategy that prioritizes debts with the highest interest rates for efficient and cost-effective repayment. The method involves listing and organizing outstanding debts, determining a monthly debt payment budget, applying additional funds to the highest-interest debt, and repeating the process with the next highest-interest debt until all debts are paid off. The method offers benefits such as saving money on interest payments, paying off debts faster, encouraging responsible financial behavior, and providing a structured and strategic approach to debt repayment. However, it requires discipline and commitment, and may not be suitable for individuals who need immediate motivation. Tips for maximizing the success of the debt avalanche method include creating a budget and tracking expenses, prioritizing debt repayment in financial goals, celebrating milestones and progress, and seeking professional financial advice if needed.What Is Debt Avalanche Method?

Steps for Implementing the Debt Avalanche Method

Listing and Organizing Outstanding Debts

Determining a Monthly Debt Payment Budget

Applying Additional Funds to the Highest-Interest Debt

Repeating the Process With the Next Highest-Interest Debt

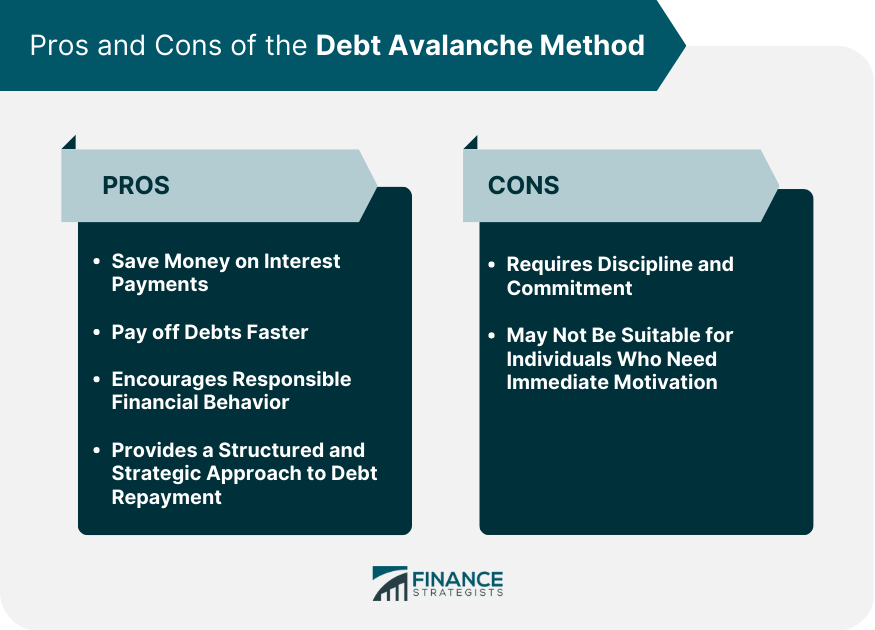

Pros of the Debt Avalanche Method

Saving Money on Interest Payments

Paying Off Debts Faster

Encouraging Responsible Financial Behavior

Providing a Structured and Strategic Approach to Debt Repayment

Cons of the Debt Avalanche Method

Requiring Discipline and Commitment

Limited Immediate Motivation

Tips for Maximizing the Success of the Debt Avalanche Method

Creating a Budget and Tracking Expenses

Prioritizing Debt Repayment in Financial Goals

Celebrating Milestones and Progress

Seeking Professional Financial Advice

Final Thoughts

Debt Avalanche Method FAQs

The debt avalanche method is a debt repayment strategy that prioritizes paying off debts with the highest interest rates first. By focusing on high-interest debts, the method helps you save money on interest payments and pay off debts faster. The process involves listing all outstanding debts, determining a monthly debt payment budget, applying additional funds to the highest-interest debt, and repeating the process until all debts are paid off.

The debt avalanche method focuses on paying off debts with the highest interest rates first, while the debt snowball method targets debts with the smallest balances first. The debt avalanche method can save you more money on interest payments and potentially help you pay off debts faster, whereas the debt snowball method provides quicker emotional rewards from paying off smaller debts, which can be motivating for some individuals.

The debt avalanche method can be an effective strategy for many people, but it may not be suitable for everyone. It requires discipline and commitment, as it prioritizes long-term financial benefits over short-term emotional rewards. Individuals who need immediate motivation or have difficulty sticking to a plan may find the debt snowball method or other debt repayment strategies more suitable for their needs.

To maximize the success of the debt avalanche method, consider creating a budget and tracking expenses, prioritizing debt repayment in your financial goals, celebrating milestones and progress along your debt repayment journey, and seeking professional financial advice if needed.

Yes, the debt avalanche method can potentially help you become debt-free faster compared to other debt repayment strategies. By targeting high-interest debts first, you can reduce the overall balance more quickly, minimize the total amount of interest paid, and accelerate your path to becoming debt-free.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.