Family business continuity refers to the ability of a family-owned enterprise to maintain operations and transition leadership across generations while preserving the business's long-term success and values. Continuity planning in family businesses is important because it helps manage the challenges of succession planning, conflict resolution, and balancing family and business interests. This planning ensures a smooth transition of leadership and minimizes disruptions to the business. The objectives of a continuity plan for family businesses include: Identifying and preparing potential successors for leadership roles Establishing clear governance structures and decision-making processes Developing effective conflict resolution strategies Managing legal and financial aspects of the business transition Ensuring the long-term success and sustainability of the family business I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. My expertise in family business continuity focuses on financial strategies to ensure long-term viability and growth. This includes succession planning, governance structures to manage family and business interests, diversification of investments to mitigate risks, and financial education for future generations. I also emphasize the importance of establishing clear financial policies and the use of external advisors to bring in fresh perspectives and specialized knowledge, ensuring the business thrives across generations. Let's ensure your legacy flourishes for generations to come. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation One of family businesses' most significant challenges is succession planning, which involves identifying potential successors, providing adequate training and development, and transferring leadership to the next generation. Succession planning is often a complex and emotionally charged process, with family members having differing opinions on who should take over the business and how the transition should occur. Choosing a successor is a critical decision for family businesses. Family members may have different skill sets, experiences, and ambitions, making identifying the most suitable candidate challenging. Additionally, the potential successor may not be interested in taking over the business, further complicating the selection process. Once a potential successor is identified, they must be prepared to take on the responsibilities of leading the business. This requires ongoing training and development, which may include formal education, mentorship, and on-the-job experience. It is crucial to develop a well-rounded successor capable of managing the business's operational and relational aspects. The final stage of succession planning involves the actual transfer of leadership from one generation to the next. This process can be fraught with tension and emotion as family members must navigate the complex dynamics of relinquishing control and accepting new roles within the organization. Family businesses often experience conflicts that can jeopardize their continuity. These conflicts may arise from differences in opinion, perceived inequalities, or misunderstandings. Developing strategies for effective communication, mediation, and arbitration is essential to maintain family business continuity. Open and honest communication is the foundation of successful conflict resolution in family businesses. Family members must be willing to listen to one another's perspectives and express their own feelings and concerns constructively. Establishing regular meetings and communication channels can help facilitate these conversations. When conflicts cannot be resolved through communication alone, family businesses may need to seek outside help in the form of different types of mediation or arbitration. Mediators can facilitate productive discussions and help family members reach a mutually agreeable resolution, while arbitrators can make binding decisions to resolve disputes. Family councils can play a crucial role in conflict resolution by providing a structured forum for discussing family and business issues. These councils can help establish communication, decision-making, and conflict resolution guidelines, ensuring that family members clearly understand their roles and responsibilities. Family businesses must strike a delicate balance between the family's interests and the business's needs. This requires clearly defining roles and responsibilities, maintaining a high level of professionalism, and establishing boundaries between family and business matters. Each family member should clearly understand their role within the business and the expectations associated with their position. Clearly defined roles and responsibilities can help reduce confusion and prevent family members from overstepping their boundaries. To ensure the success and continuity of the family business, it is essential to maintain a professional work environment. Family members should treat one another with respect, uphold ethical standards, and make decisions based on the best interests of the business rather than personal preferences. Setting boundaries between family and business matters is critical for maintaining healthy relationships and ensuring the enterprise's long-term success. Family members should avoid discussing sensitive business issues during personal gatherings and refrain from allowing personal issues to influence business decisions. Effective succession planning is vital to the continuity of a family business. Developing a comprehensive succession plan, involving key stakeholders, and managing expectations can help facilitate a smooth transition and minimize potential conflicts. A well-crafted succession plan outlines the process of selecting, training, and transitioning leadership to the next generation. It should include a timeline, criteria for choosing a successor, and a plan for ongoing training and development. The plan should also address potential contingencies, such as the unexpected departure of a key family member or changes in the business environment. Involving key stakeholders in the succession planning process can help ensure that their perspectives are considered and that they feel invested in the outcome. This may include family members, non-family employees, and other important business partners. Setting realistic expectations and establishing clear communication channels can help manage the emotions and uncertainties surrounding the succession process. This involves openly discussing the plan with all family members, addressing their concerns, and making adjustments as needed to ensure a successful transition. Establishing formal governance structures can help family businesses maintain continuity by providing clear decision-making and conflict-resolution guidelines. These structures may include family councils, boards of directors, and advisory boards. Family councils provide a forum for family members to discuss business and family issues, establish guidelines for decision-making, and resolve conflicts. Regular council meetings can help maintain open communication and foster a sense of unity among family members. A board of directors, composed of both family and non-family members, can bring valuable expertise and objectivity to the decision-making process. The board can help ensure that business decisions are made in the company's best interests and provide oversight to protect the enterprise's long-term success. Advisory boards, consisting of external experts and experienced business professionals, can offer guidance and support to family businesses. These boards can provide objective advice on strategic planning, succession planning, and other critical aspects of business continuity. Proper legal and financial planning is essential for ensuring family business continuity. This includes estate planning, understanding tax implications, and establishing shareholder agreements. Estate planning helps family businesses manage the transfer of wealth and ownership between generations. By establishing a comprehensive estate plan, family businesses can minimize the potential for disputes and ensure a smooth transition of assets. Family businesses must consider the tax implications of ownership transitions and business transactions. Engaging tax professionals can help identify strategies to minimize tax liabilities and ensure compliance with local, state, and federal regulations. Shareholder agreements provide a legal framework for managing the ownership and control of a family business. These agreements outline the rights and responsibilities of shareholders, establish rules for transferring shares, and define procedures for resolving disputes. External advisors can play a crucial role in supporting family business continuity by offering expertise in family business dynamics, providing objectivity and impartiality, and facilitating communication and conflict resolution. External advisors with experience in family businesses can bring valuable insights and best practices to support continuity efforts. Their knowledge of common challenges and strategies for overcoming them can be invaluable in navigating the complexities of family business management. As non-family members, external advisors can provide an objective perspective on family business issues. This impartiality can help family members see beyond their personal biases and make decisions that are in the business's best interest. External advisors can serve as neutral mediators in resolving conflicts and facilitating communication among family members. Providing a structured environment for open and honest discussions can help family members address their concerns and find mutually agreeable solutions. Family businesses can be challenging to manage, especially when it comes to succession planning. However, there are several examples of successful family business continuity. For instance, the Walton family, founders of Walmart, has done an excellent job of keeping the business within the family while growing it into the world's largest retailer. Another example is the Ferrero family, who took over their father's small chocolate business and transformed it into the international company we know today as Ferrero Group. The Mars family, behind the famous candy brand, has also managed to successfully pass on the business to the next generation while maintaining its brand identity and values. These family businesses have been able to navigate the complex issues of generational transition and maintain their success over the years. Analyzing the success stories of family businesses that have achieved continuity across generations can provide valuable insights and lessons for others. These case studies highlight the best practices, strategies, and approaches that have contributed to their enduring success. Some common themes and best practices that emerge from successful family business case studies include: 1. Proactive Succession Planning: Successful family businesses plan for the future and invest time and resources into developing the next generation of leaders. 2. Clear Governance Structures: Establishing formal governance structures, such as boards of directors and family councils, can provide guidance and oversight to ensure the business's long-term success. 3. Open Communication: Maintaining open and honest communication among family members is critical for resolving conflicts and fostering a strong sense of unity. 4. Balancing Family and Business Interests: Successful family businesses strike a delicate balance between the needs of the family and the requirements of the business, ensuring that both are taken into account in decision-making. The strategies and best practices identified in successful family business case studies can be adapted to suit different industries and family structures. Family businesses can tailor these approaches to meet their needs and support their continuity efforts by understanding the unique challenges and opportunities within their specific context. Family business continuity is essential for maintaining the success and longevity of family-owned enterprises. By proactively addressing the challenges of succession planning, conflict resolution, and balancing family and business interests, family businesses can lay the foundation for enduring success across generations. Engaging external advisors and learning from the experiences of successful family businesses can provide valuable guidance and support in navigating the complexities of family business continuity. Ultimately, the legacy and future of a family business depend on the commitment and foresight of its leaders, who must work together to ensure a seamless transition of leadership and maintain the core values that define their enterprise. Ensuring family business continuity requires a proactive approach and the right strategies. If you are seeking guidance on maintaining the success and longevity of your family business, consider reaching out to a financial advisor with experience in family businesses. A knowledgeable advisor can provide valuable insights, help you develop a tailored plan, and support you in navigating the complexities of family business continuity. Don't wait until it's too late—invest in your family business's future by seeking professional advice today.What Is Family Business Continuity?

Hear It From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

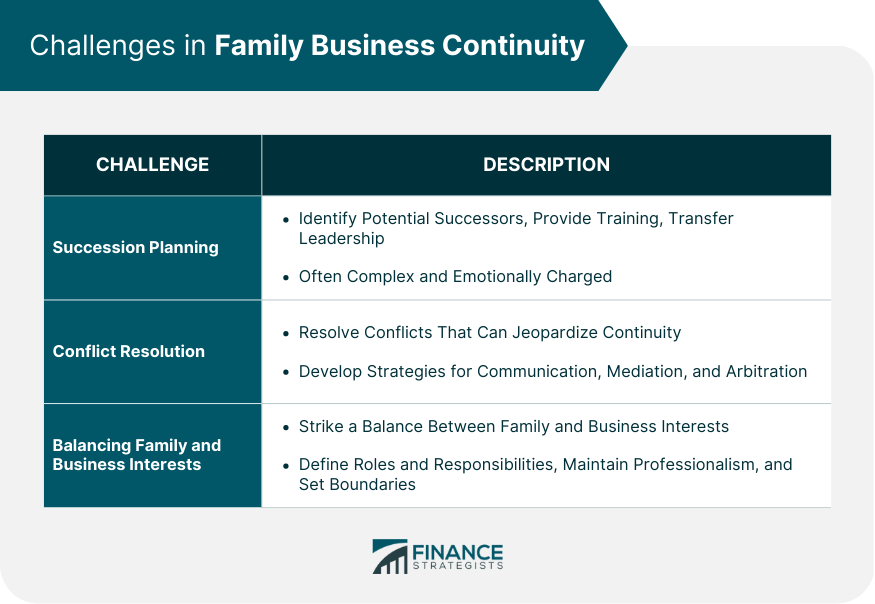

Challenges in Family Business Continuity

Succession Planning

Identifying Potential Successors

Training and Development

Transfer of Leadership

Conflict Resolution

Communication Strategies

Mediation and Arbitration

Role of Family Councils

Balancing Family and Business Interests

Defining Roles and Responsibilities

Maintaining Professionalism

Establishing Boundaries

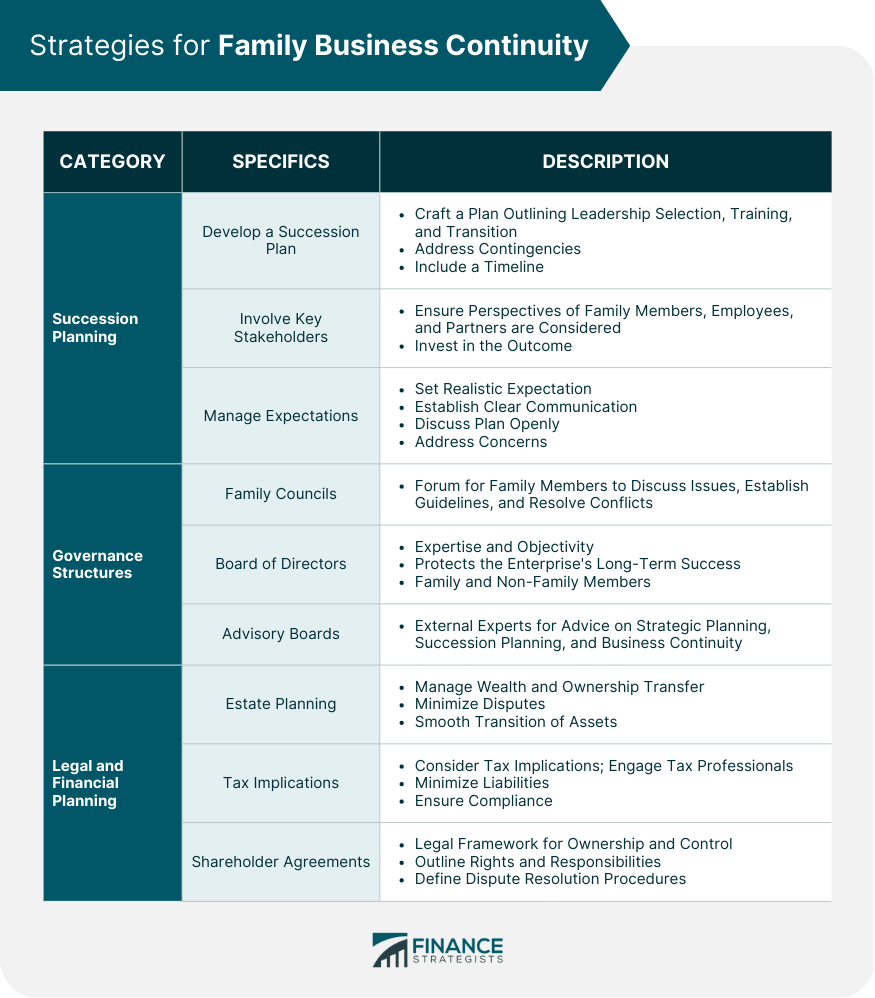

Strategies for Ensuring Family Business Continuity

Succession Planning

Developing a Succession Plan

Involving Key Stakeholders

Managing Expectations

Governance Structures

Family Councils

Board of Directors

Advisory Boards

Legal and Financial Planning

Estate Planning

Tax Implications

Shareholder Agreements

Role of External Advisors in Family Business Continuity

Expertise in Family Business Dynamics

Objectivity and Impartiality

Facilitating Communication and Conflict Resolution

Case Studies of Successful Family Business Continuity

Analysis of Successful Family Businesses

Lessons Learned and Best Practices

Adapting Strategies to Different Industries and Family Structures

Final Thoughts

Family Business Continuity FAQs

Succession planning is crucial for family business continuity because it ensures a smooth transition of leadership across generations. Family businesses can maintain their operations and minimize disruptions during the transition process by identifying potential successors, providing adequate training and development, and managing the transfer of leadership.

Family businesses can support continuity by developing effective conflict resolution strategies, which include establishing open communication channels, using mediation and arbitration when necessary, and leveraging family councils to provide a structured forum for discussing family and business issues. These approaches help maintain harmony among family members and ensure the long-term success of the business.

Governance structures, such as family councils, boards of directors, and advisory boards, provide clear guidelines for decision-making and conflict resolution within family businesses. These structures ensure that business decisions are made in the best interests of the company and provide oversight to protect the long-term success of the enterprise, thereby promoting family business continuity.

Involving external advisors in family business continuity efforts can be beneficial because they bring expertise in family business dynamics, objectivity, and impartiality. They can help facilitate communication, mediate conflicts, and provide valuable insights on best practices and strategies for overcoming common challenges in family businesses, ultimately contributing to the long-term success and continuity of the business.

Family businesses can adapt successful family business continuity strategies to their specific context by understanding their unique challenges and opportunities within their industry and family structure. By tailoring approaches such as proactive succession planning, establishing clear governance structures, and fostering open communication, family businesses can effectively address their unique needs and support their continuity efforts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.