Money market accounts (MMAs) are deposit accounts that are similar to savings accounts but offer higher interest rates in exchange for higher minimum balance requirements and limited check-writing privileges. These accounts are offered by banks and credit unions, and other financial institutions and are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per account owner. The history of money market accounts dates back to the 1970s when the Federal Reserve allowed banks to offer interest-bearing accounts that allowed a limited number of transactions per month. These accounts were created to compete with money market mutual funds, which were becoming popular at the time. MMAs were initially offered only to institutional investors, but they later became available to retail customers as well. The purpose of money market accounts is to provide a safe and convenient place for people to save and invest their money while earning a higher rate of interest than they would with a traditional savings account. MMAs are also designed to be liquid, meaning that account holders can access their funds easily and quickly when needed. One of the main features of money market accounts is the interest rate they offer. MMAs typically offer higher interest rates than traditional savings accounts but lower rates than certificates of deposit (CDs). The interest rates on MMAs are variable, which means they can change over time. The rate of interest paid on an MMA is usually tied to the prevailing interest rates in the market. Most money market accounts require a minimum balance to be maintained in the account to avoid fees and earn interest. The minimum balance requirement can vary from one financial institution to another, but it is typically higher than the minimum balance required for a savings account. The minimum balance requirement for an MMA can range from a few hundred dollars to several thousand dollars. Another feature of money market accounts is that they have withdrawal limits. Federal regulations limit the number of transactions that can be made on an MMA to six per month. These transactions can include withdrawals, transfers, and checks written against the account. Exceeding the withdrawal limit can result in fees or the account being converted to a checking account. Money market accounts are insured by the Federal Deposit Insurance Corporation up to $250,000 per account owner. This means that if the financial institution where the account is held fails, the account owner is protected up to $250,000. One of the main benefits of money market accounts is the higher interest rates they offer. This makes them an attractive option for people who want to earn more interest on their savings but do not want to take on the risk associated with other types of investments. Money market accounts are considered low-risk investments because they are insured by the FDIC and the interest rates are relatively stable. This makes them a good option for people who want to save their money without exposing it to significant risk. Another benefit of money market accounts is that they provide easy access to funds. Account holders can withdraw money from their account or write checks against it when needed. This makes MMAs a good option for people who want to save their money while still having access to it when needed. One of the main drawbacks of money market accounts is their limited check-writing privileges. While account holders can write checks against their account, they are usually limited to a certain number of checks per month. This can be inconvenient for people who need to write more checks than the limit allows. Money market accounts can also come with potential fees and penalties. For example, some financial institutions may charge fees for falling below the minimum balance requirement or for exceeding the withdrawal limit. These fees can reduce the amount of interest earned on the account and eat into the account holder's savings. Another potential drawback of money market accounts is the potential for inflation to erode the returns earned on the account. While money market accounts offer higher interest rates than savings accounts, they may not keep pace with inflation, which can erode the purchasing power of the account holder's savings over time. Money market accounts are often compared with savings accounts because they are both deposit accounts that offer interest. However, money market accounts typically offer higher interest rates than savings accounts, and they often require higher minimum balances to avoid fees. Money market accounts also offer limited check-writing privileges, while savings accounts do not. Checking accounts are another type of deposit account that is often compared with money market accounts. While both types of accounts offer some degree of liquidity, checking accounts offer more flexibility in terms of the number of transactions allowed and the check-writing privileges. However, checking accounts typically offer lower interest rates than money market accounts. Certificate of deposit accounts are another type of deposit account that is often compared with money market accounts. While CDs offer higher interest rates than money market accounts, they require account holders to lock up their funds for a specific period of time, which can range from a few months to several years. Money market accounts, on the other hand, offer more flexibility in terms of access to funds but usually offer lower interest rates than CDs. Money market accounts are a popular option for people who want to save and invest their money while earning a higher rate of interest than they would with a traditional savings account. MMAs offer many benefits, such as higher interest rates, low-risk investment, easy access to funds, and FDIC insurance. However, they also have some drawbacks, such as limited check-writing privileges, potential fees and penalties, and the potential for inflation to erode returns. When considering whether to open a money market account, it is important to weigh the benefits and drawbacks carefully and compare them with other types of bank accounts. For those who value the safety and stability of a low-risk investment and want easy access to their savings, a money market account may be an excellent choice. However, those who need more flexibility in terms of check-writing privileges or want higher interest rates may want to consider other options, such as checking accounts or CDs.Definition of Money Market Accounts

Features of Money Market Accounts

Interest Rates

Minimum Balance Requirements

Withdrawal Limits

FDIC Insurance

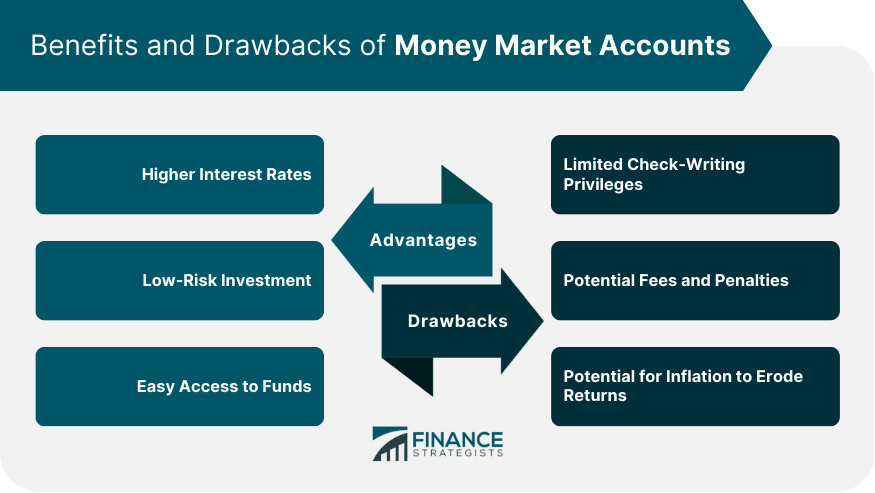

Benefits of Money Market Accounts

Higher Interest Rates

Low-Risk Investment

Easy Access to Funds

Drawbacks of Money Market Accounts

Limited Check-Writing Privileges

Potential Fees and Penalties

Potential for Inflation to Erode Returns

Comparing Money Market Accounts With Other Types of Bank Accounts

Savings Accounts

Checking Accounts

Certificate of Deposit (CD) Accounts

Conclusion

Money Market Accounts FAQs

A money market account is a type of savings account that typically pays a higher interest rate than a traditional savings account and allows limited check-writing capabilities.

Money market accounts usually offer higher interest rates than savings accounts, but they may require higher minimum balances and limit the number of monthly transactions.

Money market accounts offer higher interest rates than traditional savings accounts and are typically FDIC-insured. They also provide easy access to funds and some check-writing capabilities.

Money market accounts may require higher minimum balances and have limits on the number of transactions. They also may have fees and penalties for falling below the minimum balance.

Money market accounts can be a good option for those looking for a low-risk investment with higher interest rates than traditional savings accounts. However, they may not be the best option for long-term investment goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.