A pyramid scheme is an illegal business model that promises participants high returns through recruiting others to join the scheme, rather than by selling products or services. The pyramid structure consists of multiple levels, with each new recruit adding another layer to the pyramid. As the number of recruits grows, the scheme becomes unsustainable and eventually collapses, leaving the majority of participants with financial losses. Although pyramid schemes and MLMs share some similarities, there are crucial differences. Legitimate MLMs focus on selling products or services and offer commissions based on sales volume. In contrast, pyramid schemes primarily generate income through recruitment and often have little to no legitimate products or services. Pyramid schemes have existed in various forms for centuries. One of the earliest recorded examples is the "chain letter" scam, which dates back to the 1800s. In these scams, participants were instructed to send money to the person at the top of the list, add their name to the bottom, and forward the letter to new potential victims. 1. Charles Ponzi and the Ponzi Scheme: In the 1920s, Charles Ponzi defrauded thousands of investors with a scheme promising high returns on postal reply coupons. The scheme, which later became known as a "Ponzi scheme," relied on using money from new investors to pay off earlier investors, creating the illusion of profits. 2. Bernard Madoff's Investment Fraud: In 2008, Bernard Madoff's investment firm was revealed to be a massive pyramid scheme, defrauding investors of an estimated $65 billion. Madoff's scheme, which operated for decades, is considered one of the largest financial frauds in history. In a pyramid scheme, new participants invest money with the promise of high returns. These investments are used to pay returns to those at the top of the pyramid. To maintain the flow of funds, participants are encouraged to recruit new members, who then invest money into the scheme, perpetuating the cycle. The payout structure in a pyramid scheme favors those at the top. Early participants receive returns from the investments of new recruits, while those at the bottom must continually recruit more members to see any profit. This structure is inherently unsustainable, as it relies on an ever-growing number of recruits. As the pyramid grows, it becomes increasingly difficult to recruit new participants, causing the flow of new investments to slow. When there are no longer enough new recruits to support the returns promised to earlier investors, the scheme collapses, leaving most participants with financial losses. In the United States, the Federal Trade Commission (FTC) is responsible for enforcing laws that prohibit pyramid schemes. The FTC investigates and prosecutes those involved in such schemes, often working in collaboration with state and local authorities. Penalties for operating a pyramid scheme can include fines, asset forfeiture, and imprisonment. Many countries have enacted laws and regulations to combat pyramid schemes. These laws vary in scope and enforcement but generally aim to protect consumers from financial losses and hold those responsible for the schemes accountable. Pyramid schemes are widely criticized for their exploitative nature, as they prey on the hopes and financial vulnerabilities of participants. These schemes are inherently unethical, as they rely on deception and false promises to generate profits for a select few at the expense of the majority. The collapse of a pyramid scheme often leaves participants with significant financial losses, potentially leading to bankruptcy, ruined credit, and lasting financial hardship. Additionally, those involved in promoting or operating pyramid schemes may face legal consequences, including fines, asset forfeiture, and imprisonment. To protect oneself from pyramid schemes, it is essential to recognize the red flags and warning signs, such as: Emphasis on recruitment over product sales Promises of high returns with little or no risk Pressure to invest quickly or make large investments Complex or secretive compensation structures Lack of transparency about the company's operations Before investing in any business opportunity, it is crucial to conduct thorough research. This includes: Verifying the legitimacy of the company and its leadership Investigating the company's products or services Understanding the compensation structure and potential earnings Speaking with current and former participants Consulting with trusted financial advisors If you suspect that you are involved in a pyramid scheme, it is important to take immediate action, such as: Ceasing all recruitment and investment activities Reporting the scheme to the appropriate authorities, such as the FTC or local law enforcement Seeking legal advice to explore options for recovering any losses Sharing your experience with others to raise awareness and prevent further victimization Not all MLMs are pyramid schemes. Legitimate MLMs focus on selling products or services and offer commissions based on sales volume. Before joining an MLM, it is essential to research the company and its offerings thoroughly to ensure that it is a legitimate opportunity. There are many other business and investment opportunities that do not rely on deceptive practices or unsustainable growth. These may include traditional investments, such as stocks, bonds, and real estate, or starting a small business or franchise. One of the best ways to avoid falling victim to pyramid schemes is to become financially literate. By understanding the fundamentals of personal finance, investing, and risk management, individuals can make informed decisions about their financial future and avoid scams. There are several strategies that can be employed to combat pyramid schemes and protect consumers, including: 1. Education and Awareness: Public education campaigns can help raise awareness of pyramid schemes and their warning signs, empowering individuals to make informed decisions and avoid scams. 2. Regulatory Oversight: Strengthening regulations and enforcement efforts can deter the creation of pyramid schemes and help hold those responsible accountable. 3. International Cooperation: Cross-border collaboration between regulatory agencies and law enforcement can help combat global pyramid schemes and protect consumers in multiple jurisdictions. 4. Consumer Advocacy: Organizations and individuals can advocate for stronger consumer protections and share information about known scams, helping to build a network of informed and vigilant consumers. Pyramid schemes continue to pose a significant threat to the financial well-being of individuals and communities worldwide. Understanding the characteristics, warning signs, and consequences of these schemes is essential to preventing victimization and promoting financial literacy. By raising awareness, strengthening regulations, and fostering international cooperation, it is possible to combat pyramid schemes and protect consumers from the devastating financial losses they can cause. The ongoing challenge of pyramid schemes underscores the importance of vigilance, education, and collaboration in the fight against financial fraud.What Is a Pyramid Scheme?

Differences Between Pyramid Schemes and Legitimate Multi-Level Marketing (MLM)

Historical Context of Pyramid Schemes

Origins and Early Examples

Notorious Pyramid Schemes in History

How Pyramid Schemes Work

Recruitment and Investment

Payout Structure

Unsustainability and Collapse

Legal and Ethical Implications

Laws and Regulations Against Pyramid Schemes

U.S. Federal Trade Commission (FTC)

International Efforts

Ethical Concerns and Criticisms

Consequences for Participants and Victims

Identifying and Avoiding Pyramid Schemes

Red Flags and Warning Signs

Investigating Potential Opportunities

Steps to Take if Involved in a Pyramid Scheme

Alternatives to Pyramid Schemes

Legitimate Multi-Level Marketing (MLM) Companies

Other Business Opportunities and Investments

Financial Education and Planning

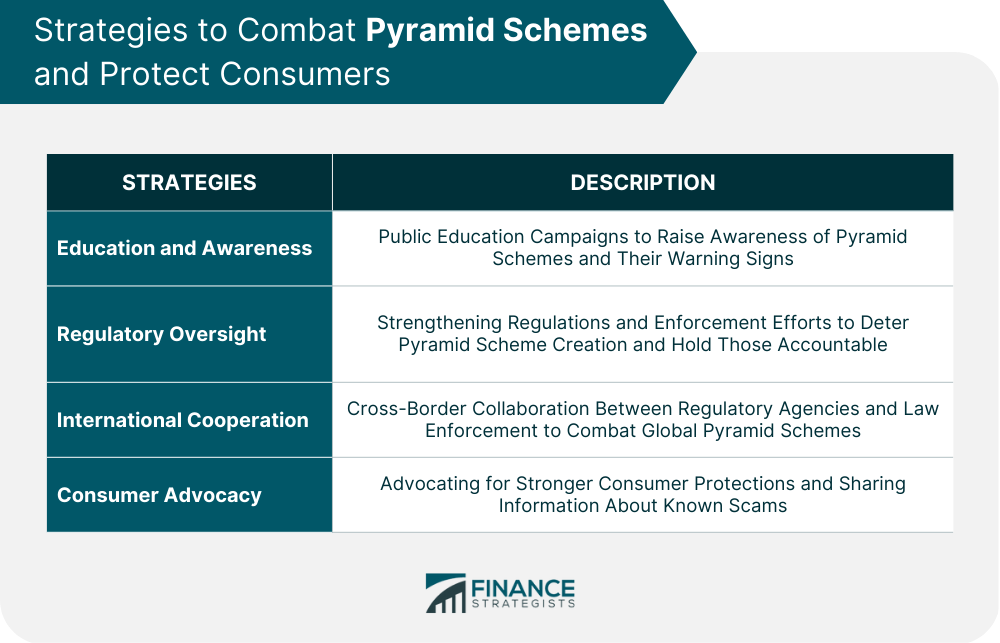

Strategies to Combat Pyramid Schemes and Protect Consumers

Conclusion

Pyramid Scheme FAQs

A pyramid scheme is a fraudulent business model that involves recruiting new participants with promises of earning money by selling a product or service, but where the main source of income is based on recruiting more people into the scheme.

Pyramid schemes usually offer quick and easy profits with minimal effort or investment, without any real product or service being sold. They also rely heavily on recruiting new members and offer commissions for bringing in new participants.

Yes, pyramid schemes are illegal in most countries as they are considered fraudulent and deceptive practices. They can lead to financial losses for the majority of participants, as only a small group of people at the top of the pyramid make significant profits.

While some people at the top of the pyramid may make money, the majority of participants are likely to lose money in a pyramid scheme. The model is unsustainable and relies on constantly recruiting new members to pay out commissions to the higher-level participants.

If you suspect you are involved in a pyramid scheme, the best thing to do is to stop participating and report it to the authorities. You can also seek legal advice to try and recover any losses you may have suffered. Remember, it is important to always research any business opportunity thoroughly before investing your time or money.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.